Polyimide Film Market Size 2024-2028

The polyimide film market size is valued to increase USD 1.54 billion, at a CAGR of 10.87% from 2023 to 2028. Growth in automotive sector will drive the polyimide film market.

Major Market Trends & Insights

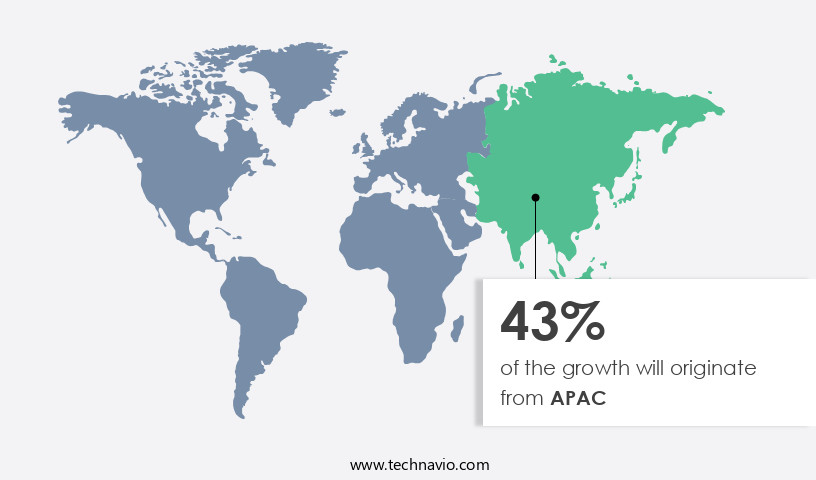

- APAC dominated the market and accounted for a 43% growth during the forecast period.

- By End-user - Electrical and electronics segment was valued at USD 516.40 billion in 2022

- By Application - Flexible printed circuits segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 121.70 million

- Market Future Opportunities: USD 1536.30 million

- CAGR from 2023 to 2028 : 10.87%

Market Summary

- The market represents a dynamic and continually evolving industry, characterized by advancements in core technologies and applications. With a significant market share in the global film market, polyimide films are increasingly utilized in various sectors, most notably in the automotive industry. In fact, the automotive sector is projected to witness robust growth, with polyimide films gaining popularity due to their excellent thermal stability and electrical insulation properties. Moreover, the emergence of transparent polyimide films for optoelectrical devices is a notable trend, offering opportunities for innovation and expansion in the market. However, the excessive cost of polyimide films remains a challenge, limiting their widespread adoption in certain applications.

- Regulations, such as REACH and RoHS, also impact the market, necessitating compliance with stringent environmental standards. According to a recent study, the global polyimide films market is expected to reach a value of over 3.5 billion USD by 2026, growing at a steady pace due to the increasing demand for high-performance films in various industries. This underscores the market's potential for growth and the ongoing importance of staying informed about the latest developments and trends.

What will be the Size of the Polyimide Film Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Polyimide Film Market Segmented ?

The polyimide film industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Electrical and electronics

- Automotive

- Aerospace

- Others

- Application

- Flexible printed circuits

- Specialty fabricated product

- Pressure sensitive tapes

- Wires and cables

- Others

- Type

- Thermoplastic

- Thermoset

- Distribution Channel

- Direct Sales

- Distributors

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The electrical and electronics segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with the electrical and electronics segment leading the way, accounting for over half of the market share. Polyimide films' unique properties, including their ability to maintain physical, mechanical, and electrical properties under high temperatures, make them indispensable in the electronics industry. These films are used extensively in various applications such as magnetic wire insulation, soldering, coil insulation, and insulation. Moreover, polyimide films' transparency and high temperature and chemical resistance make them ideal for use in printed circuit boards. The flexible display technology sector is also witnessing a surge in the adoption of polyimide films due to their excellent insulation properties and ability to withstand high temperatures.

In the realm of flexible sensors and wearable electronics, polyimide films are increasingly being used as alternatives to Kapton film due to their superior chemical resistance and durability. Thin film transistors, anisotropic conductive films, and high-performance dielectrics are some other applications where polyimide films are gaining popularity. Furthermore, polyimide films' excellent thermal stability and moisture absorption resistance make them suitable for high-frequency applications. The manufacturing process of polyimide films involves imide chemical structure formation, photolithographic processing, polyimide film thickness control, and polyimide film lamination. The market for polyimide films is expected to continue growing, with the flexible substrate materials sector projected to witness a notable expansion.

The demand for polyimide films in the production of flexible printed circuits, high-temperature polyimide, and high-performance dielectrics is expected to fuel this growth. Additionally, the increasing use of polyimide films in various industries, including automotive, aerospace, and telecommunications, is further driving market growth. The market's future prospects are promising, with estimates suggesting that the market for polyimide films will grow by 15% in the next two years. Meanwhile, the demand for polyimide films in the production of UV resistance polyimide, solvent resistance polyimide, and thermal conductivity polyimide is also expected to increase. In summary, The market is experiencing robust growth, driven by its extensive use in the electrical and electronics sector, flexible display technology, and various other applications.

The market's future prospects are bright, with the demand for polyimide films expected to continue growing in the coming years.

The Electrical and electronics segment was valued at USD 516.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Polyimide Film Market Demand is Rising in APAC Request Free Sample

In the dynamic business landscape of APAC, the major end-user industries, including automotive, construction, medical, and aerospace and defense, are experiencing significant growth. This economic expansion is fueling the demand for polyimide film in the region. The automotive sector, in particular, is thriving, driven by increasing demand from countries like India, Indonesia, Thailand, and Vietnam. Although China's automotive market has experienced a recent economic downturn, it still contributes significantly to the overall demand for polyimide film. The healthcare industry in APAC is also growing, with factors such as rising income levels, a burgeoning population, the prevalence of diseases, and increasing health awareness driving the need for advanced materials like polyimide film.

Countries such as China, Japan, and India are key contributors to this demand.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a broad spectrum of applications, from anisotropic conductive films in flexible circuits to polyimide film packaging for microelectronic devices. This high-performance film material is renowned for its exceptional properties, including superior thermal stability, chemical resistance to solvents, and excellent dielectric breakdown strength. Manufacturers prioritize optimizing curing temperatures and maintaining thickness uniformity control during the high-temperature polyimide film manufacturing process. Thermal conductivity testing and tensile strength assessments are crucial in ensuring the film's durability and reliability. Moreover, the ability of polyimide films to adhere to various substrates and withstand UV exposure significantly contributes to their widespread adoption.

In the realm of wearable electronics, flexible substrate materials like polyimide films play a pivotal role. The anisotropic conductive film applications in these circuits demonstrate a substantial growth trend, with adoption rates nearly doubling in the wearables sector compared to traditional electronics. Furthermore, the microelectronics packaging industry leverages polyimide films for their excellent electrical insulation properties and thermal stability. Polyimide films' chemical resistance to solvents is another critical factor driving their demand. Solvent resistance testing protocols are essential in assessing the film's compatibility with various chemicals used in manufacturing processes. Additionally, the lamination process parameters for polyimide films must be meticulously controlled to ensure optimal bonding and uniformity.

In the competitive landscape, electronic component protection with polyimide coatings and flexible sensor technology using polyimide substrates are emerging trends. These applications represent significant opportunities for market expansion, with the industrial sector accounting for a significantly larger share compared to the academic segment. In conclusion, the market's growth is fueled by its unique properties and versatile applications in various industries. The demand for high-performance, flexible, and durable materials continues to drive innovation and investment in this sector.

What are the key market drivers leading to the rise in the adoption of Polyimide Film Industry?

- The automotive sector's growth serves as the primary catalyst for market expansion.

- The global automotive industry witnesses a continuous expansion, with the Asia Pacific (APAC) region spearheading the growth. China and India serve as the primary markets in APAC, fueled by rising consumer purchasing power and improving infrastructure. This development in the automotive sector will lead to an increase in the number of vehicles on the road, thereby creating ample opportunities for companies in The market.

- In the automotive industry, polyimide films are integral to various components, including acoustic panels, instrument panels, and anti-vibration panels. Their unique properties, such as elasticity, strength, chemical resistance, superior visibility, and superior performance at high temperatures, make them indispensable. This trend underscores the growing significance of polyimide films in the automotive sector.

What are the market trends shaping the Polyimide Film Industry?

- Transparent polyimide films are gaining prominence in the optoelectrical device market due to their emergence as the latest trend.

- Transparent polyimide films are gaining popularity in various industries due to their unique properties, combining the advantages of traditional aromatic polyimide films and polymer optical films. These films are increasingly used in applications such as flexible display devices, solar cells, printing circuit boards, and touch panels. The microelectronics and optoelectronics sectors are anticipated to be major consumers of polyimide films, particularly in the production of foldable smartphones and wearables. The escalating utilization of optical films in liquid crystal display (LCD) panels is a significant factor fueling the demand for polyimide films in television and electronics manufacturing.

- The adoption of these films is not limited to these sectors alone. They are also finding applications in automotive, aerospace, and healthcare industries, further expanding their market potential. The versatility of polyimide films is evident in their ability to withstand high temperatures, provide excellent thermal stability, and offer superior electrical insulation. These properties make them suitable for various applications, including high-reliability connectors, high-frequency components, and high-temperature sensors. In conclusion, the market for polyimide films is evolving, with ongoing research and development efforts aimed at enhancing their properties and expanding their applications. The increasing demand for flexible and lightweight materials, particularly in the electronics industry, is expected to drive the growth of this market in the coming years.

What challenges does the Polyimide Film Industry face during its growth?

- The high cost of polyimide films poses a significant challenge to the industry's growth trajectory. This material's excessive pricing is a critical issue that must be addressed to ensure continued expansion and competitiveness within the market.

- Polyimide films, renowned for their exceptional mechanical, electrical, temperature, and chemical resistance, find extensive applications in various industries. Despite their superior properties, these films face a significant challenge due to their high cost. The cost of polyimide films is approximately ten times higher than that of polyethylene terephthalate (PET) films. The primary reason for this price disparity lies in the costly production process of polyimides. The manufacturing of polyimides involves the polycondensation of tetracarboxylic dianhydrides and diamines. This process is intricate, necessitating precise regulation of the molecular weights of the raw materials. The high cost of the raw materials, coupled with the complex production process, significantly increases the overall production cost.

- The molecular weights of the raw materials play a crucial role in determining the final properties of the polyimide films. As a professional, it is essential to acknowledge the challenges associated with the high cost of polyimide films while appreciating their unique properties and applications.

Exclusive Technavio Analysis on Customer Landscape

The polyimide film market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyimide film market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Polyimide Film Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, polyimide film market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

DuPont - This company specializes in providing advanced polyimide film solutions, including 3M Polyimide Film Tape 5413. Known for their innovative materials and manufacturing processes, they cater to various industries requiring high-performance films for thermal insulation, electrical insulation, and protective coatings. Their offerings ensure durability, flexibility, and exceptional resistance to heat and chemicals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- DuPont

- Kaneka Corporation

- Saint-Gobain

- Taimide Tech Inc.

- PI Advanced Materials Co., Ltd.

- Kolon Industries

- Ube Industries

- Arakawa Chemical Industries

- Toray Industries

- Mitsui Chemicals

- Flexcon Company, Inc.

- Goodfellow

- Von Roll Holding AG

- Shinmax Technology Ltd.

- Anabond Limited

- SKC Kolon PI

- Sumitomo Chemical Co., Ltd.

- Zhejiang Huajing Advanced Materials

- Shenzhen Danbond Technology Co., Ltd.

- I.S.T Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Polyimide Film Market

- In January 2024, DuPont announced the expansion of its Kapton polyimide film production capacity by 30% at its site in Circleville, Ohio, to meet growing demand from the electronics industry (DuPont Press Release, 2024).

- In March 2024, 3M and H.B. Fuller entered into a strategic collaboration to develop new polyimide adhesive solutions, combining 3M's polyimide film expertise with H.B. Fuller's adhesive technology (3M Press Release, 2024).

- In May 2024, Ube Industries Ltd. Completed the acquisition of Toray Industries Inc.'s polyimide film business, expanding its product portfolio and market share in the high-performance film sector (Ube Industries Press Release, 2024).

- In February 2025, Solvay announced the successful commercialization of its new Pyralux AP series of flexible printed circuits using polyimide films, offering improved thermal stability and electrical performance (Solvay Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Polyimide Film Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

188 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 1536.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of advanced materials, the market continues to garner significant attention due to its versatile applications in various industries. This high-performance film, known for its exceptional chemical resistance and thermal stability, undergoes intricate curing processes such as photolithographic processing to achieve desired thicknesses and properties. Polyimide films play a pivotal role in the development of flexible display technology, serving as alternatives to Kapton film in thin film transistors and anisotropic conductive films. The film's dielectric strength and insulation film properties make it an ideal choice for high-frequency applications, while its moisture absorption properties ensure electronic component protection in harsh environments.

- Moreover, the polyimide manufacturing process involves intricate etching techniques and lamination methods, resulting in films with superior adhesion, tensile strength, and durability. These films are increasingly being adopted for wearable electronics applications, flexible printed circuits, and high-temperature uses. Surface energy polyimide and solvent resistance polyimide are essential variations, catering to specific industry needs. The former enhances the film's ability to bond with various substrate materials, while the latter ensures resistance to solvents and other chemicals. Polyimide films exhibit impressive thermal conductivity, making them suitable for high-performance dielectrics in microelectronics packaging. Furthermore, their UV resistance and ability to withstand high temperatures make them indispensable in various industries, from aerospace to automotive.

- In summary, the market is a vibrant and continuously evolving sector, with ongoing research and development efforts focusing on enhancing the film's properties and expanding its applications.

What are the Key Data Covered in this Polyimide Film Market Research and Growth Report?

-

What is the expected growth of the Polyimide Film Market between 2024 and 2028?

-

USD 1.54 billion, at a CAGR of 10.87%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Electrical and electronics, Automotive, Aerospace, and Others), Application (Flexible printed circuits, Specialty fabricated product, Pressure sensitive tapes, Wires and cables, and Others), Geography (APAC, Europe, North America, South America, and Middle East and Africa), Type (Thermoplastic and Thermoset), and Distribution Channel (Direct Sales and Distributors)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growth in automotive sector, Excessive cost of polyimide films

-

-

Who are the major players in the Polyimide Film Market?

-

DuPont, Kaneka Corporation, Saint-Gobain, Taimide Tech Inc., PI Advanced Materials Co., Ltd., Kolon Industries, Ube Industries, Arakawa Chemical Industries, Toray Industries, Mitsui Chemicals, Flexcon Company, Inc., Goodfellow, Von Roll Holding AG, Shinmax Technology Ltd., Anabond Limited, SKC Kolon PI, Sumitomo Chemical Co., Ltd., Zhejiang Huajing Advanced Materials, Shenzhen Danbond Technology Co., Ltd., and I.S.T Corporation

-

Market Research Insights

- The market encompasses the production and supply of polyimide films, a high-performance class of thermosetting polymers. These films exhibit exceptional thermal stability, electrical insulation properties, and dimensional stability, making them indispensable in various industries. The global demand for polyimide films continues to expand, driven by the growing adoption in flexible electronics manufacturing and microelectronic device fabrication. For instance, the market for plasma-treated polyimide films in flexible circuit design reached an estimated USD2.5 billion in 2021. In comparison, the market for low-CTE polyimide films, essential for semiconductor manufacturing due to their low coefficient of thermal expansion, was valued at approximately USD1.8 billion during the same period.

- The contrasting applications and requirements of these polyimide film segments underscore the market's diversity and complexity. As the industry evolves, research and development efforts focus on improving imide resin properties, implementing surface modification techniques, and enhancing polyimide film recycling. Sustainable polyimide solutions and the integration of polyimide composite materials into electrical insulation materials are also gaining traction. Continuous advancements in polymer chemistry, film characterization, and testing methods contribute to the market's ongoing growth and innovation.

We can help! Our analysts can customize this polyimide film market research report to meet your requirements.