Privileged Access Management Solutions Market Size 2025-2029

The privileged access management solutions market size is forecast to increase by USD 17.71 billion at a CAGR of 40.1% between 2024 and 2029.

- Privileged Access Management (PAM) solutions have gained significant traction In the market due to the increasing need for enhanced security measures. One of the primary growth factors is the requirement for multi-factor authentication (MFA) for privileged accounts. MFA adds an extra layer of security by requiring additional verification methods, making it more difficult for unauthorized users to gain access. Another trend is the growing adoption of Bring Your Own Device (BYOD) policies, which increase system integration and interoperability issues. PAM solutions help address these challenges by providing centralized management and control of privileged access across multiple systems and devices. However, implementing these solutions can be complex, requiring significant resources and expertise.

- Additionally, ensuring compliance with various regulations and standards adds to the complexity and cost. Despite these challenges, the benefits of PAM solutions, such as improved security and compliance, make them an essential investment for organizations seeking to protect their sensitive data and systems.

What will be the Size of the Privileged Access Management Solutions Market During the Forecast Period?

- The market is experiencing significant growth due to increasing cybersecurity threats and the adoption of cloud-centric strategies. With the proliferation of digital assets and the reliance on authorized users with privileged accounts, organizations are prioritizing strong security measures to mitigate risks from both external and internal actors. Innovative technologies, such as multi-factor authentication and behavioral analytics, are gaining traction to enhance security solutions.

- However, inflation rates and IT budgets remain key considerations for small businesses and large industrial sectors alike when implementing privileged identity management tools. The market is expected to continue expanding as organizations address the challenges of managing privileged access across organizational silos and mitigating insider attacks. Privileged access management solutions are essential components of a comprehensive cybersecurity strategy, safeguarding against potential security breaches and maintaining regulatory compliance.

How is this Privileged Access Management Solutions Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solution

- Service

- End-user

- BFSI

- IT and telecom

- Government and public sector

- Healthcare

- Others

- Application

- Large enterprises

- SMEs

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Component Insights

- The solution segment is estimated to witness significant growth during the forecast period. Privileged Access Management (PAM) solutions mitigate risks associated with privileged access, which refers to accounts, credentials, and actions granting elevated access to IT infrastructure. Both software and humans managing IT systems employ these tools. PAM solutions can be deployed as hardware appliances, on-premises software, or Software-as-a-Service (SaaS). Key functions include discovering privileged accounts, managing credentials, controlling access, and monitoring sessions. In today's cloud-centric landscape, PAM solutions are crucial for securing cloud environments and infrastructure against cyber threats. Internal actors pose significant risks, and PAM tools help mitigate insider threats. Innovative technologies, such as artificial intelligence and machine learning, enhance PAM capabilities.

- Financial strain and digital transformation drive IT spending on PAM solutions, with cloud IT spending and public cloud adoption increasing. Compliance with regulations like HIPAA and legal requirements in sectors such as finance and healthcare is a significant factor. PAM tools protect digital assets from ransomware attacks and insider attacks, ensuring organizational security and reducing security incidents. Small businesses and large industrial sectors benefit from PAM solutions, bridging organizational silos and improving access management for large enterprises.

Get a glance at the market report of share of various segments Request Free Sample

The Solution segment was valued at USD 886.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

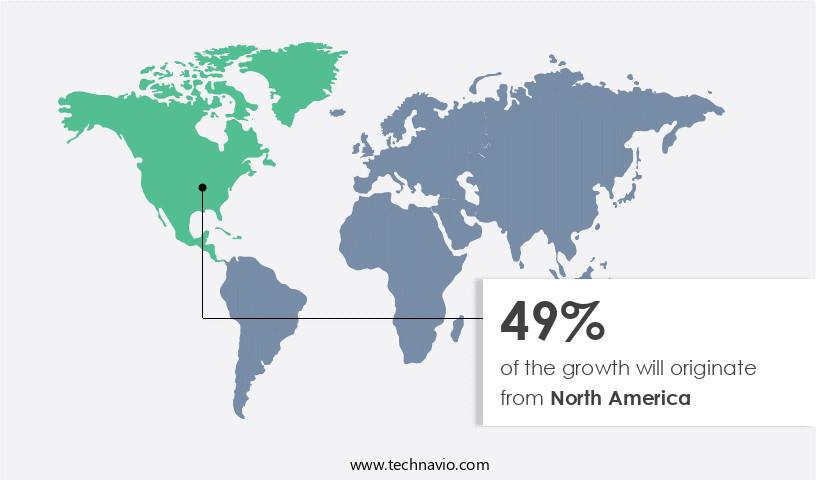

- North America is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market leads the Privileged Access Management (PAM) solutions industry, experiencing significant revenue growth due to heightened security concerns. Insider attacks, a growing issue in enterprises across the region, necessitate the adoption of Privileged Identity Management (PIM) solutions. Additionally, government regulations and increasing cyber threats, including hosted server attacks, mandate the use of these solutions in industries such as services and industrials. PAM tools are essential for managing and securing privileged accounts, mitigating insider threats, and complying with legal requirements in sectors like healthcare and financial institutions. Innovative technologies, such as Cloud-centric strategies and Identity as a Service (IDaaS), are transforming the PAM landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Privileged Access Management Solutions Industry?

- Need for multi-factor authentication (MFA) for privileged accounts is the key driver of the market. Privileged Access Management Solutions have gained significant importance in the business world as enterprises grapple with the challenge of securing their digital assets from internal actors and external cybersecurity threats. With the increasing digital transformation and the adoption of cloud-centric strategies, the number of privileged accounts has proliferated, leading to a lack of granularity in access control and an increased risk of insider threats. According to Forrester, insider threats accounted for 32% of all security incidents in 2020. Financial strain and inflation rates have put IT budgets under pressure, making it essential for organizations to invest in innovative technologies that provide maximum security while minimizing costs.

- Privileged Identity Management (PIM) solutions offer a strong access control system that secures sensitive data and digital assets in cloud environments and traditional IT infrastructure. PIM tools use Multi-Factor Authentication (MFA) systems to authenticate users, ensuring that only authorized individuals gain access to corporate information, services, and networks. MFA systems use a combination of username, password, PIN, or security questions, smartphones, one-time passcodes, or smartcards, and biometrics such as retina scans, fingerprint, or voice recognition to verify the user's identity. In the face of increasing cyber threats, such as ransomware attacks, financial institutions and healthcare institutions have turned to PAM solutions to meet legal requirements like HIPAA and protect their sensitive data. Managed services have also gained popularity as a cost-effective solution for small businesses and large industrial sectors.

What are the market trends shaping the Privileged Access Management Solutions Industry?

- Increased adoption of the BYOD concept is the upcoming market trend. In today's business landscape, cloud-centric strategies have become essential for organizations as they enable employees to work remotely using various digital tools. With the increasing adoption of Bring Your Own Device (BYOD) policies, a significant number of employees are accessing organizational data and resources from their devices, such as laptops, smartphones, and tablets. This trend has become more prevalent due to the COVID-19 pandemic, which has forced many organizations to adopt work-from-home models. However, this shift towards cloud environments and remote work comes with its own set of challenges. Cybersecurity threats, including insider threats from authorized users, have become more frequent and sophisticated.

- Financial strain due to inflation rates and IT budget constraints further complicate matters. To mitigate these risks, organizations are investing in innovative technologies such as Privileged Access Management Solutions (PAM). These solutions help manage and secure privileged accounts, providing access control to sensitive data and digital assets. They are crucial in preventing security breaches and cyber attacks, particularly in industries with stringent legal requirements, such as financial institutions and healthcare institutions. PAM tools offer various deployment modes, including on-premises and cloud, and come in different solution types, such as access management and identity and access as a service (IDaaS).

What challenges does the Privileged Access Management Solutions Industry face during its growth?

- System integration and interoperability issues is a key challenge affecting the industry growth. Privileged access management solutions have become essential for businesses to mitigate cybersecurity threats from both external and internal actors. With the increasing digital transformation and adoption of cloud-centric strategies, the focus on securing digital assets in cloud environments has grown. However, the integration of multiple systems in cloud IT spending, particularly in large enterprises and verticals such as financial institutions, healthcare, and energy and utilities, can result in interoperability and integration issues. These challenges can lead to operational inefficiencies, increased costs, and potential security vulnerabilities. Innovative technologies, like AI and machine learning, are being employed to address these issues, providing granular access control and real-time threat detection.

- Training authorized users and implementing access control solutions, such as Keeper Security, Vectra, and CyberArk, can help mitigate insider threats and ransomware attacks. Despite financial strain and inflation rates, organizations must prioritize cybersecurity to protect sensitive data and comply with legal requirements, like HIPAA, In their digital transformation journey. Managed services and IDaaS solutions from Delinea, Hitachi ID, and Secret Server can help organizations overcome these challenges and ensure secure access management for their privileged accounts.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ARCON: The company offers privileged access management solutions such as endpoint privilege management solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARCON

- BeyondTrust Corp.

- Broadcom Inc.

- Centrify Corp.

- CyberArk Software Ltd.

- Devolutions

- Fudo Security Inc.

- Hitachi Ltd.

- International Business Machines Corp.

- Iraje Inc.

- Kron Telekomunikasyon Hizmetleri A.S.

- One Identity LLC

- Open Text Corporation

- Oracle Corp.

- Osirium Ltd.

- Silverlake Mastersam

- Simeio Solutions LLC

- Thycotic Software LLC

- Wallix Group SA

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Privileged Access Management (PAM) solutions have gained significant importance in today's digital landscape, as organizations continue to adopt cloud-centric strategies and face an increasing number of cybersecurity threats. These solutions enable organizations to manage and secure access to digital assets, ensuring that only authorized users have the necessary privileges to perform critical tasks. Internal actors pose a significant risk to an organization's security, and insider threats have become a major concern for businesses across various industries. PAM solutions help mitigate these risks by providing granular access control and monitoring capabilities. Innovative technologies, such as machine learning and artificial intelligence, are being integrated into PAM solutions to enhance threat detection and response capabilities.

Moreover, financial strain and inflation rates have put IT budgets under pressure, leading organizations to seek cost-effective PAM solutions. Cloud IT spending continues to grow, with public cloud spending expected to surpass traditional IT spending in the coming years. This shift to cloud environments necessitates the adoption of PAM solutions that can effectively manage privileged access in cloud infrastructure. Digital transformation initiatives have led to an increase in the number of digital assets and online identities, making it essential for organizations to implement strong access control solutions. PAM tools play a crucial role in managing privileged accounts and ensuring compliance with legal requirements, such as HIPAA, in industries like healthcare and financial institutions.

Furthermore, managed services have become a popular deployment mode for PAM solutions, as they offer cost savings, scalability, and expertise. Access management solutions have evolved to cater to the needs of large enterprises and verticals, such as energy and utilities, retail and e-commerce, and large industrial sectors. Component solutions and services are available in various deployment modes, including on-premises and cloud. The choice of deployment mode depends on an organization's specific requirements and preferences. PAM solutions can be categorized based on their solution type, which includes access management and identity as a service (IDaaS). The market for PAM solutions is dynamic, with new players and innovations emerging regularly.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 40.1% |

|

Market growth 2025-2029 |

USD 17.71 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

28.8 |

|

Key countries |

US, Germany, Canada, Japan, UK, China, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Privileged Access Management Solutions Market Research and Growth Report?

- CAGR of the Privileged Access Management Solutions industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the privileged access management solutions market growth of industry companies

We can help! Our analysts can customize this privileged access management solutions market research report to meet your requirements.