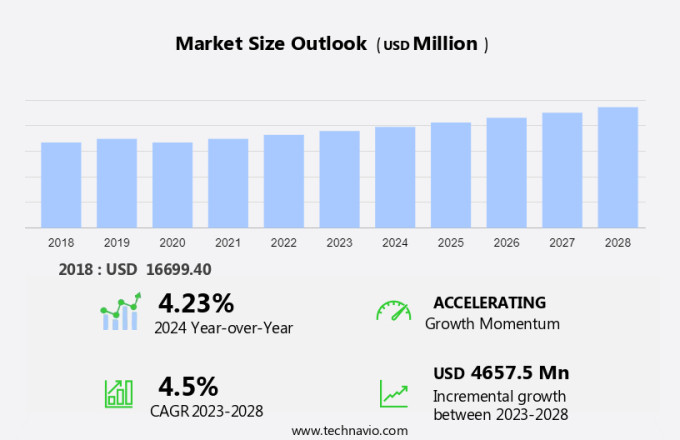

Oxygen Free Copper Market Size 2024-2028

The oxygen free copper market size is forecast to increase by USD 4.66 billion at a CAGR of 4.5% between 2023 and 2028. The oxygen-free copper (OFC) market is experiencing significant growth due to its high conductivity and increasing applications in various industries. The demand for OFC, specifically in the form of Cu-OFE grade copper wires and strips, is on the rise in sectors such as high frequency applications, electric vehicles, and solar energy investments. The aviation industry is also tapping into the potential of OFC for its lightweight and superior electrical conductivity. Additionally, the superior electrical conductivity and resistance to corrosion of OFC make it an ideal choice for various applications, including telecom, power generation, and electrical wiring. However, the slowdown in global automotive production may slightly hinder the market growth. The report provides a comprehensive analysis of these trends and the challenges they pose to the OFC market.

What will be the Size of the Market During the Forecast Period?

Oxygen-free copper (Cu-OFE) is a high-quality copper alloy with superior electrical and thermal conductivity, low impurities, and high frequency capabilities. This copper variant is widely used in various industries due to its unique properties. In this article, we will discuss the key trends and applications of oxygen-free copper in the market. Electrical Applications: The electrical industry is the largest consumer of oxygen-free copper. Its high conductivity and low impurities make it an ideal choice for power generation, transmission, and distribution applications. Cu-OFE is extensively used in the manufacturing of electrical appliances, renewable energy systems, and high-frequency equipment.

Furthermore, the renewable energy sector is witnessing significant growth, and oxygen-free copper is playing a crucial role in this transition. Solar power installations require high-quality copper for the production of solar panels and photovoltaic cells. Additionally, oxygen-free copper is used in the manufacturing of wind turbines and other renewable energy systems due to its excellent electrical conductivity and resistance to corrosion. The telecommunications industry relies heavily on oxygen-free copper for the production of various components such as microwave tubes, vacuum capacitors, vacuum interrupters, waveguides, and electronic gadgets. The high thermal conductivity of Cu-OFE makes it an ideal choice for cooling systems in telecommunications equipment.

Moreover, manufacturing: Oxygen-free copper is extensively used in the manufacturing industry for the production of printed circuit boards, high-vacuum systems, and various other components. Its high conductivity and low impurities make it an ideal choice for these applications. The automotive industry is another major consumer of oxygen-free copper. The increasing popularity of electric vehicles (EVs) and the shift towards lightweight and fuel-efficient vehicles is driving the demand for high-quality copper. Cu-OFE is used in the manufacturing of electric motors, batteries, and other automotive components due to its excellent electrical conductivity and resistance to corrosion. The consumer electronics industry is witnessing a rise in demand for mobile phones, smart devices, and other electronic gadgets.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Electronics and electrical

- High-tech and telecom

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

The electronics and electrical segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to its increasing utilization in various sectors, particularly in the electronics and electrical industries. OFC is commonly employed in high-frequency applications, such as wires and copper strips, for use in audiovisual systems and advanced technologies. This is primarily due to its superior electrical conductivity, which enables efficient transfer of electrical current and enhances the performance of electronic devices. Beyond audiovisual applications, OFC finds extensive use in various industries, including electric vehicles, automotive production, and solar energy investments. In electric vehicles, OFC is utilized in the manufacturing of batteries and wiring harnesses, while in automotive production, it is used for engine wiring and electrical systems.

Furthermore, in the renewable energy sector, OFC is employed in solar panels and photovoltaic systems due to its high conductivity and resistance to oxidation. Furthermore, OFC is used in various industrial applications, such as backing plates, heat sinks, klystrons, microwave tubes, vacuum capacitors, casting molds, video and audio systems, magnetrons, and other related applications. The superior properties of OFC make it an ideal choice for industries that require high-performance electrical components and systems. In conclusion, the United States the market is poised for continued growth due to its wide range of applications and the increasing demand for high-performance electrical components and systems in various industries.

Get a glance at the market share of various segments Request Free Sample

The electronics and electrical segment accounted for USD 14.56 billion in 2018 and showed a gradual increase during the forecast period.

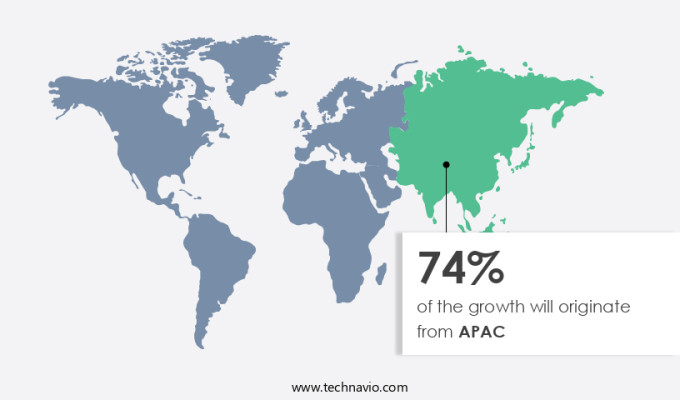

Regional Insights

APAC is estimated to contribute 74% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific region has experienced significant growth due to the escalating demand for this material in various industries. OFC's utilization is predominantly driven by the electronics sector, where it is extensively used in semiconductor manufacturing. The ongoing semiconductor shortage has intensified the demand for high-quality copper cathodes, which are essential in the production of semiconductors. Moreover, the increasing demand for electronics in North America, fueled by the rise of e-commerce and the shift towards remote work, has led to a rise in the production of microwave tubes and other electronic components, further increasing the demand for OFC.

Furthermore, the presence of major manufacturing hubs and end-users in countries like China, South Korea, and Japan, which are leading producers of electronics and automobiles, has also contributed to the market's expansion. In the automotive industry, OFC is used in the manufacturing of high-performance batteries, electric motors, and other critical components. The growing popularity of electric vehicles (EVs) in North America is expected to accelerate the demand for OFC in the coming years. In conclusion, the oxygen-free copper market in the Asia Pacific region is poised for continued growth due to the increasing demand for copper in the electronics and automotive industries.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Untapped applications of OFC are the key driver of the market. Oxygen-free copper (OFC) plays a crucial role in various end-user industries, including electronics and electrical, telecommunication, automotive, and medical sectors. Beyond these traditional applications, OFC holds significant potential in emerging markets, such as power generation and distribution, in the conventional and renewable energy sectors. The superior conductivity of OFC makes it an indispensable component in generating and distributing electricity in these markets. As global energy demand continues to rise, there is a pressing need to find more efficient and cost-effective methods for managing energy resources. Market participants address this challenge by providing innovative OFC-based solutions that help conserve energy and minimize environmental impact.

Vacuum capacitors, vacuum interrupters, waveguides, and other OFC-based components are integral to electronic gadgets, including mobile phones, smart devices, and consumer electronics. The increasing popularity of smartphones and smart devices has led to a rise in demand for these components, further expanding the market potential for OFC. In the telecommunication industry, OFC is used extensively in waveguides and other applications that require high-speed data transmission. In the automotive sector, OFC is utilized in various electrical systems, such as engine management systems and power steering systems. In the medical industry, OFC is used in various medical devices, including pacemakers and defibrillators, due to its excellent conductivity and biocompatibility.

Market Trends

Growing demand for OFC from aviation industry is the upcoming trend in the market. Oxygen-free copper (OFC) is a high-conductivity copper variant with minimal impurities, making it an essential component in various industries, including electrical, superconductors, semiconductors, and high-vacuum systems. OFC's unique properties, such as low volatility under vacuum, make it suitable for applications in renewable energy technologies, like solar power systems and printed circuit boards.

In the aviation sector, OFC finds extensive use in magnetrons, high-powered vacuum tubes used in radar equipment production. These magnetrons, manufactured using OFC, have significant potential in the aviation industry, with applications ranging from bearings and bushings in landing gears and cargo doors to wing and tail actuators, wheel and brake components, hydraulic pump components, pylons, and more. The growing aviation industry, fueled by increasing consumer disposable income and the escalating demand for air transport, further highlights the importance of OFC in this sector.

Market Challenge

Slowdown of global automotive industry is a key challenge affecting market growth. The global production of motor vehicles experienced a significant decrease in 2020, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA). The decline amounted to approximately 16%, resulting in the manufacturing of fewer than 78 million cars, which was equivalent to sales levels seen in 2010. China, the world's leading automotive manufacturing hub, produced 25,225,242 units in 2020, a decline from the 25,720,665 units produced in the previous year.

This trend was a result of the COVID-19 pandemic's impact on the industry. Other regions, including Europe, experienced similar declines, with motor vehicle production dropping by 21% in 2020 compared to 2019. In the market, sectors such as PCs, laptops, medical electronics, energy, and thermal continue to rely on oxygen-free copper for their components. Oxygen-free copper's demand remains strong in these industries due to its superior conductivity and resistance to oxidation.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aviva Metals Inc. - The company offers oxygen free copper that includes copper alloys, which are high electrical and thermal, high ductility, ease of welding, high impact strength, and low volatility under high vacuum.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aurubis AG

- Aviva Metals Inc.

- Citizen Metalloys Ltd.

- Cupori Oy

- Farmers Copper LTD.

- Furukawa Electric Co. Ltd.

- Hitachi Metals Neomaterial Ltd.

- Hussey Copper

- JX Nippon Mining and Metals Corp.

- KGHM Polska Miedz SA

- KME Germany GmbH

- Metrod Holdings Berhad

- Mitsubishi Materials Corp.

- Sam Dong America

- Sequoia Brass and Copper.

- Shanghai Metal Corp.

- Tranect Ltd.

- Watteredge LLC

- Wieland Werke AG

- Zhejiang Libo Holding Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Oxygen-free copper (Cu-OFE) is a high-purity copper grade with low impurities, making it an ideal choice for various electrical applications due to its high conductivity and thermal stability. The global market for oxygen-free copper is driven by the increasing demand for high-performance electrical components in sectors such as renewable energy, semiconductors, and telecommunications. In conclusion, the market is expected to grow significantly due to its wide applications in various industries, particularly in electrical applications, renewable energy, mining and the automotive sector. The semiconductor industry also relies heavily on Cu-OFE for the production of high-frequency components, such as microwave tubes, vacuum capacitors, and vacuum interrupters.

Moreover, the automotive industry is a significant consumer of Cu-OFE, with its use in electric vehicles (EVs) and hybrid electric vehicles (HEVs) increasing due to their growing popularity. The demand for OFC is increasing in solar energy investments, particularly in the manufacturing of solar panels, metals and photovoltaic cells. The demand for Cu-OFE is also driven by the manufacturing of printed circuit boards, wires, and copper strips for various electrical appliances. The high cost of Cu-OFE is a major challenge for the market, with the price being influenced by processing costs and the current semiconductor shortage. However, the market is expected to recover due to the increasing demand for Cu-OFE in various end-use industries, including the energy sector, thermal sector, and consumer electronics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 4.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 74% |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aurubis AG, Aviva Metals Inc., Citizen Metalloys Ltd., Cupori Oy, Farmers Copper LTD., Furukawa Electric Co. Ltd., Hitachi Metals Neomaterial Ltd., Hussey Copper, JX Nippon Mining and Metals Corp., KGHM Polska Miedz SA, KME Germany GmbH, Metrod Holdings Berhad, Mitsubishi Materials Corp., Sam Dong America, Sequoia Brass and Copper., Shanghai Metal Corp., Tranect Ltd., Watteredge LLC, Wieland Werke AG, and Zhejiang Libo Holding Group Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch