Russia Pet Food Market Size 2024-2028

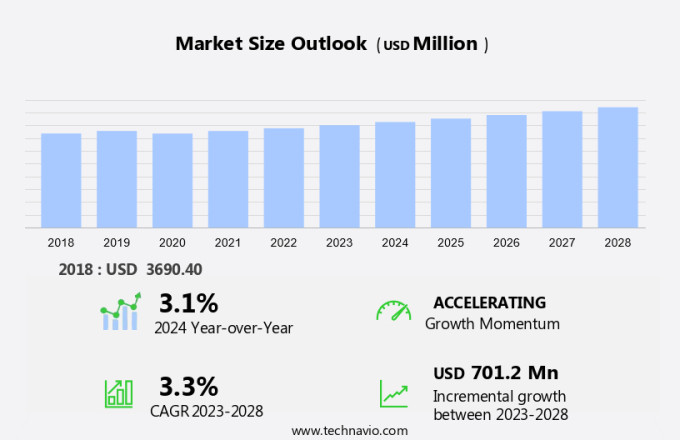

The Russia pet food market size is forecast to increase by USD 701.2 million at a CAGR of 3.3% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing popularity of pets as family members among individuals. With this rise, there is a growing emphasis on providing pets with appropriate and nutritious food to meet their unique nutritional needs. This trend is leading to an increase in demand for pet food that is nutritionally adequate, of high quality, and ensures safety. Moreover, pet owners are increasingly seeking out organic and natural pet food varieties to provide the best possible nutrition for their pets. Companies are responding to this demand by scaling back production and investments to focus on creating recipes that cater to the diverse nutritional requirements of dogs and cats. The market is expected to continue growing, with trends such as personalized pet nutrition and functional pet food gaining traction. Despite these opportunities, challenges such as price competition and regulatory compliance remain key considerations for market participants.

What will be the size of the market during the forecast period?

- Pet food is an essential aspect of ensuring the health and well-being of our beloved dogs and cats. With a vast array of options available in the market, pet owners face the challenge of selecting the most appropriate and nutritionally adequate food for their pets. In this article, we will discuss the popular pet food choices that cater to the nutritional needs of dogs and cats, focusing on quality, safety, and convenience. Pet owners prioritize their pets' physical health, and a balanced diet is crucial in achieving this goal. Nutritionally complete and balanced pet foods provide the necessary energy, protein, fat, vitamins, and minerals for dogs and cats. Wet and dry pet food varieties cater to different preferences and feeding habits.

- Wet pet food, also known as canned or moist food, offers several advantages. It is rich in water content, making it an excellent choice for pets prone to dehydration. Wet food also has a more appealing texture and taste, which can be particularly attractive to finicky eaters. However, it may require more frequent feeding due to its quicker digestion. Dry pet food, on the other hand, is a convenient and cost-effective option. It is easy to store and transport, and it allows pets to have a more structured feeding schedule. Dry food also helps keep pets' teeth clean by reducing plaque buildup. Pet owners value the safety and quality of their pets' food. They look for recipes that cater to their pets' specific nutritional requirements and ensure that the food is free from harmful additives and contaminants.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Dry pet food

- Wet pet food

- Pet snacks and treats

- Type

- Dog food

- Cat food

- Others

- Geography

- Russia

By Product Insights

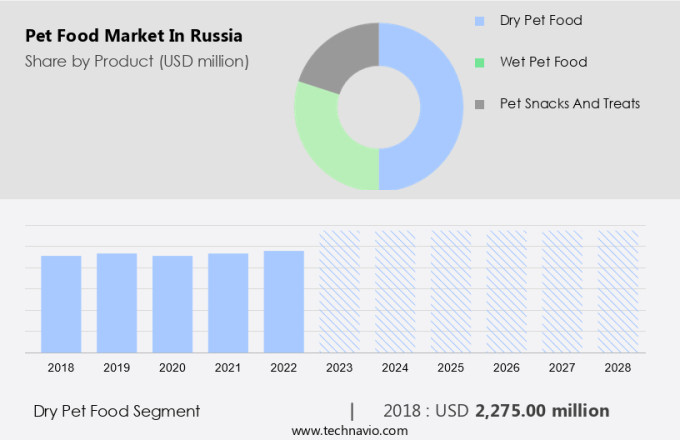

- The dry pet food segment is estimated to witness significant growth during the forecast period.

Dry pet foods have gained significant popularity among individuals responsible for the care of dogs and cats in Russia. The convenience and practicality of dry pet foods, including their ease of transportation and extended shelf life compared to wet pet foods, make them a preferred choice for many pet owners. These foods are typically rich in seed-based and grain-based proteins, providing essential nutrients for pets. However, the dry pet food market faces challenges related to nutritional adequacy and safety concerns. The recurrence of health warnings and an increasing number of recalls have raised questions about the quality of dry pet foods.

However, to address these challenges, companies are offering dry pet foods in a variety of convenient packages, such as stand-up zip lock pouches, to cater to the demands of pet owners. Ensuring nutritional adequacy and safety remains a top priority for manufacturers to maintain the trust and confidence of their customers. Dry pet food recipes continue to evolve, offering a wide range of varieties to meet the diverse nutritional needs of dogs and cats.

Get a glance at the market share of various segments Request Free Sample

The dry pet food segment was valued at USD 2.27 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Russian pet Food Market?

Rising awareness of pet nutrition is the key driver of the market.

- The growing awareness among pet owners regarding the nutritional needs of their pets has fueled the demand for commercial pet food in Russia. Each pet species, be it a dog or a cat, has distinct nutritional requirements based on their age, activity level, and overall health. Homemade diets, while popular among some pet lovers, may not provide all the essential nutrients pets need. Some human foods, such as raisins, grapes, chocolates, and macadamia nuts, can be harmful to pets. For instance, methylxanthines in chocolates can lead to diarrhea, cardiac arrhythmias, convulsions, polyuria, and even death in dogs.

- Macadamia nuts, on the other hand, can cause depression, vomiting, muscle spasms, heat, and tachycardia in cats. Even if homemade diets made with animal-based or plant-based products are fed to pets, nutritional deficiencies may still occur. Commercial pet food brands offer a wide range of products, including those specifically formulated to cater to the unique nutritional needs of various pet species and life stages. These foods ensure a balanced intake of essential nutrients, minimizing the risks associated with homemade diets.

What are the market trends shaping the Russia Pet Food Market?

Growing demand for organic pet food is the upcoming trend in the market.

- Organic pet food is a growing trend in the pet care industry, prioritizing the health and well-being of domesticated animals. Made from organic raw materials, this type of pet food is free from pesticides, artificial fertilizers, and chemicals. The ingredients, including plant-based and animal-based sources, meet strict regulatory requirements. Animal by-products used in organic pet food are sourced ethically, ensuring the animals are raised on organic feed, given access to the outdoors, and not treated with antibiotics or hormones. Consumers are increasingly concerned with the nutritional value and safety checks of their pet's food, leading to a preference for organic options.

- Organic pet food is formulated with added vitamins, minerals, and nutritional supplements to support various body systems. Premixes, which contain these essential nutrients, undergo rigorous testing to ensure their quality and safety. Nutritional supplements, when necessary, are also added to meet the specific dietary needs of pets. As the demand for organic and natural food continues to grow in the human food sector, pet owners are seeking similar options for their pets. This shift in consumer behavior is driving the market for organic pet food, with regulatory bodies ensuring its safety and quality through stringent checks and requirements.

What challenges does Russia Pet Food Market face during the growth?

Companies scaling back production and investments is a key challenge affecting the market growth.

- The market is a significant industry, with consumers seeking sole-source nutrition for their pets that is both tasty and appealing. Manufacturers strive to create formulas that provide complete and balanced essential nutrients, including essential fatty acids and amino acids, in finished products. The cooking process is crucial to maintain quality expectations while keeping the price point competitive. Unfortunately, geopolitical events can disrupt the pet food industry. In 2022, the Russian invasion of Ukraine led several leading pet food manufacturers, such as Mars and Nestle Purina PetCare, to reassess their business strategies in Russia.

- Nestle announced an investment in expanding production at its Vorsino Industrial Park factory but later suspended all advertising, capital investments, and non-essential food imports to Russia due to the conflict. These decisions reflect the importance of maintaining quality and adhering to price points while navigating geopolitical challenges. As the industry continues to evolve, manufacturers must remain agile and responsive to global events while maintaining their commitment to producing high-quality, appealing pet food formulas.

Exclusive Russia Pet Food Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Affinity Petcare SA

- Aller Petfood Group AS

- Blue Buffalo Co. Ltd.

- Colgate Palmolive Co.

- heristo aktiengesellschaft

- INVIVO

- Mars Inc.

- Merrick Pet Care Inc.

- Nestle SA

- Schell and Kampeter Inc.

- Sunshine Mills Inc.

- The J.M Smucker Co.

- Tiernahrung Deuerer GmbH

- Wellness Pet Co. Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the nutritional adequacy of dogs and cats, ensuring they receive a balanced diet for their physical and mental well-being. Individual pet owners seek convenient, nutritionally complete options to meet their pets' energy requirements, including proteins, carbohydrates, essential vitamins, and minerals. Pet food comes in various textures and recipes, such as wet and dry, to cater to individual preferences. Wet pet food provides essential hydration, while dry pet food offers convenience and longer shelf life. Nutritional value is a significant concern, with pet owners looking for nutrient requirements based on age, activity levels, and health conditions.

Furthermore, quality and safety are essential factors in pet food selection. Regulatory requirements ensure safety checks, while added vitamins and minerals contribute to complete and balanced formulas. Sustainability is also a growing concern, with pet food manufacturers focusing on animal-based and plant-based products. Pet satisfaction is crucial, with tasty and appealing recipes essential for maintaining a bond between pet lovers and their pets. Essential nutrients, including proteins, essential fatty acids, and amino acids, are vital for maintaining physical health and mental activity. Nutritional supplements and premixes may be added to enhance the nutritional value of pet food, while regulatory requirements ensure the safety and quality of these additives. The cooking process and price point are also essential considerations for pet owners.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

117 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market Growth 2024-2028 |

USD 701.2 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Russia

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch