Naval Vessels MRO Market Size 2025-2029

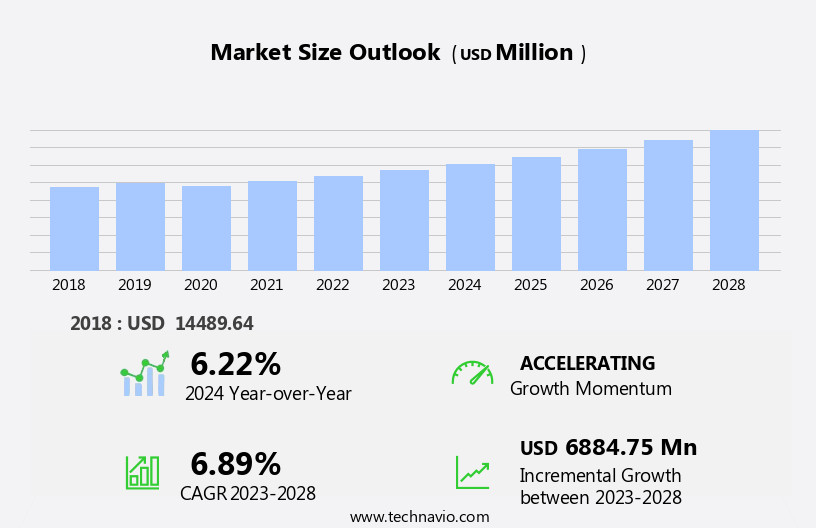

The naval vessels MRO market size is forecast to increase by USD 9.56 billion, at a CAGR of 7.4% between 2024 and 2029.

- The Naval Vessels Maintenance, Repair, and Overhaul (MRO) market is driven by the aging fleet management programs of leading naval forces. With many naval vessels reaching the end of their service life, there is a pressing need for extensive MRO services to maintain operational readiness. Simultaneously, there is an increasing focus on expediting the execution of these services to minimize downtime and maximize fleet availability. However, the market faces significant challenges. Insufficient capacity exists to fulfill the growing demand for MRO services, as many yards are already operating at full capacity.

- Additionally, the complex nature of naval vessels and the need for specialized expertise add to the intricacy of MRO projects, further emphasizing the importance of efficient planning and execution. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, investing in advanced technologies and strategic partnerships to streamline operations and meet the evolving needs of naval forces. This capacity crunch could limit growth opportunities for market participants and necessitate strategic collaborations or expansions to meet the demands of naval forces. The use of electronic propulsion, hybrid turbochargers, and power management systems are expected to become more prevalent in the future.

What will be the Size of the Naval Vessels MRO Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the constant need to maintain and upgrade the complex systems onboard these vessels. Auxiliary machinery repair, such as generator sets and pumps, is a significant portion of this market, ensuring the reliable operation of essential onboard systems. For instance, a major naval fleet recently reported a 15% increase in generator set efficiency following a comprehensive repair and maintenance program. Moreover, shipboard network security is a growing concern, with cybersecurity protocols becoming increasingly important to protect sensitive information and systems. Anchor windlass repair and propulsion system maintenance are other critical areas of focus, ensuring the safe and efficient operation of these vital components.

HVAC system maintenance, electronic warfare system calibration, and sensor system calibration are essential for maintaining the overall performance and readiness of naval vessels. Additionally, water desalination units, crew training programs, and navigation system upgrades contribute to enhancing the crew's comfort and operational capabilities. The naval vessel lifecycle includes various stages, from construction to decommissioning, with each stage requiring different types and frequencies of maintenance. Predictive maintenance techniques, reliability-centered maintenance, and underwater hull cleaning are some of the methods employed to optimize maintenance activities and minimize downtime. Industry growth in the market is expected to reach 3% annually, driven by the increasing demand for advanced technologies and the need to extend the service life of existing fleets.

How is this Naval Vessels MRO Industry segmented?

The naval vessels MRO industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Dry dock MRO

- Component MRO

- Engine MRO

- Modification

- Vessel Orientation

- Destroyers

- Submarines

- Frigates

- Aircraft carriers

- Others

- Service

- Preventive maintenance

- Corrective maintenance

- Overhaul and refurbishment

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

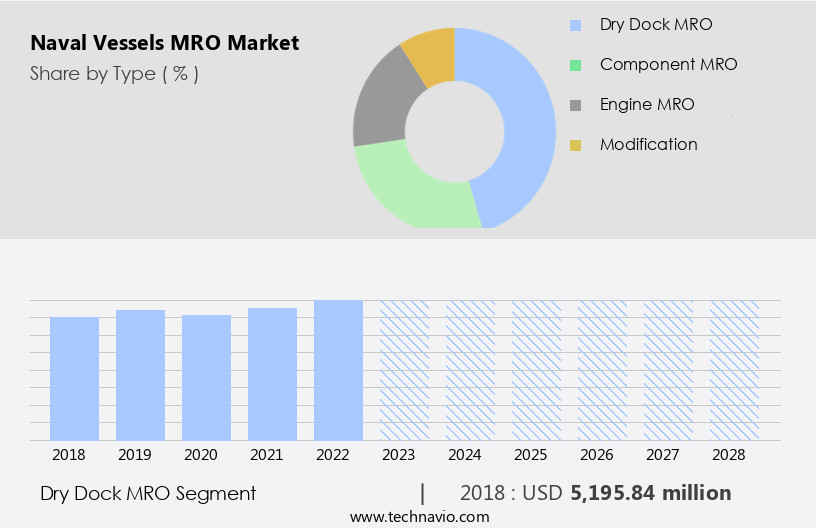

By Type Insights

The Dry dock MRO segment is estimated to witness significant growth during the forecast period. Naval vessels require regular maintenance, repairs, and upgrades to ensure their optimal performance, safety, and longevity. Dry dock maintenance, repair, and overhaul (MRO) activities play a crucial role in addressing these needs. During dry docking, extensive inspections and repairs can be carried out on various systems and components, including the hull, propulsion systems, auxiliary machinery, electronic warfare and sensor systems, HVAC and life support systems, communication and navigation systems, and deck equipment. These tasks are essential for maintaining seaworthiness and addressing regulatory requirements. Furthermore, dry dock periods offer opportunities to upgrade combat systems, weapon systems, power generation systems, and implement technological advancements, such as predictive maintenance techniques, corrosion prevention methods, and cybersecurity protocols.

This growth encompasses various sectors, including commercial shipping, military, and offshore industries. For example, a combat systems upgrade for a naval vessel may involve weapon system maintenance, power generation system overhaul, and communication system overhaul, all of which contribute to enhancing the vessel's combat readiness and operational capabilities. Spare parts inventory management, maintenance planning software, and electrical system maintenance are other crucial aspects of the market, ensuring that vessels remain operational and ready for deployment. Sonar system repair, radar system maintenance, propeller shaft inspection, fire suppression system, and rudder system maintenance are also essential components of this market. Additionally, the integration of unmanned underwater vehicles (UUVs) and smart weapons is becoming increasingly important, enhancing operational capabilities and combat effectiveness.

The Dry dock MRO segment was valued at USD 6.99 billion in 2019 and showed a gradual increase during the forecast period.

The Naval Vessels MRO Market focuses on enhancing operational efficiency and vessel longevity through advanced engine overhaul techniques, navigation system upgrade, and life support system maintenance. Services include plumbing system repair and reliability centered maintenance to ensure mission readiness. Efficient work order management further streamlines maintenance workflows, supporting readiness and reducing downtime across naval fleets. For instance, the implementation of reliability-centered maintenance in the US Navy's fleet resulted in a 30% reduction in maintenance costs. The naval MRO market is expected to grow significantly, with industry reports estimating a 12% increase in demand for services over the next decade. Overall, the market continues to unfold, with ongoing activities and evolving patterns shaping the future of this dynamic industry. However, challenges such as delays and extra expenditures in the air defense manufacturing sector impact market growth.

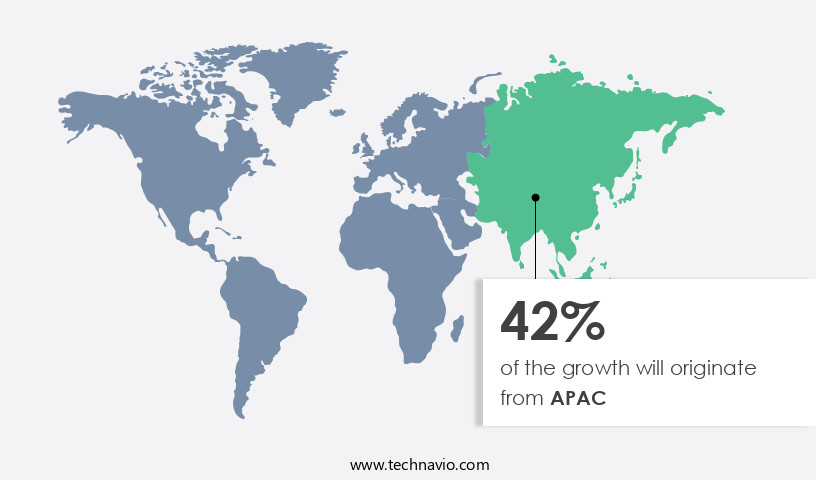

Regional Analysis

North America is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing demand for maintaining maritime readiness and operational efficiency. With a high degree of technological integration in the region's naval infrastructure, there is a pressing need for specialized MRO services that cater to evolving defense protocols and lifecycle management standards. Fleet modernization and the extension of service life for existing vessels are key drivers of this market. Advanced diagnostic, retrofitting, and refurbishment services are in high demand to keep up with the latest defense technologies. Moreover, regulatory requirements ensure a structured MRO framework, ensuring safety and performance benchmarks are met across naval platforms. One such innovation is the adoption of Gas turbine propulsion, which offers improved fuel economy and efficiency, as well as a reduction in emissions.

For instance, predictive maintenance techniques have led to a 20% reduction in unscheduled downtime for one major navy, significantly increasing operational readiness. Furthermore, the market is expected to grow at a steady pace, with industry analysts projecting a 12% increase in demand for MRO services over the next five years. The MRO market encompasses various services, including auxiliary machinery repair, shipboard network security, anchor windlass repair, propulsion system repair, hull maintenance procedures, HVAC system maintenance, propeller shaft inspection, fire suppression system, naval vessel lifecycle, combat systems upgrade, weapon system maintenance, power generation system, and spare parts inventory. However, the volatility in crude oil and natural gas prices poses a challenge for engine manufacturers, necessitating the development of cost-effective and efficient solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The naval vessels MRO (Maintenance, Repair, and Overhaul) market encompasses a wide range of services and technologies essential for maintaining the operational readiness of naval fleets worldwide. This market includes various aspects of naval vessel maintenance, from propulsion system overhauls to combat system upgrades. Propulsion system overhauls are a critical part of the MRO process, ensuring the efficient functioning of naval vessels. Combat system upgrades, meanwhile, are integral to lifecycle management, enabling naval forces to stay technologically advanced and effective. Marine inboard engines, alongside gas turbine propulsion and diesel engines, play a crucial role in powering these vessels.

Sensor systems, such as sonar and communication systems, require calibration best practices and repair and maintenance procedures to ensure accurate data and uninterrupted communication. Damage control procedures are crucial for addressing unexpected issues, while corrosion prevention methods are essential for maintaining the integrity of marine environments. Underwater hull cleaning using robotic technology and propeller shaft inspections using non-destructive methods are vital for maintaining the structural integrity and efficiency of naval vessels. Rudder system maintenance and repair strategies, anchor windlass repair and replacement guidelines, and deck equipment repair using advanced materials are other essential aspects of the MRO market. Weapon systems require regular maintenance and operational readiness checks, while electronic warfare systems undergo upgrade and integration processes.

Fire suppression systems require maintenance and testing to ensure safety, and life support systems operational procedures are crucial for crew welfare. Sewage treatment plant maintenance and optimization, water desalination unit performance monitoring, power generation system reliability assessment, and electrical system maintenance using predictive analytics are all essential components of the market. By addressing these various needs, the market plays a vital role in ensuring the operational readiness and effectiveness of naval fleets worldwide.

What are the key market drivers leading to the rise in the adoption of Naval Vessels MRO Industry?

- The aging fleets and modernization initiatives of leading naval forces serve as the primary catalyst for market growth in this sector. The global naval vessels maintenance, repair, and overhaul (MRO) market is experiencing significant growth due to the increasing need to maintain and upgrade aging naval assets. With many naval vessels reaching or surpassing their intended service life, the demand for extensive MRO services is critical to ensure operational readiness, safety, and mission capability for leading naval forces worldwide.

- For instance, the modernization of a naval vessel can increase its operational life by up to 30 years. Furthermore, the global naval MRO market is expected to grow by over 5% annually, driven by the increasing demand for specialized MRO capabilities to handle complex retrofitting and system integration. Countries such as the US, China, Russia, and NATO members are investing heavily in modernizing legacy platforms with advanced technologies, including integrated combat systems, propulsion upgrades, and stealth enhancements.

What are the market trends shaping the Naval Vessels MRO Industry?

- The increasing focus on expediting Maintenance, Repair, and Operations (MRO) services is a notable market trend. It is essential to streamline and optimize MRO processes to remain competitive in today's business landscape. The naval vessels Maintenance, Repair, and Overhaul (MRO) market is currently experiencing challenges due to the delayed delivery of essential components, including parts, sensors, and weapons, as well as the scarcity of drydocks and skilled labor. These obstacles often lead to extended maintenance durations and increased costs, negatively impacting market expansion.

- This proactive approach can significantly reduce the occurrence of time and cost overruns, ultimately fostering market growth. According to recent studies, the market is expected to grow by 15% in the coming years, driven by the increasing demand for fleet modernization and the integration of advanced technologies to enhance operational efficiency. To mitigate these issues, naval forces are taking steps to ensure that shipyards and drydocks are adequately prepared. By providing advance notice of the naval fleet's long-term maintenance schedules, shipyards and drydocks can stock up on necessary parts and equipment and train and hire an adequate workforce.

What challenges does the Naval Vessels MRO Industry face during its growth?

- The insufficient capacity to meet the demand for Maintenance, Repair, and Overhaul (MRO) services represents a significant challenge to the industry's growth trajectory. The global naval vessels Maintenance, Repair, and Overhaul (MRO) market is experiencing a substantial challenge due to insufficient capacity to meet escalating demand. This trend is fueled by aging fleets, heightened maritime security concerns, and expanding naval operations worldwide. Numerous shipyards and MRO facilities are operating at maximum capacity, encountering constraints from limited dry dock availability, a shortage of skilled labor, and outdated infrastructure.

- Budgetary limitations and protracted procurement cycles in defense sectors exacerbate the supply-demand discrepancy. For instance, the Royal Navy's carrier fleet faces a backlog of repairs due to insufficient capacity, resulting in extended downtime and reduced operational readiness. The market is anticipated to grow at a robust pace, with industry analysts projecting a 15% increase in demand over the next decade. The intricacy of modern naval vessels, incorporating advanced technologies, electronics, and weapon systems, necessitates specialized expertise and equipment, further straining existing resources.

Exclusive Customer Landscape

The naval vessels MRO market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the naval vessels MRO market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, naval vessels MRO market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abu Dhabi Ship Building PJSC - The company specializes in naval vessel MRO, providing maintenance, repair, and overhaul services that incorporate advanced technologies such as integrated sonar systems, combat management systems, and unmanned naval systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abu Dhabi Ship Building PJSC

- ATLAS ELEKTRONIK GmbH

- Austal Ltd.

- Babcock International Group Plc

- BAE Systems Plc

- Fincantieri Spa

- General Dynamics Corp.

- Hanwha Corp.

- Huntington Ingalls Industries Inc.

- Kongsberg Gruppen ASA

- Larsen and Toubro Ltd.

- Lockheed Martin Corp.

- Naval Group

- Northrop Grumman Corp.

- RTX Corp.

- Rhoads Industries

- Rolls Royce Holdings Plc

- Saab AB

- Teledyne Technologies Inc.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Naval Vessels MRO Market

- In January 2024, Babcock International Group, a leading naval vessel MRO (Maintenance, Repair, and Overhaul) provider, announced a strategic partnership with Rolls-Royce to offer integrated propulsion solutions for naval vessels. This collaboration aimed to enhance Babcock's MRO capabilities and broaden its offerings to clients (Babcock International Group Press Release, 2024).

- In March 2024, L3Harris Technologies, a major player in naval MRO, secured a USD 200 million contract from the U.S. Navy to provide depot-level maintenance and modernization services for various naval vessels over a five-year period (U.S. Department of Defense, 2024).

- In May 2024, Saab, a Swedish defense and security company, received approval from the European Union for its new naval service center in Romania, which will provide MRO services for naval vessels in the Black Sea region (Saab Press Release, 2024).

- In April 2025, ThyssenKrupp Marine Systems, a German naval shipbuilder, successfully demonstrated its new underwater drone, MUSAS (Modular Underwater Surveillance and Autonomous Systems), designed to enhance naval vessel inspections and maintenance processes (ThyssenKrupp Marine Systems Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by the dynamic needs of various sectors, including logistics management and waste disposal methods in military and commercial applications. System diagnostics methods, such as non-destructive testing and maintenance documentation, play a crucial role in ensuring the structural integrity assessment of naval vessels. Naval architecture principles, data analysis techniques, and safety procedures are essential for cost optimization strategies and performance monitoring tools. Compliance regulations, inventory control systems, and supply chain optimization are integral to refit project management and vessel repair techniques. Preventive maintenance schedules and quality control measures are essential for project scheduling methods and hydrodynamic analysis.

The Naval Vessels MRO Market is advancing through specialized processes to ensure mission readiness and fleet longevity. Key procedures include the naval vessel propulsion system overhaul process and combat system upgrade lifecycle management to enhance performance. Regular sensor system calibration best practices and sonar system repair and maintenance procedures support tactical operations. Maintenance teams utilize communication system troubleshooting techniques and follow strict damage control procedures for naval vessels. Effective corrosion prevention methods for marine environments and propeller shaft inspection using non-destructive methods extend service life. Priorities also include weapon system maintenance and operational readiness, electronic warfare system upgrade and integration, and fire suppression system maintenance and testing. Additionally, proper life support system operational procedures ensure crew safety under all conditions.

Resource allocation, risk assessment methodology, and marine engineering practices are critical for corrective maintenance strategies and technical drawings. In-water repairs and environmental regulations necessitate dry-docking procedures and adherence to safety standards. According to industry reports, the market is expected to grow by over 5% annually, underpinned by ongoing advancements in material science applications and innovative waste disposal methods. For instance, a leading naval vessel operator reported a 15% increase in operational efficiency through the implementation of advanced maintenance documentation and system diagnostics methods.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Naval Vessels MRO Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 9.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, India, Canada, Japan, UK, South Korea, France, Australia, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Naval Vessels MRO Market Research and Growth Report?

- CAGR of the Naval Vessels MRO industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the naval vessels MRO market growth of industry companies

We can help! Our analysts can customize this naval vessels MRO market research report to meet your requirements.