Plant-Based Beverages Processing Equipment Market Size 2024-2028

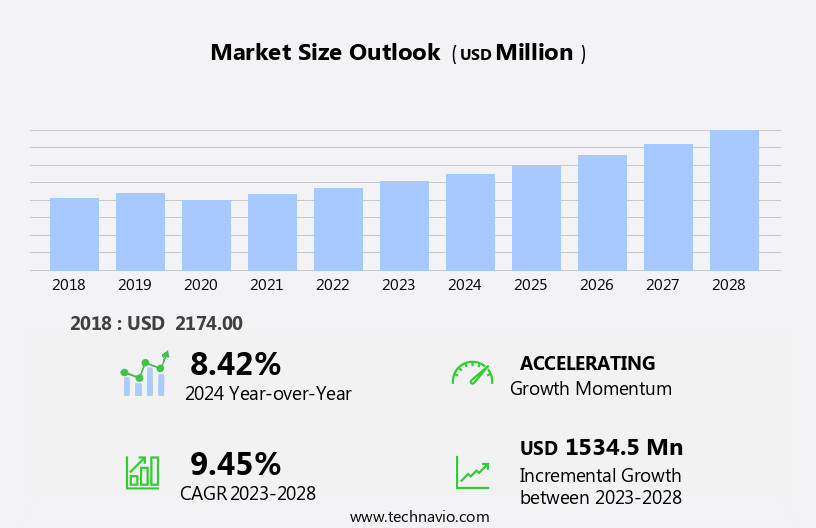

The plant-based beverages processing equipment market size is forecast to increase by USD 1.53 billion at a CAGR of 9.45% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing demand for single-serve and multi-packs of plant-based beverages, as consumers seek convenience and portability. Additionally, the rising trend of health consciousness is fueling market growth, as plant-based beverages are perceived as healthier dailry alternatives to traditional dairy , yoghurt and sugar-laden beverages. However, the market faces challenges, including the rising energy costs, which can increase operational expenses for manufacturers. These costs may lead to higher prices for consumers, potentially impacting demand.

- To capitalize on market opportunities, companies must focus on energy efficiency and cost reduction strategies, while also addressing consumer preferences for sustainable packaging solutions. By staying attuned to these market dynamics, businesses can effectively navigate challenges and capitalize on the growing demand for plant-based beverages.

What will be the Size of the Plant-Based Beverages Processing Equipment Market during the forecast period?

How is this Plant-Based Beverages Processing Equipment Industry segmented?

The plant-based beverages processing equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Homogenizer

- Filtration

- Heat exchangers

- Filling and packaging systems

- Others

- Type

- Soy

- Almond

- Oat

- Others

- End-User

- Large-Scale Manufacturers

- SMEs

- Contract Manufacturers

- Technology

- Automated Systems

- Manual Systems

- Hybrid Systems

- Distribution Channel

- Direct Sales

- Equipment Distributors

- Online Platforms

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

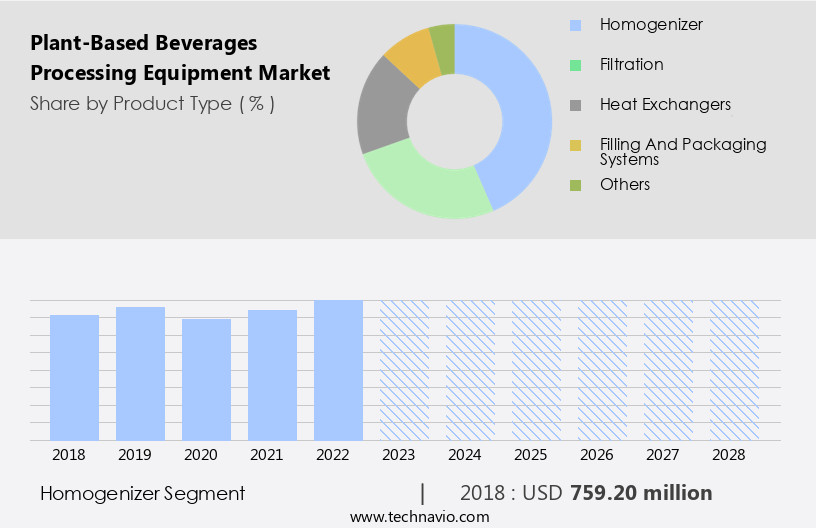

The homogenizer segment is estimated to witness significant growth during the forecast period.

In the realm of plant-based beverages, continuous processing plays a crucial role in ensuring consistency and efficiency in beverage production. This method integrates various systems such as mixing, homogenizing, and cooling, enabling the seamless transition between processes. Plant-based milk alternatives, including pea milk, soy milk, almond milk, rice milk, walnut milk, cashew milk, coconut milk, oat milk, hemp milk, and others, undergo homogenization for improved texture and shelf life. Homogenizers, which utilize high-pressure pumps and homogenizing valves, facilitate the disintegration of fat molecules through cavitation and turbulence. Food safety is paramount in beverage processing, and aseptic processing, a critical component of continuous production, ensures the elimination of microorganisms.

High-pressure processing (HPP) is another technology that enhances food safety by applying high pressure to the product, thereby inactivating harmful bacteria. Blending systems enable the creation of functional foods and alternative milk blends, while line integration streamlines production and reduces costs. Heating systems, such as plate heat exchangers, are essential for pasteurization and sterilization. Control systems and quality control measures ensure the production of clean-label, high-quality plant-based beverages. Process optimization and conveying systems further enhance production efficiency. Plant-based yogurt, cream, cheese, and ice cream also benefit from these processing technologies. Ultrasonic processing is an emerging trend in plant-based beverage production, offering advantages such as reduced processing time, improved nutrient retention, and enhanced product quality. Overall, the plant-based beverage market is witnessing significant growth, driven by the health and wellness trend, consumer preference for dairy food, and the increasing popularity of plant-based diets.

The Homogenizer segment was valued at USD 759.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

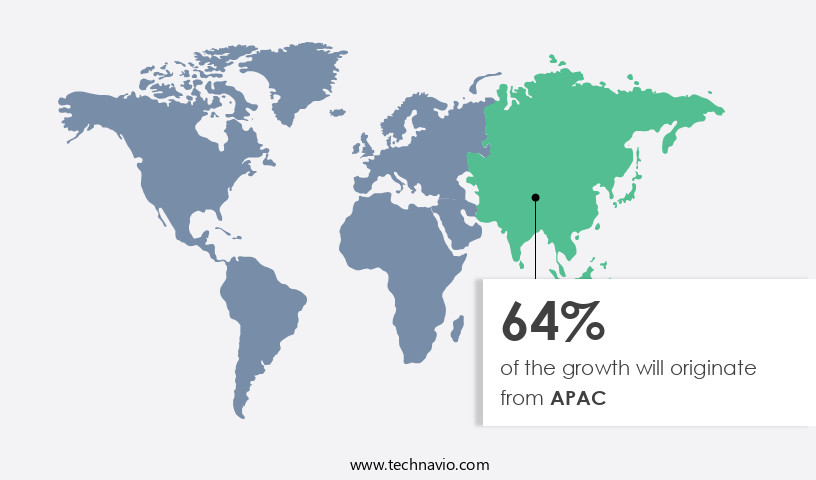

APAC is estimated to contribute 64% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region. This expansion is driven by several factors, including the entry of global brands, strategic partnerships between suppliers, retailers, and global brands, government initiatives promoting plant-based food consumption, and increasing awareness about the health benefits of plant-based beverages. The vegan population is also on the rise in vegan food, contributing to the market's growth. China, Japan, and Australia are the major contributors to the APAC market. In China, concerns over meat quality and health issues associated with meat products have fueled the demand for plant-based beverages. Food safety, process optimization, and line integration are crucial considerations in the manufacturing of plant-based yogurt, milk alternatives like pea milk, soy milk, almond milk, rice milk, cashew milk, coconut milk, oat milk, hemp milk, and plant-based cream.

Aseptic processing, high-pressure processing (HPP), blending systems, conveying systems, cooling systems, and heating systems are essential equipment for producing these beverages. Additionally, functional foods and beverage, plant-based cheese, and plant-based ice cream are gaining popularity, necessitating advanced processing equipment. Quality control, clean label, and control systems are essential to meet consumer demands for health and wellness. Ultrasonic processing is also used in the production of plant-based beverages for improved texture and taste.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Plant-Based Beverages Processing Equipment Market is expanding with rising demand for plant-based milk processing equipment for oat milk and aseptic processing systems for almond milk production. Manufacturers are investing in high-pressure processing equipment for soy milk and energy-efficient pasteurizers for plant-based beverages to ensure safety and sustainability. Advanced filtration systems for coconut milk manufacturing and UHT processing equipment for dairy-free beverages improve shelf life and product quality. Automation trends include automated filling machines for plant-based milk and homogenizers for cashew milk production. The market also emphasizes sustainable processing equipment for hemp milk and scalable modular plant-based beverage production lines.

The plant-based beverages processing market continues to evolve, driven by the growing demand for dairy alternatives and functional foods. Beverage processing companies invest in advanced technologies such as continuous processing, aseptic processing, and high-pressure processing (HPP) to meet consumer preferences for clean label, safe, and high-quality plant-based milk and yogurt alternatives. Functional foods, including plant-based beverages made from almond, rice, soy, pea, cashew milk, hemp, oat, and coconut milk, are integrated into various food processing lines. Blending systems and cooling systems play a crucial role in ensuring optimal process conditions and product consistency. Line integration and batch processing enable efficient production, while process optimization and quality control systems ensure food safety and regulatory compliance.

What are the key market drivers leading to the rise in the adoption of Plant-Based Beverages Processing Equipment Industry?

- The market is propelled forward by the growing demand for single-serve and multi-pack offerings, as well as the increasing preference for sustainable packaging solutions. The growing number of single-person households is fueling demand for convenient single-serve beverage packs, particularly in European countries like Denmark, Finland, and Germany.

- Consumers also seek space-efficient options, while retailers are stocking more multi-packs and variety packs to encourage trial. Simultaneously, a strong preference for sustainable packaging, exemplified by Tetra Pak's paper straws, is emerging as buyers aim to reduce their environmental impact. The increased consumption of single-serve and multi-packs will boost packaging material production, driving revenue for plant-based beverage processing equipment vendors. Furthermore, the rising demand for sustainable packaging will be a key growth driver for this global market in the forecast period.

What are the market trends shaping the Plant-Based Beverages Processing Equipment Industry?

- Market trends indicate a growing emphasis on health consciousness. This increasing awareness represents a significant shift in consumer behavior and preferences.One of the positive trends which can influence the growth of the global plant-based beverages processing equipment market during the forecast period is the increasing health consciousness among consumers. The increasing instances of obesity and related diseases are making consumers more health conscious.

- They demand natural food and beverage products that are natural and low in fat and calories. Players have started coming up with new plant-based products that have lower fat and calorie content to cater to the changing consumer demands. The health and wellness trends are gaining popularity among consumers, especially young consumers, in the age group of 18-32 years. Many consumers are also ready to pay a premium price for healthy products that offer various functional benefits. The increasing demand for healthy food and beverage products will help grow the global plant-based beverages processing equipment market during the forecast period.

What challenges does the Plant-Based Beverages Processing Equipment Industry face during its growth?

- The escalating energy costs pose a significant challenge to the expansion and growth of various industries. Since plant-based beverages processing equipment uses a significant amount of electrical energy, increasing energy costs is one of the major concerns among end-users of this equipment, which mostly comprise players operating in the food and beverage industry.

- The energy consumption of plant-based beverages processing equipment depends on the type of products being filled into different containers. For instance, the power consumption for filling high-viscosity products or products with large particulates is high. This is because the rotor inside the fillers faces higher stress while filling high-viscosity food products, consuming more power to fill the products accurately. Filling appliances such as vacuum and pressure fillers have high energy consumption rates, using vacuum and pressure for filling operations. The increase in energy consumption leads to additional costs for food processing manufacturers as their operational costs increase. This will result in reduced profit margins for such end-users (food processing manufacturers), which might discourage them from purchasing plant-based beverages processing equipment, negatively impacting market growth during the forecast period.

Exclusive Customer Landscape

The plant-based beverages processing equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plant-based beverages processing equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plant-based beverages processing equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Tetra Pak International S.A. - This company specializes in providing advanced plant-based beverage processing equipment and associated solutions, including the TY Rap system in a buoyant polypropylene configuration, ideal for various liquid processing applications. Our offerings cater to the growing demand for sustainable and innovative beverage technologies. The TY Rap system's versatility and durability make it a preferred choice for businesses seeking efficient and eco-friendly processing solutions. With a commitment to innovation and quality, we deliver equipment that enhances productivity and contributes to the creation of unique, high-quality plant-based beverages.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Tetra Pak International S.A.

- Alfa Laval AB

- GEA Group AG

- SPX FLOW Inc.

- Buhler AG

- Krones AG

- JBT Corporation

- Feldmeier Equipment Inc.

- HRS Process Systems Ltd.

- MicroThermics Inc.

- Shanghai Jimei Food Machinery Co., Ltd.

- ProXES GmbH

- Scherjon Dairy Equipment Holland

- Stephan Machinery GmbH

- Techno Process Equipment

- Della Toffola SpA

- Anderson Dahlen Inc.

- Secomak Ltd.

- Idaho Milk Products

- Clextral S.A.S.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plant-Based Beverages Processing Equipment Market

- In February 2023, Tetra Pak, a leading food processing and packaging solutions company, introduced its new plant-based beverage processing line, the Tetra Evero Aseptic, designed specifically for plant-based beverages. This innovation enables producers to process and package various plant-based beverages, including almond, soy, and oat milk, with enhanced efficiency and sustainability (Tetra Pak Press Release, 2023).

- In July 2024, Danish dairy cooperative Arla Foods entered into a strategic partnership with Danish engineering firm, FLSmidth, to develop and construct a new plant-based beverage production facility in Denmark. This collaboration is expected to significantly expand Arla's plant-based beverage offerings and strengthen its position in the global market (Arla Foods Press Release, 2024).

- In October 2024, leading plant-based beverage company, Ripple Foods, raised a USD200 million Series E funding round, bringing its total funding to over USD500 million. This substantial investment will support the company's continued growth and expansion into new markets and product categories (Business Wire, 2024).

- In March 2025, the European Union (EU) approved new regulations for plant-based beverage labeling, requiring plant-based milk alternatives to carry a label stating "plant-based" instead of using dairy terms such as "milk" or "cream." This policy change aims to prevent consumer confusion and promote transparency in the market (European Commission Press Release, 2025).

Research Analyst Overview

The plant-based beverages processing industry is experiencing significant activity and trends, driven by shifting consumer preferences towards healthier, sustainable options. Precision agriculture and ingredient sourcing play crucial roles in ensuring high-quality raw materials. Sustainability practices, such as waste reduction and energy efficiency, are essential for competitive advantage. Trade shows provide platforms for showcasing innovation hubs, including precision fermentation and sensory analysis, which enable product differentiation and development. Cell-based milk and fiber extraction are emerging areas of interest, offering extended shelf life and novel textures.

The Plant-Based Beverages Processing Equipment Market is advancing through innovations like energy-saving processing systems and scalable modular processing lines. Manufacturers are adopting zero-waste extraction technologies and IoT-enabled equipment monitoring for improved efficiency and sustainability. Demand for high-capacity aseptic systems is rising to meet large-scale production needs, while sustainable packaging solutions reduce environmental impact. Intelligent automation through AI-driven process optimization enhances product consistency. Techniques like low-temperature processing help retain nutrients, and compact homogenization units support space-efficient operations. Additionally, the use of recyclable equipment components reflects the industry's commitment to eco-friendly and responsible manufacturing practices.

The market's dynamic nature is further reflected in the emergence of plant-based dairy alternatives like plant-based cream, cheese, and Ice Cream, as well as the increasing popularity of alternative milk varieties like pea milk and pea protein processing and reverse osmosis-processed rice milk. The health and wellness trend continues to fuel market growth, with consumers seeking nutrient-rich, plant-based beverages that cater to diverse dietary needs, including plant-based diets and specific health conditions. Companies continue to innovate and adapt to meet these evolving consumer demands, ensuring the plant-based beverages processing market remains a vibrant and dynamic sector.

Industry associations foster collaboration and knowledge sharing, while packaging design caters to health trends and consumer demand. Flavor encapsulation and ingredient optimization contribute to product development, ensuring optimal taste and nutrition. Water conservation remains a priority in processing, as the industry strives to minimize its environmental footprint. Overall, these trends and practices shape the dynamic landscape of the plant-based beverages processing market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plant-Based Beverages Processing Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 1534.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plant-Based Beverages Processing Equipment Market Research and Growth Report?

- CAGR of the Plant-Based Beverages Processing Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plant-based beverages processing equipment market growth of industry companies

We can help! Our analysts can customize this plant-based beverages processing equipment market research report to meet your requirements.