Oilfield Surfactants Market Size 2024-2028

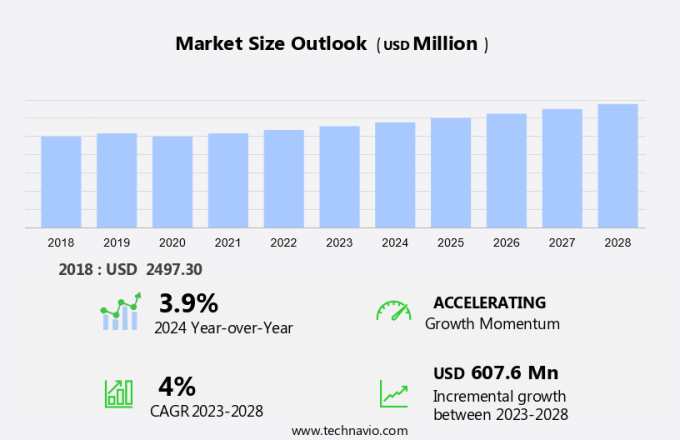

The oilfield surfactants market size is forecast to increase by USD 607.6 million at a CAGR of 4% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for enhanced oil recovery (EOR) techniques, particularly surfactant flooding, in various regions. Surfactant flooding is an effective EOR method used to reduce interfacial tension (IFT) between oil and water, thereby improving the mobility of oil in reservoirs. Wettability alteration through surfactants is another key trend in the market, as it enhances the recovery of oil from reservoirs during the tertiary recovery phase. Chemical EOR processes, which utilize surfactants, are gaining popularity due to their ability to improve reservoir conditions and enhance the recovery of crude oil. However, fluctuating crude oil prices and the high cost of surfactant production are major challenges facing the market. Proper surfactant selection, based on reservoir conditions, is crucial for maximizing the benefits of surfactant flooding and other chemical EOR processes. Therefore, a thorough understanding of surfactant properties and their behavior in reservoirs is essential for market participants to remain competitive.

What will be the Size of the Market During the Forecast Period?

- The oil and gas industry continues to seek innovative solutions to maximize hydrocarbon recovery from reservoirs. One such area of focus is the use of polymer materials and surfactants in oilfield applications. These specialized chemicals play a crucial role in enhancing oil recovery, particularly during the tertiary recovery phase. Polymer materials, including synthetic polymers, are widely used as viscosity reducers and fluid loss reducers in drilling and production processes. Viscosity reducers help maintain the desired viscosity of drilling fluids, ensuring efficient drilling operations. Fluid loss reducers minimize the loss of drilling fluids into the formation, preventing potential damage to the reservoir and reducing non-productive time. Sulfonic acid groups are essential components of various oilfield surfactants. These groups, when incorporated into surfactant molecules, facilitate the reduction of interfacial tension (IFT) between oil and water. Lower IFT values promote better wettability alteration, which is essential for effective surfactant flooding.

- Surfactant flooding is a widely used chemical enhanced oil recovery (EOR) technique that involves injecting a surfactant solution into the reservoir to reduce IFT and improve oil displacement. Polymeric alcohol surfactants, such as methyl gluconate and glycerin-based drilling fluids, are commonly used for this purpose. These surfactants offer advantages like improved stability, lower toxicity, and enhanced oil recovery. Coagulants are another type of chemical used in oilfield applications. They are employed to remove or destabilize surfactant solutions when necessary, such as during water flooding or during the production phase. Proper surfactant screening and characterization, including phase behavior and surfactant adsorption studies, are essential to ensure optimal performance of these chemicals. Chemical EOR techniques, including surfactant flooding, are often employed under reservoir conditions that are challenging for hydrocarbon production. These conditions may include high temperatures, pressures, and the presence of water and gas. Effective surfactant selection and application are crucial to ensure successful implementation of these techniques. In addition to surfactant flooding, other EOR methods like gas injection, microbial recovery, and thermal recovery also benefit from the use of surfactants.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Source

- Biobased

- Synthetic

- Geography

- Middle East and Africa

- North America

- US

- Europe

- France

- APAC

- South America

- Middle East and Africa

By Source Insights

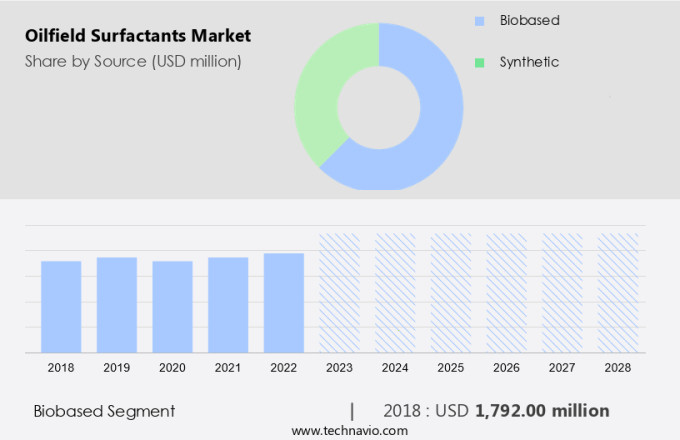

- The biobased segment is estimated to witness significant growth during the forecast period.

The market is witnessing notable growth due to the challenges posed by reservoir heterogeneities in enhancing oil production rates. Surfactants are essential in various oilfield applications, including waterflooding and artificial lift systems, to improve the efficiency of primary recovery. Biobased surfactants are gaining popularity due to their eco-friendly nature and sustainability. Derived from natural and renewable resources such as plant oils, sugars, and fatty acids, these surfactants offer biodegradability and lower environmental impact.

In 2023, regulatory requirements to minimize the use of hazardous chemicals and mitigate concerns regarding water contamination and soil degradation have fueled the demand for biobased surfactants. For instance, researchers at the Department of Chemistry and Chemical Engineering, Petroleum and Gas, University of Tehran, under the supervision of Dr. Forough Ameli, have explored the potential of magnetic surfactants for enhanced oil recovery. This innovation could further boost the market growth.

Get a glance at the market report of share of various segments Request Free Sample

The Biobased segment was valued at USD 1.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

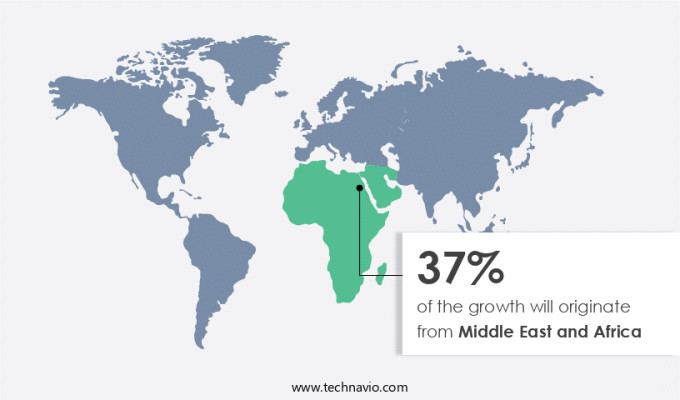

- Middle East and Africa is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the Middle East and Africa (MEA) region, the market is experiencing significant growth due to the wave in oil and gas exploration activities and the presence of vast hydrocarbon reserves. Major oil-producing countries such as Saudi Arabia, the United Arab Emirates, and Nigeria are investing heavily in new oilfields and upgrading existing infrastructure to boost production. This increased production activity necessitates the use of surfactants, which play a vital role in improving oil recovery, enhancing drilling efficiency, and reducing operational costs. Enhanced oil recovery (EOR) methods, which are essential for maximizing output from mature oilfields, are a primary application area for surfactants.

The focus on increasing oilfield productivity, even in challenging environments, is driving the adoption of specialized surfactants. These surfactants aid in various drilling operations, including emulsifying drilling fluids to prevent corrosion and thickening mud to improve drill bit performance. Additionally, they help in creating froth to facilitate the separation of drilling waste and enhance overall drilling efficiency. In conclusion, the MEA the market is poised for substantial growth due to the increasing demand for surfactants in various drilling and mud operations. The market's growth is driven by the need to optimize oil production, reduce operational costs, and enhance drilling efficiency in the region's mature and challenging oilfields.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Oilfield Surfactants Market?

Increasing demand for oilfield surfactants in developing countries is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand in developing countries. In regions such as APAC, South America, and Africa, there is a rapid expansion of oil and gas exploration and production activities in response to growing energy requirements and industrialization. Countries like India, China, Brazil, and Nigeria are investing substantially in onshore and offshore oilfields to meet their domestic demand and decrease reliance on imports. Oilfield surfactants, which play a crucial role in enhanced oil recovery, drilling, and well-stimulation processes, are gaining popularity in these nations. Developing countries are prioritizing the optimization of their oil production capabilities, particularly from mature and challenging reservoirs, where surfactants enhance oil extraction efficiency and lower operational costs.

What are the market trends shaping the Oilfield Surfactants Market?

The adoption of nanotechnology in developing oilfield surfactants is the upcoming trend in the market.

- The integration of nanotechnology in the production of oilfield surfactants represents a notable trend shaping the global market. Nanotechnology enables the creation of surfactants with enhanced efficiency, stability, and performance, especially in complex oilfield conditions, such as deepwater or high-temperature reservoirs. By incorporating nanoparticles into surfactants, advanced formulations can effectively lower surface and interfacial tensions, leading to heightened oil recovery in mature and unconventional oilfields. Nanotechnology-enhanced surfactants provide several benefits, including heightened chemical stability and improved dispersion. These advantages enable the surfactants to penetrate tight rock formations and recover trapped hydrocarbons more effectively. Furthermore, these nanomaterials can be engineered to function optimally under challenging conditions, including high salinity, pressure, or temperature, where traditional surfactants may lose efficacy.

What challenges does Oilfield Surfactants Market face during the growth?

Fluctuating crude oil prices is a key challenge affecting the market growth.

- The oil and gas industry faces significant challenges due to the unpredictability of crude oil prices. This volatility can negatively impact the strategies, demand-supply patterns, and investment plans of oil and gas companies and their service providers. Fluctuations in oil prices create uncertainty in end-use markets, affecting the profitability of all stakeholders, including companies in the market. The low crude oil price environment may decrease the demand for new rigs, leading to reduced onshore and offshore exploration and drilling activities. Consequently, the usage of oilfield surfactants, such as polymer materials, synthetic polymers, sulfonate-based surfactants, viscosity reducers, fluid loss reducers, lubricants, and polymeric alcohol surfactants, may be affected during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Ashland Inc.

- BASF

- Clariant International Ltd

- Croda International Plc

- Dow Inc.

- Ethox Chemicals LLC

- Evonik Industries AG

- Halliburton Co.

- Innospec Inc.

- Kao Corp.

- Libra Speciality Chemicals Ltd.

- Nouryon Chemicals Holding B.V.

- Pilot Chemical Co.

- Sasol Ltd.

- Schlumberger Ltd.

- Solvay SA

- Stepan Co.

- The Lubrizol Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a significant role in enhancing oil recovery by reducing interfacial tension (IFT) between oil and water, altering wettability, and improving the rheological properties of drilling fluids. Synthetic polymers, such as polymeric alcohol surfactants and sulfonated polymers, are commonly used due to their ability to function as viscosity reducers, fluid loss reducers, lubricants, and coagulants. Methyl gluconate and glycerin-based drilling fluids are also utilized due to their hydrophobic characteristics and solubility in both oil and water. Surfactant flooding, chemical enhanced oil recovery (EOR), and tertiary recovery phase processes rely on surfactants to improve oil displacement efficiency, reduce capillary forces, and manage the ionic composition of the reservoir.

Surfactant screening, characterization, and phase behavior studies are crucial for optimizing surfactant selection and application. Nanoparticles (NPs) and magnetic surfactants have gained attention due to their potential in addressing reservoir heterogeneities and improving oil production rates. The oilfield application of surfactants extends to various processes, including waterflooding, artificial lift systems, drilling operations, and mud operations. Corrosion prevention, drilling waste management, and drill bit lubrication are additional benefits of using surfactants in the oilfield. Forough Ameli, from the Department of Chemistry and Chemical Engineering at the Petroleum and Gas University, has conducted extensive research on the use of surfactants in oil recovery, focusing on the hydrocarbons, surface tension, and capillary density aspects.

The application of surfactants in the oilfield continues to evolve, with ongoing research in the areas of alkali addition, nanoparticles, and magnetic characteristics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2024-2028 |

USD 607.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

US, UAE, Iran, Saudi Arabia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, North America, Europe, APAC, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch