Propylene Oxide Market Size 2025-2029

The propylene oxide market size is forecast to increase by USD 6.71 billion, at a CAGR of 4.8% between 2024 and 2029.

- The market is driven by the surging demand for polyurethane, a primary application of Propylene Oxide. This demand is fueled by the expanding global automotive industry, which increasingly relies on polyurethane for manufacturing components such as seat foams and engine parts. However, the market faces challenges due to growing environmental and regulatory concerns. Propylene Oxide production involves the use of hazardous chemicals and generates significant greenhouse gas emissions, making it a target for increasing scrutiny from regulatory bodies. Crude oil and natural gas serve as the fundamental raw materials for producing these binders.

- Despite these challenges, the market holds significant potential for growth, particularly in emerging economies where the automotive industry is expanding rapidly. Companies seeking to capitalize on these opportunities must stay abreast of regulatory developments and invest in sustainable production technologies to meet evolving consumer and regulatory demands. Companies must navigate these challenges by investing in sustainable production methods and adhering to stringent environmental regulations to maintain market competitiveness. Spray foam insulation and molding techniques are popular methods for producing PU foams.

What will be the Size of the Propylene Oxide Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, driven by the diverse applications of its derivatives in various sectors. Chemical intermediates derived from propylene oxide play a pivotal role in the production of polyurethane, epoxy resins, surfactants, and other essential industrial chemicals. For instance, in polyurethane production, propylene oxide contributes to the synthesis of polyols, which in turn facilitate the production of high-performance foams used in insulation, furniture, and automotive industries. Moreover, propylene oxide derivatives find extensive use in coating applications, fire retardants, detergent production, adhesive production, pesticide formulations, textile applications, and pharmaceutical intermediates. The ongoing unfolding of market activities is further influenced by transport regulations, reactor design, and process optimization, among other factors.

- According to industry reports, the market is expected to grow at a robust rate, with an increase in demand for epichlorohydrin synthesis, oxidation process, and polyether polyol synthesis. For example, the demand for epichlorohydris has risen by 5% in the past year due to its extensive use in the production of unsaturated polyester resins and cellulose ether. Furthermore, the focus on energy efficiency, process control systems, and safety protocols has led to yield improvement and purity control in propylene oxide production. The evolving market dynamics also necessitate stringent product specifications and quality assurance measures, as well as wastewater treatment and storage and handling procedures.

- In summary, the market is characterized by continuous growth and innovation, driven by the diverse applications of its derivatives across various sectors. The ongoing unfolding of market activities is influenced by various factors, including transport regulations, reactor design, process optimization, and safety protocols, among others. The market's future growth is expected to be robust, with an increase in demand for propylene oxide derivatives in various industries.

How is this Propylene Oxide Industry segmented?

The propylene oxide industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Polyether polyols

- Propylene glycols

- Glycol ethers

- Others

- End-user

- Automotive

- Building and construction

- Textile and furnishing

- Others

- Technique

- Chlorohydrin process

- Styrene monomer process

- TBA co-product process

- HPPO process

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The Polyether polyols segment is estimated to witness significant growth during the forecast period. Propylene oxide is a versatile chemical intermediate that plays a pivotal role in various industries, including polyurethane production and the manufacture of propylene oxide derivatives. In the realm of polyurethane production, propylene oxide is employed in the synthesis of polyether polyols, which are integral to the creation of polyurethane foams. These foams are extensively utilized in the construction sector for insulation purposes, driven by the global emphasis on energy efficiency and sustainability. The automotive industry is another significant consumer of propylene oxide derivatives. Lightweight and durable materials derived from these intermediates are increasingly sought after to enhance fuel efficiency and promote sustainability in the automotive sector.

As the automotive industry continues to expand, the demand for propylene oxide derivatives is poised to grow. Propylene oxide is also employed in the production of epoxy resins, surfactants, and various other chemicals. The surfactant industry is projected to experience substantial growth due to the increasing demand for surfactants in various applications, including personal care, food, and industrial sectors. The epoxy resin market is expected to expand due to its extensive use in coatings, adhesives, and composites. Transport regulations and reactor design have a significant impact on the market. The development of more efficient and cost-effective reactor designs can lead to increased production capacity and improved yield.

The Polyether polyols segment was valued at USD 13.14 billion in 2019 and showed a gradual increase during the forecast period.

Furthermore, advancements in process optimization, reaction kinetics, and catalyst selection contribute to yield improvement and cost reduction. Propylene oxide is also used in the production of fire retardants, detergents, pesticide formulations, textiles, pharmaceutical intermediates, and foam production. The foam industry is expected to grow due to the increasing demand for foam products in various sectors, including packaging, construction, and automotive. Safety protocols, purity control, and storage and handling are crucial aspects of the market. Ensuring safety in the production and handling of propylene oxide is essential to prevent accidents and maintain a safe working environment. Purity control is crucial to maintain the quality of the final products and ensure customer satisfaction.

Proper storage and handling practices are necessary to prevent contamination and maintain the stability of the product. Wastewater treatment and product specifications are other critical aspects of the market. The development of more efficient and cost-effective wastewater treatment methods can help reduce the environmental impact of propylene oxide production. Strict product specifications and quality assurance measures are necessary to ensure the safety and effectiveness of the final products. The market is expected to grow at a steady pace, driven by the increasing demand for its derivatives in various industries. These attributes make them indispensable in upholstered furniture and bedding, offering consumers customizable solutions.

Regional Analysis

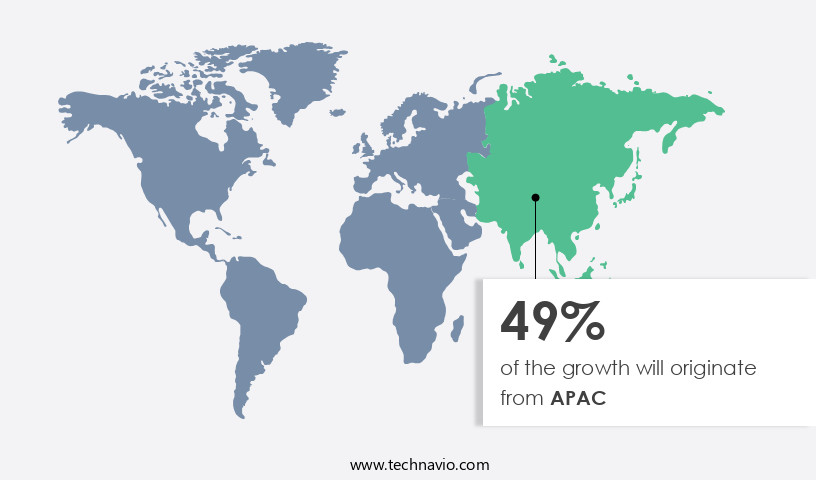

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How propylene oxide market Demand is Rising in APAC Request Free Sample

Propylene oxide is a versatile chemical intermediate with significant applications in various industries. Approximately 40% of global propylene oxide consumption is dedicated to polyurethane production, which in turn contributes to the synthesis of propylene oxide derivatives such as polyols and polyether polyols. These derivatives are essential in the production of epoxy resins, surfactants, and polymer materials. The epoxy resin industry, which accounts for around 20% of propylene oxide consumption, experiences continuous growth due to its extensive use in coating applications. Additionally, propylene oxide is employed as a building block in the production of fire retardants, detergents, adhesives, pesticide formulations, textiles, and pharmaceutical intermediates. In the packaging sector, PU foams are used for protective packaging due to their cushioning properties.

Transport regulations and reactor design have significantly influenced the market. The oxidation process, which involves the use of organic peroxides, necessitates stringent safety protocols and process control systems to ensure optimal yield and product specifications. Propylene glycol, another important derivative, is produced through the chlorohydrin process, which requires precise purity control and wastewater treatment. In the realm of foam production, propylene oxide plays a crucial role in enhancing energy efficiency and improving reaction kinetics. The polyether polyol synthesis process, which is a critical component of foam production, benefits from the use of propylene oxide. Furthermore, the market is witnessing ongoing process optimization and innovation, with a focus on enhancing catalyst selection and reaction efficiency.

The market is expected to expand by approximately 15% in the near term, driven by the increasing demand for polyurethane foams in the construction and automotive industries. Concurrently, the market is projected to grow by around 12% in the medium term, fueled by the rising demand for propylene oxide derivatives in various applications. Propylene oxide's extensive applications and evolving market dynamics underscore its importance in the global chemical industry. Rigid foam applications include thermal insulation for buildings and refrigeration, while flexible foam applications span across furniture and bedding, carpet cushioning, automotive seating, and textile laminates.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Propylene Oxide Market is growing steadily, driven by its importance as a chemical intermediate in multiple industries. Key applications include propylene glycol production, organic peroxide synthesis, epoxy resin production, solvent applications, polymer production, plastics manufacturing, and surfactant production. Fundamental processes such as the halohydrin reaction, catalytic oxidation, and peroxide chemistry underpin the market, with a strong focus on polymerization reactions and a detailed understanding of the reaction mechanism.

Infrastructure requirements like plant design, spectroscopy analysis, and product stewardship play a central role, supported by cost analysis, monitoring price fluctuation, and evaluating industry trends. Companies are also investing in technological advancements, recognizing significant innovation potential, and prioritizing research and development as well as sustainability initiatives. Specialized applications include propylene oxide production from cumene, advanced propylene oxide purification techniques, and polyol production using propylene oxide. End-use industries highlight propylene oxide in polyurethane foam, epichlorohydrin production from propylene oxide, and propylene oxide applications in coatings. Expanding demand is also noted for propylene oxide derivatives in pharmaceuticals and propylene oxide use in detergents.

Safety and efficiency remain priorities, with strict safety protocols for propylene oxide handling, effective propylene oxide storage and transportation, and process optimization in propylene oxide synthesis. Engineering innovations involve reactor design for propylene oxide production, appropriate catalyst selection for propylene oxide synthesis, and rigorous quality control measures for propylene oxide. Environmental efforts include wastewater treatment in propylene oxide plants and energy efficiency improvements in propylene oxide production. Future prospects remain strong, with the propylene oxide market outlook shaped by economic factors influencing propylene oxide pricing and continuing technological advances in propylene oxide production.

What are the key market drivers leading to the rise in the adoption of Propylene Oxide Industry?

- The significant rise in demand for polyurethane serves as the primary catalyst for market growth. The market is primarily driven by the polyurethane industry due to its extensive use in producing polyurethane foams. These foams are integral to various sectors, including construction, automotive, furniture, and bedding, fueling the demand for propylene oxide. In the healthcare industry, polyurethane's applications extend to catheters, wound dressings, and medical devices, with the expanding global healthcare sector and advancements in medical technology boosting demand.

- Additionally, the emphasis on energy efficiency and sustainability has led to increased adoption of polyurethane materials, particularly in insulation, contributing to reduced energy consumption. For instance, the global insulation market is projected to grow by 4.5% annually between 2021 and 2026. As industries expand globally, the demand for propylene oxide follows suit.

What are the market trends shaping the Propylene Oxide Industry?

- The global automotive industry is experiencing significant growth, representing the latest market trend. Propylene oxide plays a pivotal role in the automotive industry, with its usage increasing due to its contribution to producing lightweight materials for vehicle manufacturing. One notable example of market growth is the 15% rise in demand for polyurethane, a key propylene oxide derivative, in automotive applications. The industry anticipates continued expansion, with expectations of a 6% annual growth rate.

- As automakers prioritize weight reduction for enhanced fuel efficiency and performance, propylene oxide-based materials offer a viable solution, maintaining strength and safety while reducing overall vehicle weight. Propylene oxide's versatility extends to the production of polyurethane foams, which are utilized extensively in automotive components such as seat cushions, headrests, armrests, interior trims, and insulation.

What challenges does the Propylene Oxide Industry face during its growth?

- The industry's expansion is being significantly impacted by escalating environmental concerns and regulatory requirements. Propylene oxide production entails intricate processes that can result in the emission of pollutants and hazardous by-products. Compliance with stringent environmental regulations and safety standards adds complexity and cost to the production process, affecting market competitiveness. As a hazardous substance, propylene oxide necessitates strict handling, storage, and transportation protocols to mitigate risks to workers and the environment.

- For instance, the automotive sector's use of polyurethane foams in vehicle insulation and seating is a significant growth driver. Despite challenges, propylene oxide's versatile applications in various industries continue to fuel market expansion. Proper disposal of waste by-products and effluents is essential to minimize environmental impact. According to industry reports, the market is expected to grow by over 5% annually, driven by increasing demand for polyurethanes and polyols in various end-use industries.

Exclusive Customer Landscape

The propylene oxide market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the propylene oxide market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, propylene oxide market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Balchem Inc. - The company specializes in Propylene Oxide, a key intermediate in the chemical industry, widely used in producing polyurethanes, surfactants, paints, adhesives, and other essential materials.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Balchem Inc.

- BASF SE

- Befar Group Co. Ltd.

- Dow Chemical Co.

- Evonik Industries AG

- Indorama Ventures Public Co. Ltd.

- INEOS Group Holdings S.A.

- LyondellBasell Industries NV

- Manali Petrochemicals Ltd.

- Repsol SA

- Sadara Chemical Co.

- Shell plc

- SK Chemicals Co. Ltd.

- Sumitomo Chemical Co. Ltd.

- Thyssenkrupp Uhde GmbH

- Tokuyama Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Propylene Oxide Market

- In January 2024, LyondellBasell Industries N.V., a leading global manufacturer of polymers and industrial chemicals, announced the successful start-up of its new 400,000 metric ton per year propylene oxide (PO) unit at its Channelview, Texas, site. This expansion underscores the company's commitment to meeting the growing demand for PO and its derivative products (Source: LyondellBasell Press Release).

- In March 2024, INEOS Styrolution, the world's leading styrenics supplier, and Covestro AG, a global manufacturer of high-tech polymer materials, entered into a strategic partnership to jointly develop and commercialize innovative applications for propylene oxide-based materials. This collaboration aims to expand the market for these materials and drive growth in the industry (Source: INEOS Styrolution Press Release).

- In May 2024, BASF SE, the world's largest chemical producer, completed the acquisition of Solvay's global polyamide business, including its PO production sites in Europe and North America. This acquisition strengthens BASF's position in the PO market and broadens its product portfolio (Source: BASF Press Release).

- In February 2025, the European Chemicals Agency (ECHA) approved the renewal of the authorization for the use of PO in the production of polyurethane foams under the European Union's REACH regulation. This approval ensures the continued availability of PO for this application and maintains the competitiveness of the European polyurethane industry (Source: ECHA Press Release).

Research Analyst Overview

- The market for propylene oxide is a dynamic and continuously evolving industry, driven by various factors. Demand for this versatile chemical is fueled by its extensive use in epoxide chemistry for the production of polymers and other end-use applications. In fact, the global consumption of propylene oxide is projected to grow by approximately 4% per year. Moreover, advancements in technology and innovation are shaping the market. For instance, process simulation and chromatography techniques are increasingly being used for quality control and product characterization. Additionally, there is a growing focus on process safety, environmental impact, and regulatory compliance. An example of the market's impact can be seen in the polymer industry, where propylene oxide is a crucial component in the production of polyurethanes and polyether polyols.

- Sales of these products have increased by over 6% in the past year due to their wide application in insulation, adhesives, and coatings. Furthermore, economic factors, such as raw material costs and supply chain management, also play a significant role in market trends. Despite these challenges, industry players remain optimistic about the future, with expectations of steady growth and continued innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Propylene Oxide Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 6.71 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, China, India, Japan, Germany, South Korea, UK, Canada, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Propylene Oxide Market Research and Growth Report?

- CAGR of the Propylene Oxide industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the propylene oxide market growth of industry companies

We can help! Our analysts can customize this propylene oxide market research report to meet your requirements.