PPR Pipe Market Size 2025-2029

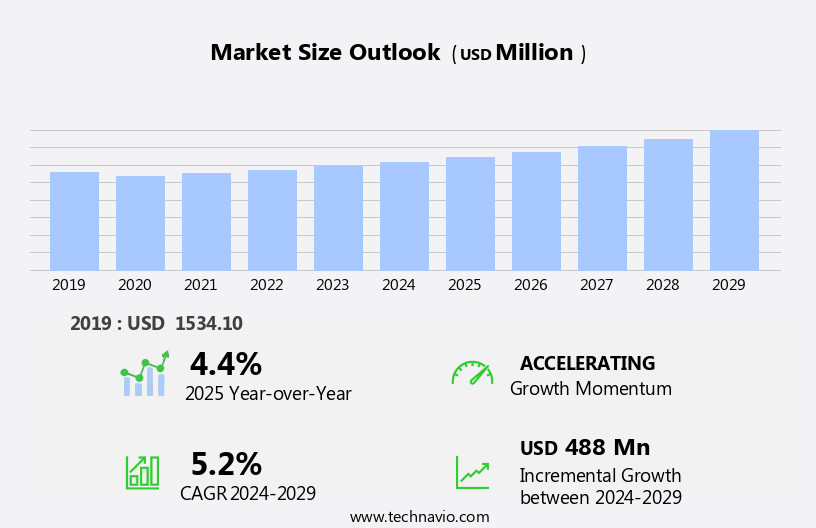

The ppr pipe market size is forecast to increase by USD 488 million at a CAGR of 5.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing construction and infrastructure sectors. Renovation and replacement projects are particularly boosting market expansion, as PPR pipes offer advantages such as durability, resistance to corrosion, and ease of installation. However, the market faces intense competition from substitutes, including traditional materials like steel and cast iron pipes. This competition puts pressure on pvc pipe manufacturers to differentiate their offerings through innovation and cost-effectiveness. Additionally, regulatory compliance and environmental concerns are emerging challenges, requiring companies to invest in sustainable production methods and adhere to stringent quality standards.

- To capitalize on market opportunities and navigate these challenges effectively, PPR pipe manufacturers must focus on product innovation, cost competitiveness, and regulatory compliance. By doing so, they can capture market share and maintain a strong market position in the face of intense competition.

What will be the Size of the PPR Pipe Market during the forecast period?

- The market continues to evolve, driven by the diverse requirements of various sectors. Pipe replacement is a constant activity, with corrosion resistance being a key consideration for infrastructure projects and distribution networks. Drainage systems demand pipe diameters that ensure efficient water flow, while leak detection and pressure testing are crucial for maintaining water supply systems. Thermal properties are essential for energy efficiency in heating and cooling applications, with PPR pipes offering superior insulation and heat resistance. In commercial construction, PPR pipes are used for sustainability initiatives, such as geothermal energy systems and green building projects. New technologies continue to emerge, including injection molding and fusion welding, which enhance the performance characteristics of PPR pipes.

- Pipe maintenance is an ongoing concern, with pressure testing, pipe insulation, and quality assurance playing vital roles in ensuring longevity. PPR pipes are also used extensively in residential construction, with pipe hangers, pipe supports, and threaded connections ensuring proper installation. Sustainability is a growing focus, with renewable energy projects and wastewater treatment systems increasingly utilizing PPR pipes due to their chemical resistance and pressure ratings. The industry standards and manufacturing processes are continually evolving to meet the demands of the market, with solvent cementing and pipe joints ensuring reliable connections. PPR pipes offer a range of benefits, from energy efficiency and UV resistance to mechanical properties and life cycle analysis.The market dynamics remain fluid, with ongoing innovation and evolving patterns shaping the future of the PPR pipe industry.

How is this PPR Pipe Industry segmented?

The ppr pipe industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Hot and cold water PPR pipes

- Composite PPR pipes

- Application

- Commercial

- Residential

- Industrial

- Agriculture

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

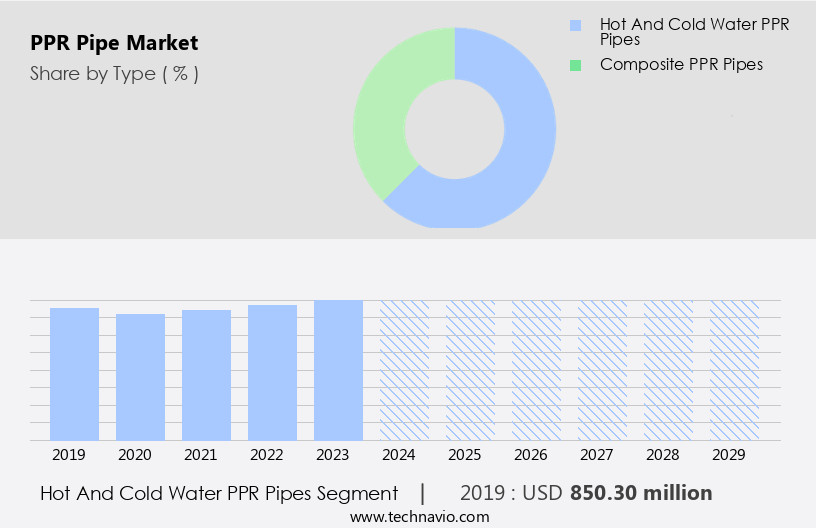

The hot and cold water ppr pipes segment is estimated to witness significant growth during the forecast period.

PPR pipes have gained significant traction in the market due to their versatility and performance characteristics. These pipes are extensively used in both residential and commercial applications for water supply and drainage systems. Their corrosion resistance and durability make them an ideal choice for various applications, including heating and cooling systems, geothermal energy, and solar thermal systems. The ease of installation, with the use of solvent cementing or fusion welding for pipe joints, further adds to their popularity. Moreover, PPR pipes offer energy efficiency, as they have good thermal properties and insulation capabilities. These pipes are also UV resistant and have excellent mechanical properties, ensuring they can withstand high pressure and temperature variations.

In addition, PPR pipes are lightweight and can be easily transported and installed, reducing labor costs and project timelines. The demand for PPR pipes is driven by the increasing focus on sustainability initiatives and green building projects. The pipes' ability to contribute to water conservation and water treatment, as well as their compatibility with renewable energy sources, makes them a preferred choice for infrastructure projects. Furthermore, the development of new technologies and manufacturing processes, such as injection molding and fusion welding equipment, has led to improvements in pipe quality and performance. The market is expected to grow significantly due to the increasing demand for pipe replacement and pipe repair in various industries.

The market is also witnessing the emergence of advanced pipe systems, such as distribution networks and pipe hangers, that offer improved efficiency and performance. Additionally, the growing emphasis on quality assurance and industry standards has led to increased demand for certified PPR pipes and fittings. In conclusion, the market is experiencing steady growth due to the numerous advantages offered by these pipes. Their corrosion resistance, durability, ease of installation, and thermal properties make them a popular choice for various applications. The market's growth is further fueled by the increasing focus on sustainability initiatives, renewable energy, and energy efficiency. With ongoing advancements in manufacturing processes and technologies, the future of the market looks promising.

The Hot and cold water PPR pipes segment was valued at USD 850.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

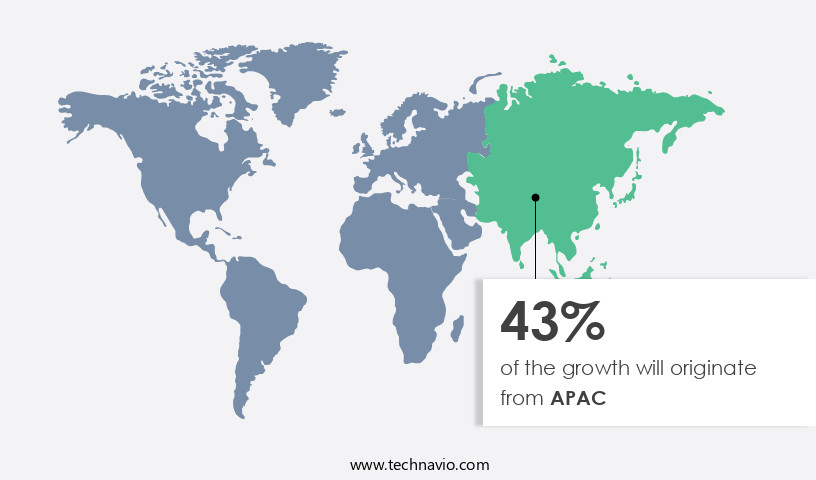

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In APAC regions, the ongoing urbanization and infrastructure development drive the demand for dependable and long-lasting piping systems in residential, commercial, and industrial construction projects. Agricultural sectors in these countries are modernizing, leading to the adoption of advanced irrigation techniques and water management systems, thereby increasing the demand for PPR pipes in agricultural applications. The burgeoning construction industry in APAC, particularly in China, India, and Southeast Asian countries, necessitates piping solutions for various construction applications, thereby fueling the demand for PPR pipes. Simultaneously, the industrial sector in APAC is expanding, leading to heightened demands for reliable piping systems in manufacturing plants, chemical processing facilities, and industrial infrastructure, contributing to the growing need for PPR pipes.

PPR pipes offer advantages such as corrosion resistance, thermal properties, energy efficiency, and mechanical strength, making them an ideal choice for diverse applications. The integration of new technologies, including geothermal energy, solar thermal systems, and water conservation and treatment methods, further boosts the demand for PPR pipes. The construction industry's focus on sustainability initiatives, green building, and performance characteristics also influences the adoption of PPR pipes. The manufacturing processes for PPR pipes involve fusion welding, injection molding, and solvent cementing, ensuring quality assurance and adherence to industry standards. The versatility of PPR pipes, available in various pipe diameters, pipe lengths, and pipe hangers, caters to diverse piping requirements. The supply chain management of PPR pipes ensures timely delivery and availability, making them a preferred choice for infrastructure projects and renewable energy applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of PPR Pipe Industry?

- The construction and infrastructure sector's growth serves as the primary catalyst for market expansion.

- The market experiences growth due to the increasing demand for pipe replacement in both residential and commercial sectors. These pipes are known for their corrosion resistance and reliability, making them ideal for various applications in drainage systems and water supply. PPR pipes offer superior thermal properties, enabling energy efficiency and reducing energy losses. Leak detection is facilitated through their excellent pressure testing capabilities. PPR pipes are essential for pipe maintenance in high-pressure environments, particularly in industrial applications. Their mechanical properties ensure durability and longevity, reducing the need for frequent replacements. PPR fittings and pipe insulation are crucial components that enhance the overall performance and efficiency of the piping systems.

- UV resistance is another essential feature of PPR pipes, making them suitable for outdoor applications. The thermal and mechanical properties, coupled with their energy efficiency and leak detection capabilities, contribute to the market's growth. As urbanization continues and construction activities increase, the demand for PPR pipes is expected to rise, driven by the need for reliable plumbing systems in various applications.

What are the market trends shaping the PPR Pipe Industry?

- The trend in the market is being driven by the increasing demand for renovation and replacement projects. Renovation and replacement initiatives are significantly contributing to the market growth in this sector.

- The market is experiencing significant growth due to the increasing demand for pipe repair and upgrades in various industries, particularly in commercial construction and distribution networks. Sustainability initiatives, such as the adoption of green building practices and the integration of geothermal energy systems, are driving the market's expansion. PPR pipes offer several advantages, including superior material properties, such as resistance to corrosion and excellent performance characteristics in heating and cooling applications. New technologies, including pipe hangers and pipe length optimization, are enhancing the efficiency and durability of PPR pipe systems.

- The need to meet modern safety and environmental standards is a key factor in the market's growth, as outdated piping systems require frequent maintenance and repairs, leading to increased costs over time. Upgrading infrastructure with PPR pipes ensures compliance with industry standards and regulations, making them an ideal choice for pipe renovation projects.

What challenges does the PPR Pipe Industry face during its growth?

- The intense competition posed by substitutes is a significant challenge impeding the industry's growth trajectory.

- The market experiences robust competition from traditional materials like PVC, copper, and steel pipes, as well as newer alternatives such as cross-linked polyethylene (PEX) pipes. Each material offers unique advantages, making it essential to persuade consumers to adopt PPR pipes. Chlorinated Polyvinyl Chloride (CPVC) pipes provide heat resistance, making them suitable for applications involving higher temperatures. CPVC pipes are commonly used in water treatment and solar thermal systems due to their resistance to corrosion and chlorine. PEX pipes, on the other hand, are known for their flexibility, ease of installation, and resistance to freezing. They are widely used in water conservation and wastewater treatment projects.

- PPR pipes undergo rigorous product certifications to ensure quality assurance. Manufacturing processes, including injection molding and fusion welding, ensure the pipes meet industry standards. Wall thickness and life cycle analysis are crucial factors in determining the suitability of PPR pipes for various applications. The market's growth is driven by the increasing demand for water conservation and water treatment solutions, as well as infrastructure projects requiring high-performance materials.

Exclusive Customer Landscape

The ppr pipe market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ppr pipe market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ppr pipe market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

APL Apollo TUBES Ltd. - The company specializes in providing advanced PPR pipes, including Mono Layer, Triple Layer, Thermotech, and Thermotech Plus. These pipes are engineered for superior performance and durability, enhancing infrastructure efficiency and sustainability. The Mono Layer pipe boasts a single layer structure for enhanced strength and flexibility, while Triple Layer offers increased insulation for energy conservation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- APL Apollo TUBES Ltd.

- Euroaqua

- Formul Plastik A.S

- Georg Fischer Ltd.

- Heim Weh GmbH

- KPT Piping System

- Kunststoff Pipes LLP

- Ningbo Sunplast Pipe Co. Ltd.

- NORTHEAST POLYPIPES LLP

- Polyraj

- Rietti Group SRL

- RIIFO

- SFMC India

- SHK Polymer

- Tianjin Jingtong Pipe Industry Co.,Ltd

- Tommur Industry Co.,Ltd

- Vasen Europe

- Vectus Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in PPR Pipe Market

- In February 2024, PPR Pipes announced the launch of its innovative PEXa piping system, which offers improved flexibility, durability, and resistance to harsh environmental conditions. This new product expansion is expected to bolster the company's market presence in the residential and commercial construction sectors (PPR Pipes Press Release).

- In May 2025, PPR Pipes formed a strategic partnership with leading construction firm, Skanska, to integrate its piping solutions into Skanska's building projects. This collaboration aims to enhance the efficiency and sustainability of Skanska's construction processes, further solidifying PPR Pipes' position as a preferred supplier in the industry (Skanska Press Release).

- In August 2024, PPR Pipes completed a significant acquisition of competitor, Copper Tube Manufacturing Company, adding an estimated USD150 million in annual revenue and expanding its product portfolio. This strategic move is expected to strengthen PPR Pipes' market position and increase its global reach (SEC Filing: PPR Pipes).

- In November 2025, the European Union approved new regulations mandating the use of lead-free pipes in all new construction projects, creating a substantial demand for PPR Pipes' PEXa piping system. This regulatory shift is projected to increase the company's sales by approximately 25% in the European market (European Union Regulation).

Research Analyst Overview

The market continues to evolve, driven by advancements in pipe system design and optimization. PPR pipes offer several advantages, including durability, reliability, and efficiency. However, the cost of pipe system installation and replacement remains a significant consideration for businesses. Pipe system repair and maintenance are essential for ensuring pipe system sustainability and longevity. PPR pipe research focuses on enhancing pipe performance and extending pipe lifespan through innovative materials and manufacturing processes. Pipe dimensions and specifications play a crucial role in pipe system efficiency and compatibility with various applications. PPR pipe trends include a shift towards more sustainable and cost-effective alternatives, such as composite pipes.

The pipe industry faces challenges in addressing pipe system replacement and optimization while minimizing disruptions to business operations. Pipe system design and installation require careful consideration of pipe performance, pipe system lifecycle, and pipe system sustainability. The market growth is influenced by factors such as pipe system efficiency, pipe system maintenance, and pipe repair. Despite some disadvantages, PPR pipes remain a popular choice for businesses due to their versatility and long-term benefits.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled PPR Pipe Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 488 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

China, US, India, Germany, France, Canada, Japan, UK, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this PPR Pipe Market Research and Growth Report?

- CAGR of the PPR Pipe industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ppr pipe market growth of industry companies

We can help! Our analysts can customize this ppr pipe market research report to meet your requirements.