Powersports Market Size 2024-2028

The powersports market size is forecast to increase by USD 12.84 billion at a CAGR of 5.6% between 2023 and 2028.

- The market encompasses various vehicle types, including snowmobiles, all-terrain vehicles (ATVs), personal watercraft, and scooters. This industry experiences significant growth due to the increasing popularity of recreational and adventure sports. The number of ATV experience zones and off-roading events, particularly in the Asia-Pacific region, is on the rise. However, environmental concerns due to off-roading activities pose a challenge to market expansion. Physical fitness enthusiasts and leisure seekers are increasingly turning to powersports for adventure and thrill. Powersports vehicles cater to diverse applications, including off-road and on-road use. The market growth is driven by the increasing demand for adventure sports and leisure activities, making it an attractive industry for investors and manufacturers.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a diverse range of motorized vehicles used for various recreational activities. These vehicles include motorcycles, snowmobiles, personal watercraft, scooters, ATVs (All-Terrain Vehicles), and SxS (Side-by-Side) vehicles. These vehicles cater to a wide array of recreational pursuits, such as adventure sports, off-road applications, and on-road applications. The market in the United States has witnessed significant advancements in recent years. Fuel efficiency has emerged as a key focus area for OEM (Original Equipment Manufacturers) in the powersports industry. Both gasoline and diesel engines have undergone substantial improvements to enhance fuel economy.

- In addition, new energy vehicles, including electric vehicles, have gained traction in the market due to their eco-friendly nature and reduced environmental impact. The adoption of electrification is expected to increase as technological advancements lead to more efficient and cost-effective solutions. Extreme operating conditions pose unique challenges for powersports vehicles. Manufacturers are continually innovating to meet the demands of adventure tourism and recreational infrastructure. Vehicle modifications and accessories play a crucial role in enhancing the performance and functionality of these vehicles. Off-highway vehicles, such as ATVs and SxS vehicles, are popular for their versatility and adaptability to various terrains.

How is this market segmented and which is the largest segment?

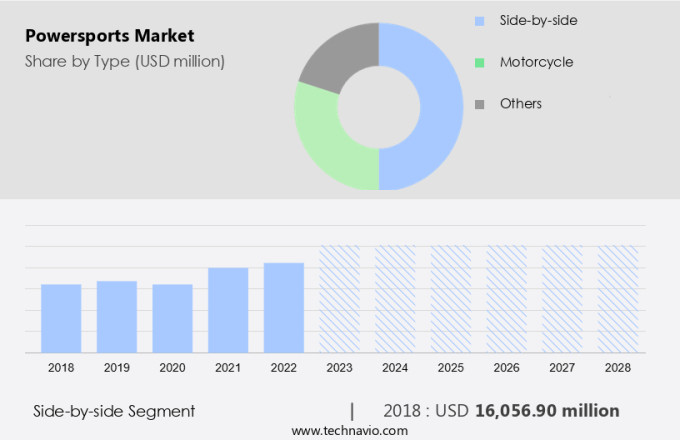

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Side-by-side

- Motorcycle

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Brazil

- North America

By Type Insights

- The side-by-side segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the adoption of Side-by-Side Vehicles (SxS), also known as ATVs (All-Terrain Vehicles), for outdoor activities. These vehicles, featuring high-performance engines, multi-passenger seating, and ample cargo space, have gained popularity due to their ability to traverse rough terrain with ease. With their lightweight design, high suspension, and short wheelbase, they offer optimal handling and stability. SxS Vehicles come equipped with four or more deep-treaded tires, seating arrangements for two or more occupants, a steering wheel, and foot pedals for acceleration and braking. Polaris Inc.'s introduction of the single-seater Sportsman Ace, complete with a steering wheel, foot pedals, and a roll cage, further expands the SxS category. Vehicle modifications and accessories play a significant role in the market. Customization options cater to various preferences, enhancing the user experience. The trend towards electrification and Electric Models is on the rise, aligning with the push for Green Energy. The market is expected to grow steadily, driven by these factors and the increasing popularity of side-by-side vehicles for outdoor activities.

Get a glance at the market report of share of various segments Request Free Sample

The side-by-side segment was valued at USD 16.06 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

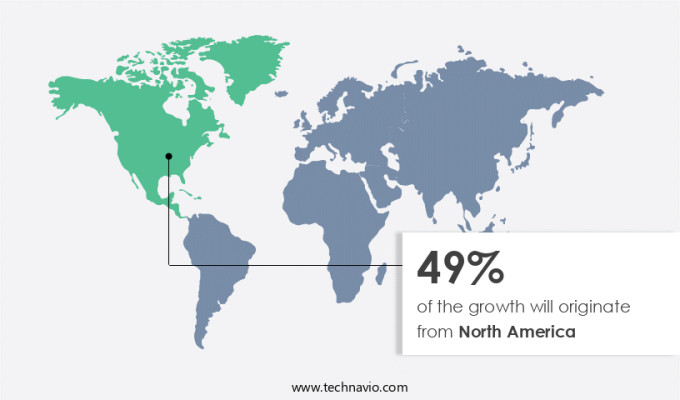

- North America is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the United States and Canada are key contributors to the market due to the significant demand for mobility solutions, specifically off-road vehicles such as side-by-side vehicles, ATVs, and motorcycles. The region's popularity for off-road adventures and recreational activities has fueled the market's growth. Major players in the industry, including Yamaha Motor Co., have a strong presence in the US, driving sales and revenue generation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Powersports Market?

Increasing number of recreational and adventure sports activities is the key driver of the market.

- The market experiences continuous growth due to the rising trend of leisure activities and adventure sports in North America and Europe. Activities such as mountain racing, dirt racing, and surfing are becoming increasingly popular, leading to an increase in the demand for Powersports vehicles. Organizations like the Canada Council of Snowmobile and North America Snowmobile conduct annual sports events, which boosts sales of All-terrain Vehicles (ATVs) and Snowmobiles.

- The Canadian Off-highway Distributors Council offers safety training for ATV riders, ensuring the safe usage of these vehicles. The US recreation transportation sector, which includes boats, marines, and off-road vehicles, is expanding significantly, fueling the demand for Powersports vehicles. These vehicles cater to the growing number of sports enthusiasts who seek thrilling outdoor experiences. The Powersports market encompasses various vehicle types, including those powered by Diesel Engines, Gasoline Engines, and New Energy Vehicles. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Powersports Market?

An increasing number of ATV experience zones is the upcoming trend in the market.

- ATV manufacturers in the US are actively promoting their products through various initiatives to boost consumer interest. One such approach is the establishment of dedicated experience zones where potential buyers can test drive ATVs and learn about their features.

- Additionally, manufacturers are expanding their dealership networks across North America and Europe to increase accessibility. Furthermore, they are targeting emerging markets in Asia to tap into untapped potential. These efforts aim to enhance the visibility and presence of ATVs as leisure and adventure sports vehicles, as well as for off-road and on-road applications, contributing to physical fitness and overall well-being. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does Powersports Market face during the growth?

Increasing number of off-roading events in APAC Environmental impact due to off-roading activities is a key challenge affecting the market growth.

- Powersports vehicles, including motorcycles and off-road vehicles, have a significant impact on various environmental elements such as soil, wildlife, habitat, vegetation, air, and water. Soil compaction is a primary concern, leading to increased bulk density, strength, and decreased permeability. This reduction in soil permeability negatively affects vegetation growth by inhibiting root systems and reducing water infiltration. Moreover, the use of powersports vehicles in recreational clubs and adventure activities can have detrimental effects on wildlife behavior. Animals may abandon essential activities like hunting, foraging, and mating due to the increasing presence of these vehicles. This disruption in animal behavior can lead to long-term consequences for their populations and ecosystems.

- Fuel-efficient electric vehicles are gaining popularity in the market as an alternative to traditional gasoline-powered vehicles. These vehicles offer reduced environmental impact and contribute to a more sustainable future. Recreational clubs and mobility services are increasingly adopting electric vehicles to minimize their carbon footprint and promote eco-friendly practices. In conclusion, the powersports industry's environmental impact is a critical concern, with significant effects on soil, wildlife, habitat, vegetation, air, and water. By transitioning to fuel-efficient electric vehicles and practicing responsible usage, the industry can mitigate its negative effects and promote sustainable recreational activities.

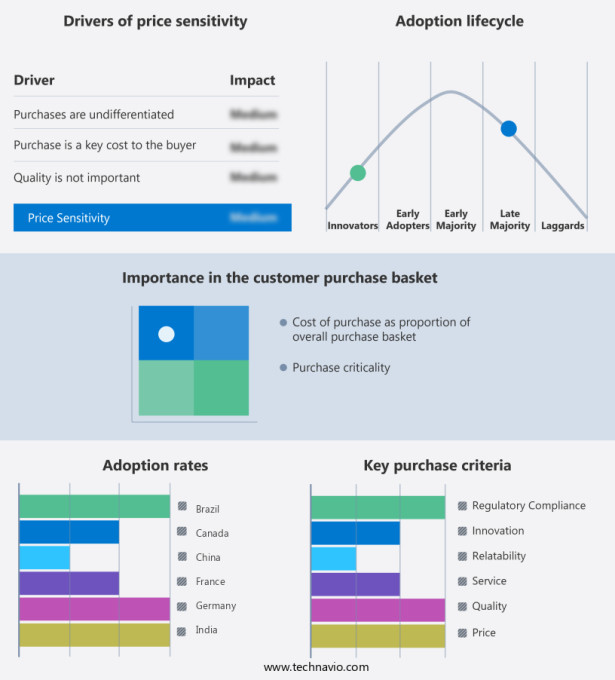

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Guardian

- Bennche LLC

- Bombardier Recreational Products Inc.

- Ducati Motor Holding S.p.A

- Harley Davidson Inc.

- Honda Motor Co. Ltd.

- Intimidator Inc.

- Kawasaki Heavy Industries Ltd.

- Kymco

- Massimo Motor Sports LLC

- Michelin Group

- Piaggio and C. Spa

- PIERER Mobility AG

- Polaris Inc.

- Suzuki Motor Corp.

- Textron Inc.

- The Coleman Co. Inc.

- Triumph Group Inc.

- Yamaha Motor Co. Ltd.

- Zhejiang CfMoto Power Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of vehicles designed for recreational activities and personal transportation. These include motorcycles, snowmobiles, all-terrain vehicles (ATVs), personal watercraft, scooters, and recreational off-road vehicles (ROVs). Powersports vehicles are popular for adventure activities, leisure pursuits, and off-road applications. Two primary engine types power these vehicles: gasoline and diesel.

However, the market is witnessing a shift towards new energy vehicles, with electric vehicles gaining traction due to their fuel efficiency and eco-friendliness. Powersports vehicles are used in various extreme operating conditions, from snowy terrains to desert landscapes. Adventure tourism and recreational infrastructure play significant roles in the market's growth. Recreational clubs and mobility services cater to the needs of enthusiasts, offering vehicle modifications, accessories, and trail maps. The market is segmented into on-highway and off-highway vehicles. On-highway vehicles are used primarily for personal transportation and commuting, while off-highway vehicles are designed for adventure sports and outdoor activities. Electrification and vehicle customization are key trends in the powersports market. Electric models and green energy are driving the adoption of ATVs/SxS vehicles and ROVs. Mobility solutions and recreational facilities cater to the diverse needs of this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2024-2028 |

USD 12.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.2 |

|

Key countries |

US, Germany, UK, UAE, China, India, France, Canada, Japan, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch