Latin America Push Buttons Signaling Devices Market Size 2024-2028

The latin america push buttons signaling devices market size is forecast to increase by USD 14.1 million at a CAGR of 4.2% between 2023 and 2028.

The market is experiencing significant growth due to the increasing demand for industrial safety. This trend is being driven by the need to ensure worker safety and comply with regulations in various industries. Additionally, technological advancements in design and functionality are making these devices more efficient and cost-effective. However, the market is also facing challenges from fluctuating prices of raw materials, which can impact the cost structure of manufacturers and potentially impact the competitiveness of the market. Despite these challenges, the market is expected to continue growing due to the ongoing demand for safety solutions in various industries. The use of push buttons signaling devices is becoming increasingly prevalent in industries such as manufacturing, oil and gas, and mining, where worker safety is a top priority.Overall, the market is expected to witness steady growth In the coming years, driven by the need for safety and technological advancements.

What will be the size of the Latin America Push Buttons Signaling Devices Market during the forecast period?

Request Free Sample

The Latin American push buttons signaling devices market is experiencing significant growth due to the increasing demand for cost reduction, worker safety training, and hazard identification in various industries. Remote monitoring solutions and risk mitigation are key trends driving market expansion, as businesses seek to optimize processes and improve productivity through Industry 4.0, smart factories, and digital transformation. Technical expertise in areas such as industrial IoT, predictive maintenance, and data analytics are essential for manufacturers looking to enhance operational efficiency, minimize downtime, and ensure regulatory and safety compliance. Ergonomics and safety culture are also critical factors, as companies strive to prevent accidents and improve the connected workplace through human factors engineering and industrial lighting solutions.Market opportunities abound in sectors like machinery monitoring, supply chain management, and industrial automation, but market challenges include the need for industry-specific technical expertise and the high initial investment costs. Overall, the Latin American push buttons signaling devices market is poised for continued growth, driven by the increasing importance of industrial security, incident investigation, sustainable manufacturing, and driver assistance systems.

How is this market segmented and which is the largest segment?

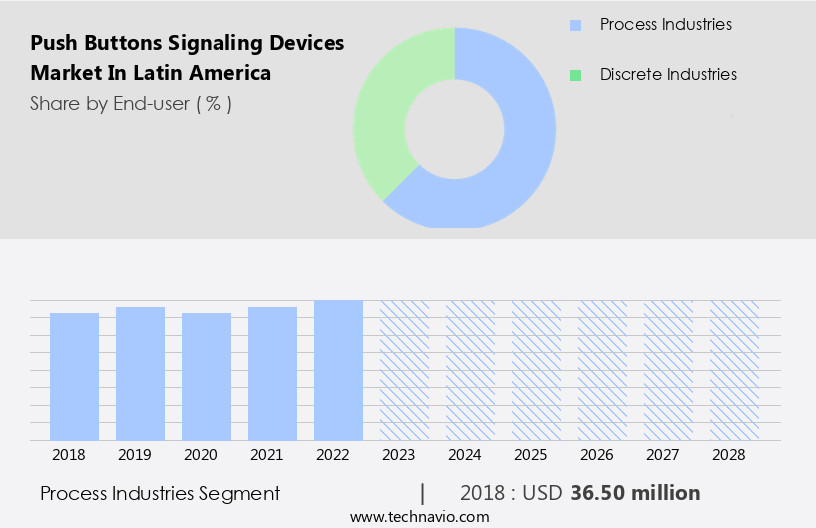

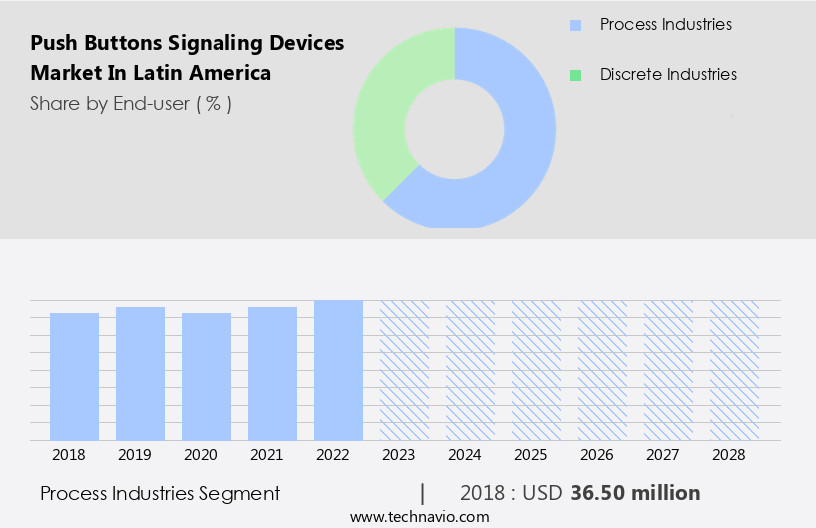

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Process industries

- Discrete industries

- Geography

By End-user Insights

- The process industries segment is estimated to witness significant growth during the forecast period.

The Latin American process industries, including oil and gas, power, automotive, and wastewater sectors, are witnessing a notable increase In the demand for push buttons signaling devices. This trend is attributed to the need for productivity enhancement, connectivity, and adherence to safety regulations In these industries. In the automotive sector, which is a significant market for push buttons, Mexico and Brazil are key players due to their growing economies and increasing consumer disposable income. The shift towards electric vehicles in Brazil, alongside the rise in automobile usage, is driving market growth. Despite these opportunities, factors such as lack of awareness, installation cost, and regulatory restrictions may hinder adoption.

However, the integration of innovative methods, such as real-time monitoring, LED lights, and remote control, is expected to boost the market's efficiency, reliability, and safety. Investment in industrial safety indicators, emergency lighting, and surveillance technologies is also a significant growth factor.

Get a glance at the market share of various segments Request Free Sample

The Process industries segment was valued at USD 36.50 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Latin America Push Buttons Signaling Devices Market?

Increasing demand for industry safety is the key driver of the market.

In Latin America, the market for push buttons signaling devices has gained traction due to the increasing focus on industrial safety and productivity. Governmental initiatives and safety regulations have driven the adoption of these devices in various industries, including oil and gas operations, plastic production, and food and beverage processing. Push buttons offer a quick and efficient way to respond to emergency situations, reducing the risk of fatalities and injuries. Connected devices and real-time monitoring have become essential in industrial settings, enabling remote control and maintenance of machinery. Productivity and efficiency are key factors driving the growth of this market, as push buttons and indicator lights help minimize downtime and improve safety management.Industrial regulations require the installation of safety-related applications, such as push buttons and indicator lights, in machinery and commercial vehicles. The cost of push buttons and signaling devices has decreased due to advancements in technology, making them an affordable investment for businesses. LED lights, which are energy-efficient and long-lasting, are increasingly being used in place of traditional bulbs. The use of push buttons in keyless automotive applications, such as push-button ignition and start-stop systems, has also contributed to the growth of this market. Safety standards, such as those related to vehicle driver safety, vehicular safety, and industrial safety regulations, emphasize the importance of audible signals and visual signaling, including push buttons and indicator lights.Innovative methods, such as interlocks and autonomous driving systems, are being developed to enhance the functionality of push buttons and signaling devices, providing ease of utilization and improving safety management systems. Push buttons are used in various applications, including emergency condition actuation, process control, and equipment operation. They are also used in electrical vehicles, where they serve as lighting switches and engine start/stop buttons. The durability and reliability of push buttons make them a preferred choice for high-temperature wash down and high-pressure environments, such as those found in industrial sectors. The market for push buttons and signaling devices in Latin America is expected to continue growing, as businesses invest in safety-related applications to prevent accidents and injuries.The use of push buttons and signaling devices in industrial sectors, such as oil and gas, plastic production, and food and beverage processing, is expected to drive the growth of this market. The market is also expected to benefit from the increasing adoption of connected devices and real-time monitoring technologies, which enable remote control and maintenance of machinery and equipment. In conclusion, push buttons and signaling devices play a crucial role in ensuring the safety of workers and equipment in various industries. The adoption of these devices is driven by governmental initiatives, safety regulations, and the need for productivity and efficiency.The use of push buttons and signaling devices is expected to continue growing in Latin America, as businesses invest in safety-related applications to prevent accidents and injuries and improve overall safety management.

What are the market trends shaping the Latin America Push Buttons Signaling Devices Market?

Technological advancements in design and functionality is the upcoming trend In the market.

In Latin America, the market for push buttons signaling devices, including emergency lighting, is experiencing growth due to various factors. Governmental initiatives aimed at enhancing industrial productivity and safety regulations are driving the adoption of these devices In the industrial sector. Connectivity technologies, such as Bluetooth and Wi-Fi, are being integrated into signaling devices, enabling remote control and real-time monitoring, which increases efficiency and reliability. Industrial regulations mandate the use of safety indicators, such as push buttons, in machinery and automotive applications to prevent accidents and injuries. Despite the benefits, the lack of awareness and high installation costs may hinder market growth.However, the increasing demand for safety standards in industries like food and beverage, chemical, and automotive manufacturing is expected to offset these challenges. The integration of innovative methods, such as LED lights, visual signaling, and surveillance technologies, into push buttons and indicator lights is also contributing to market growth. The market for push buttons signaling devices in Latin America is expected to grow significantly during the forecast period due to the increasing need for safety management systems and the availability of cost-effective solutions. The market for push buttons signaling devices in Latin America is witnessing growth due to various factors.Productivity and safety are key priorities for industries In the region, leading to the adoption of advanced signaling devices. Industrial regulations mandate the use of safety indicators, such as push buttons, in machinery and automotive applications to prevent accidents and injuries. These devices are also being integrated with connectivity technologies, such as Bluetooth and Wi-Fi, to enable remote control and real-time monitoring, increasing efficiency and reliability. Moreover, the increasing demand for safety standards in industries like food and beverage, chemical, and automotive manufacturing is expected to drive market growth. However, the lack of awareness and high installation costs may hinder market growth.To address these challenges, manufacturers are offering cost-effective solutions and innovative methods, such as LED lights, visual signaling, and surveillance technologies, to enhance the functionality and ease of utilization of push buttons and signaling devices. The market for push buttons signaling devices in Latin America is expected to grow significantly during the forecast period. Push buttons and signaling devices are becoming increasingly important in various industries due to their role in enhancing safety and productivity. In the industrial sector, these devices are used to indicate machine status, prevent accidents, and ensure compliance with safety regulations. In the automotive industry, push buttons are used for engine start/stop, lighting switches, and safety features like seat belts, doors, and airbags.The integration of innovative methods, such as LED lights, visual signaling, and surveillance technologies, is also contributing to the growth of the market. Despite the benefits, the lack of awareness and high installation costs may hinder market growth. However, the increasing demand for safety standards in industries like food and beverage, chemical, and automotive manufacturing is expected to offset these challenges. The market for push buttons signaling devices in Latin America is expected to grow significantly during the forecast period due to the increasing need for safety management systems and the availability of cost-effective solutions. The integration of connectivity technologies, such as Bluetooth and Wi-Fi, into push buttons and signaling devices is also driving market growth.These technologies enable remote control and real-time monitoring, increasing efficiency and reliability. For instance, in industrial applications, real-time monitoring of equipment performance can help prevent downtime and reduce maintenance costs. In the automotive industry, connected devices can provide drivers with important information, such as engine performance and fuel efficiency, improving vehicle driver safety. The market for push buttons signaling devices in Latin America is expected to grow significantly during the forecast period due to the increasing need for safety management systems and the availability of cost-effective solutions. The integration of innovative methods, such as LED lights, visual signaling, and surveillance technologies, is also contributing to market growth.The use of push buttons and signaling devices in various industries, including industrial safety, automotive manufacturing, and commercial applications, is expected to drive market growth in Latin America. Push buttons and signaling devices play a crucial role in ensuring safety and productivity in various industries. In the industrial sector, these devices are used to indicate machine status, prevent accidents, and ensure compliance with safety regulations. In the automotive industry, push buttons are used for engine start/stop, lighting switches, and safety features like seat belts, doors, and airbags. The integration of innovative methods, such as LED lights, visual signaling, and surveillance technologies, is also contributing to the growth of the market.The market for push buttons signaling devices in Latin America is expected to grow significantly during the forecast period due to the increasing need for safety management systems and the availability of cost-effective solutions. The integration of connectivity technologies, such as Bluetooth and Wi-Fi, into push buttons and signaling devices is also driving market growth. These technologies enable remote control and real-time monitoring, increasing efficiency and reliability. The use of push buttons and signaling devices in various industries, including industrial safety, automotive manufacturing, and commercial applications, is expected to drive market growth in Latin America. The increasing demand for safety standards in industries like food and beverage, chemical, and automotive manufacturing is also contributing to market growth.The availability of cost-effective solutions and the integration of innovative methods, such as LED lights, visual signaling, and surveillance technologies, are expected to further boost market growth. In conclusion, the market for push buttons signaling devices in Latin America is expected to grow significantly during the forecast period due to the increasing need for safety management systems and the availability of cost-effective solutions. The integration of innovative methods, such as LED lights, visual signaling, and surveillance technologies, is also contributing to market growth. The use of push buttons and signaling devices in various industries, including industrial safety, automotive manufacturing, and commercial applications, is expected to drive market growth in Latin America.

What challenges does Latin America Push Buttons Signaling Devices Market face during the growth?

Fluctuating prices of raw materials is a key challenge affecting the market growth.

In Latin America, the push buttons signaling devices market encompasses various applications, including emergency lighting, industrial regulations, and productivity enhancement in sectors such as industrial, food and beverage, and commercial vehicles. Governmental initiatives promoting safety regulations and the increasing adoption of connectivity and innovative methods in industrial safety are driving market growth. Productivity and efficiency are key factors, with real-time monitoring, ease of utilization, and reliability being essential features. Industrial sectors, machinery, and automotive manufacturing facilities require safety-related applications, such as indicator lights, visual signaling, and push buttons. These devices are crucial for worker safety, preventing fatalities and injuries from accidents, breakdowns, and internal vehicle damage.The market is also influenced by regulations, such as safety standards for chemicals, machinery, and vehicle driver safety. The cost of push buttons and signaling devices is affected by the price of raw materials, including thermosetting plastics, electroplated metals, LED lights, and other electronic accessories. Price fluctuations in raw materials, such as plastic, steel, and zinc, can significantly impact the overall price of these devices. companies are forced to enter into long-term agreements with suppliers to secure raw materials and maintain consistent pricing. Connected devices, such as remote control and real-time monitoring systems, are gaining popularity In the market due to their convenience and efficiency.Keyless automotive applications, including push-button ignition and LED lights, are also driving growth. However, a lack of awareness and restrictions on the use of certain signaling devices may hinder market adoption. In summary, the market is experiencing growth due to safety regulations, productivity enhancement, and the adoption of innovative methods in various sectors. However, price fluctuations in raw materials and lack of awareness may pose challenges. companies must focus on providing cost-effective, reliable, and durable devices to meet the evolving needs of their customers.

Exclusive Latin America Push Buttons Signaling Devices Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB

- BACO

- Eaton Corp plc

- Emerson Electric Co.

- HESCO

- Honeywell International Inc.

- Nuova ASP Srl

- OMRON Corp.

- PATLITE Corp.

- Potter Electric Signal Co. LLC

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- SOLOMON TECHNOLOGY CORP.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The push button signaling devices market in Latin America is experiencing significant growth due to the increasing prioritization of industrial safety and productivity in various sectors. With the advent of connectivity and advanced technologies, these devices have become essential components in ensuring safety and efficiency in industrial settings. Industrial regulations and safety standards have become increasingly stringent, necessitating the adoption of reliable and efficient signaling devices. These regulations cover a wide range of applications, from machinery and equipment to commercial vehicles and automobiles. The lack of awareness regarding the importance of safety regulations and the potential consequences of non-compliance have led to a growing demand for push button signaling devices.

These devices provide visual and audible signals, enabling workers to respond promptly to potential hazards or emergencies. The use of push buttons in industrial applications extends beyond safety. They are also used for machine control, process control, and equipment start-up. In automotive applications, push buttons are used for keyless ignition systems, seat belts, doors, and various features. The adoption rate of push buttons is being driven by several factors. First, the increasing use of connected devices and real-time monitoring systems in industrial settings is making push buttons an essential component for efficient and reliable operations. Second, the growing demand for less space-consuming and cost-effective solutions is driving the adoption of push buttons in automobile interiors and industrial sectors.

The market for push buttons is diverse, with applications ranging from industrial safety to automotive manufacturing facilities. In the industrial sector, push buttons are used for safety-related applications, such as emergency condition actuation and safety management systems. In the automotive sector, they are used for engine start/stop, lighting switches, and autonomous driving interlocks. The use of push buttons is not limited to traditional applications. Innovative methods, such as LED lights and strobes, are being used to enhance their functionality and ease of utilization. These devices are also being used in high-temperature wash down environments and in industries with strict regulations, such as healthcare and food and beverage production.

Despite the growing demand for push buttons, there are challenges to their adoption. Restrictions on the use of certain materials and restrictions on the use of certain technologies in specific industries can limit the market growth. Additionally, the cost of installation and maintenance can be a barrier to entry for smaller businesses. In conclusion, the push button signaling devices market in Latin America is experiencing significant growth due to the increasing importance of industrial safety and productivity. These devices provide essential visual and audible signals, enabling workers to respond promptly to potential hazards or emergencies. The adoption rate of push buttons is being driven by factors such as connectivity, efficiency, reliability, and cost-effectiveness.

However, challenges such as regulations, installation costs, and material restrictions can limit market growth.

|

Market Scope

|

|

Report Coverage

|

Details

|

|

Page number

|

139

|

|

Base year

|

2023

|

|

Historic period

|

2018-2022 |

|

Forecast period

|

2024-2028

|

|

Growth momentum & CAGR

|

Accelerate at a CAGR of 4.2%

|

|

Market growth 2024-2028

|

USD 14.1 million

|

|

Market structure

|

Fragmented

|

|

YoY growth 2023-2024(%)

|

4.1

|

|

Competitive landscape

|

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks

|

Request Free Sample

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Latin America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch