China Retail Market Size 2025-2029

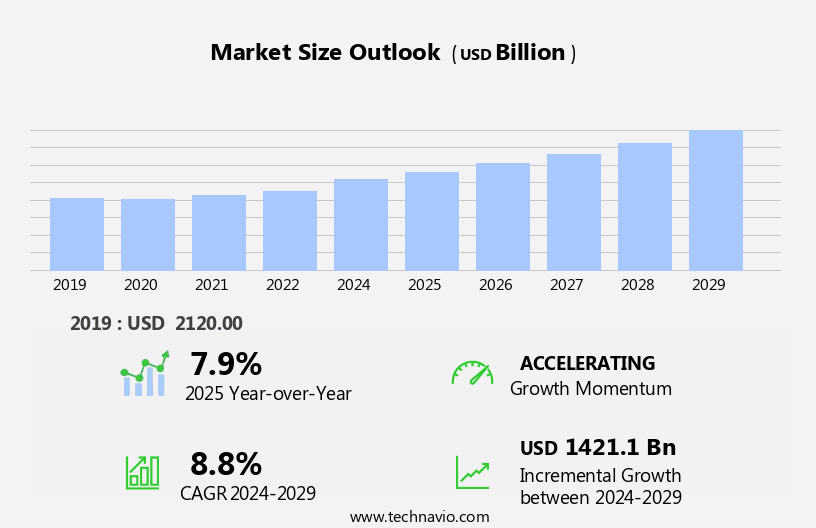

The china retail market size is forecast to increase by USD 1421.1 billion, at a CAGR of 8.8% between 2024 and 2029.

- The market is witnessing significant shifts driven by the growing trend towards premiumization and the increasing adoption of online and omni-channel trading. Consumers in China are increasingly seeking high-quality, luxury goods, leading retailers to focus on offering premium products to cater to this demand. This trend is particularly prominent in sectors such as fashion, cosmetics, and food and beverage. However, the market faces a major challenge in the form of rampant counterfeiting, particularly in the premium segment. The prevalence of counterfeit goods poses a significant threat to both consumers and retailers, damaging brand reputations and undermining the authenticity of premium offerings.

- To navigate this challenge, retailers must invest in robust anti-counterfeiting measures and build strong relationships with consumers based on trust and transparency. Effective brand protection strategies, such as holograms, serial numbers, and authentication apps, can help mitigate the risk of counterfeiting and maintain the integrity of premium product offerings. By addressing this challenge and capitalizing on the opportunities presented by the trend towards premiumization and online trading, retailers in China can effectively grow their businesses and stay competitive in this dynamic market.

What will be the size of the China Retail Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In China's retail market, e-commerce continues to dominate with innovative technologies shaping consumer behavior. Virtual try-on features allow customers to test products digitally, enhancing the shopping experience. Data-driven customer insights enable personalized product recommendations and marketing automation, driving sales growth. Sustainable e-commerce practices, including ethical sourcing and green logistics, are gaining traction. Language localization and cultural sensitivity are essential for international marketing strategies. E-commerce security software and fraud prevention tools ensure safe transactions. Payment processing platforms support international payment gateways for seamless cross-border commerce. E-commerce scaling requires efficient transportation management systems and delivery management platforms. Omnichannel marketing and customer experience optimization are key trends, with voice search optimization and social media commerce expanding reach.

- Predictive customer modeling and micro-influencer marketing help brands connect with consumers. E-commerce legal compliance, data privacy, and cybersecurity solutions are crucial for business success. Interactive product demos and customer feedback platforms foster engagement and improve product development. E-commerce innovation includes interactive content, video marketing, and social listening tools. Customer journey mapping and global logistics networks streamline operations and enhance customer satisfaction. E-commerce growth strategies incorporate e-commerce analytics tools and live chat support. Warehouse management systems and e-commerce analytics tools optimize inventory management and supply chain efficiency.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

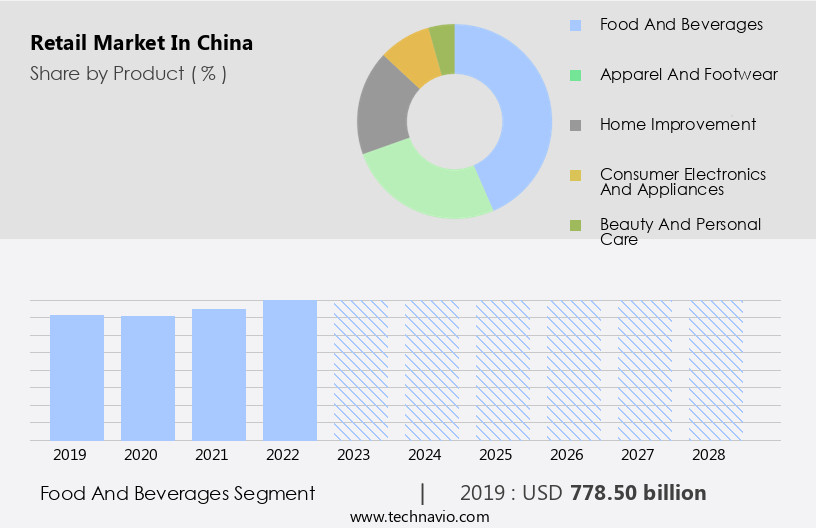

- Product

- Food and beverages

- Apparel and footwear

- Home improvement

- Consumer electronics and appliances

- Beauty and personal care

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- APAC

By Product Insights

The food and beverages segment is estimated to witness significant growth during the forecast period.

In China's vast retail market, technology plays a pivotal role in enhancing customer experience and driving growth. Personalized recommendations powered by artificial intelligence (AI) are becoming increasingly popular, enabling consumers to receive tailored product suggestions based on their preferences and past purchases. Fraud detection systems ensure secure credit card processing, while social media listening provides valuable insights into consumer behavior and trends. Omnichannel strategies, incorporating social media marketing and mobile commerce (m-commerce), are essential for businesses seeking to reach customers through multiple touchpoints. Smart logistics and delivery options, including drone delivery, ensure efficient order fulfillment and timely delivery. E-commerce regulations mandate strict data security measures, with financial services integration and machine learning algorithms used to prevent fraud and improve sales performance.

Predictive analytics and customer segmentation help retailers optimize conversion rates and marketing automation. Brand reputation is crucial, with online reputation management and consumer protection measures ensuring a positive image. Social commerce and loyalty programs are popular, while blockchain technology offers secure digital payment systems and electronic invoicing. Returns and exchanges are streamlined through automated order processing and targeted advertising, while last-mile delivery and subscription models cater to evolving consumer demands. Big data analytics and inventory management enable data-driven decision making and retail analytics, ensuring retailers remain competitive. The retail landscape is continually evolving, with cloud computing, mobile payment systems, and order fulfillment systems enhancing operational efficiency.

Warehouse automation and e-commerce platforms enable seamless shopping experiences, while supply chain management and logistics networks ensure timely delivery of products.

The Food and beverages segment was valued at USD 778.50 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the China Retail Market drivers leading to the rise in adoption of the Industry?

- The premiumization trend significantly drives the market, as an increasing number of consumers opt for higher-end products and services.

- The market has experienced significant growth due to the increasing trend of premiumization. This strategy involves retailers offering higher-value propositions to customers through cross-selling and upselling. The consciousness of Chinese consumers regarding health and food safety has driven the demand for premium organic food products. With an expanding population of affluent consumers, there is a growing market for premium offerings across all retail sectors. Machine learning algorithms and financial services integration are essential tools for retailers in China to effectively manage inventory, consumer behavior, and order fulfillment. Cloud computing and mobile payment systems facilitate data-driven decision making and retail analytics.

- Warehouse automation and automated order processing are crucial for last-mile delivery and targeted advertising. Subscription models have also gained popularity in the Chinese retail market. E-commerce platforms are leveraging content personalization and targeted advertising to enhance the customer experience. The integration of these advanced technologies has transformed the retail landscape in China, making it a dynamic and competitive market. Retailers must stay agile and adapt to the evolving consumer preferences and market trends to remain competitive.

What are the China Retail Market trends shaping the Industry?

- The trend in trade is shifting towards online and omni-channel platforms. This approach, referred to as online and omni-channel retailing, combines the benefits of traditional brick-and-mortar stores with the convenience of e-commerce.

- In China's retail market, the omnichannel strategy is gaining momentum as companies recognize the importance of this approach in maximizing product visibility. Omnichannel retailing integrates various sales channels, including retail stores, mobile stores, online stores, mobile app stores, and telephone sales, to enhance customer engagement. Although adoption is still relatively low compared to developed countries, the growing prevalence of internet shopping and increasing internet connectivity make the online channel an attractive opportunity for retailers over the next five years. Artificial intelligence (AI) is also transforming the retail landscape in China. AI-driven personalized recommendations and fraud detection systems are becoming commonplace, improving the user experience (UX) and increasing customer satisfaction.

- Social media listening is another essential tool for retailers, enabling them to monitor customer sentiment and respond to queries and complaints in real-time. Content marketing and social media marketing are essential components of a successful retail strategy in China. Retailers are investing in payment gateways and credit card processing to facilitate seamless transactions. Smart logistics solutions are helping to streamline the delivery process, reducing shopping cart abandonment and improving customer satisfaction. Returns and exchanges are a significant challenge for retailers in China. Effective online reputation management and customer service channels are crucial for addressing customer concerns and maintaining a positive brand image.

- Retailers must prioritize UX, ensuring that their websites and apps are user-friendly and mobile-optimized to meet the evolving needs of Chinese consumers.

How does China Retail Market faces challenges face during its growth?

- The premium segment of the industry faces significant challenges due to rampant counterfeiting, which negatively impacts its growth.

- The market presents significant opportunities for US businesses, yet it also comes with unique challenges. Data security is a major concern due to the prevalence of counterfeit products, with estimates suggesting that up to 40% of goods sold in China may be fake. This issue extends to luxury brands, whose counterfeits can significantly impact market shares and brand reputation. To navigate this market, businesses must prioritize digital payments and mobile app development for seamless transactions. Delivery options, including electronic invoicing and drone delivery, are also essential to meet consumer demands. Consumer protection is crucial, with social commerce and loyalty programs offering opportunities for building trust.

- Innovative technologies like blockchain technology, mobile wallets, and big data analytics can help ensure product authenticity and enhance the customer experience. Regulations surrounding e-commerce are evolving, requiring businesses to stay informed. Personalized marketing and brand reputation management are essential for standing out in a competitive market. In conclusion, the Chinese retail market offers vast opportunities for US businesses. By addressing challenges such as counterfeit products, embracing digital solutions, and focusing on consumer needs, businesses can thrive in this dynamic and complex market. Recent research indicates that the market is expected to continue its growth trajectory, making it an attractive destination for businesses seeking expansion.

Exclusive China Retail Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AS Watson Group

- Alibaba Group Holding Ltd.

- Bailian Group

- Beijing Dangdang Kewen Electronic Commerce Co. Ltd.

- China Resources Enterprise Ltd.

- DFI Retail Group.

- E Mart Co. Ltd.

- GOME Retail Holdings Ltd.

- JD.com Inc.

- Lotte Corp.

- PDD Holdings Inc.

- PetroChina Co. Ltd.

- President Chain Store Corp.

- Quanlian Industrial Co. Ltd.

- Sun Art Retail Group Ltd.

- Suning.com Co. Ltd.

- Vipshop Holdings Ltd.

- Walmart Inc.

- Yonghui Superstores Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Retail Market In China

- In February 2023, Alibaba Group, the leading e-commerce company in China, announced the launch of its new retail format, "Fresh Hema Xianghai," integrating online and offline shopping experiences with AI technology and fresh food offerings (Alibaba Group Press Release, 2023). This innovative approach represents a significant shift in the Chinese retail market, merging the convenience of e-commerce with the appeal of brick-and-mortar stores.

- In March 2024, JD.Com, China's second-largest e-commerce platform, entered into a strategic partnership with Walmart to jointly develop an e-commerce platform focusing on fresh food and daily necessities (JD.Com Press Release, 2024). This collaboration marks a major milestone in the Chinese retail landscape, as two of the largest players in the market join forces to enhance their offerings and compete more effectively against Alibaba.

- In June 2024, Pinduoduo, a leading social e-commerce platform in China, raised approximately USD4.6 billion in its initial public offering (Reuters, 2024). This significant funding round underscores the growing investor interest in the Chinese retail market, particularly in the social e-commerce segment, which has experienced rapid growth in recent years.

- In December 2025, the Chinese government announced the implementation of a new policy encouraging foreign retailers to enter the Chinese market and invest in domestic e-commerce platforms (Xinhua News Agency, 2025). This policy change represents a significant opportunity for international retailers to expand their presence in the world's largest consumer market, potentially leading to increased competition and innovation in the Chinese retail sector.

Research Analyst Overview

In the dynamic retail market of China, businesses continually adapt to evolving consumer behaviors and technological advancements. Artificial intelligence (AI) plays a pivotal role in personalized recommendations, enhancing the user experience (UX) and driving sales performance. Fraud detection systems ensure secure digital payments and credit card processing, while content marketing and social media listening engage customers and foster brand loyalty. Social media marketing and customer service channels provide real-time interaction, addressing queries and concerns. Omnichannel strategy integrates various touchpoints, from online marketplaces to physical stores, offering seamless shopping experiences. Smart logistics and delivery options optimize supply chain management and last-mile delivery, reducing turnaround times and improving customer satisfaction.

Predictive analytics and machine learning algorithms help retailers anticipate trends and customer churn, enabling data-driven decision making. Returns and exchanges are streamlined with automated order processing and inventory management, ensuring a hassle-free shopping experience. Online reputation management maintains brand reputation, while marketing automation and customer segmentation target specific demographics. Payment gateways and mobile wallets facilitate digital payments, and e-commerce regulations ensure consumer protection. Big data analytics and cloud computing provide valuable insights into consumer behavior, enabling targeted advertising and conversion rate optimization. Cross-border e-commerce and online banking expand market reach, while drone delivery and warehouse automation revolutionize the industry.

Brand loyalty is nurtured through loyalty programs and personalized marketing, while e-commerce platforms offer seamless shopping experiences. Consumer behavior is shaped by various factors, including social commerce, product reviews, and sales performance. The retail landscape is ever-changing, with continuous innovation in areas like financial services integration, logistics networks, and user experience.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Retail Market in China insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2025-2029 |

USD 1421.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch