Nitrile Butadiene Rubber Market Size 2024-2028

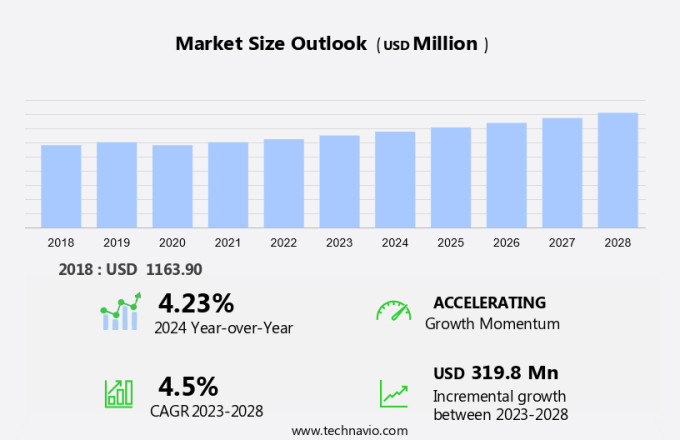

The nitrile butadiene rubber market size is forecast to increase by USD 319.8 million, at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to increasing demand from key industries such as oil & gas, medical, and construction. In the automotive sector, the use of NBR in the manufacturing of hoses, seals, and gaskets is driving market expansion. The aeronautics industry also relies heavily on NBR for fuel and hydraulic systems. Furthermore, the medical sector's demand for NBR in the production of gloves and other medical devices is on the rise. Additionally, the trend toward using bio-based feedstock for NBR production is gaining momentum, contributing to market growth. However, fluctuating raw material prices, particularly for oil and natural rubber, pose a challenge to market stability. Isoprene, thermoplastic elastomers, latex, and fluoroelastomers are alternative materials that can impact market share. Overall, the NBR market is poised for continued growth, driven by its versatility and wide range of applications.

Market Analysis

Nitrile butadiene rubber (NBR), a type of thermoplastic elastomer, is a copolymer of butadiene and acrylonitrile. The unique properties of NBR, including its excellent resistance to oil, fuel, and chemicals, make it a popular choice in various industries. This article provides an in-depth analysis of the market, focusing on its applications and trends. These components are essential in various industries, including automotive, aerospace, and oil & gas, where sealing performance is critical. Furthermore, NBR's resistance to chemicals, oil, and fuel makes it an ideal material for manufacturing gloves. These gloves are widely used in industries such as automotive, healthcare, and laboratory applications, where protection against hazardous substances is essential. NBR is used extensively in the production of molded and extruded products.

These products find applications in various industries, including construction, automotive, and electrical, where the need for durability and resistance to chemicals is high. NBR's resistance to oil, fuel, and chemicals makes it an ideal material for use in the oil & gas industry. It is used in the manufacturing of hoses, seals, and gaskets, which are essential components in the exploration and production of oil and gas. NBR's excellent resistance to chemicals and biocompatibility make it a popular choice in the medical industry. It is used in the manufacturing of medical devices, such as catheters and tubing, where the need for sterilization and biocompatibility is essential.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- HB and C

- Seals and O-rings

- Industrial and medical gloves

- Molded and extruded products

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

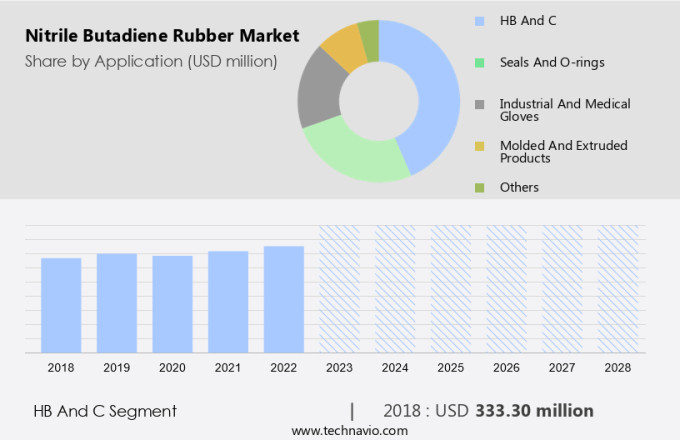

The HB and C segment is estimated to witness significant growth during the forecast period. Nitrile butadiene rubber (NBR) is a popular elastomer widely utilized in various industries due to its exceptional resistance to oil, fuel, temperature, and chemicals. In the global market, the hose, belting, and cable segment holds the largest share. Nitrile butadiene rubber finds extensive applications in the automotive and aeronautical sectors for producing fuel-handling hoses and oil-handling hoses. Its high resistance to oil and acids compared to natural rubber is the primary reason for its extensive consumption in these industries. Additionally, NBR is used in medical applications for creating products requiring high resistance to chemicals and temperature, such as gloves and catheters.

