Road Logistics Market Size 2025-2029

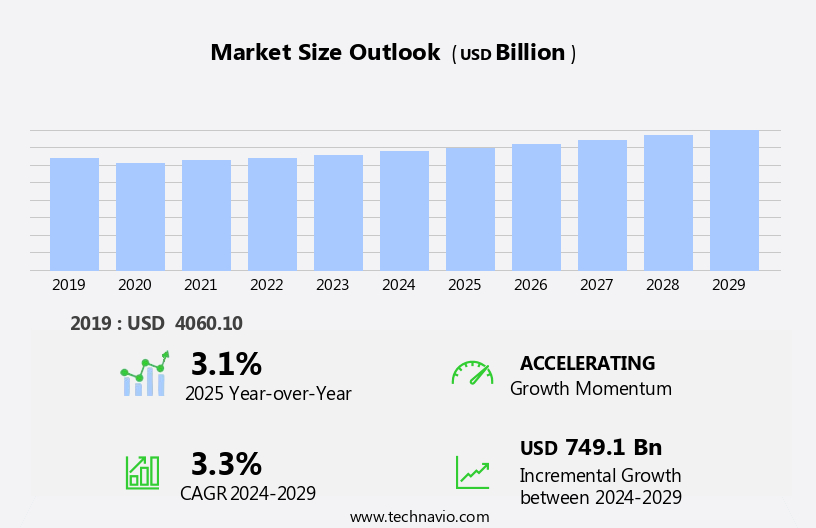

The road logistics market size is forecast to increase by USD 749.1 billion, at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for green logistics solutions and the automation of same-day delivery processes. Companies are prioritizing sustainable practices to reduce their carbon footprint and meet customer expectations for eco-friendly transportation. This trend is particularly prominent in the e-commerce sector, where rapid delivery times are essential. Meanwhile, the pricing dynamics of Less-Than-Truckload (LTL) carriers pose a challenge for market participants. The volatility of fuel prices and increasing operational costs are causing LTL carriers to raise their rates, putting pressure on logistics providers to find cost-effective solutions. To navigate these challenges, logistics companies must focus on optimizing their operations through technology and process improvements.

- This could include implementing route optimization algorithms, investing in automation, and exploring alternative fuel options to reduce transportation costs and improve efficiency. By staying agile and responsive to market trends, companies can capitalize on the opportunities presented by the evolving road logistics landscape.

What will be the Size of the Road Logistics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its applications across various sectors. Carbon footprint and transportation costs remain significant factors, driving the need for sustainability initiatives and supply chain optimization. Specialized transportation, such as LTL (less-than-truckload) and FTL (full-truckload) shipping, adapts to meet the demands of diverse industries. Fuel surcharges and compliance regulations influence carrier selection and freight forwarding decisions, while risk management and shipment tracking are essential for ensuring on-time delivery and maintaining customer satisfaction. The shortage of equipment and driver retention pose challenges, necessitating fleet management and route optimization strategies. Technological advancements, including GPS tracking, autonomous vehicles, data analytics, RFID technology, and digital freight matching, revolutionize the industry, enhancing freight visibility and enabling real-time delivery scheduling.

Cold chain logistics and warehouse automation cater to specific requirements, while network planning and capacity planning ensure efficient operations. Emission reduction and alternative fuels, such as electric vehicles, are gaining traction, reflecting the industry's commitment to sustainability. Performance measurement, contract negotiation, and insurance costs are crucial elements of logistics management. Temperature monitoring, inventory management, and load planning are essential for maintaining product quality and customer trust. In the ever-changing landscape of road logistics, market activities unfold continuously, with evolving patterns shaping the future of the industry. The integration of predictive modeling, blockchain technology, and e-commerce logistics further underscores the market's dynamic nature.

How is this Road Logistics Industry segmented?

The road logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Domestic

- International

- Type

- Truckload

- Less than truckload

- Parcel

- Same day

- End-user

- Manufacturing

- Retail

- Automotive

- Healthcare

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

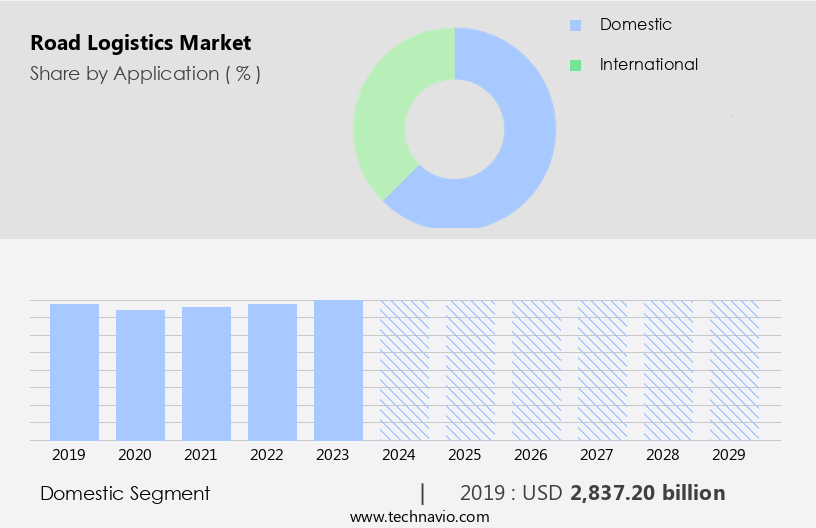

The domestic segment is estimated to witness significant growth during the forecast period.

The market experiences significant developments in 2024, with the domestic segment leading the way due to cost-effectiveness and operational efficiency. Amidst escalating fuel prices and inflation, governments respond by implementing Value-Added Tax (VAT) reductions to alleviate financial burdens. In the courier, parcel, and express sectors, competition intensifies, compelling companies to innovate. To enhance efficiency, they adopt advanced automation in same-day delivery services and invest in digital solutions for freight optimization. The e-commerce sector's growth continues to fuel demand for road logistics, particularly for last-mile deliveries. Major players focus on digital freight matching, real-time tracking, and predictive modeling to streamline operations.

Safety regulations, inventory management, load planning, and compliance with labor laws remain essential considerations. Sustainability initiatives, such as the adoption of electric vehicles (EVs) and alternative fuels, are gaining traction to reduce carbon footprint and transportation costs. The market also faces challenges like driver shortages, capacity planning, and route optimization. Despite these hurdles, the market is expected to continue growing, with a focus on fuel efficiency, performance measurement, and network planning. Additionally, specialized transportation for hazardous materials, temperature-sensitive cargo, and over-dimensional loads remains in demand. The integration of blockchain technology, cargo insurance, and customs brokerage further enhances freight visibility and risk management.

Overall, the market is undergoing transformative changes, driven by technological advancements, e-commerce growth, and the need for more efficient and sustainable supply chain solutions.

The Domestic segment was valued at USD 2837.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

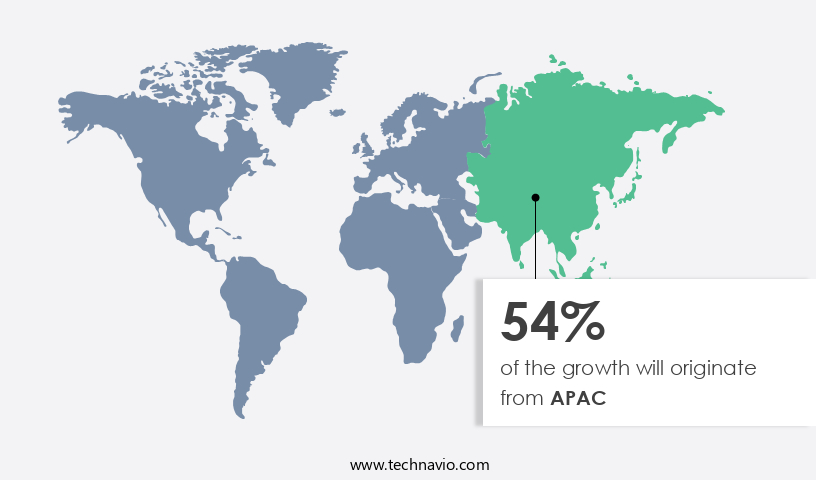

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic world of road logistics, several trends and factors shape the market's activity. On-time delivery remains a top priority, with fuel surcharges influencing overall transportation costs. Reverse logistics gains importance as businesses focus on reducing waste and optimizing supply chains. Safety regulations are a crucial consideration, with logistics management adopting technology to enhance safety and compliance. Sustainability initiatives, such as the use of electric vehicles (EVs) and alternative fuels, are on the rise, driving the shift towards more eco-friendly transportation solutions. Specialized transportation, including less-than-truckload (LTL) and full-truckload (FTL) shipping, caters to various industries' unique requirements.

The handling of hazardous materials necessitates stringent regulations and expertise. Inventory management, load planning, and documentation management are essential components of efficient logistics operations. Predictive modeling and contract negotiation help optimize costs and improve performance measurement. Insurance costs, temperature monitoring, and fleet management are other critical aspects of the road logistics landscape. The shortage of equipment and the increasing adoption of digital technologies like blockchain, GPS tracking, and autonomous vehicles, are shaping the industry's future. Cold chain logistics, e-commerce, and fourth-party logistics (4PL) are emerging sectors, with demand forecasting, real-time tracking, and order fulfillment playing significant roles.

Emission reduction and capacity planning are essential for long-term sustainability, with route optimization and fuel efficiency key to reducing transportation costs. Third-party logistics (3PL) and freight forwarding services help businesses navigate complex logistics networks. Risk management, shipment tracking, and carrier selection are crucial elements of a robust logistics strategy. In the Asia Pacific (APAC) region, the logistics sector continues to thrive, driven by economic growth and increasing consumer purchasing power. The LTL carrier market benefits from industrialization and the need for global raw material and finished goods transportation. E-commerce growth and manufacturing expansion fuel demand for logistics services in developing economies like China, India, and Indonesia.

Despite a slowdown in rental growth, markets like Melbourne and Jakarta remain resilient due to their strategic importance in the global logistics network.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and complex the market, efficient and reliable transportation of goods plays a pivotal role in ensuring business success. From freight forwarders and third-party logistics providers to carriers and shippers, all stakeholders rely on advanced technology and innovative solutions to optimize their operations. Real-time tracking, automated dispatch, and route optimization are essential components of modern road logistics, enhancing productivity and reducing costs. Integrated transportation management systems facilitate seamless coordination between various modes, while secure and compliant cargo handling ensures the safety of goods in transit. Sustainability is a growing concern, with electric and hybrid vehicles, renewable energy, and carbon offsetting initiatives shaping the future of the market. Collaborative networks, predictive analytics, and automation further streamline processes, making the market a vital and evolving sector.

What are the key market drivers leading to the rise in the adoption of Road Logistics Industry?

- The increasing demand for eco-friendly logistics solutions is the primary market catalyst.

- The market is undergoing significant transformations in response to increasing environmental regulations and consumer demand for sustainability. In 2024, companies are adopting green logistics solutions to reduce carbon emissions and enhance operational efficiency. This includes the integration of electric and hydrogen-powered vehicles, AI-driven route optimization, and renewable energy systems. Major players, such as Amazon, Walmart, and Maersk, are investing in sustainable supply chains, integrating eco-friendly practices like electric trucks, hydrogen-powered fleets, and green warehouses. Stricter policies, such as the EU Green Deal and the U.S. Clean Energy Plan, are compelling logistics providers to transition to sustainable practices to avoid penalties and maintain competitiveness.

- Additionally, predictive modeling and network planning are becoming essential for optimizing warehouse space and managing intermodal transportation and shortage of equipment. Insurance costs, temperature monitoring, and over-dimensional cargo continue to be key considerations for logistics providers. Innovations like blockchain technology and performance measurement are also gaining traction for enhancing transparency and efficiency in the industry. Fleet management and warehouse automation are other critical areas of focus to improve operational efficiency and reduce costs. Electric vehicles (EVs) are increasingly being adopted for their environmental benefits and cost savings in the long run. Insurance costs remain a significant concern, with temperature monitoring and cargo insurance being crucial for ensuring the safe transportation of goods.

- The shortage of equipment continues to be a challenge, necessitating effective network planning and fleet management strategies. Overall, the market is evolving to meet the demands of a changing business landscape, with a focus on sustainability, efficiency, and innovation.

What are the market trends shaping the Road Logistics Industry?

- The same-day delivery industry is experiencing a significant trend towards automation. This automation includes the use of drones, robots, and other advanced technologies to streamline delivery processes and ensure swift, efficient service.

- In the logistics industry, the shift towards autonomy is gaining traction, particularly in same-day delivery services. Fueled by rising labor, maintenance, and fuel costs, logistics players are investing in autonomous logistics to maintain profitability. Autonomous logistics offers precise outcomes by minimizing human errors, reducing logistics operation duration by approximately 80-85%. The Internet of Things (IoT) is another innovation revolutionizing the logistics sector. It enables virtual connectivity, streamlining warehouse picking operations. Moreover, advanced technologies like delivery scheduling, demand forecasting, real-time tracking, driver management, load monitoring, capacity planning, route optimization, and freight visibility are transforming the logistics landscape. These technologies enhance operational efficiency, improve delivery time, and boost customer satisfaction.

- Freight consolidation and customs brokerage services are also gaining importance, enabling businesses to save costs and expedite their supply chain processes. Alternative fuels and e-commerce logistics are further shaping the industry, catering to the evolving market demands. Third-party logistics (3PL) providers play a crucial role in the logistics market, offering cost-effective and flexible solutions to businesses. They provide expertise in various areas, including warehousing, transportation, and distribution, ensuring seamless logistics operations. Overall, the logistics market is undergoing significant changes, driven by technological advancements and evolving customer expectations. Logistics players must stay updated with these trends to remain competitive and deliver superior value to their customers.

What challenges does the Road Logistics Industry face during its growth?

- The pricing issue in less-than-truckload (LTL) carrier services poses a significant challenge to the industry's growth trajectory.

- The market is experiencing significant challenges and opportunities due to rising transportation costs, increasing demand for logistics services, and a shortage of qualified drivers. LTL carriers face escalating fuel expenses, which can impact their fuel surcharge revenues and profitability. This fuel price volatility is a major concern for LTL carriers, as they invest heavily in trucks, drivers, and facilities. Last-mile delivery operations pose another challenge for LTL carriers, requiring them to maintain profitability while ensuring transparency and improving delivery efficiency. Long-distance freight transportation, such as seaways, railways, and roadways, remains a cost-effective solution for bulk shipping. To mitigate risks and improve operational efficiency, LTL carriers are adopting technologies like carbon footprint reduction strategies, GPS tracking, RFID technology, digital freight matching, and cold chain logistics.

- Autonomous vehicles and data analytics are also gaining traction in the industry. Carrier selection and risk management are crucial for LTL carriers, as they navigate the complex logistics landscape. Shipment tracking and order fulfillment are essential components of delivering a seamless customer experience. Overall, the market is evolving to meet the demands of a rapidly changing business environment.

Exclusive Customer Landscape

The road logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the road logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, road logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acme Truck Line Inc. - As a seasoned research analyst, I specialize in optimizing logistics solutions, including expedited freight and third-party logistics management. By leveraging innovative strategies and industry insights, I enhance supply chain efficiency and boost operational performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme Truck Line Inc.

- Agility Public Warehousing Co. K.S.C.P

- ArcBest Corp.

- Bennett International Group LLC

- C H Robinson Worldwide Inc.

- Deutsche Post AG

- FedEx Corp.

- J B Hunt Transport Services Inc.

- Knight Swift Transportation Holdings Inc.

- Kuehne Nagel Management AG

- Penske Corp.

- Quantix SCS Inc.

- RD Logistics

- Ryder System Inc.

- Saltchuk

- Schneider National Inc.

- United Parcel Service Inc.

- Werner Enterprises Inc.

- XPO Inc.

- Yellow Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Road Logistics Market

- In January 2024, DHL Supply Chain, a leading global logistics provider, announced the launch of its new Road Logistics Control Tower in Europe. This innovation aimed to optimize road freight operations by providing real-time visibility and control over shipments, reducing transportation costs, and enhancing delivery reliability (DHL Press Release).

- In March 2024, Kuehne + Nagel, the international freight forwarding company, entered into a strategic partnership with Tesla to deploy electric trucks for its road logistics operations. This collaboration was a significant step towards reducing carbon emissions and improving sustainability in the logistics industry (Kuehne + Nagel Press Release).

- In May 2024, C.H. Robinson, a prominent global provider of multimodal logistics services, acquired Transplace, a leading transportation management services and logistics technology firm. This acquisition strengthened C.H. Robinson's technology capabilities and expanded its North American presence (C.H. Robinson Press Release).

- In April 2025, the European Union approved the Connecting Europe Facility (CEF) funding for the development of the Trans-European Transport Network (TEN-T). This â¬7.5 billion investment will significantly improve the road logistics infrastructure, enhancing the competitiveness of European businesses and reducing transportation costs (European Commission Press Release).

Research Analyst Overview

- The market is experiencing significant evolution, driven by the integration of technology and a heightened focus on sustainability and supply chain resilience. Equipment maintenance, including corrective and preventive measures, is being optimized through digital transportation management systems. These platforms facilitate load board usage, enabling real-time freight matching and efficient network design. Green logistics is gaining traction, with eco-friendly transportation solutions such as hydrogen fuel cells and electric trucks becoming increasingly popular. Regulatory compliance software and sustainability reporting tools are essential for companies seeking to mitigate risk and enhance their environmental reputation. Logistics consulting services, vehicle maintenance, and driver training are crucial components of a robust logistics strategy.

- Route planning software, shipment optimization, and inventory optimization further streamline operations, while cargo and data security measures ensure the protection of valuable assets. Fraud prevention, disaster recovery planning, and theft prevention are essential for maintaining supply chain visibility and transportation safety management. Logistics platforms also offer trailer tracking and security measures to mitigate risks and improve overall efficiency. Demand planning and transportation planning software enable accurate forecasting and effective capacity utilization. Maintenance management systems and transportation management software further optimize operations, reducing downtime and enhancing overall productivity.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Road Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 749.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, China, Japan, Canada, India, Australia, Germany, France, Italy, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Road Logistics Market Research and Growth Report?

- CAGR of the Road Logistics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the road logistics market growth of industry companies

We can help! Our analysts can customize this road logistics market research report to meet your requirements.