On-Board Diagnostics Telematics Market Size 2024-2028

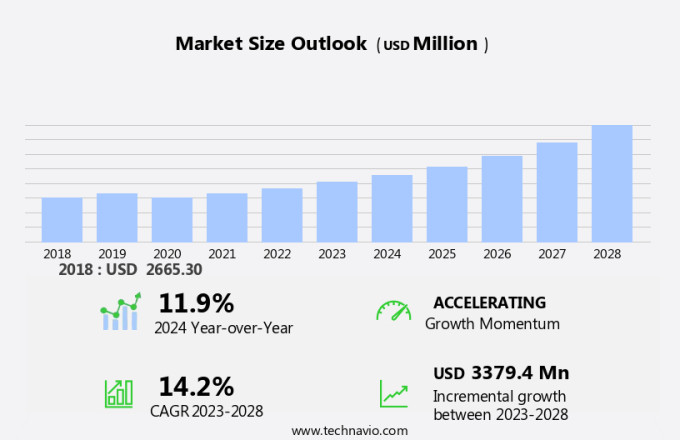

The on-board diagnostics telematics market size is forecast to increase by USD 3.38 billion at a CAGR of 14.2% between 2023 and 2028.

- The On-Board Diagnostics (OBD) telematics market is experiencing significant growth due to the increasing adoption of advanced engine components and computer control systems in vehicles. With the shift from mechanical fuel injection to electronic fuel injection, monitoring system failures has become essential for maintaining vehicle performance and reducing emissions. The standardization of telematics platforms through next-generation telematics protocol (NGTP) is also driving market growth.

- However, the increasing threat from embedded telematics systems poses a challenge to market players. Engine component manufacturers and automakers are integrating monitoring systems, connectors, and computers directly into vehicles, potentially reducing the need for external OBD telematics devices. To address this challenge, OBD telematics providers are focusing on offering value-added services, such as predictive maintenance, real-time vehicle data analysis, and connected vehicle solutions. The market is expected to continue growing as vehicle connectivity becomes increasingly important for enhancing safety, improving fuel efficiency, and reducing emissions.

What will the size of the market be during the forecast period?

- The On-Board Diagnostics (OBD) telematics market refers to the use of computer systems in personal vehicles and commercial trucks to monitor and analyze vehicle data for improved performance and maintenance. This technology enables real-time vehicle diagnostics, providing insights into various indicators and diagnostic signals that help identify potential system failures and vehicle health issues. Historically, OBD systems have been essential for emissions control, focusing primarily on engine components and vehicle emissions. With the evolution of technology, OBD systems have expanded their capabilities, integrating sensors and monitoring systems to cover a broader range of vehicle functions.

- OBD telematics systems use standardized connectors to access vehicle data, enhancing proactive maintenance and minimizing downtime for commercial vehicles. By integrating electronic fuel injection and advanced monitoring systems, these telematics improve efficiency, reliability, and engine performance, allowing fleet managers to make informed maintenance decisions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Passenger cars

