PVC Sheet Market Size 2024-2028

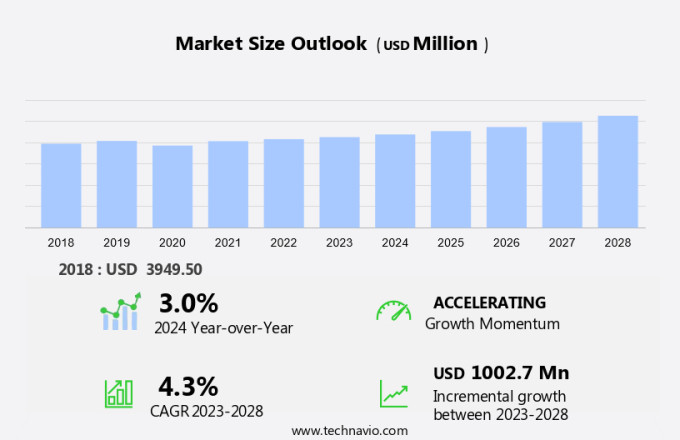

The PVC sheet market size is forecast to increase by USD 1 billion at a CAGR of 4.3% between 2023 and 2028.

- The market is experiencing significant growth, driven by the expansion of the industrial sector and increasing demand for textile applications. A key trend in this market is the development of chlorine-free coatings for PVC sheets, which addresses environmental concerns. Furthermore, the demand for lead-free and heavy metal-free foam sheets is on the rise, as industries shift towards more sustainable manufacturing practices. The growth in plastic production is also fueling the market, with PVC sheets being a popular choice due to their durability and versatility. Another market driver is the increasing use of PVC sheets in radar-based monitoring systems, which require high-performance materials. Overall, the market is poised for continued growth, with a focus on sustainability and innovation.

What will be the Size of the Market During the Forecast Period?

- PVC sheets, or Polyvinyl Chloride sheets, are versatile plastic materials widely used across various industries due to their unique properties. These sheets come in different forms, including rigid and semi-rigid, and are available in transparent, opaque, and semitransparent options. In the medical and healthcare sector, PVC sheets are extensively used because of their biocompatibility and ease of cleaning, with applications in the production of medical equipment, laboratory tables, and hospital furniture. In-home furnishing, PVC sheets are utilized for making furniture covers, flooring, wall panels, and other decorative items, offering durability, resistance to wear and tear, and easy maintenance, making them a popular choice for homeowners. In the building and construction industry, PVC sheets are commonly used for wall claddings, roofing, and insulation due to their excellent resistance to weathering, UV radiation, and moisture, making them ideal for outdoor applications. The transport sector also benefits from PVC sheets, using them for manufacturing automotive interiors, seat covers, and other automotive parts, as they are lightweight, durable, and resistant to wear and tear..

- With growing environmental concerns, the demand for eco-friendly PVC sheets made from biomass-based materials is rising; these sheets offer the same benefits as traditional PVC but are produced through sustainable manufacturing processes. These sheets are manufactured using various techniques, including calendaring, extrusion, and lamination, enabling the production of sheets with different properties such as transparency, opacity, and semitransparency to meet industry needs. Due to their resistance to weathering and UV radiation, these sheets are also widely used in outdoor applications, including signage, banners, awnings, and other products. Additionally, PVC sheets have applications in textiles, electrical insulation, and structural composites in textile, industrial, and other industries. They also offer additional features, such as lead-free and heavy metal-free coatings, which make them a preferred choice for industries with stringent regulations. In conclusion, these sheets are highly versatile, durable, and resistant to wear and tear, making them a popular choice across industries such as medicine, home furnishing, building and construction, transport, and more. Their broad range of applications and benefits continues to drive their use, with manufacturers and consumers alike recognizing their value.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Rigid PVC sheet

- Flexible PVC sheet

- Application

- Building and construction

- Advertising

- Packaging

- Automotive

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- US

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

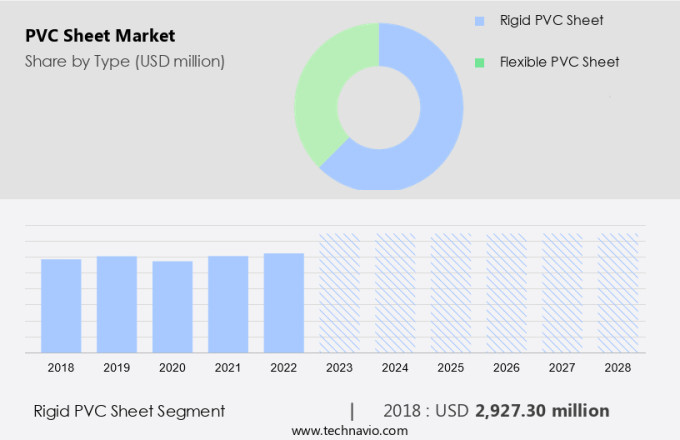

- The rigid PVC sheet segment is estimated to witness significant growth during the forecast period.

In the market, rigid PVC holds a substantial position due to its durability, chemical resistance, and versatility in various industries. This material's rigid structure and strength make it an ideal choice in the construction sector, replacing rubber and wood in applications such as wall claddings, siding, window frames, and plumbing tubing. Rigid PVC's resistance to acids, salts, and other corrosive substances increases its longevity and reliability, particularly in challenging environments like sewage systems. Available in standard shades of white, gray, and clear, this material can also be custom-colored to meet specific design or functional needs.

Key industries utilizing rigid PVC include model making, structural composites, and the production of CFRT, sandwich panels, and PET. Its chemical resistance and flexibility make it a preferred choice for these applications. Rigid PVC's versatility and durability ensure its continued use in various industries, making it a valuable investment for businesses seeking reliable and long-lasting materials.

Get a glance at the market report of share of various segments Request Free Sample

The rigid PVC sheet segment was valued at USD 2.93 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

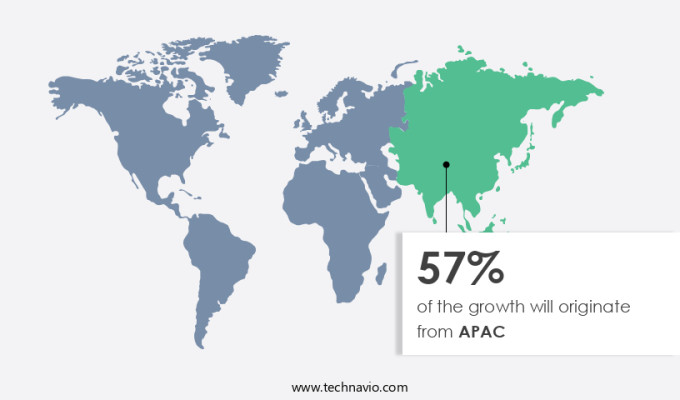

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia-Pacific region is witnessing notable expansion, majorly due to the thriving sectors of electronics, healthcare, and building and construction. Countries like India, China, and Japan are spearheading this growth, fueled by technological innovations and increasing demand for adaptable materials.

Furthermore, government initiatives, such as Digital India and Smart City projects, are boosting the demand for PVC sheets in electronic components, packaging, and construction materials. In the healthcare sector, eco-friendly PVC sheets are gaining popularity due to their sustainability and durability. The building and construction industry also relies heavily on PVC sheets for insulation, roofing, and cladding applications. Sustainable PVC sheets, which are produced using environmentally friendly processes, are increasingly being adopted to reduce the carbon footprint of buildings. Overall, the PVC sheet market in the Asia-Pacific region is poised for continued growth, driven by these key sectors and the region's economic development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of PVC Sheet Market?

Growth in plastic production is the key driver of the market.

- The global market including both rigid and semi-rigid varieties, is experiencing notable growth due to the rising demand for plastic products, particularly in emerging economies such as India and Brazil. The Indian government is actively fostering this expansion through the creation of numerous plastic parks, which are anticipated to amplify manufacturing output substantially. These initiatives are further bolstered by government funding that covers up to 50% of project costs, making new production facilities more financially feasible.

- In the realm of PVC sheets, transparency, opaque, and semi-transparent options are widely used in various construction activities. Biomass-based PVC sheets are gaining traction due to their eco-friendly nature, contributing to the market's growth.

What are the market trends shaping the PVC Sheet Market?

The development of PVC sheets for radar-based monitoring systems is the upcoming trend in the market.

- The market is witnessing technological innovation with the introduction of radar-based monitoring systems for enhancing quality control during plastic sheet production. This system uses radar waves to inspect sheets for defects such as blowholes and foreign materials through a sophisticated transmission and reflection setup. This approach not only improves detection accuracy but also reduces costs compared to traditional inline measurement technologies.

- Furthermore, the use of chlorine-free coatings, lead-free, and heavy metal-free PVC sheets is gaining popularity in the industrial and textile sectors due to increasing environmental concerns. Foam sheets, a significant segment of the market, are also witnessing growth due to their insulation properties and versatility. Overall, the market is poised for growth, driven by technological advancements and evolving industry trends.

What challenges does PVC Sheet Market face during the growth?

Environmental issues is a key challenge affecting the market growth.

- The market encompasses various applications, including calendared, extruded, laminated, and translucent sheets. These sheets are extensively utilized in diverse sectors, such as outdoor applications, construction, and medicine. In the outdoor sector, PVC sheets are employed for signage, awnings, and greenhouse covers, among others. In the construction industry, they are used for roofing, wall cladding, and insulation. In the medical sector, PVC sheets find application in medical equipment and packaging. Despite the numerous benefits of PVC sheets, their environmental impact is a significant concern. The United Nations Environment Programme (UNEP) has raised awareness about the detrimental effects of plastic use in agriculture, including the utilization of PVC-coated seeds and mulch films.

- Furthermore, while these plastics contribute to increased agricultural productivity, their degradation poses a threat to soil health and biodiversity. Contaminants released from broken-down plastics can lead to soil degradation, potentially jeopardizing long-term food security and agricultural productivity. Moreover, the extraction and production of PVC sheets impact the environment throughout their entire lifecycle, from the extraction of fossil fuels to disposal. In conclusion, the market faces challenges related to environmental concerns associated with plastic use, particularly in agriculture. While plastics contribute to increased agricultural productivity, their degradation can lead to soil degradation and pose a threat to long-term food security and agricultural productivity.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3A Composites Holding AG

- Armacell International SA

- Avient Corp.

- Brett Martin

- Chase Doors

- Curbell Plastics Inc.

- Dugar Polymers Limited

- Extruflex

- Kömmerling Chemische Fabrik GmbH

- Laird Plastics

- Marvel Vinyls Ltd.

- PAR Group Ltd.

- Palram Industries Ltd

- Plas Tech Inc.

- Shih Kuen Plastics Co Ltd.

- Shin Etsu Chemical Co. Ltd.

- Simona AG

- Swami Plast Industries

- Tarkett

- United States Plastic Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

PVC sheets have gained significant popularity across various industries due to their versatility and durability. These sheets are extensively used in medical and healthcare, home furnishing, building and construction, transport, and sustainable applications. In the medical and healthcare sector, rigid and semi-rigid PVC sheets are used for creating equipment and components, while in home furnishing, they are used for making furniture and upholstery. The building and construction industry utilizes PVC sheets for wall claddings, model making, and structural composites. Transparent, opaque, and semitransparent PVC sheets are widely used in home and outdoor applications. PVC sheets are also eco-friendly as they can be made from biomass-based materials.

Furthermore, PVC sheets are used in various forms, including calendared, extruded, and laminated sheets. They are lead-free and heavy metal-free, making them a preferred choice for various applications. PVC foam sheets are used in industrial applications, while chlorine-free coatings are used to enhance their properties. PVC sheets find extensive use in textile, transportation, marine, aerospace, wind energy applications, and more. They are used in making face shields, healthcare systems, transportation components, marine parts, aerospace components, and wind turbine parts. PVC sheets are also used in making pet foam, turbine blades, and stone polymer composites (SPC). PVC sheets are also used in the production of CFRT (Carbon Fiber Reinforced Thermoplastic) and SPC (Sandwich Panels).

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market Growth 2024-2028 |

USD 1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.0 |

|

Key countries |

China, US, India, Germany, France, Japan, UK, Italy, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch