Real-Time Operating System Market Size 2025-2029

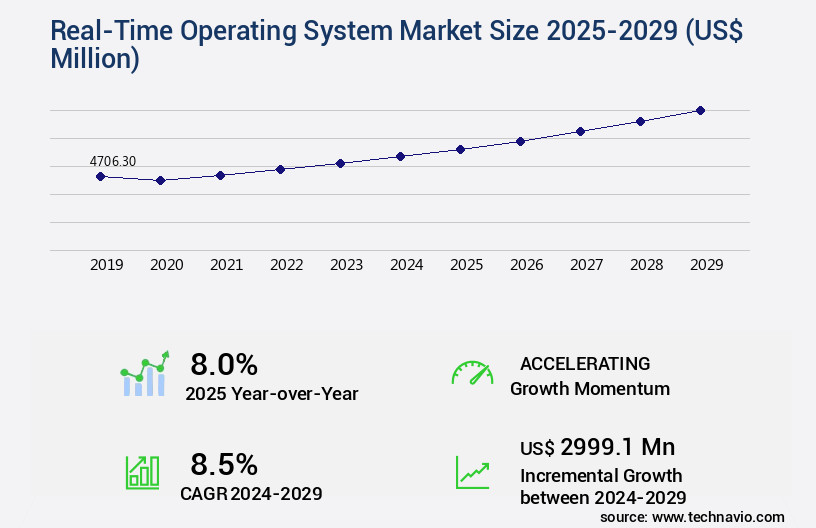

The real-time operating system market size is valued to increase USD 3 billion, at a CAGR of 8.5% from 2024 to 2029. Robust advancement in the healthcare industry will drive the real-time operating system market.

Major Market Trends & Insights

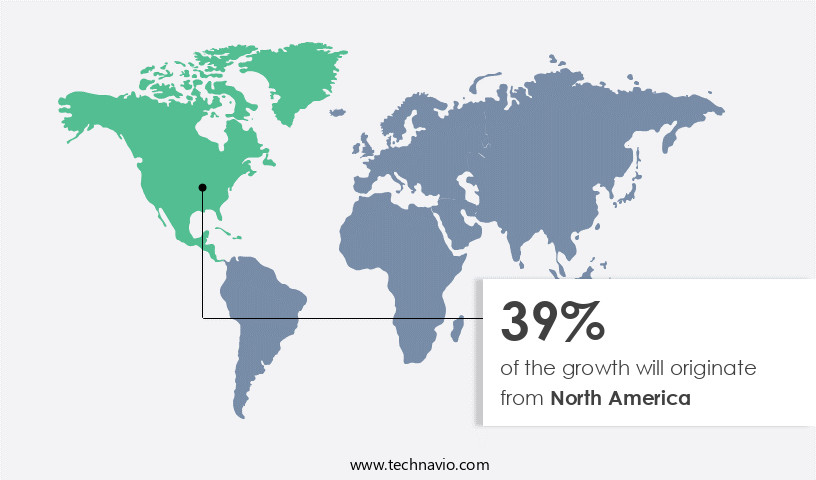

- North America dominated the market and accounted for a 39% growth during the forecast period.

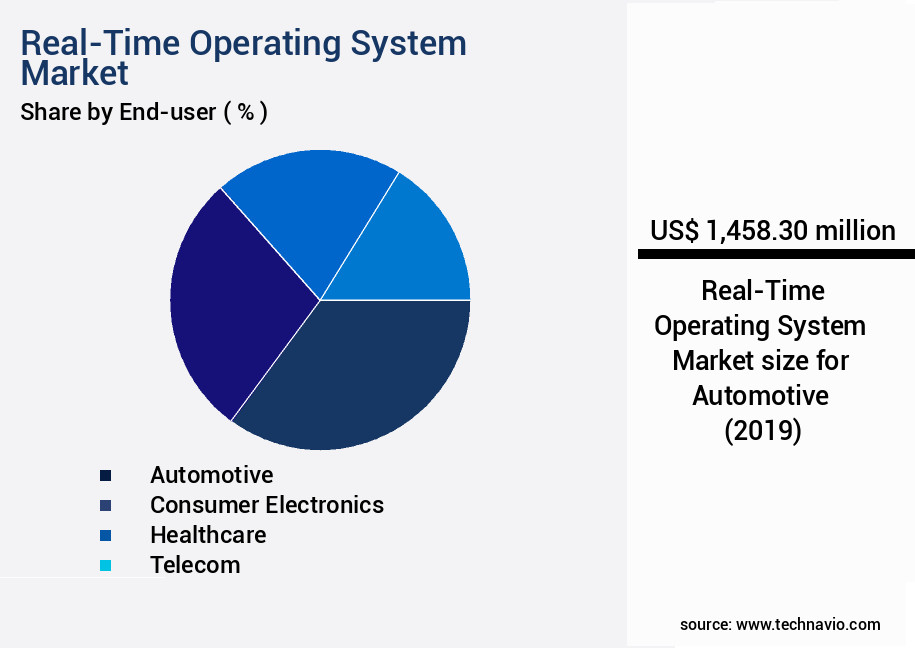

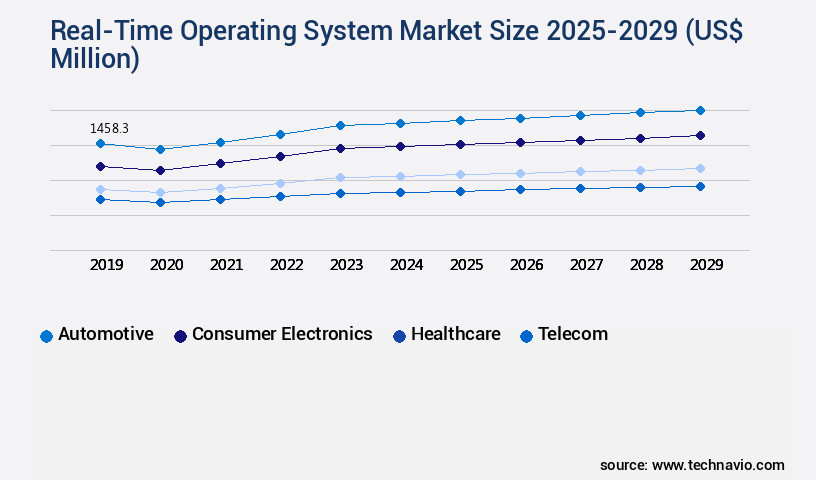

- By End-user - Automotive segment was valued at USD 1.46 billion in 2023

- By Type - Soft real-time operating system segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 90.40 million

- Market Future Opportunities: USD 2999.10 million

- CAGR from 2024 to 2029: 8.5%

Market Summary

- The Real-Time Operating System (RTOS) market experiences significant growth, driven by the increasing demand for real-time applications in various sectors, particularly in healthcare and industrial automation. According to a recent report, the global RTOS market is projected to reach a value of USD 8.3 billion by 2026, underscoring its increasing importance in modern technology infrastructures. RTOSs provide deterministic processing capabilities, ensuring that critical tasks are executed on time, making them indispensable in applications requiring high reliability and precision. In healthcare, for instance, RTOSs are used in medical devices to ensure accurate and timely data processing, ultimately improving patient care.

- In industrial automation, they enable efficient and reliable control of complex systems. Despite their benefits, the high cost of implementing and maintaining RTOSs remains a challenge for many organizations. However, partnerships and collaborations between technology providers and system integrators are addressing these concerns by offering customized and cost-effective solutions. As technology advances, the integration of AI and machine learning capabilities into RTOSs is expected to further expand their applications and functionality. In conclusion, the RTOS market continues to evolve, driven by the increasing demand for real-time applications in various industries. With a projected market value of USD 8.3 billion by 2026, it is clear that RTOSs will play a crucial role in shaping the future of technology infrastructures.

What will be the Size of the Real-Time Operating System Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Real-Time Operating System Market Segmented?

The real-time operating system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Consumer electronics

- Healthcare

- Telecom

- Others

- Type

- Soft real-time operating system

- Hard real-time operating system

- Firm real-time operating system

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The automotive segment is estimated to witness significant growth during the forecast period.

In the ever-evolving technological landscape, the Real-Time Operating System (RTOS) market continues to gain momentum, particularly in sectors like automotive, where real-time performance is paramount. The automotive industry's shift towards advanced driver assistance systems (ADAS), autonomous driving, and enhanced connectivity has intensified the demand for RTOS solutions. These systems are instrumental in managing the intricate, safety-critical tasks of modern vehicles, ensuring both efficiency and reliability. Autonomous vehicles, in particular, necessitate precise and immediate responses to a multitude of inputs. RTOS plays a crucial role in handling these tasks effectively, enabling the vehicle to react to its environment in real-time.

The Automotive segment was valued at USD 1.46 billion in 2019 and showed a gradual increase during the forecast period.

RTOS solutions offer features such as i/o management, error handling, firmware integration, and security features, which are essential for managing the complexities of modern automotive systems. They provide robust memory management, response time guarantees, and network protocol support, ensuring seamless communication between various vehicle components. Additionally, RTOS solutions offer hardware abstraction, code optimization, thread management, multicore support, and real-time scheduling, making them indispensable for the development of embedded systems. Moreover, RTOS solutions offer debugging tools, priority inversion prevention, POSIX compliance, power management, data integrity, and system calls, mitigating potential issues and ensuring the reliability of automotive systems.

With features like resource contention management, task synchronization, performance monitoring, virtualization support, and real-time clock integration, RTOS solutions cater to the stringent timing constraints and interrupt handling requirements of the automotive sector.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Real-Time Operating System Market Demand is Rising in North America Request Free Sample

The Real-Time Operating System (RTOS) market demonstrates a robust and evolving nature, with key applications spanning various industries such as aerospace, defense, automotive, and industrial automation. The North American market holds a significant share in this sector, driven primarily by the region's substantial presence in these sectors. The US, in particular, leads in RTOS adoption, fueled by extensive defense modernization programs, the burgeoning development of autonomous vehicles, and rapid advancements in industrial digitalization. In the aerospace and defense sectors, the demand for RTOS is critical due to stringent safety and performance requirements. The US dominates this domain, with RTOS being an essential component in numerous defense systems and aerospace applications, ensuring reliable and precise operations.

The automotive industry, particularly in Detroit and other manufacturing hubs, continues to be a significant contributor to RTOS demand, driven by the increasing integration of advanced technologies and the development of connected and autonomous vehicles.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The real-time operating system (RTOS) market is experiencing significant growth due to the increasing demand for real-time data acquisition and processing in various industries. RTOS plays a crucial role in embedded systems, where memory management and real-time task scheduling algorithms are essential for optimal performance. Interrupt handling mechanisms in RTOS ensure timely response to external events, while performance optimization techniques help maximize system throughput. Designing robust real-time systems requires handling resource contention effectively and implementing efficient inter-process communication. In the context of IoT devices, an RTOS for IoT applications offers reliable and deterministic real-time response, making it an ideal choice for mission-critical applications. Security considerations are increasingly important in real-time systems, with advanced encryption and authentication techniques being integrated into RTOS solutions. Developing safety-critical embedded software necessitates power management strategies, such as dynamic voltage and frequency scaling, to minimize power consumption. Hardware abstraction layer design principles ensure compatibility with various hardware platforms, while real-time system performance analysis helps identify bottlenecks and optimize system architecture. Advanced real-time scheduling techniques, such as Earliest Deadline First (EDF) and Rate Monotonic Analysis (RMA), provide effective error handling and multicore system optimization. Virtualization for real-time applications is gaining popularity, enabling the consolidation of multiple applications on a single platform while maintaining real-time responsiveness. Testing and validation of real-time systems are essential to ensure reliability and meet stringent industry standards. Effective error handling in RTOS is crucial to minimize downtime and maintain system availability. Overall, the market continues to evolve, offering innovative solutions for real-time data acquisition, processing, and response in various industries.

What are the key market drivers leading to the rise in the adoption of Real-Time Operating System Industry?

- The healthcare industry's robust advancements, characterized by innovation and technological progressions, serve as the primary catalyst for market growth.

- The Real-Time Operating System (RTOS) market is undergoing significant evolution, with various sectors recognizing its value in delivering deterministic performance for time-sensitive applications. In healthcare, this need is particularly pronounced, as RTOS ensures critical tasks are executed within precise time constraints. This is essential for medical devices and systems, such as patient monitoring equipment, diagnostic tools, and surgical robots. The importance of RTOS in healthcare is underscored by recent investment trends. For instance, Ambience Healthcare, a leading AI operating system provider for healthcare organizations, secured a USD 70 million Series B funding round in February 2024.

- This substantial investment, co-led by Kleiner Perkins and the OpenAI Startup Fund, highlights the growing emphasis on healthcare technology and the indispensable role of RTOS in this domain.

What are the market trends shaping the Real-Time Operating System Industry?

- Partnership and collaboration have emerged as the prevailing market trends.

- The real-time operating system (RTOS) market is undergoing a transformative phase, marked by an increasing number of collaborations and partnerships. One notable instance is Ambiq's support for the Zephyr Project RTOS in October 2024. This open-source initiative has resulted in the integration of Zephyr RTOS with Ambiq's Apollo3 Family SoCs, Apollo4 Plus, Apollo4 Blue Plus, and the upcoming Apollo510 MCU. These collaborations play a pivotal role in advancing RTOS technology, as they combine the unique strengths of different organizations to develop more robust and versatile solutions.

- The RTOS market's evolution is not limited to the technology sector alone; it is gaining traction in various industries such as healthcare, automotive, and industrial automation. According to recent estimates, the global RTOS market is projected to reach a significant market size by 2028, growing at a steady pace due to its increasing adoption across diverse sectors.

What challenges does the Real-Time Operating System Industry face during its growth?

- The high cost of implementation poses a significant challenge to the growth of the industry. This expense, a key consideration for businesses looking to enter or expand within this sector, can hinder progress and innovation.

- The Real-Time Operating System (RTOS) market continues to evolve, offering valuable solutions to industries requiring precise timing, low-latency response, and deterministic behavior. However, the high cost of implementation poses a significant challenge to its widespread adoption. Commercial RTOS solutions can cost between USD 10,000 and USD 20,000, a substantial investment for many organizations. Moreover, licensing fees for advanced features or commercial versions can escalate rapidly, often based on factors like the number of cores, target hardware, or devices.

- These expenses can be prohibitive for smaller entities and projects with limited budgets. Despite these challenges, the benefits of RTOS, including improved system reliability and efficient resource utilization, make it an essential consideration for industries such as automotive, aerospace, and healthcare.

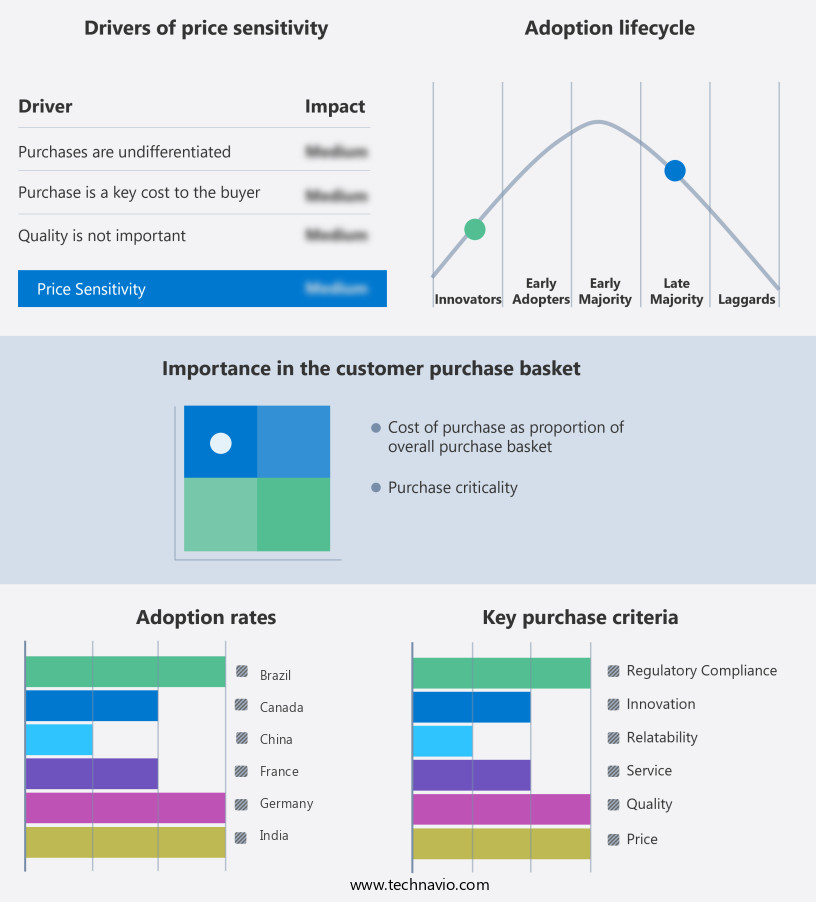

Exclusive Technavio Analysis on Customer Landscape

The real-time operating system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the real-time operating system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Real-Time Operating System Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, real-time operating system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aldec Inc. - The company specializes in providing open-source real-time operating systems, including Free RTOS, which caters to microcontrollers and small microprocessors for efficient real-time application execution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aldec Inc.

- Amazon.com Inc.

- Arm Ltd.

- BlackBerry Ltd.

- DDC-I Inc.

- Enea AB

- EUROS Embedded System GmbH

- Green Hills Software LLC

- Huawei Technologies Co. Ltd.

- Lynx Software Technologies

- Microchip Technology Inc.

- Microsoft Corp

- NXP Semiconductors NV

- Renesas Electronics Corp.

- SEGGER Microcontroller GmbH

- Siemens AG

- Silicon Laboratories Inc.

- SYSGO GmbH

- Wind River Systems Inc.

- WITTENSTEIN high integrity systems Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Real-Time Operating System Market

- In January 2024, Wind River Systems, a leading provider of real-time operating systems (RTOS), announced the launch of its new VxWorks 7 real-time operating system, featuring enhanced security and artificial intelligence capabilities (Wind River Systems Press Release).

- In March 2024, Mentor Graphics and Siemens announced a strategic partnership to integrate Mentor's Nucleus RTOS with Siemens' Polarion ALM software suite, aiming to streamline the development and testing process for automotive and industrial applications (Mentor Graphics Press Release).

- In April 2024, LynuxWorks, another prominent RTOS company, secured a significant funding round of USD 20 million from SJF Ventures and Siemens' Next47 to expand its product offerings and accelerate growth in the automotive and industrial markets (LynuxWorks Press Release).

- In May 2025, Green Hills Software, a leading RTOS provider, showcased its INTEGRITY-17rt real-time operating system at the Embedded World trade fair, demonstrating its ability to support Arm Cortex-M33 and Cortex-M33E cores, further expanding its support for the automotive and IoT markets (Green Hills Software Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Real-Time Operating System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 2999.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, China, Germany, UK, India, Japan, Canada, South Korea, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The real-time operating system (RTOS) market continues to evolve, with ongoing advancements shaping its applications across various sectors. I/O management and error handling are critical components, ensuring seamless data transfer and reliable system operation. Firmware integration and security features are increasingly prioritized, as systems become more complex and vulnerable. For instance, in the automotive industry, an RTOS with excellent response time and real-time clock management is essential for engine control systems. According to recent market research, the global RTOS market is projected to grow by 8% annually, driven by the increasing demand for real-time systems in embedded systems and IoT applications.

- Kernel architecture, memory management, and thread management are other essential features, enabling preemptive multitasking and real-time scheduling. Interrupt latency, network protocols, and hardware abstraction are crucial for efficient system operation, while code optimization and power management contribute to improved performance and energy efficiency. Furthermore, debugging tools, priority inversion prevention, POSIX compliance, and virtualization support are essential for maintaining data integrity and managing resource contention and task synchronization. Context switching and process scheduling are also vital for meeting timing constraints and handling interrupts effectively. In summary, the RTOS market is characterized by continuous innovation, with a focus on improving performance, security, and efficiency.

- The integration of advanced features, such as multicore support and virtualization, is driving growth and expanding the market's applications across various industries.

What are the Key Data Covered in this Real-Time Operating System Market Research and Growth Report?

-

What is the expected growth of the Real-Time Operating System Market between 2025 and 2029?

-

USD 3 billion, at a CAGR of 8.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Automotive, Consumer electronics, Healthcare, Telecom, and Others), Type (Soft real-time operating system, Hard real-time operating system, and Firm real-time operating system), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Robust advancement in healthcare industry, High cost of implementation

-

-

Who are the major players in the Real-Time Operating System Market?

-

Aldec Inc., Amazon.com Inc., Arm Ltd., BlackBerry Ltd., DDC-I Inc., Enea AB, EUROS Embedded System GmbH, Green Hills Software LLC, Huawei Technologies Co. Ltd., Lynx Software Technologies, Microchip Technology Inc., Microsoft Corp, NXP Semiconductors NV, Renesas Electronics Corp., SEGGER Microcontroller GmbH, Siemens AG, Silicon Laboratories Inc., SYSGO GmbH, Wind River Systems Inc., and WITTENSTEIN high integrity systems Ltd

-

Market Research Insights

- The market is a dynamic and ever-evolving landscape. Two key statistics illustrate its continuous growth and significance. First, real-time operating systems are estimated to account for over 20% of the overall embedded operating system market share. Second, the global real-time systems market is projected to expand at a steady rate of approximately 5% annually. Real-time operating systems play a crucial role in various industries, from industrial automation and transportation to telecommunications and IoT devices. For instance, in the transportation sector, real-time operating systems ensure precise control over critical systems, such as engine management and safety systems, leading to improved performance and reliability.

- These systems prioritize tasks based on their deadlines, employing scheduler algorithms to optimize resource allocation and minimize network latency. They provide features like memory protection, kernel modules, and inter-process communication, enabling efficient and reliable data acquisition and processing. Additionally, real-time operating systems offer robustness through fault tolerance and power consumption optimization, ensuring seamless operation even in challenging environments. Real-time analytics and event flags are essential components of real-time systems, enabling real-time decision-making and response to external stimuli. Shared memory and message queues facilitate inter-process communication, while task priorities and API design ensure efficient system services and hardware acceleration.

- Overall, real-time operating systems are an integral part of modern technology infrastructure, enabling the development of safer, more efficient, and more responsive systems.

We can help! Our analysts can customize this real-time operating system market research report to meet your requirements.