Ricinoleic Acid Market Size 2025-2029

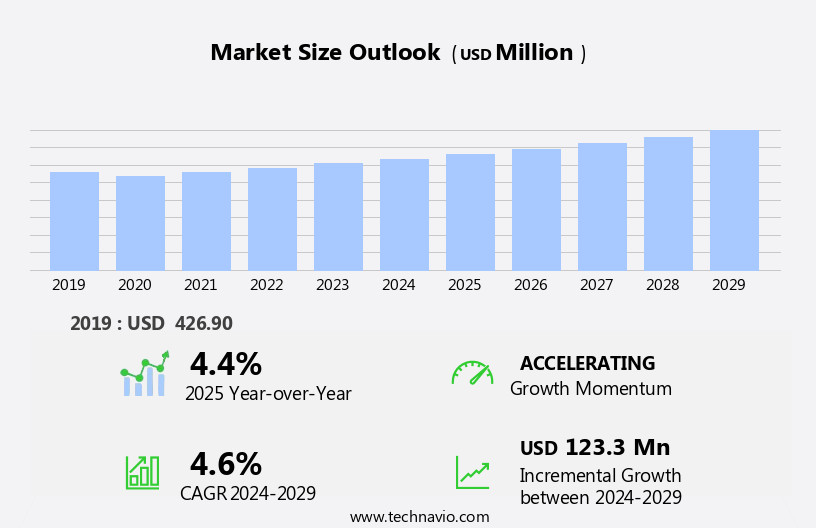

The ricinoleic acid market size is forecast to increase by USD 123.3 million, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth due to increasing demand from major end-users, particularly in the automotive and textile industries. The shift toward bio-based chemicals is driving this trend, as companies seek more sustainable alternatives to traditional petroleum-derived chemicals. However, the high price of castor seeds, the primary raw material for ricinoleic acid production, poses a significant challenge. Adverse climatic conditions in major producing regions, such as drought and heavy rainfall, have negatively impacted castor seed production, leading to supply constraints and price volatility. To capitalize on market opportunities, companies must focus on improving castor seed yields and exploring alternative sources.

- Additionally, research and development efforts aimed at enhancing the efficiency of ricinoleic acid production processes can help mitigate the impact of raw material price fluctuations. Overall, the market offers significant growth potential for companies able to navigate these challenges and capitalize on the increasing demand for sustainable, bio-based chemicals.

What will be the Size of the Ricinoleic Acid Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the versatility and applications of this unsaturated fatty acid derived from castor oil. Ricinoleic acid's unique hydroxyl group and chemical stability make it a valuable component in various sectors. In the personal care industry, it functions as a rheology modifier and provides antimicrobial properties in hair care and skin care products. Beyond personal care, ricinoleic acid's anti-inflammatory properties contribute to its use in medical applications, including wound healing. Its role extends to food additives, where it enhances the oxidative stability of edible oils and improves the nutritional value of dietary supplements.

The chemical industry utilizes ricinoleic acid in the production of bio-based polymers and green chemistry, contributing to the development of sustainable chemistry and renewable resources. Additionally, its use as a viscosity modifier and thermal stability agent in various industrial applications further expands its market potential. The production methods for ricinoleic acid continue to evolve, with ongoing research focusing on improving extraction efficiency and refining processes. The market dynamics are further influenced by the ongoing demand for sustainable and eco-friendly production methods and the increasing popularity of bio-based fuel and bio-based materials. As the market for ricinoleic acid continues to unfold, the applications of this versatile fatty acid in various sectors continue to expand, offering significant opportunities for growth and innovation.

From castor oil derivatives like methyl ricinoleate and ethyl ricinoleate to related fatty acids like palmitic acid, linoleic acid, oleic acid, and sebacic acid, the market's potential is vast and ever-evolving.

How is this Ricinoleic Acid Industry segmented?

The ricinoleic acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Lubricants and grease

- CPC

- Surfactants

- Others

- Type

- Industrial-grade

- Optimal grade

- Source

- Castor oil

- Synthetic esterification

- Form Factor

- Liquid

- Solid

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

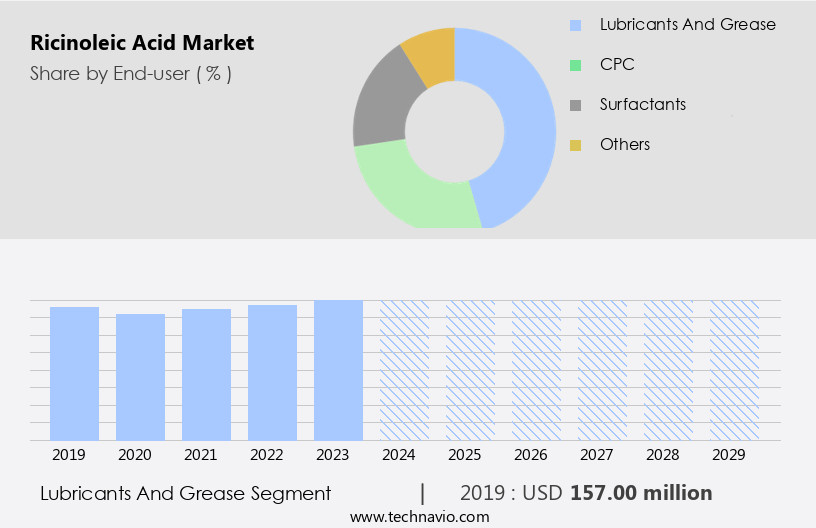

The lubricants and grease segment is estimated to witness significant growth during the forecast period.

Ricinoleic acid, a significant unsaturated fatty acid derived from castor oil, plays a crucial role in various industries. In personal care applications, it functions as a rheology modifier and viscosity modifier, enhancing the texture and performance of hair care and skin care products. Its hydroxyl group and anti-inflammatory properties contribute to its popularity in medical applications, including wound healing and pain relief. Bio-based polymers and bio-based materials are gaining traction due to their eco-friendly nature, and ricinoleic acid is a key building block. Green chemistry principles are employed during its production, ensuring sustainable chemistry. Extraction methods have evolved to maximize yield and minimize waste.

Ricinoleic acid is also used in the production of bio-based fuels and bio-based materials from renewable resources. Its high thermal stability and oxidative stability make it suitable for these applications. In the chemical industry, it is used as a raw material for producing various castor oil derivatives, such as undecylenic acid, methyl ricinoleate, and ethyl ricinoleate. The nutritional value of ricinoleic acid as a dietary supplement is gaining recognition, particularly for its potential anti-inflammatory and antimicrobial properties. In the food industry, it is used as a food additive and a viscosity modifier. The global supply chain for ricinoleic acid is robust, with various production methods, including refining processes, ensuring a steady supply.

Stearic acid, linoleic acid, oleic acid, sebacic acid, and palmitic acid are some of the other fatty acids that can be derived from castor oil. The versatility and wide range of applications of ricinoleic acid make it an essential component in numerous industries.

The Lubricants and grease segment was valued at USD 157.00 million in 2019 and showed a gradual increase during the forecast period.

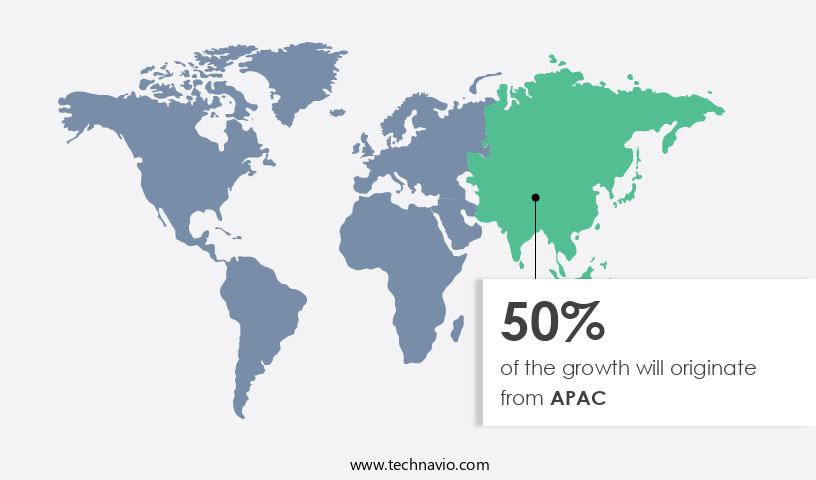

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing notable growth, particularly in the Asia Pacific (APAC) region. This expansion is driven by the burgeoning cosmetics and personal care industry, fueled by a rising middle class and increased consumer spending on beauty and grooming products. Ricinoleic acid, derived from castor oil, plays a significant role in this sector due to its anti-inflammatory properties and ability to function as a rheology modifier and viscosity modifier. In the pharmaceutical industry, ricinoleic acid is utilized for its laxative properties and potential therapeutic applications. With the increasing focus on healthcare and pharmaceutical manufacturing in APAC, the demand for ricinoleic acid in pharmaceutical applications is anticipated to rise.

Additionally, the production of castor oil and ricinoleic acid, notably in India, is contributing to the market's growth. Beyond personal care and pharmaceuticals, ricinoleic acid has applications in bio-based polymers, bio-based fuels, bio-based materials, dietary supplements, and food additives. Its hydroxyl group and unsaturated fatty acid structure provide it with unique properties, such as oxidative stability, thermal stability, and chemical stability. These characteristics make ricinoleic acid a valuable ingredient in various industries, including sustainable chemistry and renewable resources. Ricinoleic acid derivatives, such as ethyl ricinoleate and methyl ricinoleate, also contribute to the market's growth. They are used in the production of bio-based polymers, which have gained popularity due to their eco-friendly nature and reduced environmental impact.

Furthermore, ricinoleic acid's antimicrobial properties make it an attractive alternative to traditional synthetic chemicals in various applications. The production methods for ricinoleic acid include various extraction techniques and refining processes. These methods are continually evolving to improve efficiency, reduce waste, and enhance the overall sustainability of the production process. As the market for ricinoleic acid continues to expand, the focus on sustainable chemistry and renewable resources is becoming increasingly important. In summary, the market is poised for significant growth in the APAC region, driven by the cosmetics and personal care industry, increasing healthcare awareness, and the production of castor oil and ricinoleic acid.

Its unique properties and diverse applications in various industries make it a valuable commodity in the global market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant segment of the global specialty chemicals industry, characterized by its growing demand in various end-use industries. This market is driven by the unique properties of ricinoleic acid, a monounsaturated fatty acid primarily derived from castor beans. Its exceptional stability, biodegradability, and high performance make it an ideal ingredient in coatings, plastics, and personal care products. Ricinoleic acid's versatility extends to its use as a renewable raw material in the production of bio-based polymers and biodegradable plastics, contributing to the market's sustainable growth. Its applications in pharmaceuticals, as a component in the production of certain drugs and supplements, further bolster market expansion. The market is also influenced by technological advancements, with ongoing research and development efforts focusing on improving production methods and expanding applications. Factors such as increasing health awareness and consumer preference for eco-friendly products are expected to fuel market growth. Moreover, the market's competitive landscape is shaped by key trends, including the increasing demand for biodegradable and sustainable products, and the growing adoption of green chemistry principles. As a result, the market is poised for continued growth and innovation.

What are the key market drivers leading to the rise in the adoption of Ricinoleic Acid Industry?

- Major end-users' increasing demand is the primary growth driver for the market.

- Ricinoleic acid, derived from castor seeds, is a significant commercial feedstock for manufacturing various industrial chemicals. This compound, which accounts for a substantial portion of castor oil derivatives, is in high demand due to its superior properties, including high viscosity, excellent thermal conductivity, and high pour point. These characteristics make ricinoleic acid an essential ingredient in the production of cosmetics, surfactants, lubricants and greases, personal care products, detergents, surface coatings, and other oleochemicals. Moreover, ricinoleic acid acts as a reactant for the synthesis of other industrial chemicals such as Sebacic acid, undecylenic acid, methyl ricinolates, and hydroxystearic acid (HAS).

- The renewable nature of ricinoleic acid, derived from castor seeds, adds to its appeal as a sustainable alternative to traditional petroleum-based chemicals. The superior properties and versatility of ricinoleic acid have made it an indispensable component in numerous industries. Its unique chemical structure, consisting of an unsaturated 12-carbon chain with a hydroxyl group, enables it to act as a viscosity modifier and provide enhanced thermal stability to various end-products. The increasing focus on using renewable resources in industrial applications further bolsters the demand for ricinoleic acid and its derivatives.

What are the market trends shaping the Ricinoleic Acid Industry?

- The market is experiencing a significant shift towards bio-based chemicals, representing an emerging trend in the industry. Bio-based chemicals offer numerous advantages, including reduced carbon emissions and increased sustainability, making them an attractive alternative to traditional petroleum-derived chemicals.

- The market is experiencing growth in the North American region due to its extensive applications in various industries. This fatty acid is widely used in sectors such as lubricants, coatings, plastics, and adhesives, making it indispensable in the manufacturing industry. In the cosmetics and personal care sector, ricinoleic acid is valued for its moisturizing and emollient properties, making it a popular ingredient in skincare formulations, shampoos, and cosmetics. Furthermore, it is a significant component in certain laxative formulations, increasing its demand in the pharmaceutical industry. The expanding healthcare sector and pharmaceutical manufacturing in North America continue to fuel the demand for ricinoleic acid in this region.

- Its oxidative stability and chemical stability make it suitable for various applications, enhancing its value in the food additives industry as well. With the increasing focus on the nutritional value of food, the use of ricinoleic acid as a functional food ingredient is gaining traction. Methyl ricinoleate, a derivative of ricinoleic acid, is also used in the food industry for its unique flavor and aroma. Overall, the versatility and wide range of applications of ricinoleic acid make it a valuable commodity in the North American market.

What challenges does the Ricinoleic Acid Industry face during its growth?

- The escalating cost of castor seeds, primarily driven by unfavorable climatic conditions, poses a significant challenge to the growth of the industry.

- Ricinoleic acid, derived from castor oil primarily obtained from castor seeds, is a significant market player in the production of bio-based polymers and green chemistry applications. However, the global market for ricinoleic acid faces challenges due to the heavy dependence of castor crop cultivation on climatic conditions, leading to price fluctuations. India, the leading producer of castor seeds, is often affected by these conditions, impacting crop production and, consequently, the market. Gujarat, a major contributor to castor seed production, experiences drastic changes in cultivation area due to harsh weather conditions like drought and an unorganized farming structure, resulting in a significant decrease in crop yield.

- Despite these challenges, the demand for ricinoleic acid remains robust in various industries, including personal care, bio-based fuel, and bio-based materials. Its anti-inflammatory properties and use in dietary supplements further boost market growth. Ensuring quality control in the extraction methods is crucial to maintaining market competitiveness and meeting the increasing demand for sustainable and eco-friendly alternatives.

Exclusive Customer Landscape

The ricinoleic acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ricinoleic acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ricinoleic acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aceto Corporation - The company specializes in the production and application of ricinoleic acid, a versatile compound. It finds use in the leather industry for treatment and in dermatology for fungal skin infections. This renewable resource enhances product quality and promotes sustainable practices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aceto Corporation

- Adani Wilmar

- Berg + Schmidt

- Croda International

- Eastman Chemical Company

- Godrej Industries

- Hokoku Corporation

- IOI Oleochemical

- Jayant Agro-Organics

- Kao Corporation

- KLK Oleo

- Liaoning Huaxing Chemical

- Merck KGaA

- Nouryon

- Oleon NV

- PMC Biogenix

- Thai Castor Oil

- Toyo Ink SC Holdings

- Vantage Specialty Chemicals

- Wilmar International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ricinoleic Acid Market

- In January 2024, Mitsui Chemicals, a leading global specialty chemical manufacturer, announced the expansion of its ricinoleic acid production capacity at its Singapore site. The investment of approximately JPY 12 billion (USUSD 108 million) aimed to strengthen its position in the global market and meet the increasing demand for sustainable and biodegradable materials (Mitsui Chemicals Press Release, 2024).

- In March 2024, Croda International, a specialty chemicals company, and Carbios, a pioneer in industrial biotechnology, entered into a strategic partnership to develop and commercialize renewably sourced ricinoleic acid. The collaboration aimed to create a more sustainable and circular economy for the production of this essential ingredient (Croda International Press Release, 2024).

- In May 2024, Stepan Company, a leading global chemical producer, completed the acquisition of Emery Oleochemicals, a major producer of specialty chemicals derived from renewable feedstocks, including ricinoleic acid. The acquisition significantly expanded Stepan's presence in the renewable chemicals market and increased its production capacity (Stepan Company Press Release, 2024).

- In April 2025, the European Chemicals Agency (ECHA) approved the renewal of the registration of ricinoleic acid under the European Union's REACH regulation. The approval confirmed the continued use of ricinoleic acid in various applications, including personal care, food, and feed industries, while ensuring its safe production and handling (ECHA Press Release, 2025).

Research Analyst Overview

- The market encompasses semi-drying oils and non-drying oils, primarily derived from the castor bean plant. Sustainability and green initiatives are driving market trends, with an increasing focus on supply chain transparency and responsible sourcing. Industrial oils, including hydroxy fatty acids, are subject to life cycle assessments to minimize environmental impact and improve carbon footprint. Product innovation is a key factor, with a shift towards eco-friendly products and regulatory compliance. Saponification value and acid value are crucial parameters in the production of specialty chemicals.

- Safety standards are paramount, with a focus on health & safety regulations and biodegradable products. Price volatility is a challenge, influenced by factors such as iodine value and chemical synthesis. Regional markets exhibit varying dynamics, with growth in the demand for bio-based products and estersonification reactions in the specialty chemicals sector.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ricinoleic Acid Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 123.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ricinoleic Acid Market Research and Growth Report?

- CAGR of the Ricinoleic Acid industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ricinoleic acid market growth of industry companies

We can help! Our analysts can customize this ricinoleic acid market research report to meet your requirements.