Flexible Display Market Size 2024-2028

The flexible display market size is forecast to increase by USD 18.5 billion, at a CAGR of 10.08% between 2023 and 2028. The market is experiencing significant growth due to advancements in technology and increasing demand from various industries. Key drivers include increased research and development investments and the introduction of innovative flexible display products. However, the market also faces challenges such as the shortened shelf life of these displays. In the consumer electronics sector, flexible displays are gaining popularity in smartphones, laptops, and desktop screens. OLED screens, a type of flexible display, are particularly sought after for their high resolution and energy efficiency. The trend is not limited to consumer electronics alone, as flexible displays are also making their way into televisions and wearables. The supply chain for flexible displays is complex, involving multiple stakeholders from raw material suppliers to manufacturers and end-users. Ensuring a seamless supply chain is crucial to meet the growing demand for these displays. As the market continues to evolve, it is essential for businesses to stay informed about the latest trends and challenges to remain competitive.

Market Analysis

The market is witnessing significant advancements driven by the increasing demand for innovative and versatile display solutions in various applications. Flexible displays offer numerous benefits such as enhanced durability, improved design aesthetics, and the ability to conform to different shapes and sizes. In the consumer electronics sector, flexible displays are gaining popularity in smartphones and wearable devices. The integration of these displays enables manufacturers to create sleeker, more compact devices with unique form factors. Moreover, the adoption of flexible displays in connected technologies, such as smart home products, is expected to expand their application base further. Moreover, one of the primary display technologies driving the market is OLED (Organic Light-Emitting Diode). OLED displays offer several advantages, including high contrast ratio, deep blacks, and energy efficiency. Companies like TCL CSOT and Samsung are investing heavily in OLED technology to cater to the growing demand for flexible OLED displays. Another significant development in the market is the emergence of rollable displays. Rollable displays allow for larger screen sizes to be compacted into smaller form factors, making them ideal for smartphones, laptops, and even desktop screens. Stanford University and other research institutions are exploring the potential of rollable OLED displays, while companies like LG and TCL have already showcased prototypes.

Additionally, the market's supply chain is undergoing transformative changes to accommodate the increasing demand for these advanced displays. Key players are collaborating with material suppliers, equipment manufacturers, and other stakeholders to ensure a steady supply of raw materials and components. Flexible displays are also making their way into the television market, with manufacturers like Samsung and LG introducing curved and rollable TVs. These displays offer a more interactive viewing experience and are expected to gain traction among consumers looking for premium home entertainment solutions. The market's growth is not limited to consumer electronics alone. Industries like healthcare, transportation, and advertising are also exploring the potential of flexible displays for various applications. For instance, flexible EPD (Electrophoretic Display) panels are being used in e-readers and signage, while flexible glass and metal displays are being considered for use in automotive and aerospace applications.

Market Segmentation

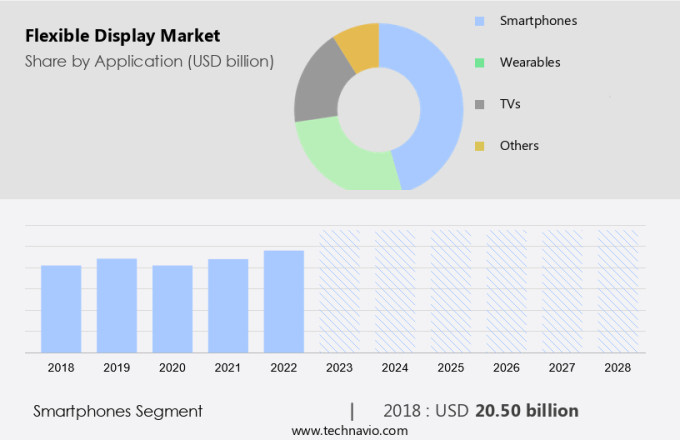

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Smartphones

- Wearables

- TVs

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

The smartphones segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, particularly in the smartphone segment. This trend is driven by the adoption of plastic and flexible organic light-emitting diode (OLED) displays, such as those made with active-matrix technology. These displays offer advantages over traditional glass panels, including being thinner and lighter. As a result, they enable the production of devices with reduced thickness and weight. In the coming years, it is anticipated that smartphones will become available in foldable and bendable designs. Major players in the industry, including Samsung Electronics Co., Ltd and LG Display Co., Ltd, have recently announced plans to expand their production capacities to meet the increasing demand for these innovative displays.

Furthermore, flexible displays are also gaining traction in other consumer electronics, such as laptops, desktop screens, televisions, and wearables. For instance, OLED technology is increasingly being used in high-end laptops and televisions due to its superior picture quality and energy efficiency. In the wearables segment, flexible displays offer the advantage of being lightweight and flexible, making them ideal for use in smartwatches and other wearable devices. According to industry reports, The market is expected to grow at a steady pace during the forecast period. This growth is attributed to the increasing demand for flexible displays in various applications, as well as advancements in display technology and manufacturing processes.

As the market continues to evolve, it is expected that flexible displays will become increasingly common in a wide range of consumer electronics. In conclusion, the market is poised for significant growth, driven by the adoption of flexible OLED displays in various consumer electronics applications, particularly in smartphones. Major players in the industry are investing in expanding their production capacities to meet the increasing demand for these innovative displays. The market is expected to continue growing due to the advantages offered by flexible displays, such as reduced thickness and weight, as well as advancements in display technology and manufacturing processes.

Get a glance at the market share of various segments Request Free Sample

The smartphones segment accounted for USD 20.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In 2023, the Asia Pacific (APAC) region holds a significant share of The market. This dominance can be attributed to the region's established supply chain for display devices and the presence of numerous electronic device manufacturers. South Korea, Japan, Taiwan, and China are home to most of these manufacturers, including those specializing in flat-panel TVs, smartphones, tablets, and wearable devices. The APAC market's leading position is expected to continue during the forecast period. Factors contributing to this include the region's large consumer base and the increasing demand for advanced display technologies. Curved displays and rollable displays are gaining popularity, particularly in the TV and smartphone segments.

Furthermore, e-readers and smartwatches are also embracing flexible displays to offer more ergonomic and portable designs. APAC's market growth can be attributed to the region's manufacturing capabilities and the increasing demand for innovative display technologies. The market is expected to witness substantial growth due to the adoption of these advanced displays in various applications. The market in APAC is a significant contributor to the global market and is expected to maintain its position as a major revenue generator during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased R&D investments are the key drivers of the market. The market has witnessed significant investment from corporations' R&D divisions, as the technology remains in its developmental stages and has not yet been commercially scaled. Since the smart devices market experienced substantial growth starting in 2014, companies like LG and Samsung have allocated resources towards R&D of hardware devices, aiming to create more durable, high-quality, and cost-effective displays.

Further, these investments are focused on South Korea and Taiwan to expedite the production of innovative flexible displays, incorporating new features suitable for various hardware applications. The market is poised for growth due to the increasing demand for advanced and versatile displays in various industries, including Automotive & Transportation. The skilled labor force and polymer compound advancements are also contributing factors to the market's expansion.

Market Trends

The advent of conceptual flexible display products is the upcoming trend in the market. The market is experiencing significant advancements as technology companies explore new applications for this innovative technology. Smartphones and wearable devices are at the forefront of this trend, with manufacturers such as Samsung, Microsoft, and Apple integrating flexible displays into their product offerings. In the realm of gaming, Sony and Microsoft are experimenting with flexible screens for console displays, aiming to enhance the user experience.

Furthermore, the home automation sector is also adopting flexible displays, with companies like TCL CSOT and others introducing OLED and AMOLED Rollable Displays for smart home products. The wearables industry has been instrumental in driving the growth of the market, as manufacturers continue to conceptualize new and innovative products. The integration of flexible displays into various consumer electronics is expected to continue, further expanding the market's potential.

Market Challenge

Reduced shelf life of products is a key challenge affecting the market growth. Flexible displays have gained significant traction in the market due to their ability to address various challenges posed by traditional displays. However, these displays come with their own setbacks. With continuous advancements in technology, manufacturers are introducing innovative products, rendering older versions less desirable. This dynamic market environment puts pressure on flexible display companies to keep up with the latest technology to remain competitive.

Moreover, the increasing geriatric population in the US presents a unique challenge for the market. The elderly population may have specific temperature requirements for using these displays, which can impact their adoption. Therefore, it is essential for companies to consider these factors while developing new products. Transportation facilities also play a crucial role in the market. The need for lightweight and portable displays in transportation applications is growing. Flexible displays offer a solution to this requirement, making them an attractive option for this sector. In conclusion, the market is witnessing rapid technological advancements, making it essential for companies to stay updated to meet the evolving demands of consumers. Additionally, considering the unique requirements of specific demographics, such as the elderly population, and sectors, such as transportation, can help companies gain a competitive edge.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AUO Corp: The company offers flexible micro LED display that satisfies the demand of fitting Central Information Display to interior shape with its dual panel, dual curvature stitching into an S shaped CID.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BOE Technology Group Co. Ltd.

- Corning Inc.

- E Ink Holdings Inc.

- Hannstar Display Corp.

- HP Inc.

- Innolux Corp.

- Kent Displays Inc.

- KLA Corp.

- LG Corp.

- Microtips Technology Inc.

- Panasonic Holdings Corp.

- Pioneer Corp.

- Plastic Logic HK Ltd.

- Royole Corp.

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- TDK Corp.

- Tianma Microelectronics Co. Ltd.

- Visionox Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for advanced displays in various consumer electronics. Smartphones and wearable devices are leading the charge, with OLED displays, such as Amoled rollable displays, becoming increasingly popular. The smartphone market is expected to continue driving the demand for flexible displays, as manufacturers seek to differentiate their products with innovative designs. Laptops and desktop screens are also adopting flexible OLED screens, while televisions are exploring curved and rollable displays.

Moreover, the market for CIOT, including smart home products, is also expected to contribute to the growth of the market. The supply chain for flexible displays involves a complex network of raw material suppliers, panel manufacturers, and assembly and packaging facilities. The use of polymer compounds, skilled labor force, and advanced transportation facilities are essential in the production of flexible displays. The geriatric population and the automotive & transportation industries are also expected to provide opportunities for growth in the market. The size and share of the market are expected to increase as technology insights continue to drive innovation in the field.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.08% |

|

Market growth 2024-2028 |

USD 18.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.0 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 44% |

|

Key countries |

US, South Korea, Japan, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AUO Corp., BOE Technology Group Co. Ltd., Corning Inc., E Ink Holdings Inc., Hannstar Display Corp., HP Inc., Innolux Corp., Kent Displays Inc., KLA Corp., LG Corp., Microtips Technology Inc., Panasonic Holdings Corp., Pioneer Corp., Plastic Logic HK Ltd., Royole Corp., Samsung Electronics Co. Ltd., Sony Group Corp., TDK Corp., Tianma Microelectronics Co. Ltd., and Visionox Co. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch