RNA Extraction And Purification Market Size 2025-2029

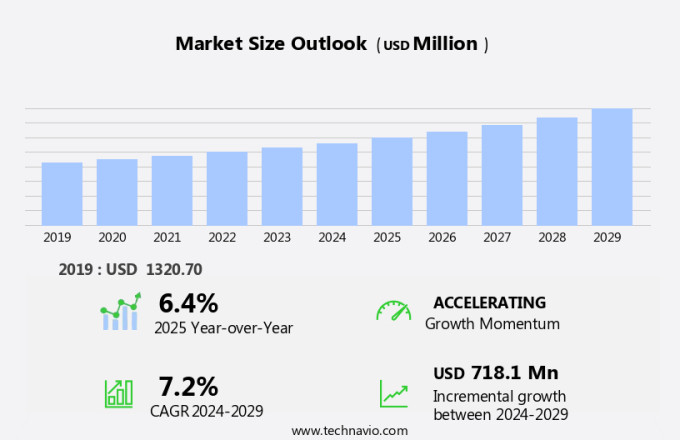

The RNA extraction and purification market size is forecast to increase by USD 718.1 million, at a CAGR of 7.2% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The rising prevalence of chronic and infectious diseases continues to fuel the demand for accurate and reliable RNA extraction techniques. Additionally, the introduction of new RNA extraction and purification products has expanded the market's scope, offering more options for researchers and diagnostic laboratories. However, the complexity of sample types, such as FFPE (formalin-fixed, paraffin-embedded) and CF (centrifuged) samples, presents challenges for market participants. To address these challenges, companies are investing in research and development to create more efficient and effective RNA extraction methods. Overall, the market is expected to continue its growth trajectory in the coming years, driven by the increasing importance of RNA-based research and diagnostics.

What will be the Size of the RNA Extraction And Purification Market During the Forecast Period?

- The market is a significant segment within the biotechnology industry, driven by the growing demand for high-quality RNA in various applications. Biotechnology companies continue to invest in innovative extraction solutions to meet the needs of molecular biology, clinical applications, and research in the life science industry. RNA isolation and purification instruments, such as spin column technology and paramagnetic beads, play a crucial role in this market. Reagents, including guanidinium chloride and oligo(dt), are essential components of RNA extraction kits, ensuring the integrity of RNA during the isolation and purification process. The market landscape for RNA isolation and purification is diverse, with biopharmaceutical firms and biotechnology industries utilizing these solutions for gene expression studies, diagnostic applications, and RNA-based drugs.

- Automation and high-throughput capabilities are key trends in this market, with automated devices and solution-based offerings gaining popularity. Molecular biological studies and clinical applications require precise and efficient RNA extraction and purification methods to ensure accurate results. Nucleic acid tests and nucleic acid extraction are also significant applications for RNA isolation and purification solutions. In summary, the RNA isolation and purification market is a dynamic and growing segment within the biotechnology industry. With a focus on high-quality RNA and innovative extraction solutions, this market will continue to play a crucial role in molecular biology, clinical applications, and research in the life science industry.

How is this segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Kits and reagents

- Instruments

- End-user

- Hospitals and diagnostic centers

- Academic research institutes

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

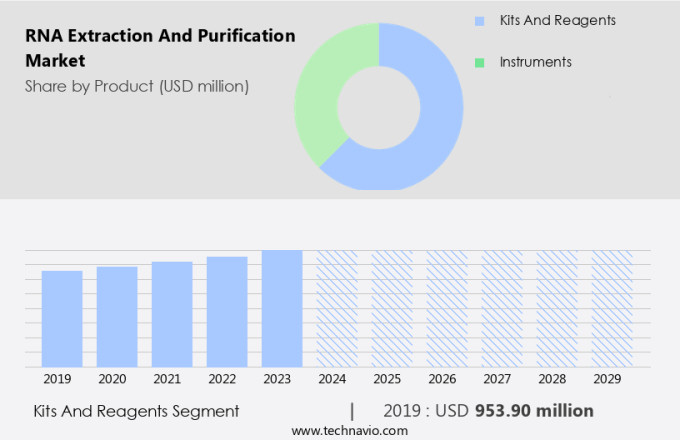

- The kits and reagents segment is estimated to witness significant growth during the forecast period.

The market encompasses the sale of kits and reagents used to isolate RNA from various biological samples. These essential tools provide buffers, enzymes, and chemicals necessary for RNA extraction, purification, and preservation. In molecular biology research and biopharmaceutical industries, where sample accuracy, reproducibility, and quality are critical, RNA extraction kits are indispensable. These pre-packaged solutions efficiently isolate high-quality RNA from samples like blood, tissue, cells, and biofluids, catering to diverse research and diagnostic applications. Microfluidic devices and advanced isolation methods further enhance RNA extraction efficiency and purity. RNA isolation plays a pivotal role in protein translation, biomarker discovery, and clinical diagnostics.

Get a glance at the market report of share of various segments Request Free Sample

The kits and reagents segment was valued at USD 953.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

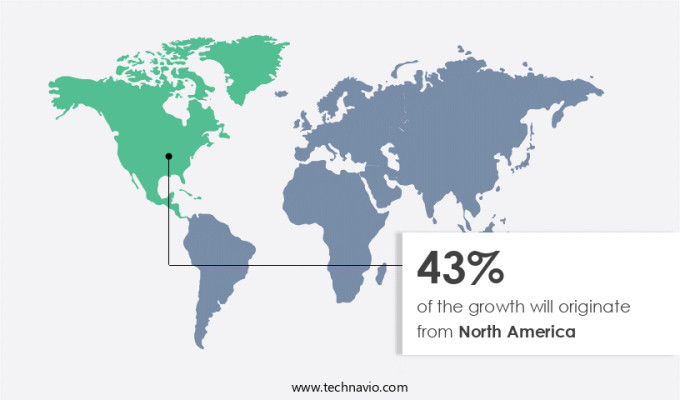

- North America is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds significant importance in the global industry due to the high prevalence of chronic diseases in the region. In the United States alone, over 130 million people had at least one major chronic condition in 2023, including heart disease, cancer, diabetes, obesity, and hypertension. These conditions are among the leading causes of death, necessitating advanced diagnostic and therapeutic solutions. In Canada, nearly half of adults aged 20 and above had at least one common chronic condition, further emphasizing the demand for effective healthcare interventions. RNA-based vaccines and disease management applications are key drivers for the market's growth. Purity, extraction reproducibility, nucleic acid isolation, extraction efficiency, yield, and cost are crucial factors influencing market trends. The market caters to research applications, ensuring the production of high-quality RNA for various downstream processes.

Market Dynamics

Our RNA extraction and purification market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the RNA Extraction And Purification Market?

Rising prevalence of chronic and infectious diseases is the key driver of the market.

- The market is experiencing significant growth due to the increasing prevalence of chronic and infectious diseases, such as cancer, HIV, hepatitis, and influenza. With the rising burden of these diseases, there is a growing need for advanced molecular testing, which heavily relies on high-quality RNA extraction. In fact, cancer alone is projected to have 35 million new cases by 2050, highlighting the urgent demand for effective diagnostic tools and treatments. RNA-based vaccines and disease management are major applications driving market growth. The development of RNA-based vaccines, such as mRNA vaccines for COVID-19, underscores the importance of RNA extraction and purification for disease prevention.

- Additionally, RNA extraction is crucial for disease management through gene expression analysis, protein translation, biomarker discovery, and molecular diagnostics. The market is also influenced by advancements in technology, such as next-generation sequencing (NGS), microfluidic devices, and automation solutions. These advancements improve extraction efficiency, purity, and yield while reducing extraction time and cost. However, challenges such as RNA degradation, extraction optimization, and validation remain critical for market development. RNA extraction and purification are essential for various research applications, including academic research, biopharmaceutical research, and biotechnology applications. High-quality RNA is necessary for applications like transcript production, protein binding assays, single-cell analysis, forensic science, microbial identification, genomic analysis, and pathogen detection.

What are the market trends shaping the RNA Extraction And Purification Market?

The introduction of new products is the upcoming trend in the market.

- The market is experiencing substantial growth due to the increasing demand for high-quality RNA in disease treatment and research applications. RNA-based vaccines and disease management require purified RNA for effective treatment and diagnosis. The need for purity, extraction reproducibility, and yield in nucleic acid isolation is driving the market. New trends in extraction development and standardization, such as automation and solution-based protocols, are addressing these requirements. Extraction efficiency, cost, and validation are crucial factors influencing market growth.

- Furthermore, RNA extraction and purification play a vital role in gene expression analysis, protein translation, biomarker discovery, microbial identification, genomic analysis, pathogen detection, and clinical diagnostics. The biotechnology industry, pharmaceutical development, next-generation sequencing, and academic research are significant end-users of RNA extraction kits and DNA extraction kits. Market potential is high due to the increasing stability of RNA and the potential for precision medicine, molecular diagnostics, and forensic science applications. However, degradation during extraction remains a challenge, necessitating ongoing research and optimization.

What challenges does the RNA Extraction And Purification Market face during the growth?

The complexity of sample types is a key challenge affecting the industry's growth.

- The market faces complexities due to the diverse range of biological samples, each with unique characteristics that require specialized RNA isolation methods. Blood, tissues, and biofluids present distinct challenges, with tissue samples, in particular, requiring optimized protocols to efficiently extract and purify mRNA, microRNA, and long non-coding RNA. Hard-to-digest tissues, such as muscle and adipose, necessitate tailored approaches, while formalin-fixed paraffin-embedded (FFPE) tissues, commonly utilized in clinical research, pose additional difficulties due to cross-linking, which can hinder RNA recovery and integrity. In the realm of disease treatment and management, RNA-based vaccines and gene expression analysis are driving the demand for high-quality RNA extraction and purification.

- Nucleic acid isolation and purification play a crucial role in research applications, including academic research, biopharmaceutical research, and biotechnology applications. The development and standardization of RNA extraction methods, reagents, and automation solutions are essential for ensuring extraction efficiency, purity, and yield. RNA extraction trends focus on minimizing degradation, optimizing extraction time, and improving extraction validation. Extraction methods, such as guanidinium hydrochloride lysis, protein purification techniques, and microfluidic devices, are being explored to enhance extraction efficiency and reduce extraction cost. High-throughput solution-based protocols and transcript production are also gaining popularity in the market. The market holds significant potential in disease prevention, precision medicine, molecular diagnostics, and next-generation sequencing (NGS).

- Applications in cancer diagnostics, viral load testing, genetic screening, and forensic science are driving market growth. Market players focus on developing RNA isolation kits, DNA extraction kits, and NGS solutions to cater to the increasing demand for RNA extraction and purification in various industries. Ensuring RNA extraction yield, stability, and integrity number (RIN) is crucial for downstream applications, such as protein translation, biomarker discovery, and protein binding assays. Single-cell analysis, clinical diagnostics, microbial identification, genomic analysis, and pathogen detection are some of the key applications of RNA extraction and purification. Lab automation solutions, such as extraction kits and validation protocols, are being adopted to streamline the RNA extraction process and improve overall extraction quality.

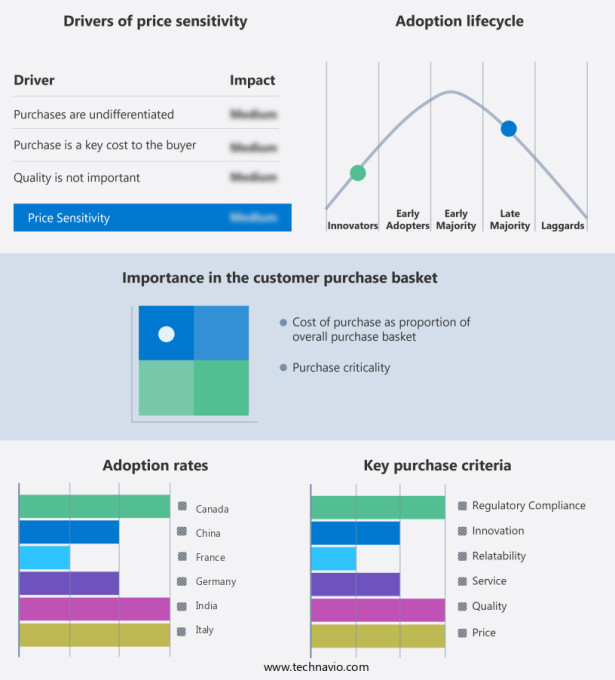

Exclusive Customer Landscape

The RNA extraction and purification market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - The company offers RNA extraction and purification solutions such as Absolutely total RNA purification kits that includes all the reagents needed for DNA-free total RNA and miRNA isolation.

The RNA extraction and purification market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Bio Rad Laboratories Inc.

- Canvax

- Danaher Corp.

- F. Hoffmann La Roche Ltd.

- FUJIFILM Wako Pure Chemical Corp.

- Geno Technology Inc.

- HiMedia Laboratories

- Illumina Inc.

- Minerva Biolabs GmbH

- New England Biolabs Inc.

- Norgen Biotek Corp.

- Pathkits

- Promega Corp.

- QIAGEN N.V.

- Sigma Aldrich Chemicals Pvt. Ltd.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Vazyme International LLC

- Zymo Research Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market holds significant importance in the realm of disease treatment and research. This process plays a pivotal role in the isolation and purification of RNA from various sources, enabling further analysis and application in various fields. RNA, a crucial component of genetic material, is essential for protein synthesis and gene expression. The purity, extraction efficiency, and yield of RNA are vital factors in ensuring accurate and reliable results in research applications. In disease treatment, RNA-based vaccines and therapies are increasingly gaining attention, necessitating the need for efficient and high-quality RNA extraction and purification methods. Nucleic acid isolation is a critical step in RNA extraction and purification. The efficiency and consistency of this process are crucial for maintaining the integrity of the RNA molecules. Several extraction methods exist, including protein precipitation, silica-based spin columns, and solution-based protocols. Each method has its advantages and disadvantages, and the choice of method depends on the specific application and sample type.

Extraction cost, time, and reproducibility are essential factors influencing the market dynamics of RNA extraction and purification. The development of automation and standardization in RNA extraction processes has led to increased efficiency and reduced costs. Additionally, the integration of RNA extraction kits and automation solutions in laboratory workflows has streamlined the process and improved reproducibility. The market is witnessing significant growth due to its applications in various fields, including academic research, pharmaceutical development, next-generation sequencing, biotechnology applications, and clinical diagnostics. The increasing demand for high-quality RNA in these areas is driving the market growth. The stability of RNA is a critical factor in its application, especially in the context of disease prevention and treatment.

Further, the development of RNA stabilization methods and the integration of RNA extraction and purification in downstream applications, such as sequencing and gene expression analysis, are key trends in the market. The market is also witnessing the emergence of new technologies, such as microfluidic devices and single-cell analysis, which offer increased sensitivity and specificity in RNA analysis. These technologies are expected to further expand the market potential of RNA extraction and purification. Despite the advancements in RNA extraction and purification methods, challenges remain, including degradation and contamination during the process. The development of new extraction methods and reagents to address these challenges is an ongoing area of research and innovation in the market.

|

RNA Extraction And Purification Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market Growth 2025-2029 |

USD 718.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Germany, China, UK, Japan, France, Canada, South Korea, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.