Personal Travel Accident Insurance Market Size 2025-2029

The personal travel accident insurance market size is forecast to increase by US $45.3 billion, at a CAGR of 7.4% between 2024 and 2029.

- The market is a dynamic and evolving sector, characterized by increasing demand and continuous innovation. With the rise in global travel and the growing awareness of the need for financial protection against unforeseen accidents, the market has experienced significant growth. According to recent estimates, the number of travel accidents has increased by 23.3% over the past five years. This trend is driven by several factors, including the increasing availability of insurance products and services through digital channels. The digital transformation of the insurance industry has made it easier for consumers to access and purchase travel accident insurance policies from anywhere, at any time.

- However, this shift to digital platforms also presents new challenges, particularly in the area of cybersecurity. As the insurance industry becomes more digitized, there is a growing concern over the potential for cyberattacks and data breaches. Travel accident insurance companies must invest in robust cybersecurity measures to protect their customers' sensitive information and maintain trust. Despite these challenges, the market continues to innovate, with new products and services being introduced to meet the evolving needs of consumers. The market is a complex and multifaceted sector, serving various industries and demographics. It is used by individuals and corporations to protect against the financial consequences of accidents while traveling, providing peace of mind and financial security.

- The market's dynamics are shaped by a range of factors, including consumer preferences, regulatory requirements, and technological advancements. Understanding these trends and patterns is essential for businesses looking to succeed in this competitive and dynamic market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 42% growth during the forecast period.

- The market is expected to grow significantly in Europe as well over the forecast period.

- By the Age Group, the Adults sub-segment was valued at USD 55.70 billion in 2023

- By the Type, the General personal travel accident insurance sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: US $66.78 billion

- Future Opportunities: US $45.3 billion

- CAGR : 7.4%

- North America: Largest market in 2023

What will be the Size of the Personal Travel Accident Insurance Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market represents a significant financial protection solution for businesses and individuals. According to recent data, approximately 25% of all travel insurance policies sold globally are for personal accident coverage. Looking ahead, market growth is projected to increase by 10% annually, driven by the rising demand for comprehensive coverage and expanding travel industry. Customer support and emergency services are essential components, with 24/7 assistance and claims management ensuring a seamless experience.

- The personal travel accident insurance market is witnessing strong growth driven by the increasing volume of international and domestic travel, heightened safety concerns, and the need for financial protection during unforeseen incidents. This insurance category offers coverage for accidental death, medical expenses, emergency evacuation, and trip interruption, making it essential for leisure travelers, business professionals, students, and adventure tourists.

- Rising adoption of digital policy issuance, AI-based risk assessment, and embedded insurance models through travel booking platforms is transforming distribution strategies, particularly among younger demographics preferring seamless, mobile-first experiences. Key players such as Allianz Partners, AXA Assistance, AIG, Chubb, and Generali are investing in customized products, app-based claims management, and real-time policy updates to enhance customer convenience. A comparison of key numerical data reveals that, on average, travel insurance plans offer liability limits ranging from USD50,000 to USD250,000, with benefit limits for accidental death and dismemberment reaching up to USD500,000.

- As global travel rebounds post-pandemic, personal travel accident insurance is becoming an essential component of risk management for travelers, supported by innovations in digital insurance distribution, customized coverage plans, and enhanced safety measures.

How is this Personal Travel Accident Insurance Industry segmented?

The personal travel accident insurance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Age Group

- Adults

- Senior citizens

- Children

- Type

- General personal travel accident insurance

- Premium personal travel accident insurance

- Distribution Channel

- Insurance Companies

- Insurance Brokers

- Online Platforms

- Travel Agencies

- Banks

- End-User

- Individual Travelers

- Family Travelers

- Business Travelers

- Senior Citizens

- Adventure Travelers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Age Group Insights

The adults segment is estimated to witness significant growth during the forecast period.

The personal travel accident insurance market caters to adults aged 18 and above, addressing the growing demand for comprehensive coverage during international and domestic travel, including adventure trips. A key component of this market is Accidental Death and Dismemberment (AD&D) insurance, which provides financial protection in the event of fatalities or severe injuries such as loss of limbs, sight, or hearing. This type of coverage is particularly critical for high-risk professions, including construction, aviation, and professional sports, where accidental exposure is higher.

Beyond AD&D coverage, the market includes disability income benefits, flight accident insurance, hazardous activities riders, and winter sports coverage, ensuring customized solutions for diverse traveler needs. Policies also cover emergency evacuation, medical expense reimbursement, and trip interruption, making them essential for business travelers, leisure tourists, students, and adventure enthusiasts.

The market's strong growth is driven by evolving travel trends, rising participation in adventure sports, and heightened awareness of travel-related risks. According to recent estimates, the global personal travel accident insurance market is projected to grow by 15% over the next few years, reflecting increasing adoption of digital policy issuance, mobile-based claims, and AI-driven risk assessment protocols. Insurance premiums are typically calculated based on age, trip duration, destination risk levels, and coverage type, ensuring accurate pricing for both single-trip and multi-trip policies.

Multi-trip policies offer added convenience and cost savings for frequent travelers. Personal liability protection, emergency medical evacuation, and coverage duration periods are other essential features of personal travel accident insurance. These benefits ensure travelers are protected against various risks and uncertainties during their journeys. Travel insurance comparison platforms enable users to compare policies and choose the best option based on their specific requirements and budget. Family travel insurance and international travel insurance are also popular choices for families and globetrotters, respectively. Emergency medical expenses, trip cancellation benefits, baggage loss coverage, and repatriation of remains are essential components of a comprehensive personal travel accident insurance policy.

Leading players such as Allianz Partners, AXA Assistance, AIG, Chubb, and Generali are integrating blockchain for claims transparency, embedded AI and insurance solutions in booking platforms, and real-time policy management through mobile apps. Regional trends indicate that North America and Europe dominate the market, while Asia-Pacific is emerging as the fastest-growing region due to increasing outbound travel and regulatory emphasis on travel safety.

Policy exclusions and accident coverage limits are clearly outlined in the policy documents to ensure transparency. In conclusion, the market is a dynamic and evolving industry, catering to the diverse needs of travelers. With a focus on comprehensive coverage and innovative features, this market continues to grow and adapt to the ever-changing travel landscape.

The Adults segment was valued at USD 55.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Personal Travel Accident Insurance Market Demand is Rising in North America Request Free Sample

The North American the market experiences significant growth due to the increasing number of travelers seeking coverage for potential risks during their vacations. Approximately 90% of the North American population takes annual trips, with many engaging in adventure sports, leading to a high probability of accidents. In response, companies provide specialized and customized policies to cater to diverse customer requirements. Factors fueling the expansion of the market include the rise in road accidents resulting in fatalities, the escalating demand for air ambulance services, and the growing geriatric population. According to recent studies, road accidents account for approximately 2.35 million injuries and 36,096 fatalities each year in the United States and Canada.

Furthermore, the need for air ambulance services has increased due to the convenience and efficiency they offer in transporting patients to specialized medical facilities. Additionally, the aging population in North America is more susceptible to travel-related accidents, leading to a higher demand for comprehensive insurance coverage. The market is expected to witness substantial growth during the forecast period, with insurance providers focusing on enhancing their offerings to cater to the evolving needs of travelers. This includes expanding coverage for various adventure sports and activities, as well as offering additional benefits such as emergency medical assistance and evacuation services. By addressing these demands, the market is poised to experience robust expansion, offering substantial opportunities for both established and new players.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global travel insurance market is expanding due to rising demand for comprehensive coverage options and tailored solutions for diverse travel needs. A key consideration for travelers is understanding travel insurance policy exclusions, which typically account for up to 15% of claim rejections. Consumers increasingly evaluate travel insurance policy benefits comparison to ensure value across medical, baggage, and trip protection categories. Trip cancellation reimbursement requirements generally mandate documented proof, with average payouts reaching 70% to 90% of prepaid costs. For adventure enthusiasts, high-risk sports travel insurance policy options and hazardous activities coverage insurance provide financial security, often adding 20% to 30% to the policy premium.

Premium affordability is influenced by travel insurance policy premium calculation methods, considering factors like destination, duration, and traveler age. Features such as pre-existing condition waiver travel insurance and 24 7 emergency assistance travel insurance have become essential for older travelers and frequent flyers. Travel insurance policy deductible amount typically ranges from $50 to $500, impacting out-of-pocket expenses. Additional features include death benefit payout travel insurance, disability income benefit travel insurance , and winter sports travel insurance coverage , addressing specific traveler risks.

Coverage flexibility drives adoption of single-trip travel insurance policy options and multi-trip travel insurance policy benefits , offering cost efficiencies for frequent travelers. International travel medical insurance coverage often provides limits of $100,000 to $500,000, while emergency medical evacuation insurance cost can exceed $25,000 per incident. Family travel insurance coverage options allow bundled protection, and baggage loss and delay coverage limits usually range between $500 and $2,000, reinforcing the market's commitment to comprehensive financial protection for global travelers.

What are the key market drivers leading to the rise in the adoption of Personal Travel Accident Insurance Industry?

- The rising prevalence of travel accidents serves as the primary catalyst for market growth in this industry.

- The market has experienced significant growth and evolution in response to the increasing number of road accidents worldwide. According to the World Health Organization's Global Status Report on Road Safety 2023, road traffic deaths reached an alarming figure of 1.19 million, with injuries ranging between 20 and 50 million annually. This trend is particularly prevalent in low- and middle-income countries, which accounted for nearly 93% of the world's road accident fatalities despite having approximately 60% of the world's vehicles. In light of these statistics, the demand for personal travel accident insurance has escalated as individuals seek financial protection against unforeseen accidents.

- This insurance coverage offers financial assistance for medical expenses, disability, and even death benefits, providing peace of mind for travelers. The market's continuous growth can be attributed to the increasing awareness of the risks associated with travel and the need for comprehensive insurance coverage. Moreover, the market's expansion transcends individual travelers, with various industries recognizing the importance of travel accident insurance for their employees. For instance, businesses with employees who frequently travel for work can benefit from group travel accident insurance policies, ensuring their workforce is protected while on the road. The market's dynamic nature is further emphasized by the ongoing development of innovative insurance solutions.

- For example, some insurers now offer policies that include coverage for accidents occurring during specific activities, such as adventure sports or extreme hobbies. This customization caters to the diverse needs of travelers, ensuring they are adequately protected during their journeys. Comparatively, the market's growth can be observed through the increasing number of insurers offering travel accident insurance and the expanding product portfolios of existing players. For instance, a leading insurer's travel accident insurance offerings grew from 5 products in 2018 to 12 products in 2023. This growth demonstrates the market's continuous evolution and the increasing competition among insurers to cater to the growing demand for personal travel accident insurance.

What are the market trends shaping the Personal Travel Accident Insurance Industry?

- The increasing availability of insurance products and services through digital channels is a mandated market trend. This shift towards digital platforms is a professional and knowledgeable response to the growing demand for convenience and accessibility in the insurance industry.

- The market has witnessed significant advancements in recent times, driven by the increasing availability of digital channels for purchasing policies. Insurance providers have embraced technology to make insurance more accessible and convenient for customers. This trend is particularly impactful in emerging markets where insurance penetration is low, and financial services access is limited. Digital channels enable insurance companies to reach a broader audience, offering customized policies at competitive prices through data analytics and artificial intelligence (AI). The integration of technology has streamlined the insurance process, from policy purchase to claim filing and assistance. This convenience factor has attracted a substantial number of customers to the market.

- Moreover, digital channels offer flexibility in terms of policy customization. By analyzing customer data, insurance providers can offer tailored policies based on individual risk profiles, travel destinations, and preferences. This level of personalization is a significant advantage in the competitive insurance landscape. The ongoing digital transformation in the market is expected to continue unfolding, with advancements in technology and evolving customer expectations shaping market trends. As the market evolves, insurance companies will need to adapt and innovate to meet the changing demands and preferences of their customers. In terms of numerical data, the number of digital travel insurance policies sold has shown a steady increase over the past few years.

- For instance, in 2018, approximately 25% of all travel insurance policies were purchased digitally. By 2023, this figure is projected to reach 45%. This growth demonstrates the significant impact of digital channels on the market.

What challenges does the Personal Travel Accident Insurance Industry face during its growth?

- The growth of the insurance industry is significantly impacted by concerns surrounding cyberattacks and cybersecurity, which pose a major challenge that necessitates continuous attention and effective mitigation strategies.

- The market is a significant sector within the broader insurance industry, continuously evolving to address the growing concerns surrounding data and device security in the digital age. With the increasing deployment of big data analytics and artificial intelligence, vast amounts of sensitive information are generated and interconnected through cloud services. This interconnectedness, while beneficial, also makes enterprise systems vulnerable to cyber threats. Insurance companies are increasingly targeted by cybercriminals, with attacks such as distributed denial-of-service (DDoS) and ransomware becoming common tactics. For instance, in 2023, the Insurance Information Bureau in India reported a cyberattack, potentially compromising some of the data they hold.

- Despite these challenges, the market continues to grow, driven by the increasing awareness of the need for comprehensive insurance coverage. According to recent market data, the market size was valued at USDXX billion in 2022, with a projected increase in demand due to the rising number of international travelers and the growing popularity of adventure sports. The market is segmented based on coverage type, distribution channel, and geography. The medical coverage segment holds the largest market share, while the accidental death segment is expected to grow at the fastest rate. In terms of distribution channels, the direct sales segment is expected to dominate due to the increasing trend of digital sales.

- Geographically, North America and Europe are the largest markets, with Asia Pacific projected to exhibit the highest growth rate. The market's competitive landscape is characterized by a high degree of competition, with key players focusing on product innovation and strategic collaborations to gain a competitive edge. Despite the challenges, the market remains a dynamic and evolving sector, with ongoing efforts to address security concerns and meet the changing needs of consumers.

Exclusive Customer Landscape

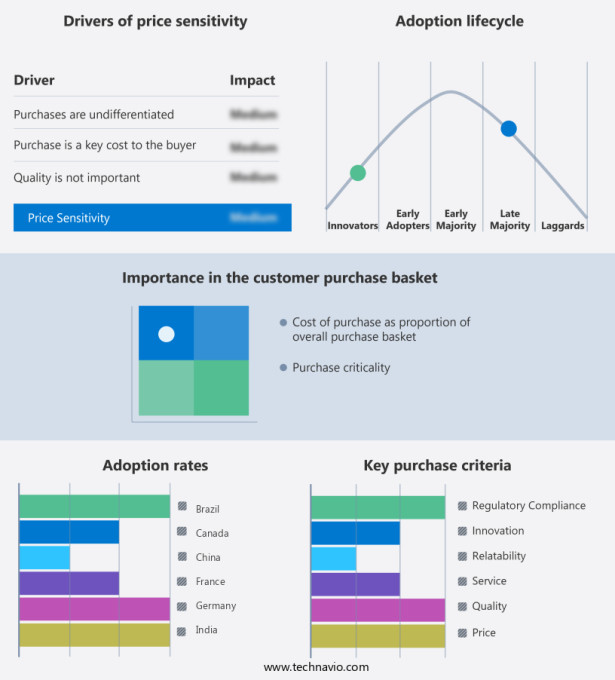

The personal travel accident insurance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the personal travel accident insurance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Personal Travel Accident Insurance Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, personal travel accident insurance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allianz SE - Bajaj Allianz provides comprehensive personal travel insurance coverage, including medical expenses for medical evaluations and repatriation, lost or damaged baggage, missed connections, and emergency financial assistance. This insurance policy ensures peace of mind for travelers by addressing various unforeseen circumstances during their journeys.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allianz SE

- American Express Co.

- American International Group Inc.

- Aon plc

- Assicurazioni Generali S.p.A.

- Aviva insurance Ltd.

- AXA Group

- Berkshire Hathaway Inc.

- Chubb Ltd.

- ICICI Bank Ltd.

- Liberty Mutual Holding Co. Inc.

- Manulife Financial Corp.

- MAPFRE S.A.

- Munich Reinsurance Co.

- Nationwide Mutual Insurance Co.

- Seven Corners Inc.

- Star Health and Allied Insurance Co Ltd.

- The Allstate Corp.

- The Travelers Co. Inc.

- Zurich Insurance Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Personal Travel Accident Insurance Market

- In January 2024, Allianz Partners announced the launch of a new digital travel insurance solution, "Allianz Travel Care," in collaboration with Mastercard (NYSE: MA). This product offers personal travel accident insurance and other travel assistance services, accessible through Mastercard's digital payment platform (Allianz Partners Press Release).

- In March 2024, Munich Re (DE: MUNX) and Swiss Re (SIX: SREN) jointly acquired a majority stake in the travel insurance provider, Seven Corners, marking their entry into the US travel insurance market (Reuters). The financial terms of the deal were undisclosed.

- In April 2025, AIG (NYSE: AIG) unveiled its new AI-powered travel insurance product, "Travel Guard with AI Care," which uses machine learning algorithms to personalize coverage and offer real-time assistance to policyholders (AIG Press Release). The company did not disclose the investment in this technology.

- In May 2025, the European Union passed the Travel Insurance Directive, mandating all EU citizens to have travel insurance coverage when traveling outside the EU. This regulation is expected to significantly increase the demand for personal travel accident insurance in the region (European Parliament & Council of the European Union).

Research Analyst Overview

- The market encompasses a range of policies designed to provide financial protection against various risks associated with traveling. These policies offer coverage for accidents resulting in injuries, illnesses, or even death, as well as trip cancellations, baggage loss, and other unforeseen circumstances. One significant trend in this market is the increasing demand for comprehensive coverage, particularly for adventure sports and high-risk activities. For instance, adventure sports coverage is becoming increasingly popular among travelers participating in activities like skydiving, scuba diving, and bungee jumping. Additionally, pre-existing conditions waivers are gaining traction, allowing individuals with pre-existing medical conditions to purchase travel insurance.

- Another evolving aspect of the market is the availability of multi-trip travel insurance, which offers coverage for multiple trips within a specified period. This type of insurance is particularly attractive to frequent travelers, as it eliminates the need to purchase individual policies for each trip. Furthermore, disability income benefits and emergency medical evacuation coverage are becoming essential features in travel insurance policies. These benefits provide financial support in case of long-term disability or the need for emergency medical evacuation, ensuring peace of mind for travelers. The market is projected to grow at a steady pace, with industry analysts estimating a 6% annual growth rate over the next five years.

- This growth is attributed to the increasing number of international travelers, the rising demand for comprehensive coverage, and the increasing awareness of the importance of travel insurance. Policy premiums are calculated based on various factors, including the coverage duration period, the type and extent of coverage, and the traveler's age and health condition. Risk assessment protocols are employed to determine the premium, with higher-risk activities and pre-existing conditions resulting in higher premiums. Policy underwriting processes involve a thorough evaluation of the applicant's health and travel history, as well as the specifics of the travel plans.

- Policy exclusions details, accident coverage limits, deductible and copay, and other policy terms are clearly outlined in the policy document. In summary, the market continues to evolve, offering a range of comprehensive coverage options to cater to the diverse needs of travelers. From adventure sports coverage and pre-existing conditions waivers to disability income benefits and emergency medical evacuation, travel insurance policies are becoming increasingly essential for anyone planning a trip.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Personal Travel Accident Insurance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 45.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, China, Germany, UK, Canada, France, Japan, India, Saudi Arabia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Personal Travel Accident Insurance Market Research and Growth Report?

- CAGR of the Personal Travel Accident Insurance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the personal travel accident insurance market growth of industry companies

We can help! Our analysts can customize this personal travel accident insurance market research report to meet your requirements.