Furthermore, thermoplastic elastomers, isoprene, latex, fluoroelastomers, and natural rubber are alternative elastomers, but nitrile butadiene rubber's unique properties make it the preferred choice in many applications. The construction industry also uses nitrile butadiene rubber for producing water-resistant hoses and seals. In summary, the versatility and durability of nitrile butadiene rubber make it an essential component in numerous industries, including automotive, aeronautical, medical, and construction.

Get a glance at the market share of various segments Request Free Sample

The HB and C segment accounted for USD 333.30 million in 2018 and showed a gradual increase during the forecast period.

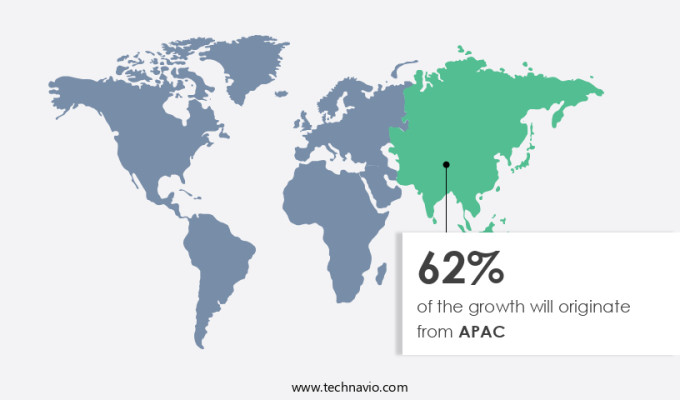

Regional Insights

APAC is estimated to contribute 62% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Nitrile Butadiene Rubber (NBR) is a type of synthetic rubber extensively used in various industries due to its exceptional properties, including high resistance to oil, fuel, and chemicals. The market is primarily driven by its applications in adhesives and sealants, compression machinery, hydraulic equipment, impact modifiers, and medical gloves industries.

Furthermore, the growth of the market in APAC is primarily driven by its usage in end-user industries, such as automotive and construction. The presence of leading automotive manufacturers in countries like China, India, Japan, and South Korea will further boost the demand for Nitrile Butadiene Rubber in the manufacturing of various automotive components and tires. In addition, Nitrile Butadiene Rubber is increasingly being used as a substitute material for Polyvinyl Chloride (PVC) and Acrylonitrile Butadiene Styrene (ABS) in several applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing consumption from the automotive and aeronautical industries is the key driver of the market. Nitrile butadiene rubber is a versatile material widely utilized in various industries, with significant applications in the automotive and industrial sectors. In the automotive industry, this rubber type is expected to dominate the market due to its extensive use in producing essential components. These components include automotive belts such as timing belts, fan belts, and conveyor belts, as well as tubing for fuel and oil hoses, grommets, seals, and gaskets. The unique properties of nitrile butadiene rubber make it an ideal choice for these applications. Its ability to withstand extreme temperatures ranging from -104°F to 224.6°F sets it apart from ordinary rubber.

In the automotive sector, it is used to manufacture various parts, including brake linings, dashboards, kick panels, and oil and fuel level sensors. Similarly, in industrial vehicles like heavy-duty trucks, nitrile butadiene rubber is employed for producing heavy-duty hoses and seals due to its superior resistance to oil, fuel, and chemicals. In summary, nitrile butadiene rubber is a vital material in the automotive and industrial sectors, with applications spanning various components such as tubing, automotive belts, and seals. Its unique properties, including temperature resistance and chemical compatibility, make it an indispensable component in manufacturing fuel and oil hoses, grommets, and gaskets.

Market Trends

Rising demand for bio-based feedstock is the upcoming trend in the market. Nitrile butadiene rubber (NBR), a type of synthetic rubber, is increasingly being produced using bio-based feedstock. The shift towards renewable resources for rubber production is gaining traction due to the rising prices and dwindling supply of traditional petroleum-derived raw materials and natural rubber. Major players in the NBR market are focusing on utilizing renewable feedstock to manufacture this elastomer. They are collaborating with industrial biotech firms to commercialize the production of bio-based rubber raw materials. Bio-based butadiene, a primary component of NBR, is derived from renewable raw material sources such as non-food biomass. This eco-friendly approach aligns with the Smart Cities Mission's goal of promoting sustainability and reducing carbon footprint.

In the realm of mechanical engineering, the demand for NBR in the production of seals and O-rings is significant. Molded and extruded NBR products are widely used in various industries, including automotive, oil and gas, and construction. By focusing on bio-based NBR production, manufacturers can cater to this demand while contributing to a more sustainable future.

Market Challenge

Fluctuating raw material prices is a key challenge affecting the market growth. Nitrile butadiene rubber (NBR), a copolymer of acrylonitrile and butadiene, is widely used in various industries due to its superior properties. The manufacturing process of NBR relies on the availability and pricing of its primary raw materials: acrylonitrile and butadiene. Both acrylonitrile and butadiene are derived from crude oil sources. Acrylonitrile is produced through catalytic ammoxidation of propylene, while butadiene is obtained as a by-product of ethylene steam cracking of gas oil or naphtha feedstock. Ethylene and propylene, the monomers used in NBR production, are derived from ethane and propane, respectively. Current market trends indicate a notable increase in the price of butadiene, which directly impacts the cost of NBR production.

This price fluctuation poses a significant challenge for manufacturers in maintaining consistent pricing for their products. In the construction equipment sector, NBR is used for the production of hoses and seals. In the electric vehicle industry, it is utilized in battery separators and insulation. The civil aviation industry relies on NBR for fuel hose applications. Additionally, NBR is used in the production of chemicals, automotive seals, and greases. As a result, the demand for NBR remains strong, making it a vital component in numerous industries. Despite the challenges presented by raw material pricing, the future of NBR looks promising due to its versatile applications.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abbott Rubber Co. Inc. - The company offers nitrile butadiene rubber which is used in rugged airline service in mining, quarries, construction, sandblasting, industrial air placement and equipment rental.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Rubber Co. Inc.

- airboss.com

- Apcotex Industries Ltd.

- Atlantic Gasket Corp.

- China National Petroleum Corp.

- Eni SpA

- EW Polymer Group LLC

- Grupo Dynasol

- Hanna Rubber Co.

- JSR Corp.

- Kumho Petrochemical Co. Ltd.

- Lanxess AG

- LG Chem Ltd.

- NANTEX INDUSTRY Co. Ltd.

- Nitriflex

- Rahco Rubber Inc.

- SIBUR Holding PJSC

- Synthos SA

- TSRC Corp.

- Zeon Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Nitrile butadiene rubber (NBR), also known as nitrile rubber, is a type of synthetic rubber derived from the copolymerization of acrylonitrile and butadiene monomers. This elastomer offers excellent resistance to oil, fuel, and chemicals, making it a popular choice in various industries. The demand for nitrile butadiene rubber is significant in sectors such as seals and o-rings, molded and extruded products, mechanical engineering, and automotive applications. In the construction industry, it is used for waterproofing and insulation. In the oil & gas sector, nitrile butadiene rubber is utilized in hoses, tubing, and gaskets.

Moreover, nitrile butadiene rubber finds extensive applications in the medical sector for producing gloves and in the aeronautics industry for producing fuel hoses and gaskets. In the food & beverage industry, it is used as an alternative to natural rubber, latex, and other elastomers in adhesives and sealants. Nitrile butadiene rubber is also a suitable substitute for other materials like isoprene, latex, thermoplastic elastomers, fluoroelastomers, and natural rubber in various applications. Its versatility and unique properties make it an essential component in numerous industries, including the manufacturing of hoses, belting, cables, and gaskets. Nitrile butadiene rubber is also used as an impact modifier in polyvinyl chloride (PVC) and acrylonitrile butadiene styrene (ABS) to enhance their durability and flexibility. In the automotive industry, it is used in the production of various types of belts, including automotive seals, gaskets, and hoses.

Furthermore, nitrile butadiene rubber's ability to withstand extreme temperatures and harsh environments makes it an ideal choice for various industrial applications, including compression machinery, hydraulic equipment, and heavy-duty vehicles. In the electric vehicle industry, it is used in batteries and charging systems due to its excellent electrical conductivity. In the civil aviation industry, nitrile butadiene rubber is used in fuel systems, hydraulic systems, and landing gear components due to its high resistance to fuel, oil, and chemicals. It is also used in the production of synthetic rubber copolymers, greases, and various other industrial applications. Nitrile butadiene rubber's unique properties make it a valuable resource in numerous industries, from manufacturing to transportation to healthcare. Its versatility and durability ensure its continued demand in a wide range of applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 319.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 62% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abbott Rubber Co. Inc., airboss.com, Apcotex Industries Ltd., Atlantic Gasket Corp., China National Petroleum Corp., Eni SpA, EW Polymer Group LLC, Grupo Dynasol, Hanna Rubber Co., JSR Corp., Kumho Petrochemical Co. Ltd., Lanxess AG, LG Chem Ltd., NANTEX INDUSTRY Co. Ltd., Nitriflex, Rahco Rubber Inc., SIBUR Holding PJSC, Synthos SA, TSRC Corp., and Zeon Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.