Pickleball Clothing And Apparel Market Size 2025-2029

The pickleball clothing and apparel market size is forecast to increase by USD 662 million at a CAGR of 10.7% between 2024 and 2029.

- The market is experiencing significant growth due to various factors. One key trend driving market expansion is the increasing popularity of pickleball as a sport, particularly among baby boomers and seniors. This demographic values comfort and functionality in their clothing and apparel, leading to a demand for breathable fabrics and moisture-wicking technology. Additionally, the health benefits associated with pickleball, such as improved cardiovascular health and increased agility, are encouraging more people to take up the sport. Digital and social media marketing are also playing a crucial role in promoting pickleball clothing and apparel. Brands are leveraging these platforms to reach a wider audience and showcase their latest offerings. Overall, the market is expected to continue expanding as the popularity of pickleball increases and consumers seek functional, stylish clothing and apparel to enhance their playing experience.

- However, inconsistent raw material prices pose a challenge for manufacturers. To mitigate this, some companies are exploring alternative fabrics, such as cotton blends and synthetic materials, to reduce their reliance on traditional sources. Another trend in the market is the development of specialized pickleball shoes and socks. These products offer enhanced grip and support, allowing players to perform at their best on the court. The use of LED technology in pickleball clothing and apparel is also gaining traction, with some brands incorporating reflective materials to enhance visibility during night games. Overall, the market is expected to continue growing, driven by these trends and the increasing popularity of the sport.

What will be the Size of the Pickleball Clothing And Apparel Market During the Forecast Period?

- The market caters to the growing demand for specialized attire for this popular sport. This market encompasses a wide range of products, from casual wear for pickleball clinics and everyday use, to performance-enhancing apparel for training and competitive play. Key trends include ergonomic designs for improved range of motion, impact absorption for enhanced protection, and temperature regulation for comfort during play. Wind resistance, moisture management, and UV protection are essential features for players in various climates. Team uniforms with embroidered logos and custom designs are popular for community building and team spirit. Lightweight, durable, and seamless construction ensure comfort and support during long matches.

- Personalized apparel and limited edition collections add a unique touch for players. Online communities and pickleball media provide a platform for discovering the latest trends and seasonal collections. Pickleball coaches and instructional videos offer insights into the importance of proper foot support and anti-odor technology for optimal performance. Size inclusivity ensures that all players can participate comfortably and confidently.

How is this Pickleball Clothing And Apparel Industry segmented and which is the largest segment?

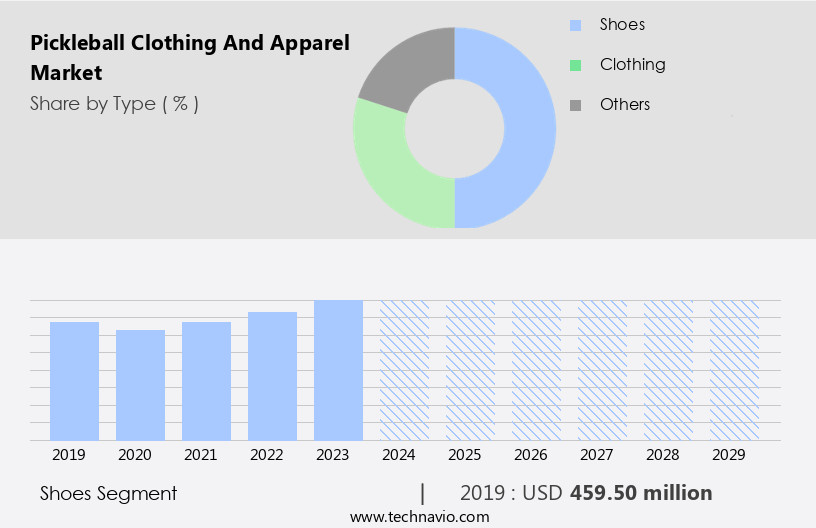

The pickleball clothing and apparel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Shoes

- Clothing

- Others

- Application

- Women

- Men

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Type Insights

The shoes segment is estimated to witness significant growth during the forecast period. The Pickleball industry encompasses various equipment and apparel essentials for both recreational and competitive players. Pickleball Nets, Balls, and Racquets form the core equipment, while shoes, bags, and accessories cater to the players' comfort and convenience. Pickleball Culture has seen a significant in popularity, with numerous leagues, clubs, and tournaments fostering a thriving community of enthusiasts. Pickleball Fashion trends include Breathable Fabrics, Sun Protection, and Quick-Drying Fabrics in Performance Apparel, such as Pickleball Shorts, Tank Tops, and Dresses. Pickleball Innovation is at the forefront, with brands introducing Compression Gear, Technical Fabrics, and Ethical Manufacturing practices. Social Media Marketing and Influencer Marketing play a crucial role in reaching a wider audience and promoting Pickleball Lifestyle.

Pickleball Accessories, like Water Bottles, Racquet Bags, and Court Shoes, cater to the players' needs, ensuring they are well-equipped for both Indoor and Outdoor Pickleball. Brand Partnerships and Performance Tees further enhance the appeal of Pickleball Apparel, providing players with a sense of belonging and style. The market dynamics are driven by the increasing number of Pickleball Players, the rise in disposable income, and the growing trend of Pickleball as a social activity.

Get a glance at the market report of share of various segments Request Free Sample

The Shoes segment was valued at USD 459.50 million in 2019 and showed a gradual increase during the forecast period.

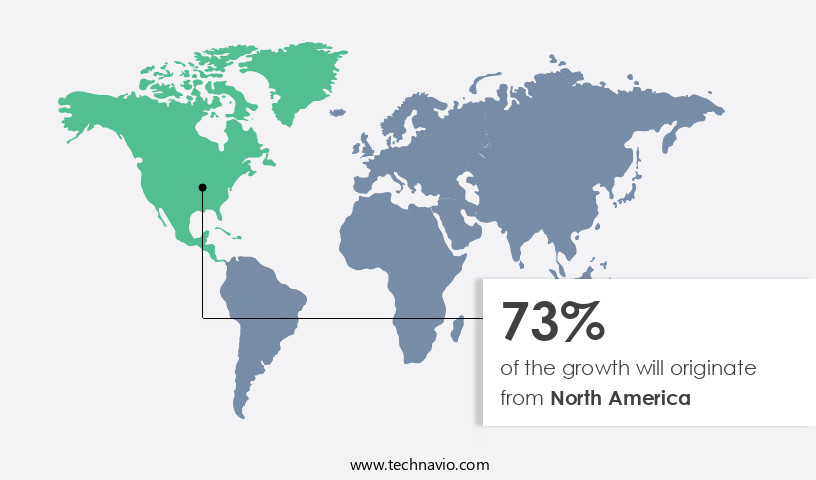

Regional Analysis

North America is estimated to contribute 73% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America, with a significant focus on the US, is experiencing notable growth due to the escalating popularity of the sport. In 2024, North America held the largest market share and is anticipated to continue its expansion at a considerable rate. Major contributors to this growth include the presence of numerous pickleball leagues, such as the Minto US Open Pickleball Championships, which have been held annually in the US since 2006. These events foster a thriving pickleball culture, attracting a vast number of enthusiasts and influencing the market's growth. The market caters to various pickleball apparel needs, including breathable fabrics for indoor and outdoor play, sun protection, and quick-drying technical fabrics for optimal performance. Fashion trends and sustainability are increasingly important, leading to eco-friendly initiatives and the use of eco-friendly materials.

Pickleball-specific equipment, such as racquet bags, court shoes, and water bottles, are also essential accessories. Innovative trends in pickleball apparel include performance tees, tank tops, dresses, compression gear, and athletic wear. Ethical manufacturing practices and brand partnerships are increasingly important to consumers, as is influencer marketing and social media promotion. Pickleball players value convenience and functionality, leading to the demand for pickleball bags, ball holders, and other accessories. The market offers a wide range of products, catering to both recreational and competitive players, as well as those seeking fashionable and stylish options. The market's continuous evolution reflects the sport's growing influence and the dedication of its enthusiastic community. Accessories like hats, visors, shoes, socks, and headbands are essential for players to enhance their performance and protect themselves from the elements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pickleball Clothing And Apparel Industry?

- Health benefits associated with pickleball as sports is the key driver of the market. Pickleball, a popular recreational sport, offers numerous benefits to its enthusiasts. The intense footwork and quick movements involved in the game provide an excellent aerobic workout, boosting cardiovascular health and burning calories. Regular play improves flexibility, agility, and overall leg strength. The sport's dynamics include elements such as measure, tempo change, timing, velocity, and proper technique execution. Pickleball's growing popularity is reflected in the expanding market for its equipment and apparel. Key product categories include Pickleball Nets, Pickleball Bags, Pickleball Shoes, Racquet Bags, and Pickleball Balls. Pickleball Fashion, featuring breathable fabrics and sun protection, is a burgeoning trend. This market caters to the unique demands of pickleball players, offering UV protection, anti-odor technology, and moisture-wicking fabrics for enhanced performance and comfort.

- Pickleball Players prioritize Performance Tees, Tank Tops, Shorts, and Compression Gear made from quick-drying technical fabrics. Pickleball's appeal transcends the court, with a vibrant culture and communities thriving both indoors and outdoors. Pickleball Leagues, Clubs, and Tournaments foster social connections and competition. Innovation continues to drive the market, with brand partnerships, influencer marketing, and ethical manufacturing shaping the Pickleball Lifestyle. Accessories such as water bottles and court shoes cater to the diverse needs of players. Stay updated on the latest Pickleball Trends through social media marketing. The market is witnessing significant growth due to the increasing popularity of this paddle sport, which combines elements of Tennis, Badminton, and Ping-pong.

What are the market trends shaping the Pickleball Clothing And Apparel Industry?

- Digital and social media marketing is the upcoming market trend. The Pickleball industry encompasses various equipment and apparel categories, including Pickleball Nets, Bags (Racquet and Pickleball), Shoes, and Clothing. Pickleball Apparel is a significant segment, featuring Breathable Fabrics, Sun Protection, and Performance Tees, Tank Tops, Shorts, Dresses, and Compression Gear. Pickleball Culture thrives through Leagues, Indoor and Outdoor Pickleball, and Clubs. Pickleball Players value quick-drying Technical Fabrics and Ethical Manufacturing. Market Dynamics: Innovation and Performance drive Pickleball Equipment trends, with Pickleball Balls, Accessories, and Racquets continually evolving. Foreign currency fluctuations negatively impact the cost of raw materials like cotton and natural fabrics. Pickleball Tournaments and Brand Partnerships fuel growth. Social Media Marketing and Influencer Marketing are essential tools for reaching Pickleball Enthusiasts and expanding Pickleball Communities.

- The Pickleball Apparel sector caters to various preferences, from Athletic Wear and Quick-Drying Fabrics to Sun Protection and Breathable Materials. Pickleball Fashion is increasingly popular, with consumers seeking stylish yet functional clothing for Recreational Pickleball and Pickleball Leagues. Water Bottles, Court Shoes, and Racquet Bags are essential Pickleball Accessories. Pickleball Lifestyle is a growing trend, with Pickleball Players embracing Performance Apparel and expressing their Pickleball Passion through branded merchandise.

What challenges does the Pickleball Clothing And Apparel Industry face during its growth?

- Inconsistent raw material prices is a key challenge affecting the industry growth. The market is experiencing market dynamics that impact profit margins for manufacturers. Raw material price volatility and increasing competition among companies have led to price wars, resulting in reduced profit margins. The influx of local players in the industry contributes to this trend. Additionally, foreign currency fluctuations negatively affect the prices of raw materials such as cotton and natural fabrics, creating a lag between cost fluctuations and the ability to increase product prices. Pickleball's growing popularity, with its culture and communities, has resulted in a demand for specialized apparel and equipment. This includes Pickleball Nets, Bags (Racquet and Pickleball), Shoes, and Accessories such as Water Bottles, Sun Protection, and Compression Gear.

- The market caters to both Indoor and Outdoor Pickleball, with a focus on Performance Apparel made from Technical Fabrics, Quick-Drying Fabrics, and Breathable Fabrics. Brand partnerships and Influencer Marketing are essential strategies for companies to reach Pickleball Players and enthusiasts. Pickleball Leagues and Clubs also provide opportunities for retail sales. The market trends include the development of Ethical Manufacturing practices and the integration of Social Media Marketing. Pickleball Tournaments and Pickleball Balls further fuel the demand for Pickleball Equipment and Apparel. The market offers a wide range of Pickleball Fashion, including Performance Tees, Tank Tops, Shorts, Dresses, and Athletic Wear. Pickleball Innovation continues to drive the market, with new products and designs emerging regularly. Overall, the market is an exciting and dynamic industry, with continued growth opportunities.

Exclusive Customer Landscape

The pickleball clothing and apparel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pickleball clothing and apparel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pickleball clothing and apparel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - The company offers pickleball clothing and apparel such as original penguin performance shorts, penguin crew neck tee, redvanly larkin hoodie and Joola trinity hat.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- ANTA Sports Products Ltd.

- Babolat

- Bolle Brands France SAS

- Civil Apparel

- Ellesse Ltd.

- FILA Holdings Corp.

- Fromuth Pickleball

- Hanesbrands Inc.

- Head

- Inner Game of Pickleball

- Maus Freres SA

- New Balance Athletics Inc.

- Nike Inc.

- Olla LLC dba PickleballCentral

- Sport Life

- The Kitchen Dink

- Under Armour Inc.

- Xtep International Holdings Ltd.

- Zazzle Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, driven by the increasing popularity of the sport both domestically and internationally. Recreational pickleball, with its accessibility and social nature, has attracted a diverse player base, leading to a demand for specialized clothing and equipment. Pickleball players prioritize comfort and functionality in their apparel choices. Breathable fabrics, quick-drying properties, and sun protection are essential features for those playing outdoors. Indoor pickleball players also seek performance-enhancing materials, such as technical fabrics and compression gear, to optimize their game. Pickleball-specific apparel includes a range of items, from court shoes and racquet bags to performance tees and shorts.

Brands have responded to this demand by introducing innovative designs and materials tailored to the sport. For instance, some manufacturers have incorporated sun protection into their clothing lines, while others have focused on creating stylish yet functional pickleball bags and racquet bags. Pickleball fashion has also emerged as a trend, with players seeking to express their individuality on the court. This has led to the creation of pickleball-themed clothing, such as tank tops and dresses, as well as branded apparel through partnerships with pickleball clubs and influencers. Retail stores have capitalized on this market growth by expanding their pickleball offerings.

These stores cater to the needs of pickleball enthusiasts by stocking a wide range of equipment, apparel, and accessories. Online retailers have also entered the market, offering convenience and a broader selection of products. The pickleball community is a tight-knit and passionate group, with many players actively engaging on social media platforms. Brands have recognized the potential of social media marketing and influencer partnerships to reach this audience and promote their products. Pickleball tournaments and events have also become popular platforms for showcasing new equipment and apparel. As the pickleball market continues to evolve, ethical manufacturing and sustainable practices have become increasingly important to consumers.

Brands are responding by implementing ethical manufacturing processes and using eco-friendly materials in their pickleball clothing and apparel lines. The market is a dynamic and growing sector driven by the increasing popularity of the sport. Players seek functional, comfortable, and stylish clothing and equipment to enhance their performance and express their individuality. Brands are responding to this demand by introducing innovative designs and materials, while retailers and influencers help to promote these products to the pickleball community. Ethical manufacturing and sustainability are also becoming essential considerations for consumers in this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.7% |

|

Market growth 2025-2029 |

USD 662 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

US, Canada, UK, Spain, China, Germany, France, India, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pickleball Clothing And Apparel Market Research and Growth Report?

- CAGR of the Pickleball Clothing And Apparel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pickleball clothing and apparel market growth of industry companies

We can help! Our analysts can customize this pickleball clothing and apparel market research report to meet your requirements.