- Commercial vehicles

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Type Insights

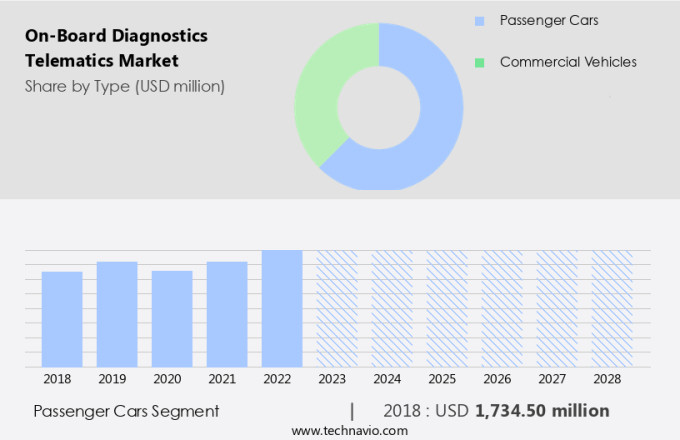

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The On-Board Diagnostics (OBD) Telematics market caters to the performance monitoring and analysis of repair needs in light-duty vehicles, including hatchbacks, sedans, and SUVs. OBD Telematics is a connected technology that enables real-time vehicle diagnostic information transmission from engine control modules to fleet management systems. The passenger cars segment holds a significant market share due to the increasing acceptance of technological advances by end-users. This segment's faster adoption rate is attributed to the convenience and benefits of performance monitoring and predictive maintenance. OBD Telematics helps fleet managers analyze wear trends, optimize fuel consumption, and improve vehicle uptime. The standard protocol employed in OBD Telematics ensures seamless communication between vehicles and fleet management systems, making it an indispensable tool for fleet operators.

Get a glance at the market report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 1.73 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

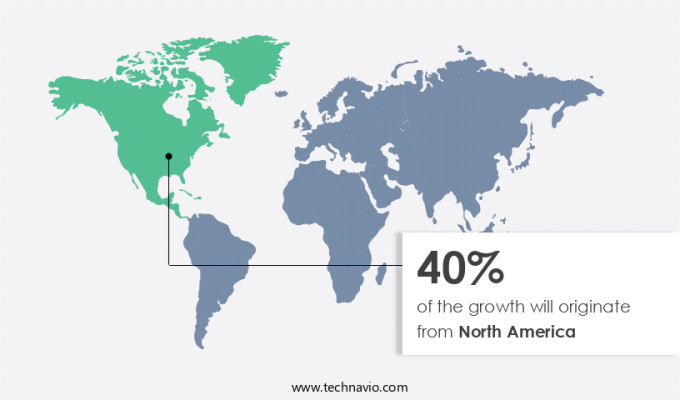

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The On-Board Diagnostics (OBD) telematics market in North America, which includes the United States and Canada, is experiencing significant growth due to several key factors. Regulations, consumer preferences, technological advancements, and innovation are driving the expansion of this market. The mandatory implementation of OBD ports in vehicles since 1996, as per federal regulations, has led to a 100% penetration of these ports in the region. This widespread availability of OBD ports presents a vast opportunity for the adoption of OBD telematics solutions across North America. Although the emergence of embedded telematics solutions may hinder the growth of the OBD telematics market to some extent, the penetration of embedded telematics is still in its nascent stages. Standardization and second-generation improvements in OBD telematics technology are expected to enhance its market potential.

Market Dynamics

Our on-board diagnostics telematics market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the On-Board Diagnostics Telematics Market?

Government initiatives increasing the adoption of OBD telematics systems is the key driver of the market.

- The On-Board Diagnostics (OBD) Telematics Market has experienced significant growth in various sectors due to the increasing importance of vehicle health monitoring. The regulatory mandates have been instrumental in driving the adoption of OBD systems in personal vehicles since 1996. The US Environmental Protection Agency (EPA) mandated the installation of OBD systems in all light-duty vehicles to ensure compliance with emissions standards. This trend continued with the European Union's requirement to include an OBD port in every vehicle from 2001. Moreover, several countries, including Thailand, South Korea, India, China, and Middle Eastern nations, are considering similar legislation.

- These regulations enable vehicle indicators and diagnostic signals to be accessed via the dashboard, allowing for efficient vehicle diagnosis. OBD systems in commercial trucks have also gained popularity due to their ability to monitor engine performance, fuel efficiency, and maintenance schedules, thereby reducing downtime and maintenance costs. In summary, OBD systems have become an essential component of modern vehicles, providing real-time vehicle health information to both consumers and commercial fleet operators. The regulatory landscape, coupled with the benefits of OBD systems, is expected to continue driving market growth in the US and beyond.

What are the market trends shaping the On-Board Diagnostics Telematics Market?

Standardization of telematics platforms through next-generation telematics protocol (NGTP) is the upcoming trend in the market.

- Telematics technology, embodied in On-Board Diagnostics (OBD), plays a significant role in monitoring engine components and identifying system failures. OBD systems utilize both electronic fuel injection and mechanical fuel injection, with computer control at their core. These monitoring systems help in decoding trouble codes, enabling efficient and timely repairs. Telematics service providers, such as WirelessCar (Volvo Group), BMW, and Connexis, employ NGTP (Networking Protocol for Telematics Applications) to develop standardized telematics solutions.

- OEMs offer open platforms for third-party companies to create telematics applications, exposing certain application interfaces. This strategy allows OEMs to develop in-house solutions for their dealers while collaborating with external companies for customer-centric applications in the insurance and logistics sectors. Connectors play a crucial role in the seamless integration of these telematics systems. By adhering to industry standards, these connectors ensure compatibility and reliability, enhancing the overall effectiveness of the telematics solutions. This approach fosters a flexible and scalable telematics ecosystem, catering to the diverse needs of various stakeholders.

What challenges does the On-Board Diagnostics Telematics Market face during the growth?

The growing threat from embedded telematics is a key challenge affecting the market growth.

- Telematics, a computer system utilized in vehicles for maintenance and car performance monitoring, has gained significant traction due to increasing regulatory mandates. In the European Union, for instance, all new vehicles are required to have the eCall facility, an emergency response system that automatically dials emergency services in the event of an accident. This legislative push towards vehicle safety is a crucial factor driving the growth of the market.

- Additionally, sensors installed in vehicles collect and transmit vital data, enabling vehicle diagnostics and emissions control. By providing real-time vehicle data, telematics solutions contribute to enhancing vehicle performance and ensuring regulatory compliance. Regulatory bodies have also focused on electronic logging devices (ELD) mandate and stolen vehicle tracking to improve road safety and security.

Exclusive Customer Landscape

The on-board diagnostics telematics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The on-board diagnostics telematics market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advantech Co. Ltd.

- BorgWarner Inc.

- CalAmp Corp.

- Continental AG

- Danlaw Inc.

- GalileoSky Research Scientific Association LLC

- Geotab Inc.

- Intel Corp.

- Insurance and Mobility Solutions

- Mediatronic Pty Ltd.

- Raven Connected Inc.

- Robert Bosch GmbH

- Sensata Technologies Inc.

- SenSight Technologies Pvt Ltd.

- Sinocastel Co. Ltd.

- SquareGPS Inc.

- Tenna LLC

- Verizon Connect Telo Inc

- Zubie Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The on-board diagnostics (OBD) telematics market is a growing sector in the automotive industry, focusing on vehicle health monitoring and diagnostics for both personal vehicles and commercial trucks. OBD systems use computerized diagnostic signals and indicators to provide real-time information on car performance, engine components, and system failures. These systems employ sensors to detect various vehicle data points, such as trouble codes, fuel injector input, and engine control module information. Historically, OBD systems were primarily used for emissions control and vehicle self-diagnosis, but they have evolved into advanced telematics solutions. Second-generation OBD systems offer reporting capabilities, vehicle diagnostic information, and performance monitoring, enabling proactive management of vehicle maintenance and repair needs.

Furthermore, telematics in OBD systems provides fleet management with valuable insights into vehicle wear trends, driving behavior, speed, idling time, and other key performance indicators. These insights allow for more effective and efficient fleet management, transitioning from reactive to proactive management strategies. Standardized OBD systems, with connectors and standard protocols, have become essential for vehicle manufacturers and repair technicians to diagnose and address issues effectively. OBD telematics solutions continue to evolve, offering vehicle tracking devices, subsystem information, and advanced monitoring capabilities to ensure optimal vehicle performance and longevity.

|

On-Board Diagnostics Telematics Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.2% |

|

Market Growth 2024-2028 |

USD 3.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.9 |

|

Key countries |

US, Germany, Canada, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch