What is the Safety Goggles And Glasses Market Size ?

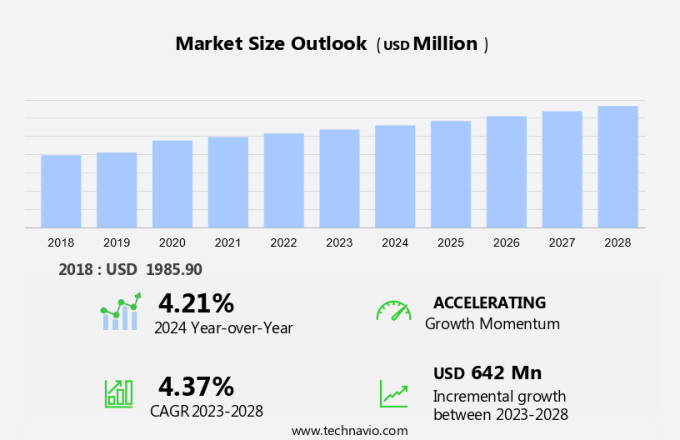

The safety goggles and glasses market size is forecast to increase by USD 642 million and is estimated to grow at a CAGR of 4.37% between 2023 and 2028. In response to the rising number of industrial accidents and fatalities, particularly in labor-intensive sectors worldwide, there is a growing emphasis on industrial safety measures. This trend is driven by increasing awareness of the importance of workplace safety, spurred on by onsite training and smart education programs. Companies are investing in advanced safety technologies, such as automated machinery and safety sensors, to minimize risks and protect their workforce. Additionally, regulatory bodies are enforcing stricter safety standards, holding employers accountable for providing a safe working environment. By prioritizing industrial safety, organizations can not only reduce the risk of accidents and fatalities but also improve overall productivity and employee morale.

Request Free Safety Goggles And Glasses Market Sample

Market Segment

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type Outlook

- Safety glasses

- Safety goggles

- End-user Outlook

- Oil and gas

- Manufacturing

- Construction

- Healthcare

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

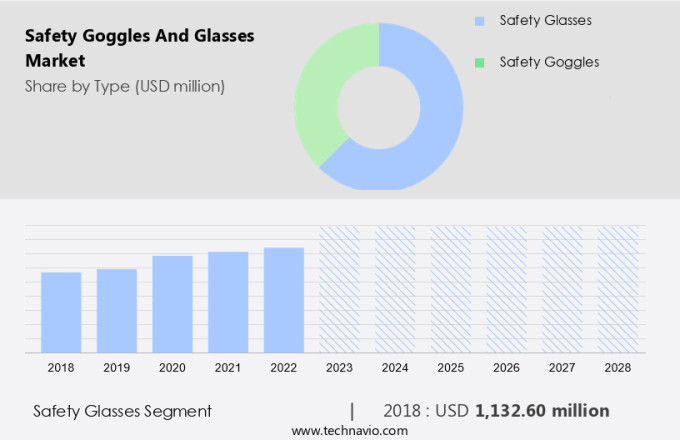

Which is the Largest Segment Driving Market Growth?

The safety glasses segment is estimated to witness significant growth during the forecast period. The market encompasses a wide range of products designed to protect the eyes from various workplace hazards and outdoor conditions. In industries such as construction, manufacturing, oil and gas, mining, and military, safety glasses are essential for preventing vision loss and limb harm caused by flying debris, harmful chemicals, infectious agents, and harmful radiation.

Get a glance at the market share of various regions Download the PDF Sample

The safety glasses segment was the largest segment and valued at USD 1.13 billion in 2018. Employers and employees rely on these protective eyewear solutions to safeguard against eye injuries, including impact resistance against projectiles and protection against UV rays, glare, blue light, and LED lighting. Regulatory bodies like the Occupational Safety and Health Administration (OSHA) and the US Environmental Protection Agency (EPA) enforce stringent testing and certification requirements for safety glasses, ensuring their effectiveness against various hazards. Hence, such factors are fuelling the growth of this segment during the forecast period.

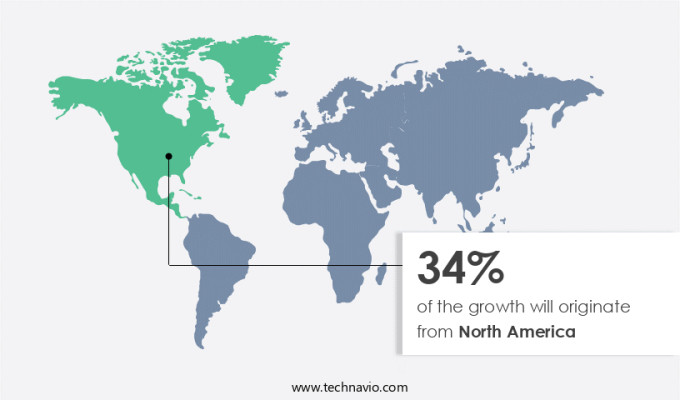

Which Region is Leading the Market?

For more insights on the market share of various regions Request Free Sample

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In the realm of workplace safety, construction sites pose significant risks to employees' eye health. Eye injuries, including vision loss, eye wounds, and harm from flying debris, chemicals, infectious agents, and harmful radiation, are common hazards. To mitigate these risks, employers invest in safety goggles and glasses. These eyewear solutions are essential for ensuring optical clarity, distortion-free vision, impact resistance, and UV protection. Polycarbonate and Trivex lenses are popular choices due to their lightweight, shatter-resistant properties. Additionally, advanced lens technologies cater to various industries, such as sports, recreation, fashion, military, and consumer product divisions. Hence, such factors are driving the market in North America during the forecast period.

How Technavio's company ranking index and market positioning comes to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co: The company offers safety goggles and glasses such as 3M SecureFit SF615SGAF Clear Scotchgard Anti fog Lens plus 1.5 Diopter 20 ea or case, 3M Solus Replacement Strap 10 ea or bag, and others.

Technavio provides ranking index for the top 20 companies along with insights on market positioning of:

- 3M Co.

- Bolle Safety AU Pty Ltd.

- Eagle Eyes Optics

- Gateway Safety Inc.

- Globus Shetland Ltd.

- Honeywell International Inc.

- Hultafors Group AB

- JSP Ltd.

- Kimberly Clark Corp.

- MCR Safety

- Medop SA

- Performance Fabrics Inc. DBA HexArmor

- Protective Industrial Products Inc.

- Pyramex Safety Products LLC

- Radians Inc.

- Tata Sons Pvt. Ltd.

- Udyogi International Pvt. Ltd.

- UVEX WINTER HOLDING GmbH and Co. KG

- Vision Rx Lab

- Vuzix Corp.

Explore our company rankings and market positioning Request Free Sample

How can Technavio Assist you in Making Critical Decisions?

What is the market structure and year-over-year growth of the Safety Goggles And Glasses Market?

|

Market structure |

Fragmented |

|

YoY growth 2023-2024 |

4.21 |

Market Dynamic

The market encompasses protective eyeglasses and goggles designed to shield the eyes from various hazards. This market caters to diverse industries and individuals, addressing concerns related to eye injuries from flying debris, chemicals, infectious agents, and harmful radiation. The growing awareness of workplace safety and the increasing prevalence of physical health issues such as dry eyes, sleep difficulties, chronic fatigue, and digital dementia caused by prolonged smartphone use and exposure to LED lighting, UV lamps rays, glare, and blue light have fueled market growth. Smart eyeglasses, a segment of the Safety Eye Wear market, offer additional features like cameras and connectivity, catering to both personal and professional needs. Materials like polycarbonate and Trivex ensure durability and impact resistance. The market is driven by the increasing demand for protective eyewear across various sectors, including manufacturing, construction, healthcare, and education. Employees in these industries are at a higher risk of eye injuries, making safety eyewear a crucial investment for employers and employees alike. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What is the Primary Factor Driving Market Growth?

Rising industrial safety measures is notably driving market growth. The market for safety goggles and glasses is witnessing significant growth due to the increasing usage of smartphones and other digital devices, leading to an upward trend in vision-related issues. Moreover, these reports emphasize the importance of safety eyewear in protecting the eyes from harmful blue light emitted by digital devices and other hazardous elements in industrial settings. Thus, such factors are driving the growth of the market during the forecast period.

What is the Significant Trends being Witnessed in the Market?

Increasing focus on acquisitions by market vendors is the key trend in the market. The market for safety goggles and glasses is witnessing significant growth due to the increasing usage of smartphones and other digital devices, leading to a higher demand for eye protection. Moreover, these reports emphasize the importance of safety goggles and glasses in protecting the eyes from harmful blue light emitted by digital devices, as well as from other hazards in industrial and construction settings. Thus, such trends will shape the growth of the market during the forecast period.

What is the Major Market Challenge?

Poor or inadequate implementation of workplace safety norms is the major challenge that affects the growth of the market. The Safety Goggles and Glasses market is witnessing significant growth due to the increasing usage of smartphones and other digital devices, leading to an upward trend in vision-related concerns.

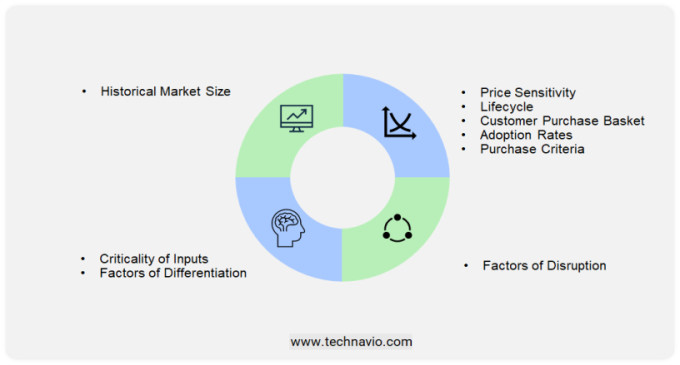

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

Protecting Human Eyes from Digital Dementia, Physical Hazards, and Infectious Diseases Safety eye wear, a crucial component of protective gear, plays a vital role in safeguarding the health of the human eyes. With the increasing usage of digital devices, issues such as dry eyes, sleep difficulties, and chronic fatigue have become common. Moreover, prolonged exposure to solid particles, radiation, and infectious diseases in various industries poses significant risks. Protective eyewear, including safety goggles and smart eyeglasses, is essential for professionals, contract workers, engineers, technicians, scientists, academicians, and artisans dealing with combustible, corrosive, carcinogenic, or irritating chemicals. These industries include construction, manufacturing, healthcare, and research. The market for safety eyewear is driven by the growing awareness of eye health and safety rules, as well as legal sanctions. The non-prescription market for safety eye wear is expected to grow significantly due to the increasing number of people working in hazardous environments. Smart eyeglasses, which offer features like vision enhancement and real-time notifications, are gaining popularity in both personal and professional use. However, the high cost of these advanced eyewear may limit their widespread adoption. Safety rules and regular

tions mandate the use of protective eyewear in industries dealing with crystalline silica gel, hydrogen sulphide gas, flash fires, and other hazardous substances. Failure to comply with these regulations can result in severe penalties and even blindness. In conclusion, safety eyewear is an essential component of safety gear, protecting the human eyes from digital dementia, physical hazards, and infectious diseases. The market for safety eye wear is expected to grow significantly due to increasing awareness, regulatory requirements, and technological advancements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.37% |

|

Market growth 2024-2028 |

USD 642 million |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Bolle Safety AU Pty Ltd., Eagle Eyes Optics, Gateway Safety Inc., Globus Shetland Ltd., Honeywell International Inc., Hultafors Group AB, JSP Ltd., Kimberly Clark Corp., MCR Safety, Medop SA, Performance Fabrics Inc. DBA HexArmor, Protective Industrial Products Inc., Pyramex Safety Products LLC, Radians Inc., Tata Sons Pvt. Ltd., Udyogi International Pvt. Ltd., UVEX WINTER HOLDING GmbH and Co. KG, Vision Rx Lab, and Vuzix Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies