Sarcoidosis Therapeutics Market Size 2025-2029

The sarcoidosis therapeutics market size is forecast to increase by USD 88.8 million at a CAGR of 5.1% between 2024 and 2029.

- The market is witnessing significant growth, driven by the rising awareness and diagnosis of this chronic inflammatory disease. The increasing understanding of the disease mechanism and the development of a novel drug pipeline offer promising opportunities for market participants. However, regulatory hurdles impact adoption, as stringent approval processes and high development costs pose challenges for market entrants. Additionally, the increasing competition from generic alternatives erodes market revenues, necessitating strategic pricing and differentiation strategies. Treatment options include surgical procedures and the use of medical devices, such as heart valves and muscle support systems.

- To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on innovative drug development, regulatory compliance, and competitive pricing strategies. By addressing these factors, market players can establish a strong market position and capitalize on the growing demand for effective sarcoidosis treatments. However, high costs associated with these procedures remain a significant challenge for both patients and healthcare systems.

What will be the Size of the Sarcoidosis Therapeutics Market during the forecast period?

- The market is characterized by ongoing research and development in various areas, including targeted therapies, stem cell therapy, and immunomodulatory therapy. The disease burden of sarcoidosis, a chronic inflammatory condition, necessitates continued innovation to address its complexities. The regulatory landscape plays a significant role in market dynamics, with stringent requirements for clinical research, cost-effectiveness analysis, and real-world evidence. Intellectual property protection and patent protection are crucial for market access and investment in R&D. Predictive modeling and machine learning (ML) are increasingly utilized to understand disease progression and personalize treatment plans. Regenerative medicine, gene therapy, and combination therapy are promising avenues for addressing long-term effects.

- Public health initiatives focus on disease surveillance, patient education, and healthcare policy to improve patient outcomes and reduce healthcare costs. Disease modeling and big data analytics help inform healthcare decision-making and improve disease management. Drug delivery systems and drug pricing are key considerations in the market, with a focus on cost-effectiveness and patient access. Clinical trials data and epidemiological studies provide valuable insights into disease prevalence and treatment efficacy. Health economics and health policy are essential for ensuring the sustainability of the market and addressing the needs of patients. Artificial intelligence (AI) and patient support systems are emerging trends, offering opportunities for improved patient care and outcomes.

How is this Sarcoidosis Therapeutics Industry segmented?

The sarcoidosis therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Corticosteroids

- Immunosuppressants

- Others

- Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

- Route Of Administration

- Oral

- Injectable

- Inhalation

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

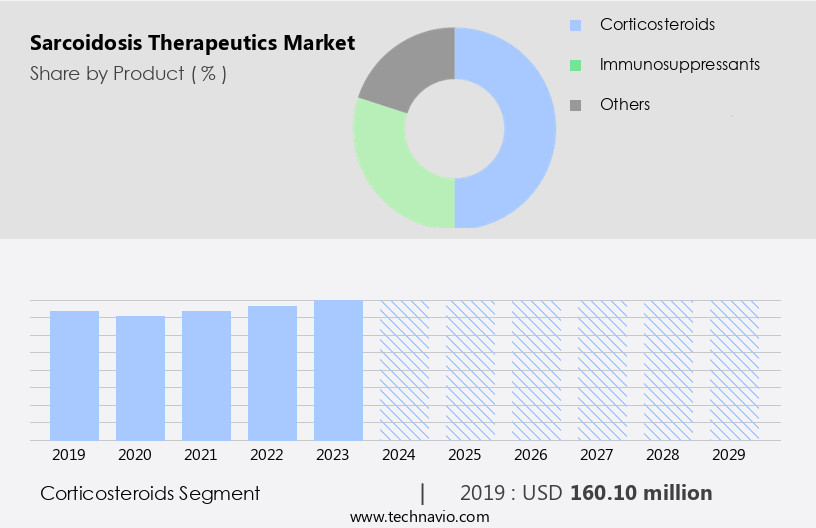

By Product Insights

The corticosteroids segment is estimated to witness significant growth during the forecast period.

Sarcoidosis, an inflammatory disease characterized by the clustering of granulomas in various organs, necessitates effective therapeutic interventions. Imaging techniques like chest X-rays and computed tomography (CT) scans aid in diagnosing sarcoidosis, while genetic testing assists in identifying susceptible individuals. Clinical practice guidelines recommend corticosteroids as the primary treatment due to their anti-inflammatory and immune suppression properties. These medications, such as prednisone, are effective in reducing systemic inflammation and preventing organ damage. Phase 1 trials explore the safety and pharmacokinetics of novel therapeutic agents like anti-IL-17 antibodies, TNF inhibitors, and Jak inhibitors. Support groups offer emotional and informational support to patients, enhancing disease management and improving quality of life.

Phase 2 trials assess the efficacy of these agents in larger patient populations. Patient advocacy and personalized medicine are essential in disease awareness and treatment options. Precision medicine, utilizing genetic information, enhances treatment efficacy and patient management. Disease monitoring and drug safety are crucial aspects of treatment, with clinical trials focusing on drug development and patient outcomes. Anti-inflammatory drugs and immunosuppressants, in addition to corticosteroids, are employed in managing various manifestations of sarcoidosis, including lung, skin, cardiac, and eye involvement.

The Corticosteroids segment was valued at USD 160.10 million in 2019 and showed a gradual increase during the forecast period.

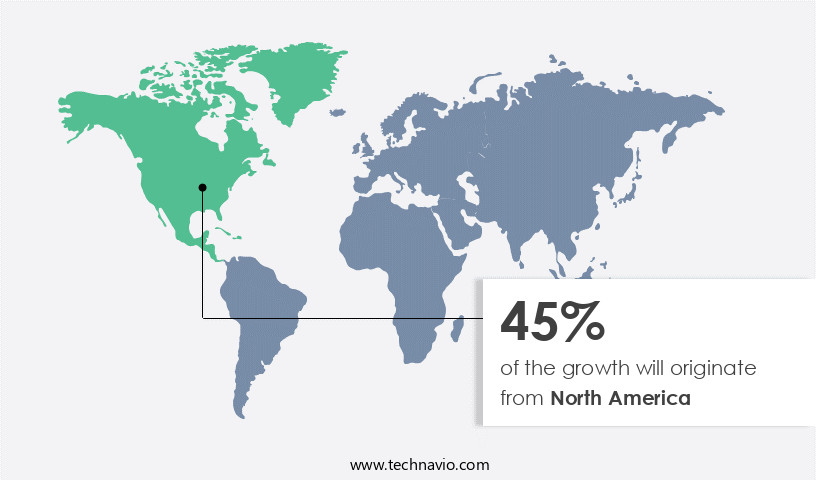

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is currently leading due to increased disease awareness in countries like the US and Canada. Organizations such as the American Lung Association, CHEST Foundation, and the Foundation for Sarcoidosis Research (FSR) are spearheading campaigns like Seek Answers Inspire Results to foster conversations about sarcoidosis. This initiative provides a Sarcoid Five tool, which includes five essential questions for patient-doctor dialogues, as well as opportunities for interaction with healthcare providers and other patients through webinars, online support communities, and research patient conferences. Imaging techniques, such as chest x-rays and computed tomography (CT), play a crucial role in diagnosing sarcoidosis.

In the therapeutic landscape, clinical practice guidelines recommend anti-inflammatory drugs for managing various symptoms. Phase 1 and 2 trials are underway for novel therapeutic agents like TNF inhibitors, JAK inhibitors, and anti-IL-17 antibodies. Genetic testing is also being explored to understand the immune response and personalize treatment options. Patient outcomes and quality of life are significant concerns in disease management. Adverse events and drug safety are essential considerations in drug development. Cardiac and lung sarcoidosis, as well as skin and eye manifestations, require specific treatment guidelines. Disease monitoring and patient management are ongoing processes that involve regular check-ups and clinical trials to assess drug efficacy and patient advocacy.

Healthcare providers play a pivotal role in diagnosing and managing sarcoidosis. Support groups offer valuable resources for patients and caregivers, fostering a sense of community and understanding. Precision medicine and personalized approaches are gaining traction in the therapeutic landscape, with the potential to improve patient outcomes. Phase 3 trials are ongoing to evaluate the safety and efficacy of new therapeutic agents. Patient advocacy organizations are instrumental in driving research and raising awareness about the disease. The market is evolving, with a focus on improving patient outcomes and enhancing disease management.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Sarcoidosis Therapeutics market drivers leading to the rise in the adoption of Industry?

- The significant rise in awareness and understanding of sarcoidosis serves as the primary catalyst for market growth. Sarcoidosis, a rare condition characterized by the formation of small granulomas in various organs, primarily affects the lungs and skin. The cause of this disease remains elusive. Diagnosis is crucial as the symptoms, which can mimic those of other diseases, can be broad and varied. Imaging techniques, such as computed tomography (CT), play a significant role in confirming the diagnosis. Phase 1 and Phase 2 clinical trials are ongoing to evaluate the efficacy of therapeutic agents. Genetic testing may also aid in diagnosis and personalized treatment.

- Cardiac sarcoidosis, a potentially life-threatening complication, requires careful monitoring. Support groups offer valuable resources for patients and their families, providing emotional support and practical advice. The National Heart, Lung and Blood Institute (NHLBI) and other organizations are increasing awareness about sarcoidosis, ensuring timely diagnosis and effective treatment.

What are the Sarcoidosis Therapeutics market trends shaping the Industry?

- The emerging trend in the pharmaceutical industry involves the development of novel drug pipelines, specifically for the treatment of sarcoidosis. This condition warrants continued research and innovation due to its complex and varied clinical manifestations. Sarcoidosis, an inflammatory disease characterized by granuloma formation, currently lacks a definitive cure. While anti-inflammatory and immune suppressants offer some relief, there is a pressing need for more effective and tolerable therapeutic options. Novel therapeutics, such as those targeting the immune response, are gaining attention. For instance, RELIEF THERAPEUTICS is developing aviptadil, which targets vasoactive intestinal peptide receptors. These advanced therapeutics, in the Phase II stage of development, hold promise for improved patient outcomes. However, it is crucial that these molecules demonstrate superior safety and efficacy profiles in future clinical trials.

- The emphasis on personalized medicine and disease management, along with the potential of anti-IL-17 antibodies and TNF inhibitors, further fuels the research and development efforts in the market. Ultimately, the goal is to enhance the quality of life for patients and reduce the burden of adverse events associated with current treatments.

How does Sarcoidosis Therapeutics market faces challenges during its growth?

- The intensifying competition posed by generic alternatives represents a significant challenge to the industry's growth trajectory. Sarcoidosis, an inflammatory disease, affects various organs, including the lungs and skin. Although the exact cause remains unknown, research is ongoing to develop effective treatments. Current treatment guidelines suggest corticosteroids for managing symptoms. However, their long-term use can lead to side effects. Therefore, there is a need for new drug options. The drug development process for sarcoidosis involves preclinical and clinical trials to assess drug efficacy and safety. Phase 3 trials are crucial in determining the safety and efficacy of new drugs in large patient populations. Precision medicine, an emerging approach, aims to develop treatments based on individual patient characteristics, including genetic makeup and disease severity.

- Patient advocacy groups play a vital role in advancing research and raising awareness about sarcoidosis. They provide valuable insights into patient needs and experiences, helping guide drug development efforts. The focus is on creating therapeutic solutions that balance efficacy and minimal side effects. Recent research has led to promising developments in the treatment of sarcoidosis. The emphasis is on creating effective, safe, and patient-centric treatment options. The use of generic drugs, which have the same therapeutic effect as branded medicines, can help reduce costs and increase accessibility to treatments.

Exclusive Customer Landscape

The sarcoidosis therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sarcoidosis therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sarcoidosis therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - The company specializes in the development and commercialization of innovative therapeutics for sarcoidosis.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Amneal Pharmaceuticals Inc.

- Apotex Inc.

- aTyr Pharma Inc.

- Fresenius SE and Co. KGaA

- Hikma Pharmaceuticals Plc

- Jubilant Pharmova Ltd.

- Kyorin Pharmaceutical Co. Ltd.

- Mallinckrodt Plc

- Novartis AG

- OrphAI Therapeutics

- Pfizer Inc.

- RELIEF THERAPEUTICS Holding SA

- Sanofi Aventis US LLC

- SarcoMedUSA Inc.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Xentria Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sarcoidosis Therapeutics Market

- In February 2023, Pfizer Inc. announced the initiation of a global Phase 3 clinical trial for its investigational sarcoidosis therapy, PF-06651600. This potential treatment, an interleukin-12 and interleukin-23 inhibitor, aims to address the inflammatory aspects of the disease (Pfizer Press Release, 2023).

- In October 2022, Insmed Incorporated received approval from the European Commission for the marketing authorization of Arikace for the treatment of adult and pediatric patients with non-tuberculous mycobacterial (NTM) pulmonary disease, a complication often seen in sarcoidosis patients. This expansion of Arikace's indication marks a significant milestone for the company (Insmed Press Release, 2022).

- In July 2021, Roche Holding AG and MorphoSys AG entered into a collaboration to develop and commercialize a new class of therapies for various autoimmune diseases, including sarcoidosis, using MorphoSys's HuCAL antibody technology (Roche Press Release, 2021).

- In March 2020, the U.S. Food and Drug Administration (FDA) granted Orphan Drug Designation to Janssen Research & Development, LLC's investigational therapy, JNJ-4527, for the treatment of systemic sarcoidosis. This designation provides Janssen with various development incentives, including tax credits and seven years of market exclusivity upon approval (Janssen Press Release, 2020).

Research Analyst Overview

The market continues to evolve, driven by ongoing research and development efforts aimed at improving patient outcomes and addressing the complexities of this multisystem disease. Imaging techniques, such as computed tomography (CT) and chest x-rays, play a crucial role in diagnosing and monitoring sarcoidosis, while clinical practice guidelines provide healthcare providers with standardized approaches to patient management. Therapeutic agents, including anti-inflammatory drugs, TNF inhibitors, and anti-IL-17 antibodies, are being explored for their potential to modulate the immune response and mitigate disease progression. Phase 1 and 2 clinical trials are underway to assess the safety, efficacy, and drug interaction profiles of these agents in various forms of sarcoidosis, including lung, skin, cardiac, and eye manifestations.

Personalized medicine and precision medicine approaches are gaining traction, with genetic testing and disease monitoring enabling healthcare providers to tailor treatment options to individual patients. Quality of life remains a key consideration, with patient advocacy groups emphasizing the importance of addressing the physical, emotional, and social aspects of living with sarcoidosis. Drug development continues to unfold, with ongoing phase 3 trials evaluating the safety and efficacy of novel therapeutic agents. Disease awareness and management are essential components of effective treatment, with support groups and patient management programs offering valuable resources for those diagnosed with sarcoidosis.

The market is characterized by its dynamic nature, with ongoing research and development efforts driving the discovery of new treatment options and approaches. The focus on improving patient outcomes, addressing adverse events, and optimizing disease management underscores the importance of continued innovation and collaboration among healthcare providers, researchers, and industry stakeholders.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sarcoidosis Therapeutics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 88.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, Canada, Germany, UK, China, France, Japan, Brazil, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sarcoidosis Therapeutics Market Research and Growth Report?

- CAGR of the Sarcoidosis Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sarcoidosis therapeutics market growth of industry companies

We can help! Our analysts can customize this sarcoidosis therapeutics market research report to meet your requirements.