US Telecom Market Size 2025-2029

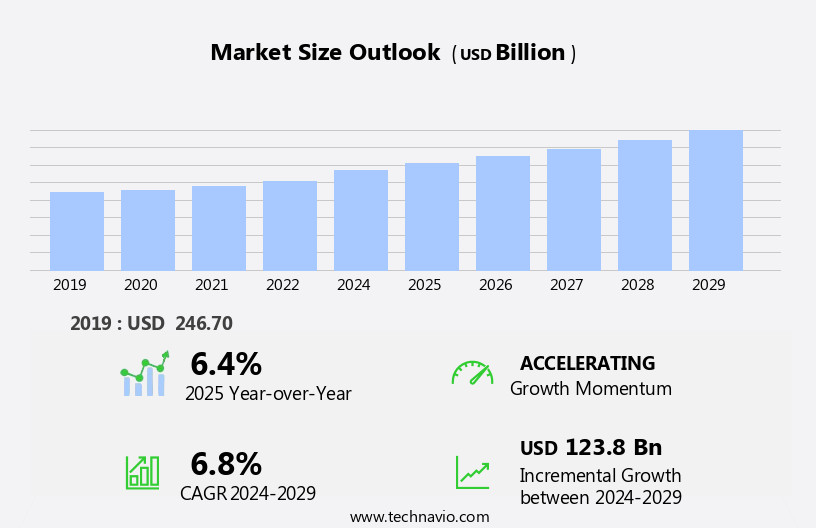

The us telecom market size is forecast to increase by USD 123.8 billion, at a CAGR of 6.8% between 2024 and 2029.

- The Telecom Market in the US is experiencing robust growth, driven primarily by the surging demand for broadband services and technological advancements. The increasing number of remote work arrangements and online learning necessitate high-speed internet connections, fueling the expansion of this sector. Moreover, the continuous evolution of technology, such as 5G and the Internet of Things (IoT), is revolutionizing the telecommunications landscape, offering new opportunities for innovation and growth. However, the market is not without challenges. Regulatory compliance poses a significant hurdle, with stringent regulations governing data privacy, network security, and spectrum allocation. Companies must invest heavily in ensuring compliance with these regulations to maintain customer trust and avoid potential legal repercussions.

- Additionally, the increasing competition and the need to offer competitive pricing while maintaining profitability further complicate the strategic landscape. Companies must navigate these challenges effectively to capitalize on the market's potential and stay ahead of the competition.

What will be the size of the US Telecom Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the dynamic US telecom market, next-generation networks are transforming the industry landscape. Network infrastructure is evolving with the integration of network programmability, SDN controllers, and NFV infrastructure. Telecommunications equipment providers are investing in AI-powered network optimization and predictive analytics to enhance network performance. Smart cities are embracing IoT platforms and connected devices, leading to an increase in data privacy concerns. Augmented reality and virtual reality applications are revolutionizing network services, requiring advanced analytics and real-time processing capabilities. Satellite operators and cable TV operators are collaborating to deliver seamless, high-speed connectivity. SD-WAN and mobile edge computing are enabling remote monitoring and industrial IoT applications in various industries.

- Network slicing is gaining traction as a key differentiator, allowing for customized network solutions for various use cases. Telecom players are focusing on digital transformation, integrating cloud security and cloud native solutions to meet evolving business needs. AI algorithms and edge AI are powering network automation and improving network services, while network services providers are offering advanced analytics and real-time insights to their clients. In the US market, telecom players are leveraging network infrastructure advancements and digital transformation to cater to the demands of businesses and consumers alike. The focus is on delivering secure, reliable, and high-performance network solutions to drive growth and innovation.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Consumer

- Business

- Type

- Wireless

- Wireline

- Application

- Residential

- Commercial

- Technology

- 5G

- 4G

- 3G

- Satellite communication

- Geography

- North America

- US

- North America

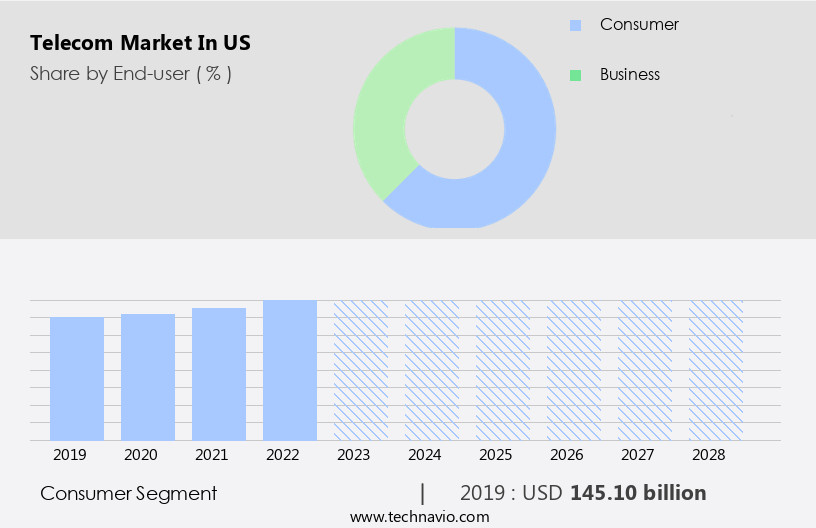

By End-user Insights

The consumer segment is estimated to witness significant growth during the forecast period.

The US telecom market is experiencing significant growth, with the consumer segment leading the way in revenue share in 2023. This trend is expected to continue as the widespread use of smartphones drives the demand for telecom services. In fact, over 92% of the US population was an Internet user in 2021, according to the World Bank. The rise of over-the-top (OTT) applications is also encouraging customers to opt for wireless Internet services, which will contribute to the expansion of communication networks. Furthermore, the increasing popularity of online gaming and ultra-high-definition films is anticipated to accelerate the segment's growth.

Network security is a critical concern in the telecom industry, with the increasing threat of cyberattacks. Virtualization technologies, such as network function virtualization (NFV) and software-defined networking (SDN), are being adopted to enhance network security and improve network efficiency. Unified communications and VoIP services are also gaining traction, enabling seamless communication between different devices and platforms. Capacity planning and network optimization are essential for ensuring network performance and reliability. Signal processing and network monitoring are crucial components of network optimization, helping to minimize packet loss and improve carrier aggregation. Massive MIMO and 5G networks are being deployed to increase network capacity and provide faster data speeds.

Revenue management and data analytics are essential for telecom companies to effectively monetize their services and gain insights into customer behavior. Fixed broadband and fiber optics are key technologies for delivering high-speed Internet services, while cloud computing and edge computing are being adopted for cost savings and improved performance. Private networks and network virtualization are becoming increasingly popular, offering enhanced security and flexibility. Spectrum licensing and allocation are critical for ensuring network performance and capacity. Regulatory compliance is also a significant challenge for telecom companies, requiring careful planning and implementation. AI applications, such as machine learning and predictive analytics, are being used to optimize network performance and improve customer experience.

Wireless infrastructure development is ongoing, with antenna technologies and deployment strategies being optimized to improve coverage and capacity. Optical amplifiers and transmission lines are essential components of telecom networks, enabling the transmission of data over long distances. IoT devices and m2m communication are also becoming increasingly prevalent, requiring specialized network solutions. Network slicing and open RAN are emerging technologies that offer the potential for greater network flexibility and efficiency. In conclusion, the US telecom market is undergoing significant change, with a focus on network security, capacity planning, and network optimization. The adoption of virtualization technologies, unified communications, and AI applications is driving innovation and improving network performance.

Regulatory compliance and spectrum licensing remain key challenges, while the deployment of 5G networks and massive MIMO will significantly impact the market in the coming years.

The Consumer segment was valued at USD 145.10 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive telecom market in the United States, providers continually innovate to meet consumer demand for reliable, high-speed wireless and wired connectivity. The telecom landscape is characterized by advanced technologies such as 5G, fiber optics, and VoIP. Telecom companies invest heavily in network infrastructure, offering various plans, including unlimited data, family plans, and international roaming. Consumers seek affordable prices, excellent coverage, and superior network quality. Telecom providers prioritize customer satisfaction through excellent service, promotions, and loyalty programs. The telecom market in the US is a significant contributor to the economy, driving innovation, creating jobs, and connecting people across the country. With a focus on 5G rollout, IoT applications, and digital transformation, the future of the US telecom market promises exciting advancements.

What are the US Telecom Market drivers leading to the rise in adoption of the Industry?

- The significant surge in broadband demand serves as the primary market catalyst.

- The telecom market in the US is experiencing significant growth due to the increasing demand for unified communications and advanced technologies such as virtualization and antenna technologies. Telecom companies are focusing on spectrum allocation and deployment strategies to enhance wireless infrastructure and support the growing demand for high-speed internet and mobile data services. Packet loss and network congestion are major challenges, leading to the adoption of carrier aggregation and infrastructure development to improve network performance. The transition to 5G networks is a priority, with massive MIMO and network monitoring playing crucial roles in delivering immersive and harmonious user experiences.

- The market dynamics are driven by the need for faster and more reliable connectivity, the proliferation of mobile devices, and the increasing adoption of cloud services and IoT applications.

What are the US Telecom Market trends shaping the Industry?

- The current market landscape is shaped by technological advancements, which have become the mandated trend for professionals. In the business world, staying updated with the latest technology is no longer an option but a requirement for success.

- The US telecom market is experiencing significant technological advancements that are transforming the industry. The deployment of 5G networks is a notable development, delivering faster speeds and reduced latency, thereby facilitating innovations such as Machine-to-Machine (M2M) communication, IoT, and augmented reality. The expansion of fiber-optic infrastructure is another critical trend, enhancing broadband connectivity for homes and businesses. Cloud computing is gaining traction, offering remote work and collaboration capabilities. Artificial intelligence (AI) and machine learning are being employed for network optimization, customer support, and predictive maintenance. Software-defined networking (SDN) and network function virtualization (NFV) are on the rise, enabling more agile and cost-effective network management.

- Spectrum licensing and the adoption of open RAN are also shaping the market landscape. Network slicing is a developing trend, allowing for the creation of customized network solutions for various industries and applications. Billing systems are being modernized, integrating AI and cloud technologies for improved accuracy and efficiency. The telecom sector's continuous evolution underscores its importance in driving economic growth and innovation.

How does US Telecom Market faces challenges face during its growth?

- Compliance with regulatory requirements poses a significant challenge to the industry's growth trajectory. It is essential for businesses to adhere to these regulations to ensure they operate legally and ethically, but the complexities and costs associated with achieving and maintaining compliance can hinder growth.

- In the dynamic telecom market, regulatory compliance plays a pivotal role for US businesses. Telecom companies must navigate a complex regulatory landscape, adhering to a multitude of federal and state rules, procedures, and standards. The Federal Communications Commission (FCC) sets the agenda with its jurisdiction over spectrum allotment, net neutrality, and universal service obligations, significantly influencing business operations. Moreover, consumer data protection is paramount, with regulations such as the Telecommunications Act of 1996 and the Communications Assistance for Law Enforcement Act (CALEA) ensuring data privacy and cooperation with law enforcement. Local governments add another layer of complexity with zoning laws for cell tower siting, which may differ significantly from one jurisdiction to another.

- Advancements in technology continue to shape the telecom industry, with the integration of big data, data centers, machine learning, IoT devices, edge computing, transmission lines, radio frequency (RF), and satellite communication shaping the future of telecom services. Ensuring regulatory compliance while embracing these advancements is essential for telecom businesses to thrive in the US market.

Exclusive US Telecom Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altice USA Inc.

- AT and T Inc.

- Charter Communications Inc.

- Cincinnati Bell Inc.

- Comcast Corp.

- Cox Communications Inc.

- DirecTV

- DISH Network L.L.C.

- Foundever Group

- Frontier Communications Parent Inc.

- Lumen Technologies Inc.

- Motorola Solutions Inc.

- Nokia Corp.

- T Mobile US Inc.

- Telefonaktiebolaget LM Ericsson

- UScellular

- Telephone and Data Systems Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Telecom Market In US

- In January 2024, T-Mobile and Sprint completed their merger, creating a new powerhouse in the US telecom market. The combined company, now named T-Mobile US, became the second-largest mobile network operator, surpassing Sprint (Reuters, 2024). In March 2024, Verizon Communications announced the launch of its 5G Home Internet service, providing fixed wireless broadband connectivity to compete with cable and fiber providers (Verizon, 2024). In May 2025, the Federal Communications Commission (FCC) approved the deployment of SpaceX's Starlink satellite internet service in the US, marking a significant entry of a new player in the broadband market (FCC, 2025). AT&T, in the same month, announced a strategic partnership with Microsoft to accelerate the adoption of 5G and edge computing technologies, aiming to deliver enhanced services and experiences to customers (AT&T, 2025).

Research Analyst Overview

The telecom market in the US continues to evolve, with dynamic market dynamics shaping the industry's landscape. M2M communication and spectrum licensing are crucial components, as the demand for seamless connectivity across various sectors grows. Optical amplifiers and private networks are essential for enhancing network performance and ensuring business continuity. Network virtualization, AI applications, and cloud computing are transforming the telecom industry, enabling advanced services such as network slicing and open RAN. IP telephony and unified communications are revolutionizing voice services, while fiber optics and billing systems streamline operations and improve efficiency. Capacity planning and network optimization are ongoing priorities, with signal processing and network monitoring essential for maintaining network quality.

Spectrum allocation and deployment strategies are critical for infrastructure development, while 5G networks and massive MIMO are driving innovation. Transmission lines and customer support are essential for maintaining network reliability, while regulatory compliance and data analytics are vital for ensuring business success. Big data and data centers are transforming the industry, with machine learning and edge computing enabling new applications and services. RF and satellite communication, IoT devices, and transmission lines are expanding the reach and capabilities of telecom networks, while network slicing and open RAN are enabling more flexible and customizable solutions. The ongoing evolution of these technologies and applications is shaping the future of the telecom market in the US.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Telecom Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 123.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch