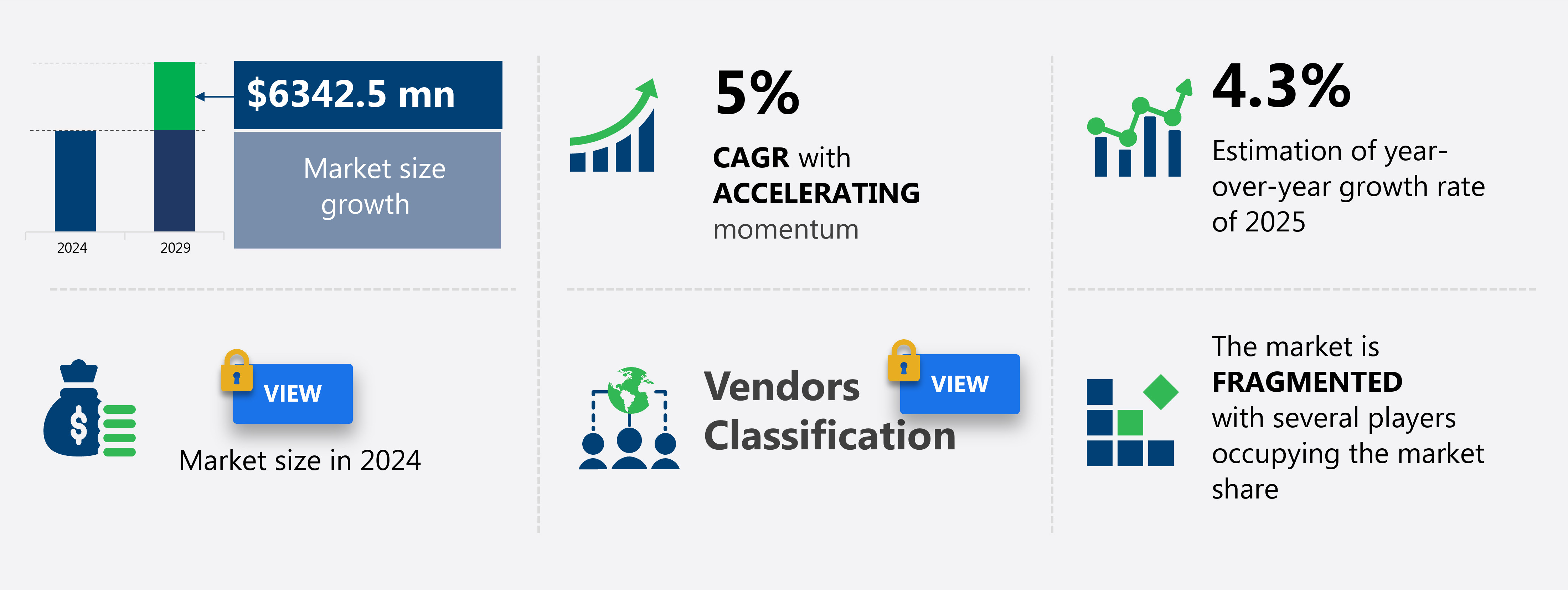

Europe Sandwiches Market Size 2025-2029

The Europe sandwiches market size is forecast to increase by USD 6.34 billion at a CAGR of 5% between 2024 and 2029.

- The European sandwiches market is experiencing robust growth, fueled by the increasing online presence of companies and innovative advertising and marketing campaigns. This digital shift enables greater consumer reach and engagement, allowing businesses to expand their customer base and boost sales. However, market expansion is not without challenges. Regulatory hurdles impact adoption, particularly with regard to food safety and labeling regulations, necessitating stringent compliance measures. Moreover, supply chain inconsistencies temper growth potential, as ensuring a steady flow of quality ingredients remains a significant challenge.

- To capitalize on market opportunities and navigate these challenges effectively, companies must focus on developing robust supply chain strategies and adhering to regulatory requirements. By doing so, they can strengthen their market position and cater to the evolving preferences of health-conscious consumers.

What will be the size of the Europe Sandwiches Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The European sandwich market is a dynamic and evolving industry, with various trends shaping its growth. Research indicates a strong focus on marketing strategies, including sandwich wraps, pairings, and combinations, to cater to diverse consumer preferences (sandwich market research). Sandwich packaging innovations, such as biodegradable materials, are gaining traction due to increasing environmental consciousness (sandwich packaging innovations). Personalization and customization are key trends, with sandwich subscriptions and catering services offering tailored menus based on consumer insights (sandwich consumer insights). Sourcing of high-quality ingredients is crucial, with many players investing in local and sustainable sourcing (sandwich ingredients sourcing). Competition remains fierce, with sandwich competition coming from both traditional players and new entrants, such as food truck sandwiches (sandwich competition).

- Technology advancements, including automation systems, ordering apps, and content marketing, are transforming the industry (sandwich technology advancements, sandwich content marketing). Sandwich trends analysis reveals a growing interest in sandwich platters for corporate events and innovation in sandwich recipes (sandwich platters, sandwich recipes). The industry continues to adapt, with sandwich vending machines and sandwich delivery services expanding the market reach (sandwich vending machines, sandwich delivery services). Brand development is crucial, with many players leveraging sandwich industry events to showcase new products and strategies (sandwich industry events). The future of the European sandwich market is bright, with continued innovation and personalization expected to drive growth.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Channel

- Food service

- Retail

- Supermarkets and Hypermarkets

- Convenience Stores

- Product

- Fresh sandwiches

- Prepackaged sandwiches

- Flavor

- Non-vegetarian

- Vegetarian

- Type

- Meat-Based

- Vegetarian

- Vegan

- Gluten-Free

- End-User

- Household

- Commercial

- Institutional

- Geography

- Europe

- France

- Germany

- Italy

- UK

- Europe

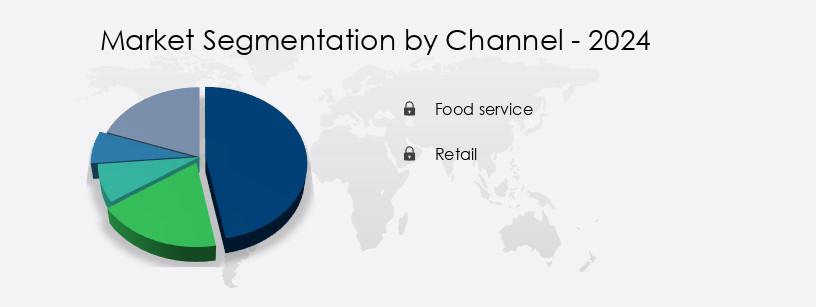

By Channel Insights

The food service segment is estimated to witness significant growth during the forecast period.

The European sandwiches market is experiencing significant growth, driven by evolving consumer preferences and trends. Gluten-free options and seasonal ingredients are increasingly popular, with food labeling playing a crucial role in catering to these preferences. Consumer demand for convenience and value for money has led to pricing strategies that balance affordability and quality. Eating habits have shifted towards mobile ordering, sandwich delivery, and casual dining, with portion control and food safety regulations becoming key concerns. Influencer marketing and social media have influenced consumer choices, driving demand for specialty sandwiches and artisan creations. Food waste reduction and local sourcing are also important considerations for businesses.

Product differentiation through organic, vegan, and vegetarian offerings, as well as healthy and fine dining options, is essential for brand loyalty. The foodservice segment, including fast food, sandwich bars, and kiosks, relies on efficient sandwich making equipment, such as slicing machines, sandwich presses, and toasting ovens, for quality control and cost management. The supply chain must ensure food preservation and food safety, while convenience stores and food processing offer opportunities for expansion. Overall, the European sandwiches market is dynamic and diverse, reflecting the evolving needs and tastes of consumers.

The Food service segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The sandwich market is shaped by multiple operational and consumer-driven factors. The impact of ingredient cost on sandwich pricing directly influences profitability, while optimization of sandwich production line layout supports efficiency. Effectiveness of various food preservation methods and methods for improving the shelf life of sandwiches are critical in reducing spoilage and maintaining product freshness, which is also tied to the impact of distribution network on product freshness. Correlation between packaging and shelf life and the impact of packaging material on product appeal are central to packaging strategy. Consumer behavior insights, such as analysis of consumer preferences for different fillings, factors affecting consumer preference for sandwiches, and measuring customer satisfaction with sandwich offerings, drive development of new sandwich products based on consumer needs. Business performance is refined through evaluation of different marketing strategies on sales, comparison of different pricing strategies on profitability, and analysis of sales data to improve inventory management. Additionally, assessment of supply chain efficiency and cost, strategies for reducing food waste in sandwich production, assessment of allergen management practices effectiveness, and optimization of retail display to enhance sales all contribute to better operational and strategic outcomes.

What are the Europe Sandwiches Market market drivers leading to the rise in adoption of the Industry?

- The significant expansion of companies' online presence serves as the primary catalyst for market growth.

- The European sandwiches market is experiencing significant growth due to the increasing popularity of fresh, convenient, and customizable sandwich options. Mobile ordering and e-commerce platforms are driving sales, allowing consumers to easily purchase sandwiches online from various companies, including brand-owned applications and third-party services like Uber Eats.

- This trend is particularly appealing to the busy and tech-savvy population. Product differentiation is a key factor in the market, with offerings ranging from pre-made sandwiches to artisan and vegan options. Food trends, such as portion control and casual dining, are also influencing the market, leading to innovative sandwich creations and unique flavors.

- companies prioritize supply chain efficiency and effective distribution networks to ensure the freshness and quality of their products. Social media plays a significant role in marketing and promoting these offerings, with many sandwich bars and companies utilizing various platforms to engage with customers and showcase their offerings. Overall, the European sandwiches market is expected to continue growing, driven by consumer demand for fresh, convenient, and customizable sandwich options.

What are the Europe Sandwiches Market market trends shaping the Industry?

- Market trends indicate a heightened focus on sandwich advertising and marketing campaigns. It is essential for businesses in this industry to increase their investment in such efforts to remain competitive.

- In Europe's sandwich market, companies prioritize customer satisfaction by providing allergen information and catering to dietary preferences with healthy, organic, vegetarian, and fine dining options. To ensure food safety and maintain cost control, advanced food processing technologies, such as slicing machines, are employed. Online ordering systems have become essential for convenience and efficiency.

- Food safety regulations are strictly enforced, and companies invest in research and development to meet these standards. The market's growth is driven by the increasing demand for convenient, nutritious meals and the trend towards healthier lifestyles.

- Companies are focusing on innovation, such as introducing new flavors and ingredients, to differentiate themselves and stay competitive. Marketing strategies include social media campaigns and sponsorships to increase brand awareness and customer engagement.

How does Europe Sandwiches Market market faces challenges face during its growth?

- The growth of the food industry is significantly impeded by the health concerns arising from food contamination. This issue, which poses a significant challenge, necessitates rigorous efforts to ensure food safety and maintain consumer trust.

- Sandwiches are a popular food choice in Europe, offering value for money and catering to increasing health consciousness. However, the preparation process involves handling raw or fresh ingredients, increasing the risk of foodborne illnesses. Harmful bacteria such as Listeria, Staphylococcus, Shigella, and Yersinia spp. Can contaminate sandwiches, with human pathogens like S. Aureus also being a concern due to potential bare-handed contact.

- The various fillings, including cheese, chicken, eggs, ham, salad, sauce, and fresh produce, contribute to microbial contamination and have been linked to foodborne illness outbreaks. To mitigate these risks, marketing campaigns emphasize food safety, with brand loyalty often influenced by perceived cleanliness and hygiene practices.

- Sandwich presses, toasting ovens, and sandwich kiosks are commonly used to ensure proper food preservation and quality control. Fast food chains and foodservice providers invest in advanced food preservation techniques and strict quality control measures to minimize the risk of contamination. Food safety regulations are stringently enforced, ensuring that businesses adhere to strict guidelines for food handling, preparation, and storage. In conclusion, the European sandwiches market faces unique challenges due to the potential for microbial contamination.

- To address these challenges, businesses focus on food safety, implementing marketing campaigns that prioritize cleanliness and hygiene practices. Advanced food preservation techniques and quality control measures are also essential to maintaining consumer trust and ensuring the safety and quality of sandwiches.

Exclusive Europe Sandwiches Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 147 Deli

- Aamanns ApS

- AIL GROUP

- Albertsons Companies Inc.

- Allantico Vinaio Italia SRL

- Baltic Bakehouse

- Cafe Santiago

- Charles Sandwiches

- Copperdeli SL

- Forno Roscioli Of Roscioli Pier Luigi and C. SAS

- FRITLAND BVBA

- Greencore Group Plc

- J Sainsbury plc

- Marks and Spencer Group plc

- Maxs Sandwich Shop

- Northern Soul MCR

- Orkla ASA

- PepsiCo Inc.

- Pret A Manger Group

- Restaurant Brands International Inc.

- Tesco Plc

- The Dusty Knuckle

- The Subway Group

- The York Roast Co.

- Toastable

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sandwiches Market In Europe

- In February 2023, Subway, the world's largest sandwich chain, announced the launch of its plant-based Sub of the Month, the Meatball Marinara, across Europe (Subway, 2023). This move reflects the growing trend towards plant-based options in the European sandwiches market, driven by increasing consumer awareness and concern for animal welfare and sustainability.

- In May 2024, Starbucks, the leading coffeehouse chain, entered into a strategic partnership with Dutch sandwich chain, The Dutch Wehkamp, to offer Starbucks' sandwiches and salads in select Wehkamp stores across the Netherlands (Starbucks, 2024). This collaboration aims to expand Starbucks' reach in the European market and cater to the growing demand for convenient food solutions.

- In October 2024, Panera Bread, a major US-based bakery-cafe chain, completed the acquisition of Dutch bakery chain, De Boer, marking its entry into the European market (Panera Bread, 2024). This acquisition not only provides Panera Bread with a strong presence in the European market but also allows it to tap into De Boer's extensive bakery and café network.

- In January 2025, the European Union approved new regulations to reduce sodium levels in sandwiches and other processed foods by 15% by 2025 (European Commission, 2025). This initiative aims to improve public health by reducing the prevalence of diet-related diseases, making it a significant regulatory development for the European sandwiches market.

Research Analyst Overview

The European sandwiches market continues to evolve, reflecting the dynamic nature of consumer preferences and market trends. Values such as health consciousness, convenience, and affordability are driving innovation across various sectors. Seasonal ingredients and food labeling are increasingly important, with consumers seeking transparency and freshness. Pricing strategies and portion control are key considerations for businesses aiming to offer value for money. Frozen sandwiches and pre-made options are gaining popularity due to their convenience, while artisan and specialty sandwiches cater to those seeking unique and authentic experiences. Influencer marketing and social media are influential in shaping consumer perceptions and driving sales.

Food safety and quality control remain top priorities, with regulations and technology playing crucial roles in ensuring customer satisfaction. Sandwich presses, toasting ovens, and other equipment are essential tools for businesses seeking to offer high-quality, fresh sandwiches. Fast food chains and casual dining establishments are adapting to changing consumer demands, with mobile ordering, online delivery, and local sourcing becoming increasingly common. Fine dining establishments offer gourmet sandwiches as part of their menus, while convenience stores and food processing companies cater to those seeking quick and affordable options. Food preservation and sustainability are also important considerations, with businesses exploring ways to reduce food waste and promote eco-friendly practices.

Brand loyalty is a significant factor, with businesses investing in marketing campaigns and customer engagement strategies to build long-term relationships. The ongoing unfolding of market activities and evolving patterns offer opportunities for businesses to differentiate themselves and stay competitive.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sandwiches Market in Europe insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 6.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

Author Bio -

Venkata Krishnan Seshadri, Vice President at Infiniti Research Ltd., brings over 15 years of experience in market research, specializing in strategic insights and growth consulting.

We can help! Our analysts can customize this market research report to meet your requirements Get in touch