Plating On Plastics (POP) Market Size 2024-2028

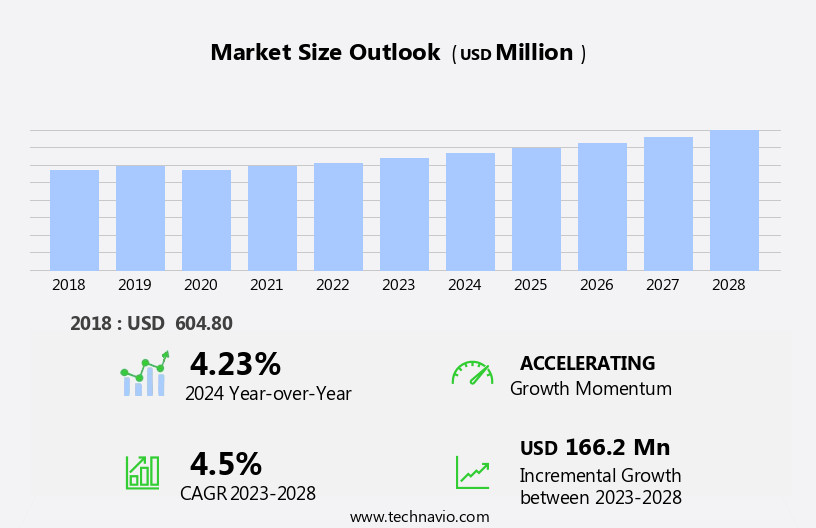

The plating on plastics (POP) market size is forecast to increase by USD 166.2 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of acrylonitrile butadiene styrene (ABS) as a preferred material for plating applications. ABS offers several advantages, including its high impact strength, excellent chemical resistance, and ease of processing. This trend is further fueled by the emergence of double (twin)-shot molding technology, which enables the simultaneous injection of two different materials within the same part, enhancing the functional and aesthetic properties of plated plastic components. However, the POP market faces challenges as well. One major obstacle is the comparatively lower complexity of plating on metals compared to plating on plastic.

- Metals, being electrically conductive, require less preparation and offer a more straightforward plating process. To capitalize on the opportunities presented by the POP market while mitigating these challenges, companies must focus on innovation, such as developing cost-effective and efficient plating processes for plastic substrates, and expanding their product offerings to cater to diverse industries and applications. By addressing these trends and challenges, market participants can effectively position themselves for growth and success in the evolving POP landscape.

What will be the Size of the Plating On Plastics (POP) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. Adhesion promoters play a crucial role in ensuring the successful bonding of metallic coatings to plastic substrates. Electroless plating, a process without the need for an external power source, offers advantages in terms of cost-effectiveness and uniformity. Cleaning agents are essential in the plating process, ensuring the substrate's surface is free from contaminants. Wastewater recycling systems help minimize environmental impact, making plating processes more sustainable. Rinse tanks are utilized to remove excess plating solutions and contaminants, contributing to the overall quality of the plated parts. Gold plating, zinc-nickel plating, silver plating, and other metallic coatings provide various benefits, including corrosion resistance, wear resistance, and decorative purposes.

Jig plating and rack plating methods offer precision and control, while barrel plating caters to larger batches. Environmental regulations drive the development of non-cyanide plating processes, which eliminate the use of hazardous chemicals. Plastic pre-treatment and surface preparation techniques ensure proper adhesion and improve the overall quality of the plated parts. In the realm of industrial plating, automated plating lines and in-line plating systems streamline production processes, enhancing efficiency and reducing costs. Thickness measurement techniques ensure consistent coat application, while quality control processes maintain high standards. Plating chemistry and plating solutions are continually evolving to cater to the diverse needs of various industries.

Selective plating and testing methods enable precise coating application and ensure the desired properties are met. Polymer coatings and paint adhesion are essential considerations in the POP market, with advancements in acrylic plating, powder coating, immersion plating, and mechanical plating offering enhanced performance and durability. Chemical etching and platinum plating provide additional surface finishing options, catering to specific applications. Plating baths and wear resistance are essential factors in the selection of plating processes for various industries. The POP market's continuous evolution reflects the ongoing efforts to improve processes, enhance performance, and minimize environmental impact. The integration of advanced technologies and regulatory compliance ensures the industry remains at the forefront of innovation.

How is this Plating On Plastics (POP) Industry segmented?

The plating on plastics (POP) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Electrical and electronics

- Construction and building

- Others

- Product

- Nickel

- Chrome

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By End-user Insights

The automotive segment is estimated to witness significant growth during the forecast period.

The market encompasses various processes, including rhodium plating, chromium plating, thickness measurement, rack plating, batch plating, palladium plating, and others. Environmental regulations have led to the adoption of non-cyanide plating, electroless plating, and other eco-friendly alternatives. Plating baths, such as barrel plating and jig plating, facilitate efficient plating processes. Tin plating, nickel plating, and zinc plating are commonly used for corrosion resistance and wear resistance. Surface preparation and plastic pre-treatment are crucial steps in ensuring proper adhesion of metallic coatings. In the industrial sector, plating on plastics is utilized for decorative and functional purposes. Decorative plating enhances the aesthetic appeal of plastic products, while industrial plating provides additional protective layers.

Metallic coatings, including gold plating, silver plating, and chromate conversion coating, offer superior corrosion resistance and improved paint adhesion. Automated plating lines and in-line plating systems ensure consistent coat thickness and quality control. Wastewater recycling and the use of rinse tanks minimize environmental impact. Plating chemistry and plating solutions play a significant role in determining the properties of the plated surfaces. Selective plating and testing methods ensure precise application and accurate evaluation of the plated coatings. The automotive segment is the largest market for POP, driven by the increasing demand for lightweight and fuel-efficient vehicles. More than 26 automotive parts are plated, with gold and silver used for brightening plastic surfaces.

The growth of the automotive segment is attributed to the high volume production and sales of various types of automotive vehicles. Plating on plastics improves surface finishing, enhances paint adhesion, and protects against wear and corrosion.

The Automotive segment was valued at USD 472.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth due to the increasing demand for lightweight and durable automotive components. Europe is the leading region in the global POP market, driven by the presence of major automobile manufacturers in Germany and the UK. Strict environmental regulations, such as Regulation (EC) No. 443/2009, which aims to reduce carbon dioxide emissions in new passenger cars, are boosting the market. The regulation sets a target of 95.3g of carbon dioxide/kilometer by the EU by 2021, driving the use of plastics in automobile production. Surface preparation plays a crucial role in the POP process.

Thorough cleaning with suitable cleaning agents is essential before plating to ensure proper adhesion. Various plating techniques, including rack plating, barrel plating, and batch plating, are used to apply metallic coatings such as nickel, chromium, palladium, gold, and silver. Wear resistance and paint adhesion are significant factors in the choice of plating methods. Automated plating lines and in-line plating systems have gained POPularity for their efficiency and cost-effectiveness. Wastewater recycling and the use of non-cyanide plating processes contribute to the market's environmental sustainability. Selective plating and chemical etching are advanced plating techniques used for producing intricate designs and patterns on plastics.

Corrosion resistance, decorative plating, and chromate conversion coatings are essential applications of POP. Industrial plating is another growing sector, with applications in various industries such as electronics, medical devices, and construction. Metallic coatings like zinc-nickel and tin are widely used for their corrosion resistance properties. The POP market is continuously evolving, with ongoing research and development in plating chemistry, plating solutions, and plating baths. Technological advancements, such as automated plating lines, have improved the quality control and consistency of the plating process. The integration of POP with other surface finishing techniques, such as powder coating and acrylic plating, offers additional benefits to manufacturers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Plating On Plastics (POP) Industry?

- The significant growth in the application of acrylonitrile butadiene styrene (ABS) is the primary factor fueling market expansion. This versatile thermoplastic material is widely used in various industries, including automotive, electronics, and construction, due to its strength, durability, and resistance to impact and heat. The increasing demand for ABS in these sectors is driving market growth and innovation.

- Plating on Plastics (POP) is a process that involves coating plastic surfaces with metals such as rhodium, chromium, palladium, nickel, and tin for enhanced durability and corrosion resistance. Electronics and appliances, as well as the transportation sector, are primary markets for plated plastic components. In the automotive industry, high-quality plastics with superior ductility are used to manufacture exterior and interior parts in commercial and passenger vehicles. The increasing focus on using lightweight materials in vehicles for weight reduction and emission control is driving the demand for plated plastic parts. Rhodium and chromium plating are commonly used for decorative purposes, while palladium plating is preferred for its excellent electrical conductivity.

- Thickness measurement is crucial in plating processes to ensure consistent coating quality. Plating methods include rack plating for individual pieces and batch plating for multiple parts. Surface preparation is essential to ensure proper adhesion of the metal coating. Environmental regulations are a significant factor in the POP market, with non-cyanide plating solutions gaining POPularity due to their reduced environmental impact. Plating baths are essential components in the plating process, providing the necessary chemical environment for the metal deposition. Barrel plating is another plating method used for coating large quantities of parts in a single batch. In 2018, Asia Pacific was the leading consumer of ABS resins, with China accounting for over one-third of the global capacity and more than 50% of the global consumption.

- The trend is expected to continue due to the region's large automotive and electronics industries.

What are the market trends shaping the Plating On Plastics (POP) Industry?

- The emergence of double (twin-shot) molding is gaining significant traction in the market as a notable trend. This advanced manufacturing process enables the production of two distinct materials or colors in a single part, offering enhanced design possibilities and cost savings.

- Plating on Plastics (POP) is a molding technique used to manufacture various products, including medical devices, consumer electronics, door handles, key fobs, grills, vent plates, and cockpit designs. This process involves the use of both plateable and non-plateable plastic resins in double-shot molding. The etch solution selectively etches one of the plastic shots, enabling the application of metallic coatings such as gold plating, zinc-nickel plating, silver plating, and copper plating. The benefits of Plating on Plastics include the construction of intricate designs and low assembly costs.

- The low assembly cost results from the use of two integrated resins for making one piece, eliminating the need for post-plating assembly. In addition, the use of adhesion promoters and cleaning agents ensures proper etching and activation, leading to no yield loss. Furthermore, wastewater recycling and the use of rinse tanks minimize environmental impact, making this technique a sustainable option for manufacturing.

What challenges does the Plating On Plastics (POP) Industry face during its growth?

- The complexities inherent in plating metals, particularly when compared to plating on plastic, pose significant challenges that hinder industry growth.

- Plating on Plastics (POP) is a specialized surface finishing process that involves applying polymer coatings to plastic substrates, such as ABS, for enhanced wear resistance, corrosion protection, and improved paint adhesion. Compared to metal plating, POP is more complex and expensive due to the need for multiple process steps, including degreasing, hydrophilic coating of plastics, curing, neutralization, pre-impregnation, activation, peptization, and final plating. These processes ensure the uniformity and adherence of the coating to the plastic substrate. The POP process is particularly useful for industrial applications where high wear resistance and corrosion protection are essential. Cyanide plating and chromate conversion coating are common methods used in POP for their superior properties.

- The success of the POP process depends on the proper interaction between the plating processes and the injection molding techniques used to produce the plastic parts. Despite the challenges, the benefits of POP make it a valuable investment for businesses seeking durable and attractive plastic components.

Exclusive Customer Landscape

The plating on plastics (POP) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plating on plastics (POP) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plating on plastics (POP) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Covestro AG - This company specializes in advanced plating solutions for various thermal plastics, including Marklon TC, and optics. Their expertise lies in enhancing the surface properties of these materials for improved performance and durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Covestro AG

- Cybershield Inc.

- DuPont de Nemours Inc.

- Element Solutions Inc.

- Galva Decoparts Pvt. Ltd.

- Grauer and Weil India Ltd.

- Integran Technologies Inc.

- Koch Industries Inc.

- Leader Plating on Plastic Ltd

- MPC Plating Inc

- Okuno Pharmaceutical Co. Ltd.

- Phillips Plating Corp.

- Plasman Plastics Inc.

- SARREL

- Sharretts Plating Co. Inc.

- The Carlyle Group Inc.

- Winning Group AS

- Xin Point Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plating On Plastics (POP) Market

- In January 2024, DuPont Electronics & Imaging announced the launch of its new line of conductive inks for Plating on Plastics (POP) applications, expanding its portfolio to cater to the growing demand for flexible and lightweight electronic devices (DuPont Press Release).

- In March 2024, 3M and Henkel Adhesives entered into a strategic partnership to co-develop advanced adhesive solutions for the POP market, aiming to enhance the performance and durability of plated components (3M Press Release).

- In May 2024, INEOS Styrolution, the world's leading styrenics supplier, completed the acquisition of Borealis AG's polyolefin business, significantly increasing its market share and capacity in the POP market (INEOS Styrolution Press Release).

- In February 2025, the European Union approved the new REACH regulation for plating chemicals, setting stricter safety and environmental standards for their production and use in the POP market (European Chemicals Agency Press Release).

Research Analyst Overview

- The plastics (POP) market encompasses various applications, including automotive and electronics industries. In automotive applications, the focus is on substrate preparation for effective plating, ensuring coating uniformity and stress relief for improved plating efficiency. The electronics sector demands precise electrolyte composition, throwing power, and process optimization for anode and cathode materials. Industry standards mandate stringent quality control measures, such as plasma treatment and ultrasonic cleaning, to maintain product life cycle and sustainability. Supplier relationships are crucial for securing raw materials and ensuring cost analysis in the face of automation technologies and increasing production capacity.

- Aerospace applications necessitate high-performance plating, with leveling agents and corrosion inhibitors essential for optimal plating uniformity and longevity. Anode and cathode materials undergo rigorous testing for current density and plating efficiency, while sustainability initiatives drive the development of eco-friendly plating processes. The plastics plating industry continues to evolve, with ongoing research and development efforts aimed at enhancing process optimization, reducing costs, and improving sustainability. The market's dynamics are shaped by technological advancements, regulatory requirements, and evolving customer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plating On Plastics (POP) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 166.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plating On Plastics (POP) Market Research and Growth Report?

- CAGR of the Plating On Plastics (POP) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plating on plastics (POP) market growth of industry companies

We can help! Our analysts can customize this plating on plastics (POP) market research report to meet your requirements.