Rum Market Size 2025-2029

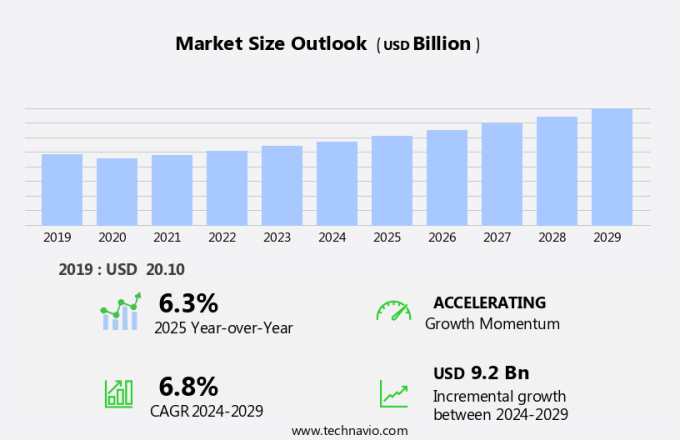

The rum market size is forecast to increase by USD 9.2 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. One of the primary drivers is the increasing demand for premium varieties of rum, as consumers seek out higher-quality and more authentic options. The market is also experiencing significant growth, driven by the increasing preference for premium quality spirits among consumers. Another trend is the rising sales of rum on e-commerce platforms, which allows for greater convenience and accessibility for consumers. However, the market also faces challenges, including stringent regulations and taxation policies on alcoholic beverage production and distribution. These regulations can increase production costs and limit market growth. Producers must navigate these regulations while also meeting the evolving preferences of consumers for premium and authentic rum offerings.

What will the size of the market be during the forecast period?

- The market has experienced significant growth in recent years, particularly among millennial consumers. This demographic, known for their preference for unique and authentic experiences, has shown a keen interest in spirits, including rum. One of the key drivers of this trend is the increasing popularity of fermented sugarcane molasses, the primary ingredient in rum production. Urban populations, with their higher per capita income, have been at the forefront of this shift. The rise of cocktail culture and product innovation has further fueled consumer interest in rum. The spirits category has seen a rise in diversification, with an increasing number of flavoured rums entering the market.

- Furthermore, the market dynamics of rum are influenced by various factors. Nightclubs, pubs, and bars continue to be significant sales channels, but ecommerce and convenience stores are gaining traction. Out-of-home data, including hotels, restaurants, catering, and cafes, also play a crucial role in rum sales. Retail sales through super- and hypermarkets and ecommerce platforms are expected to dominate the market, offering consumers a wider range of options and convenience. In conclusion, the market is poised for growth, driven by millennial consumers, urban populations, and the increasing popularity of fermented sugarcane molasses. The market dynamics are influenced by various channels, including nightlife establishments, ecommerce, and out-of-home sales. Product innovation, consumer preferences, and the growing market size are expected to further fuel growth in the market.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Gold and dark rum

- White rum

- Spiced rum

- Distribution Channel

- Off trade

- On trade

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Product Insights

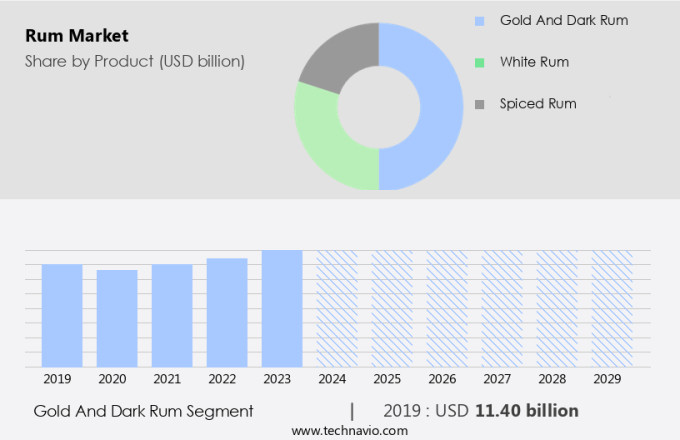

- The gold and dark rum segment is estimated to witness significant growth during the forecast period.

Gold and dark rums are popular varieties in the market, distinguished by their aging process and unique characteristics. Gold rum is produced by aging in oak barrels, resulting in a golden hue and a velvety texture. Dark rum undergoes a longer aging process, leading to a heavier alcohol content and strong flavor. The growing preference for experiential liquor retailing and the on-trade segment, particularly in specialty stores and e-commerce portals, is driving the demand for these premium rums. Additionally, the Bartender Spirits Awards and other industry accolades have highlighted enhanced flavors in gold and dark rums, such as mango Chile and balanced blends.

Furthermore, trade agreements and tariff reductions have further facilitated the growth of this market. The cocktail industry's emphasis on gold and dark rums as key ingredients also contributes significantly to market expansion.

Get a glance at the market report of share of various segments Request Free Sample

The gold and dark rum segment was valued at USD 11.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

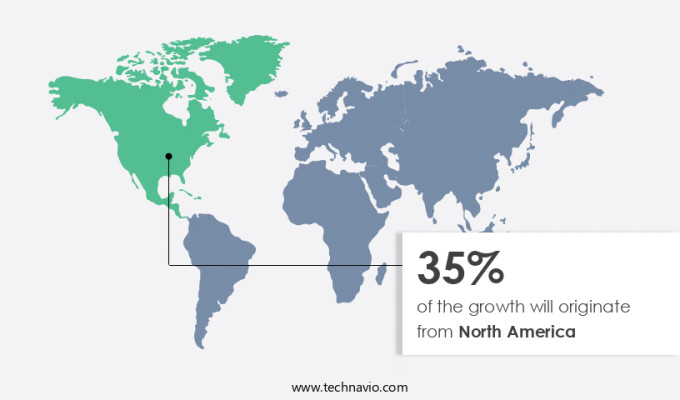

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the US and Canada are two significant markets driving the growth of the regional market. The trend toward premiumization of alcoholic beverages is a major factor fueling rum consumption. Craft distilleries have played a crucial role in market innovation and diversification. Traditional rum-producing countries, such as Puerto Rico and the Dominican Republic, continue to have a large consumer base, but domestic production is increasing. Artisanal, small-batch rums are gaining popularity. Urban populations with rising per capita income are seeking high-quality, flavored rum products. Distribution channels have expanded to include nightclubs, pubs, and bars, catering to diverse consumer preferences. White rum remains a staple, but cocktails, such as mojitos, are driving innovation and growth. The market in North America is poised for continued expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Rum Market?

Growing demand for premium varieties of rum is the key driver of the market.

- The market is experiencing significant growth due to the rising preference of millennial consumers for premium, matured, and high-quality rums. Sugarcane juice and fermented sugarcane molasses are the primary ingredients in the production of this spirit, which is popular in nightclubs, pubs, and bars among the urban population. The per capita income of this demographic group has increased, allowing them to explore new product releases and experiment with flavored rums such as coconut, pineapple, and mango. Competition in the rum industry is intense, with strategic initiatives like mergers and acquisitions, investments, and consumer interest driving product innovation and diversification.

- White rum, a staple in cocktails like mojitos and daiquiris, continues to dominate the market, but mixology and the cocktail culture have led to the rise of flavored rum. The aging process enhances the flavors and texture of rum, resulting in velvety and enhanced tastes. Small-scale and artisan producers are gaining popularity, offering smooth flavor and premium quality with a genuine taste. Country of origin, age, and organic certifications are essential factors for consumers when choosing rum. The Kraken Rum, Black Spiced Rum, Takamaka Rum, and Seychelles Series are among the popular brands. Retail channels such as liquor stores, specialty stores, e-commerce portals, and the on-trade segment are the primary distribution channels for rum.

What are the market trends shaping the Rum Market?

Increasing sales of rum on e-commerce platforms is the upcoming trend in the market.

- The market is witnessing significant growth in the urban population, particularly among Millennial consumers, who are driving the demand for flavored rum and innovative cocktail recipes. Sugarcane juice and fermented sugarcane molasses form the base for this spirit, which is then aged and distilled to create a smooth flavor and premium quality. White Rum is a popular choice for cocktails such as Mojitos and Daiquiris, while flavored varieties like Coconut, Pineapple, and Mango add to the product innovation and consumer interest. Competition in the market is intense, with strategic initiatives such as new product releases, mergers and acquisitions, and investments shaping the landscape.

- Several brands have gained popularity, while artisan producers and small-scale distilleries are also making a mark with their genuine taste and country of origin. Consumer preferences for organic certifications and age statements are also influencing the market. The distribution channels for rum have expanded beyond traditional retail sales in liquor stores and specialty stores to include the on-trade segment, such as nightclubs, pubs, and bars, as well as e-commerce portals. The aging process and enhanced flavors add to the velvety texture and experiential appeal of rum, making it a preferred choice for consumers looking for variety and innovation.

What challenges does Rum Market face during the growth?

Stringent regulations and taxation policies on alcoholic beverage production and distribution is a key challenge affecting the market growth.

- In the dynamic market, millennial consumers' preferences and urban population growth significantly influence the industry. Sugarcane juice and fermented sugarcane molasses form the base of this spirit, which is further distilled to create various types, such as White Rum, Flavored Rum, and Overproof. Cocktail culture, with popular drinks like Mojitos, Daiquiris, and cocktail recipes, fuels the demand for this beverage. Product innovation, diversification, and consumer preferences drive strategic initiatives, including new product releases, mergers and acquisitions, and investments. Competition among brands, such as The Kraken Rum, Black Spiced Rum, and Takamaka Rum, intensifies, with product innovation and experiential liquor retailing being key differentiators.

- The aging process, which enhances flavors and texture, is a crucial aspect of rum production. Consumers' increasing interest in premium quality and genuine taste, driven by the craft rum and artisan producer movement, further propels the market. Country of origin and organic certifications also influence consumer choices. The distribution channels, including retail sales in super- and hypermarkets, eCommerce, convenience stores, on-trade segment, and liquor stores, cater to various consumer segments. Trade agreements and tariff reductions impact the market dynamics, with Proximo Spirits, for instance, expanding its presence in the Seychelles Series with Rum Blanc and Zannannan (Pineapple) Dark Spiced.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Asahi Group Holdings Ltd. - The company offers rum such as captain jack, a beer flavored with rum.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asahi Group Holdings Ltd.

- Atom Supplies Ltd.

- Bacardi and Co Ltd

- Cayman Spirits Co

- Davide Campari-Milano N.V.

- Demerara Distillers Ltd.

- Diageo PLC

- LYON RUM Windon Distilling

- Maine Craft Distilling

- Mohan Meakin Ltd.

- Nova Scotia Spirit Co

- Pernod Ricard SA

- Suntory Holdings Ltd.

- Tanduay Distillers Inc.

- The Edrington Group Ltd.

- Tobacco Barn Distillery LLC

- Westerhall Estate Ltd.

- William Grant and Sons Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by various factors that shape consumer preferences and industry trends. This analysis delves into the market's intricacies, focusing on key aspects such as consumer demographics, product offerings, distribution channels, and competition. The urban population's growing interest in premium beverages, particularly among millennial consumers, has significantly influenced the market. These consumers are drawn to smooth flavor profiles, genuine taste, and the country of origin's authenticity. The Kraken Rum, for instance, has gained a strong foothold in the market with its distinctive taste and packaging. Small-scale and artisan producers have capitalized on this trend, offering craft rum with unique characteristics and a focus on organic certifications.

Furthermore, product innovation and diversification are essential strategies for rum brands to capture consumer attention. Flavored rum varieties, such as those infused with coconut, pineapple, mango, and Chile, have gained popularity in various social establishments, including nightclubs, pubs, and bars. Cocktail culture, with its focus on mixology and signature cocktails like mojitos and daiquiris, has further fueled the demand for these products. Competition in the market remains intense, with strategic initiatives such as new product releases, mergers and acquisitions, and investments shaping the competitive landscape. Proximo Spirits' acquisition of The Kraken Rum, for instance, expanded its portfolio and strengthened its presence in the dark spiced rum segment.

Similarly, Takamaka Rum's Seychelles Series and Ocho, Cuatro, and Diez offerings from Mexico showcase the importance of product differentiation and quality. Consumer preferences for rum continue to evolve, with a growing interest in enhanced flavors and velvety textures. the Alcohol and Tobacco Tax and Trade Bureau (TTB) regulates the labeling, production, and promotion of alcoholic beverages like rum. The aging process plays a crucial role in developing these characteristics, making it a critical factor for producers and consumers alike. The Bartender Spirits Awards, for example, recognize the importance of quality and innovation in the rum industry. Market dynamics are influenced by various factors, including out-of-home data, trade agreements, and tariff reductions. Supermarkets, liquor stores, specialty stores, e-commerce portals, and the on-trade segment are essential distribution channels for rum brands.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market Growth 2025-2029 |

USD 9.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, UK, Japan, China, India, Canada, Germany, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch