Plastic Fasteners Market Size 2024-2028

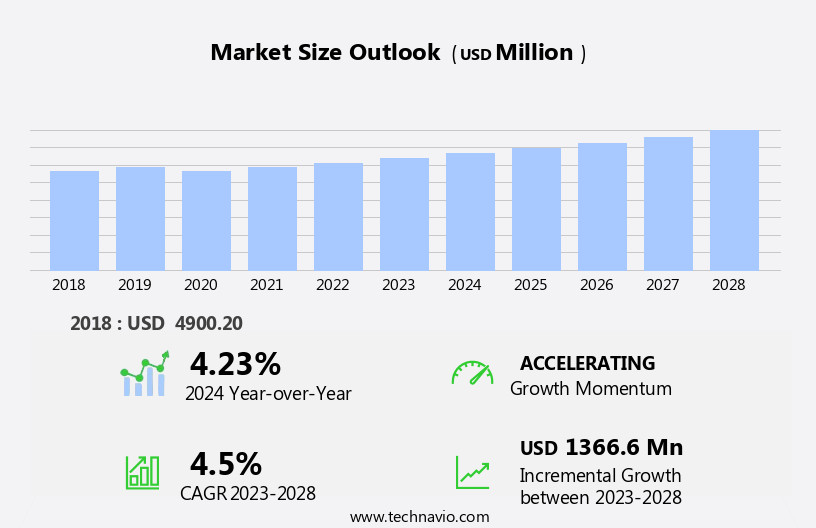

The plastic fasteners market size is forecast to increase by USD 1.37 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is driven by the cost advantages of using plastic fasteners over traditional materials. Plastic fasteners offer lighter weight and superior corrosion resistance, making them an attractive option for various industries such as automotive, construction, and electronics. However, the market faces challenges due to increasing regulations against the use of plastic, particularly in certain applications where biodegradability and recyclability are prioritized. These regulations may limit the growth potential for plastic fasteners in certain sectors, necessitating the development of eco-friendly alternatives or compliance strategies.

- Despite this, the growing popularity of lightweight fastener solutions continues to fuel market expansion, offering opportunities for companies to innovate and differentiate their offerings. To capitalize on these trends and navigate the regulatory landscape effectively, market players must stay informed of industry developments and adapt to evolving customer demands.

What will be the Size of the Plastic Fasteners Market during the forecast period?

- The market continues to evolve, driven by advancements in technology and the diverse applications across various sectors. Cost-effective solutions in plastic fasteners are increasingly preferred in industries such as furniture and consumer goods. Fastener manufacturing incorporates innovative designs, including snap fasteners and push-in fasteners, which offer temperature resistance and lightweight design. Injection Molding plays a significant role in producing these fasteners, ensuring fast production and high precision. Rivet nuts, zip ties, and cable ties are among the various types of plastic fasteners, each with unique properties. Rivet nuts provide vibration resistance and self-tapping capabilities, while zip ties and cable ties offer chemical resistance and sustainability with the use of recycled plastics.

- Fastener durability is a critical factor, with temperature resistance, UV resistance, and fastener strength being essential considerations. Fastener testing and assembly automation ensure consistent performance and reliability. Fastener certification is also crucial in ensuring compliance with industry standards and regulations. Fastener design continues to evolve, with an emphasis on sustainability and the use of eco-friendly materials. The product lifecycle is a continuous process, with ongoing research and development in areas such as fastener performance, impact resistance, and corrosion resistance. The market remains dynamic, with new innovations and applications continually emerging.

How is this Plastic Fasteners Industry segmented?

The plastic fasteners industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Electrical and electronics

- Building and construction

- Supermarkets

- Others

- Product

- Cable Ties

- Clips

- Rivets

- Washers

- Nuts

- Material Type

- Nylon

- Polypropylene

- Polyethylene

- Polycarbonate

- Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

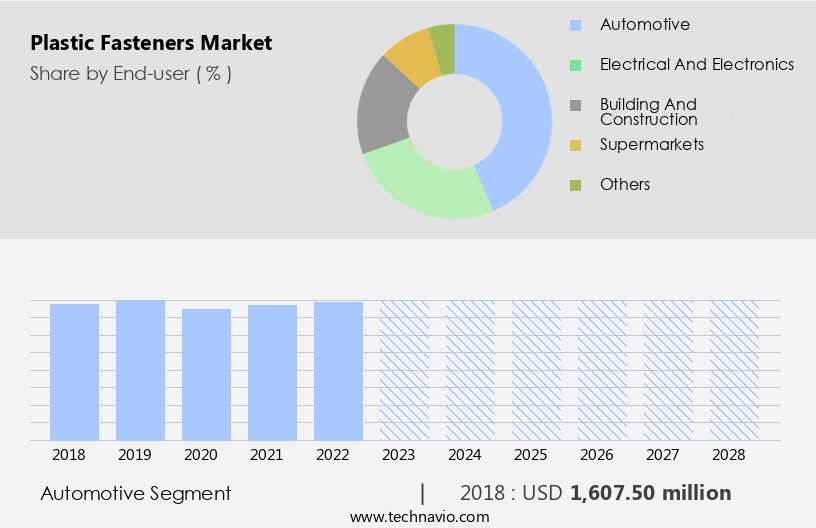

By End-user Insights

The automotive segment is estimated to witness significant growth during the forecast period.

Plastic fasteners have gained significant traction in various industries, particularly in the furniture industry and consumer goods, due to their cost-effective solutions and lightweight design. In the furniture industry, plastic fasteners are used extensively in the production of chairs, tables, and cabinets, ensuring temperature resistance and chemical resistance for long-lasting use. Similarly, in consumer goods, plastic fasteners contribute to the assembly of various products, including toys, electronics, and appliances, with push-in fasteners, zip ties, and cable ties providing vibration resistance and impact resistance. In the realm of fastener manufacturing, snap fasteners and self-tapping screws are popular choices due to their fastener testing capabilities and assembly automation.

Rivet nuts and injection molding techniques are used to enhance fastener durability and design intricacy. Sustainable materials, such as recycled plastics, are increasingly being utilized to reduce environmental impact. Fasteners are subjected to rigorous testing for performance metrics like fastener strength, corrosion resistance, and fastener certification. UV resistance is also a crucial factor, especially for outdoor applications. The product lifecycle of plastic fasteners is a critical consideration, with manufacturers focusing on enhancing fastener performance and ensuring fastener durability to meet evolving consumer demands.

The Automotive segment was valued at USD 1.61 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic global market for plastic fasteners, APAC holds a substantial share due to its thriving industries, particularly automotive and construction. Plastic fasteners, recognized for their cost-effective solutions, are increasingly preferred for their superior properties. In the automotive sector, they offer benefits such as high tensile strength, stiffness, creep resistance, and excellent wear resistance, contributing to lighter vehicle designs and improved fuel efficiency. This trend is particularly prominent in APAC, where China, the world's leading automobile producer, accounts for over 30% of global production. Moreover, plastic fasteners are indispensable in consumer goods manufacturing, where they ensure product durability and performance.

Fastener design innovations, including injection molding, push-in fasteners, zip ties, cable ties, and self-tapping screws, cater to diverse industry needs. These fasteners exhibit desirable properties such as temperature resistance, lightweight design, chemical resistance, UV resistance, and fastener testing ensures their reliability. Furthermore, assembly automation and the adoption of sustainable materials, like recycled plastics, are shaping the market. Fasteners must also meet stringent requirements, such as vibration resistance, fastener strength, impact resistance, fastener performance, corrosion resistance, and fastener certification, to ensure optimal product lifecycle. As the market evolves, plastic fasteners continue to offer innovative solutions, enhancing their appeal across various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.The global plastic fasteners market is growing steadily, driven by demand for lightweight, corrosion-resistant, and cost-effective solutions. Plastic fasteners for automotive assembly help reduce vehicle weight and improve efficiency. In electronics, rivets and push-in clips offer secure, non-conductive fastening for delicate components.

The rise of green construction fuels demand for biodegradable fasteners, while lightweight fasteners for electric vehicles support eco-friendly mobility. Nylon screws for consumer appliances are valued for durability and insulation. The aerospace sector benefits from 3D printed fasteners, offering customization and reduced weight. Sustainability goals are advancing eco-friendly fasteners and recyclable plastic fasteners in manufacturing. High-strength polymer fasteners for marine ensure durability in harsh conditions, while cable clips for automotive wire harnessing enhance electrical safety and organization.

What are the key market drivers leading to the rise in the adoption of Plastic Fasteners Industry?

- The use of plastic fasteners in industries offers significant cost advantages, making it a key market driver. Plastic fasteners are a cost-effective alternative to metal fasteners, widely utilized in various industries including construction, automobiles, and retail. Their advantages include superior chemical resistance, rustproof properties, and UV resistance. These attributes make plastic fasteners an ideal choice for applications exposed to harsh environments and extreme weather conditions. Moreover, the increasing focus on sustainability and the use of recycled plastics in manufacturing fasteners further enhances their appeal. In the automotive sector, where mass production is essential, plastic fasteners offer significant cost savings compared to other fastener types.

- The demand for plastic fasteners is expected to continue growing due to their durability and versatility, making them a preferred choice for numerous applications during the forecast period. Additionally, rigorous fastener testing ensures their reliability and performance under various conditions.

What are the market trends shaping the Plastic Fasteners Industry?

- The increasing preference for lightweight fastener solutions is a notable trend in the current market. This trend reflects the growing demand for efficient and cost-effective fixing methods in various industries.

- Plastic fasteners are essential components in various industries due to their versatility and superior properties. These fasteners are manufactured using materials such as nylon, PVC, and polypropylene, which provide desirable characteristics for numerous applications. In the construction sector, plastic fasteners are favored for their lightweight nature, making them suitable for assembling structures and forming circuit boards. Additionally, plastic fasteners offer electrical insulation, a critical factor in the electronics industry. Plastics are preferred for their ability to cater to weight, thermal, environmental, chemical, and electrical requirements in end-use applications. The demand for plastic fasteners is driven by their vibration resistance, fastener strength, impact resistance, and corrosion resistance.

- These properties enhance fastener performance and ensure durability in various applications. Moreover, plastic fasteners undergo rigorous certification processes to meet industry standards and ensure reliable performance. The emphasis on assembly automation in manufacturing processes further boosts the demand for plastic fasteners due to their ease of use and compatibility with automated systems. In conclusion, the market for plastic fasteners is expected to grow as industries continue to seek lightweight, high-performance, and cost-effective solutions for their assembly needs.

What challenges does the Plastic Fasteners Industry face during its growth?

- The strict regulations imposed on the use of plastic pose a significant challenge to the industry's growth. This mandated restriction adversely impacts businesses within the sector, potentially hindering their expansion and competitiveness.

- The market is a significant sector in the manufacturing industry, providing cost-effective solutions for various applications, including furniture and consumer goods. Regulatory compliance, however, poses challenges to market growth. European regulatory bodies, such as the European Food Safety Agency (EFSA) and the European Union (EU), have established guidelines and authorization procedures for plastic articles and materials, including fasteners, that come into contact with food. Regulation No (EC) 282/2008 sets guidelines for implementing recycling processes to produce plastics.

- These regulations aim to ensure safety and sustainability, potentially impacting the production and design processes of snap fasteners and other plastic fasteners through injection molding. Adherence to these regulations is essential for market participants to remain competitive and maintain consumer trust.

Exclusive Customer Landscape

The plastic fasteners market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plastic fasteners market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plastic fasteners market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Illinois Tool Works Inc. - This company specializes in manufacturing and supplying a range of plastic fasteners, including plastic staple fasteners. Our product line caters to various industries, providing durable and versatile solutions for securing and joining materials. With a commitment to innovation, we continuously research and develop new fastener designs to enhance functionality and efficiency. Our plastic fasteners offer several advantages over traditional counterparts, such as resistance to corrosion, lighter weight, and improved strength. By utilizing advanced manufacturing techniques and quality materials, we ensure consistent product performance and reliability. Our dedication to excellence makes US a trusted partner for businesses seeking high-quality plastic fasteners.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Illinois Tool Works Inc.

- HellermannTyton GmbH

- Nifco Inc.

- Essentra plc

- ARaymond

- Bollhoff Group

- Stanley Black & Decker Inc.

- Panduit Corp.

- Thomas & Betts Corporation

- Avery Dennison Corporation

- 3M Company

- Emhart Teknologies

- Bossard Group

- TR Fastenings Ltd.

- PennEngineering

- SMC Corporation

- LISI Group

- SFS Group AG

- YKK Corporation

- Shenzhen Fastprint Circuit Tech

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plastic Fasteners Market

- In January 2024, Husky Injection Molding Systems, a leading manufacturer of injection molding machinery, announced the launch of its new line of electric injection molding machines specifically designed for producing plastic fasteners (Husky's press release). This innovation aims to reduce energy consumption and improve production efficiency in the fastener industry.

- In March 2025, 3M and Hilti, two major players in the construction industry, entered into a strategic partnership to develop and commercialize advanced fastening solutions using 3M's VHB tape technology (3M's press release). This collaboration is expected to enhance Hilti's product portfolio and broaden 3M's reach in the construction sector.

- In May 2024, PEM Industries, a prominent plastic fastener manufacturer, completed the acquisition of Fasteners Unlimited, a leading supplier of fasteners and related components (PEM Industries' SEC filing). This acquisition significantly expanded PEM's product offerings and customer base, positioning the company as a comprehensive solution provider in the fastener market.

Research Analyst Overview

The market encompasses a diverse range of products and processes, with key factors influencing its dynamics and trends. Cost is a significant consideration in fastener assembly, as reliability and durability are essential for various applications. Fastener materials, such as engineering-grade plastics, continue to evolve, driving innovations in fastener technologies. Fastener standards and specifications ensure consistent performance and safety, while testing and certification processes validate these attributes. Fastener removal and installation processes must balance efficiency and damage prevention, with sustainability becoming an increasingly important consideration. Durability and efficiency are critical in fastener manufacturing processes, with innovations in automation and recycling technologies driving cost savings and reduced environmental impact.

The global plastic fasteners market is evolving with a strong focus on innovation, sustainability, and performance. Eco-friendly fasteners and biodegradable fastener materials are gaining traction amid growing environmental regulations. Manufacturers are developing recyclable plastic fasteners and lightweight fastener designs to support efficiency in electric vehicles and consumer goods. High-strength polymer fasteners offer corrosion resistance and durability for marine and industrial applications. Emerging smart fastener systems integrate sensors for enhanced monitoring and performance. Vibration-resistant clips are essential in automotive and aerospace sectors. Demand is rising for customizable fastener solutions enabled by 3D printing. Hybrid metal-plastic fasteners combine strength and flexibility, while fastener durability enhancements ensure long-lasting performance across high-stress environments, driving growth across multiple end-use industries.

Fastener design considerations must balance performance, safety, and cost, with applications spanning industries from automotive to construction. Fastener trends include advancements in material science, such as high-performance polymers, and the integration of smart technologies for enhanced functionality. Regulations governing fastener safety and environmental impact continue to evolve, shaping the market landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plastic Fasteners Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1366.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plastic Fasteners Market Research and Growth Report?

- CAGR of the Plastic Fasteners industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plastic fasteners market growth of industry companies

We can help! Our analysts can customize this plastic fasteners market research report to meet your requirements.