Pet Milk Market Size 2024-2028

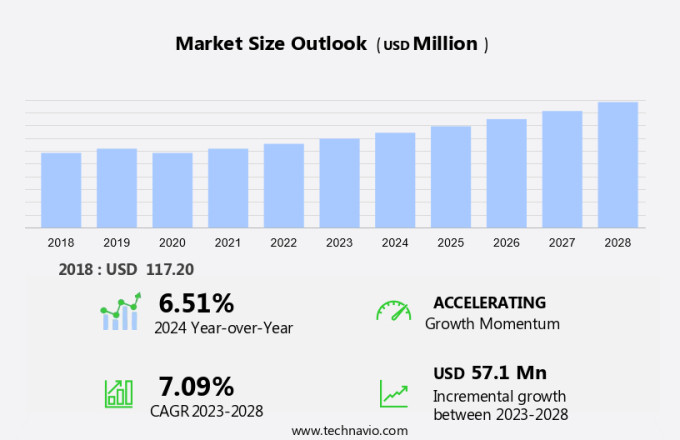

The pet milk market size is forecast to increase by USD 57.1 million at a CAGR of 7.09% between 2023 and 2028. The market is witnessing significant growth due to the increasing awareness of pet health and nutrition. With the rise in pet humanization trends, pet milk products have gained popularity among pet owners. Specialty stores and mass retailers are capitalizing on this trend by stocking a wide range of pet milk offerings. Direct-to-consumer and e-commerce platforms are also gaining traction as convenient shopping options. However, the US pet food industry has stringent regulations that restrict the entry of new companies, making it challenging for new players to penetrate the market. Pet allergies are another concern, necessitating the development of hypoallergenic pet milk products. Social media influence from celebrity pet owners and pet-friendly policies in workplaces are further fueling the demand for pet milk. Pet owners are increasingly turning to these platforms for information and recommendations on pet nutrition and care.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to the increasing number of pet owners prioritizing their pets' health and nutrition. With pet ownership on the rise, particularly in the adoption of neonatal puppies and kittens, there is a growing demand for pet milk replacers. Pet milk products cater to various pet health concerns, including pets with lactose intolerance, high blood pressure, and cholesterol levels. These milk alternatives provide essential nutrients and proteins that are crucial for the growth and development of pets, especially during their early stages. Pet milk powder is typically rich in essential nutrients such as skimmed milk, vegetable oil, soy protein isolate, and casein. These powders can be served to pets at their own pace without the concern of spoilage.

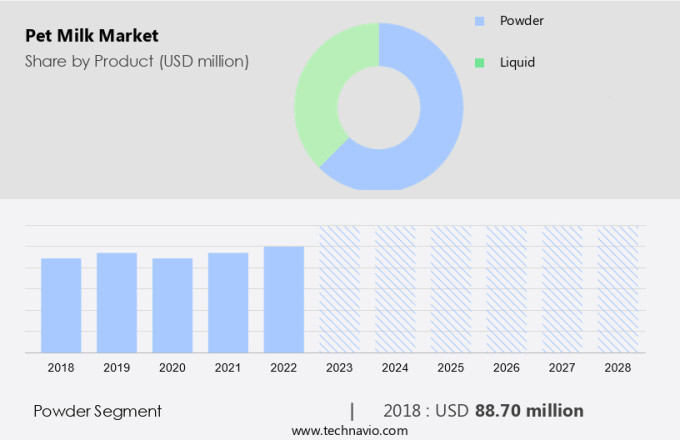

Moreover, pet humanization trends have been a driving force in the pet industry, with celebrity pet owners and pet-friendly policies in workplaces and public places further fueling the demand for high-quality pet milk products. Social media platforms have also played a significant role in increasing awareness and accessibility to these products. The market in the United States can be segmented into two main categories: powder and liquid. The powder segment holds a larger market share due to its longer shelf life and ease of use. However, the liquid segment is gaining popularity due to its closer resemblance to natural milk and the convenience it offers.

Furthermore, specialty stores and mass retailers are the primary distribution channels for pet milk products. Specialty stores cater to the specific needs of pet owners and offer a wider range of options, while mass retailers offer convenience and affordability. Pet milk replacers are essential for the survival and growth of orphaned or abandoned neonatal puppies and kittens. Mother dogs and cats may not always be able to produce enough milk, and supplementing with pet milk replacers can ensure the proper development of these young pets. In conclusion, the market in the United States is experiencing steady growth due to the increasing number of pet owners prioritizing their pets' health and nutrition.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Powder

- Liquid

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Product Insights

The powder segment is estimated to witness significant growth during the forecast period. Pet milk powder holds a significant market share in the pet milk product segment. This popularity can be attributed to several factors, including ease of transportation and storage, as well as a longer shelf life than liquid milk and other wet pet foods. Moreover, companies are catering to the convenience of pet owners by offering dry pet foods in practical packages, such as stand-up zip-lock pouches. Functional ingredients, including probiotics and vitamins, are increasingly being incorporated into pet milk powder formulations to address the dietary requirements of various pet species. Obligate carnivores, such as cats, have unique nutritional needs that can be met through specialized formulations. Feline health, in particular, can benefit from pet milk powders fortified with essential nutrients. Transparent ingredient sourcing is a crucial factor for pet owners when choosing pet milk powder. Reputable companies ensure the highest quality ingredients, providing peace of mind to pet owners.

Get a glance at the market share of various segments Request Free Sample

The powder segment accounted for USD 88.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market holds a significant market share, attributed to the large number of pet owners compared to other regions like APAC, South America, and MEA. The preference for traditional distribution channels among pet owners to purchase pet food, including pet milk products, remains strong. These channels encompass pet specialty stores and vet clinics, hypermarkets, and convenience stores. The awareness among pet owners regarding their pets' customized nutritional and dietary needs has led to a rise in demand for prescription-based pet food diets, including pet milk products.

(Petco), have witnessed increased sales in these products. The professional and knowledgeable virtual assistant will maintain a formal tone while providing accurate and relevant information. The market in North America continues to expand due to the growing number of pet owners seeking specialized pet food options to cater to their pets' unique dietary requirements. Traditional distribution channels, including pet specialty stores, vet clinics, hypermarkets, and convenience stores, remain the preferred choice for purchasing pet milk products.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising awareness of pet nutrition is the key driver of the market. In the United States, the trend of pet ownership continues to grow as people view their pets as valued family members. However, providing proper nutrition for distinct pets, such as dogs and cats, can be a challenge for pet owners. Homemade diets, even those made with organic and vegetarian ingredients, may not meet the specific nutritional requirements of pets.

Furthermore, certain human foods, like raisins, grapes, and chocolates, can be detrimental to their health. For instance, chocolates contain methylxanthines, including caffeine and theobromine, which can lead to diarrhea, cardiac arrhythmias, convulsions, polyuria, and even death in dogs. Macadamia nuts are harmful to both cats and dogs, causing depression, vomiting, muscle spasms, heat, and tachycardia. Despite the increasing pet humanization trend, nutritional deficiencies still occur. Ensuring pets receive a balanced diet is crucial for their overall health and well-being, with pet milk being an alternative option for lactose-intolerant pets.

Market Trends

A growing number of milk product launches for puppies and kittens is the upcoming trend in the market. The market in the United States has experienced notable progress in innovative product offerings, catering to the increasing diversity in pets' nutritional needs. Companies are expanding their product lines to capture a larger market share. This strategic move aims to meet the growing demand for specialized pet milk products. In the dynamic pet industry, pet humanization trends and celebrity pet owners continue to influence consumer behavior.

Social media platforms and e-commerce channels have made it easier for pet owners to access pet milk products, further driving market growth. Pet-friendly policies in mass retail stores and specialty stores have also contributed to the increasing popularity of pet milk products. Furthermore, addressing pet allergies is a significant focus for companies, ensuring they cater to the unique dietary requirements of various pets. By staying attuned to these trends and consumer needs, the market is poised for continued expansion.

Market Challenge

Stringent regulations in the US pet food industry restricting the entry of new companies is a key challenge affecting the market growth. In the United States, the pet care market encompasses a wide range of products designed to meet the nutritional needs of various breeds and pets, including birds and small animals. Pet milk is one type of pet care product available in both powder and liquid forms. This milk is formulated to provide essential nutrients for pets, particularly for those with specific dietary requirements or medical conditions. Animal cafes and pet cafes have gained popularity in recent years, offering not only a place to socialize pets but also providing access to pet milk and other pet care essentials. Additives in pet milk may include vitamins, minerals, and amino acids to enhance the nutritional value.

Furthermore, the market caters to both medicinal and non-medicated needs. Medicinal pet milk is prescribed by veterinarians to address specific health issues, while non-medicated pet milk is used as a supplement or as a substitute for mother's milk for newborn pets. The distribution channels for pet milk in the US include pet stores, supermarkets, and online retailers. Regulations governing the production and sale of pet milk are stringent in the US, with the Food and Drug Administration (FDA) and the Association of American Feed Control Officials (AAFCO) setting the standards for ingredient quality and safety. The Food Safety Modernization Act (FSMA) further regulates the industry at a federal level, ensuring the production and sale of safe and wholesome pet milk.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Beaphar Beheer BV: The company offers pet milk such as Lactol Kitten Milk.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beaphar Beheer BV

- Grober Nutrition

- Manna Pro Products LLC

- Mars Inc.

- Milk Specialties Global

- Nukamel BV

- PBI Gordon Co. Inc.

- Petlife International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Pet milk is a specialized type of milk formulation designed for the unique nutritional needs of dogs, cats, and other companion animals. With the increasing trend of pet humanization, the market has gained significant traction among pet owners, especially those with lactose intolerant pets or animals with specialized dietary requirements. Mother cat produce colostrum, a vital first milk that provides essential nutrients and antibodies to their kittens, and specialty stores, as well as mass retail stores, are increasingly stocking products that support feline health, including supplements that mimic the benefits of colostrum for both kittens and adult cats. Pet milk comes in various forms, including powder and liquid, and is available through different distribution channels such as specialty stores, mass retail stores, and e-commerce platforms. Dogs and cats, being obligate carnivores, have specific nutritional requirements that must be met to ensure their optimal health. Pet milk is fortified with essential nutrients, proteins, and vitamins to cater to the nutritional needs of neonatal pups and kittens.

Furthermore, it is also beneficial for pets with health conditions such as high blood pressure and cholesterol levels. The market is witnessing growth due to the rising trend of pet adoption, increasing pet ownership in nuclear families, and the availability of pet-friendly policies in workplaces and public places. The market is also driven by the increasing popularity of animal cafes and pet cafes, where customers can interact with animals while enjoying their favorite beverages. Birds and small pets also require specialized nutrition, and pet milk products cater to their unique needs. The market for pet milk is expected to grow further due to the increasing demand for functional ingredients, probiotics, and vitamins in pet food and milk formulations. Transparent ingredient sourcing and specialized formulations are also key trends in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

127 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.09% |

|

Market growth 2024-2028 |

USD 57.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

6.51 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 36% |

|

Key countries |

China, US, Germany, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Beaphar Beheer BV, Grober Nutrition, Manna Pro Products LLC, Mars Inc., Milk Specialties Global, Nukamel BV, PBI Gordon Co. Inc., and Petlife International Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch