Piperylene Market Size 2024-2028

The piperylene market size is estimated to grow by USD 499.9 million at a CAGR of 5.56% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for piperylene-based adhesives in various industries, particularly in the automotive and construction sectors. Additionally, the expanding economies in Asia-Pacific and other regions are driving the market's growth as they increase their production capacities and consumption of piperylene. However, the market faces challenges related to the growing concerns over pollution and degradability issues associated with plastic products, leading to a shift towards eco-friendly alternatives. Piperylene, a key building block in the production of polyesters and polyamides, is an essential raw material for the manufacturing of these plastics. Piperylene is a valuable chemical used in the production of adhesives, paints, rubber, polymers, epoxy resins, elastomers, coatings, plastics, and various other industries. As such, the market's growth is also influenced by the trends in the plastic industry, including the development of biodegradable plastics and the increasing use of recycled plastics. Overall, the market is poised for steady growth in the coming years, driven by the demand for piperylene-based adhesives and the expanding economies, while facing challenges related to environmental concerns and the shift towards eco-friendly alternatives.

What will be the size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Segmentation

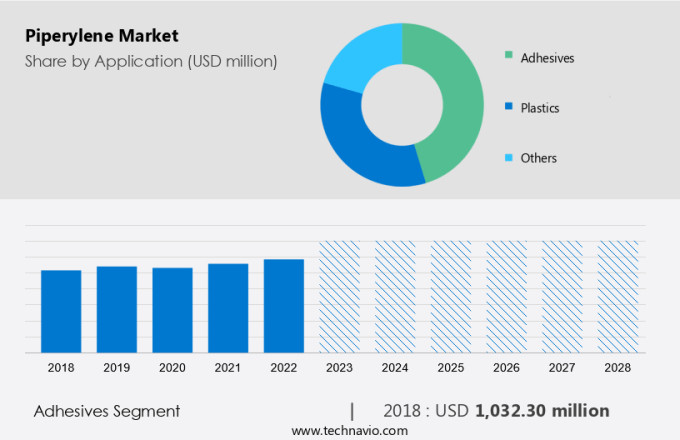

The adhesives segment is estimated to witness significant growth during the forecast period. In general, adhesion properties depend on the adhesive material. There are different types of adhesives available in the market, used to meet different technological requirements. Therefore, in some industries such as construction, automotive, and packaging, several types of adhesives are used because each adhesive has a defined set of physical and chemical properties as well as a specific purpose.

Get a glance at the market contribution of various segments View the PDF Sample

The adhesives segment was the largest segment and was valued at USD 1.03 billion in 2018. Demand for piperylene-based adhesives from the industry is also expected to increase. Industrial adhesives are primarily composed of styrene copolymers and butadiene-piperylene copolymers and are available in a variety of formulations and in a variety of hardnesses. The adhesives are widely used in many end-use industries such as automotive, construction, consumer goods, and electrical and electronics. Growing demand for adhesives from these industries is anticipated to propel the growth of the global market during the forecast period.

Market Dynamics and Customer Landscape

The global market is anticipated to witness significant growth during the forecast period 2023-2028. Piperylene is a versatile chemical compound with applications in various industries, including adhesives, paints, and rubber. The market growth is driven by the commercial development and increasing consumption of these industries. Piperylene's production and supply are analyzed at the country level to understand the cost dynamics and regional outlook. Macroeconomic analysis, political scenarios, and social scenarios are also considered to provide a comprehensive market forecast. The piperylene market is segmented based on applications, regions, and end-users. The applications include adhesives, paints, and rubber. The regions covered are North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The production and supply of piperylene impact the prices in these industries. The growth of the piperylene market is influenced by the increasing demand for high-performance materials in various applications. The market analysis also emphasizes the future consumption trends and potential opportunities in the global piperylene market. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Growing demand for piperylene-based adhesives is the key factor driving the growth of the market. One of the important factors driving the demand for adhesives is the expanding construction sector. With the rapid growth of infrastructure development projects and increasing construction activity around the world, the need for strong and reliable adhesives is increasing. Piperylene-based adhesives provide excellent bond strength, durability, and resistance to a variety of environmental conditions, making them ideal for use in construction applications such as flooring, wallboards, and tiles.

Furthermore, the growing focus on sustainability and environmental regulations has also boosted the demand for adhesives. These adhesives are known for their low volatile organic compound (VOC) emissions, making them more environmentally friendly than conventional solvent-based adhesives. With strict regulations and a growing preference for environmentally friendly products, piperylene-based adhesives are becoming increasingly important. Hence, these factors are anticipated to boost the growth of the global market trends during the forecast period.

Significant Market Trends

Increasing the company's initiatives to ensure sustainability in operations is the primary trend in the market. Suppliers are choosing organic and inorganic growth strategies. Some manufacturers are focusing on organic strategies, such as integrating new technologies in the production process, to launch new products and gain product approvals and patents for the inventions related to piperylene.

Furthermore, advances in process chemistry combined with new technology have not only reduced the cost of production but have also led to the production of new piperylene isomers. In addition, suppliers operating in the global market are increasingly focusing on expanding their manufacturing locations, which is anticipated to propel the growth of the global market during the forecast period.

Major Market Challenge

Volatility in raw material prices is a challenge that affects the growth of the market. Prices of raw materials such as ethylene, C5, and additives fluctuate because they are directly related to crude oil prices. The raw materials used to produce ethylene are natural gas and crude oil. Therefore, fluctuations in natural gas prices and crude oil prices lead to changes in ethylene prices, affecting piperylene prices.

Moreover, significant fluctuations in crude oil prices are due to systemic imbalances between supply and demand in the global crude oil industry. Volatility in crude oil prices negatively impacts production costs and reduces supplier profit margins. Therefore, crude oil price fluctuations are expected to impede the growth of the market during the forecast period.

Customer Landscape

The market growth analysis report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market research and growth report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Customer Landscape

Who are the Major Piperylene Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Zibo Luhua Hongjin New Material Group Co. Ltd.: The company offers piperylene in bulk, container tanks and 200L drums used as a raw material for the production of C5 petroleum resins and methyltetrahydrophthalic anhydride curing agent.

The market growth and forecasting report also includes detailed analyses of the competitive landscape of the market and information about 14 market companies, including:

- Braskem SA

- Chevron Corp.

- China Petrochemical Corp.

- Dow Chemical Co.

- Exxon Mobil Corp.

- Hanwha Corp.

- Kai Yen International Trading Corp.

- Lotte Corp.

- LyondellBasell Industries N.V.

- MITSUI and CO. LTD.

- NOVA Chemicals Corp.

- Shandong Yuhuang Chemical Group Co. Ltd.

- Zeon Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

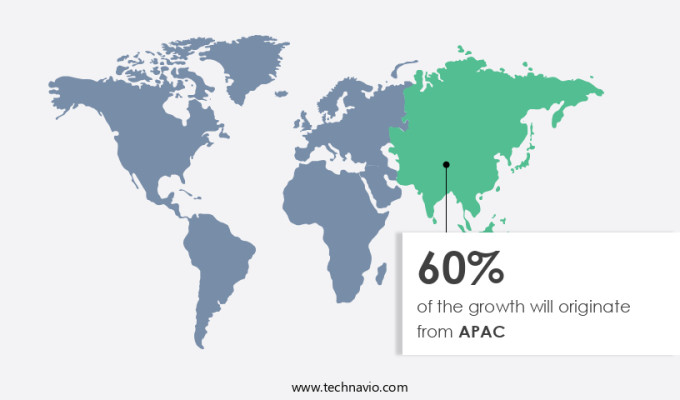

APAC is estimated to contribute 60% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The existence of an extensive population drives the demand for plastics in consumer goods, infrastructure development, and construction projects. With APAC having the largest number of plastic manufacturing plants in the world, consumption is expected to increase significantly in the region.

Furthermore, the growing demand from end-use industries such as automotive and packaging is expected to drive the growth of the market in APAC. The growth of these industries in countries such as China, India, Japan, Korea, and Indonesia is expected to support the growth of the market in the APAC region during the market forecasting period.

Segment Overview

The market report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Application Outlook

- Adhesives

- Plastics

- Others

- Product Outlook

- Less than 40 percent purity

- 40-65 percent purity

- More than 65 percent purity

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The global piperylene market is anticipated to witness significant growth in the coming years due to its extensive applications in commercial development across regions. Piperylene's cost and production are influenced by political scenarios, social scenarios, and macroeconomic analysis at the country level. The market is expected to grow at a steady pace, driven by increasing demand from the automotive, construction, electronics, packaging, pharmaceuticals, textile, and other industries. The market is also influenced by regulations and strategic insights, with innovation being a key driver. The market's growth outlook is positive, with increasing consumption in various applications and regions.

Moreover, the market research reports provide valuable insights into the market's production, supply, prices, and growth trends. In summary, the market is a significant player in the chemicals industry, with extensive applications in adhesives, paints, rubber, and other industries. The market's growth is driven by increasing demand from various end-use sectors and is influenced by political, social, and economic factors. The market research reports provide valuable insights into the market's production, supply, prices, and growth trends.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.56% |

|

Market growth 2024-2028 |

USD 499.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

5.19 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 60% |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Braskem SA, Chevron Corp., China Petrochemical Corp., Dow Inc., Exxon Mobil Corp., Hanwha Corp., Kai Yen International Trading Corp., Lotte Corp., LyondellBasell Industries N.V., Mitsui and Co. Ltd., NOVA Chemicals Corp., Shandong Yuhuang Chemical Group Co. Ltd., Zeon Corp., and Zibo Luhua Hongjin New Material Group Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.