Self Defense Products Market Size 2025-2029

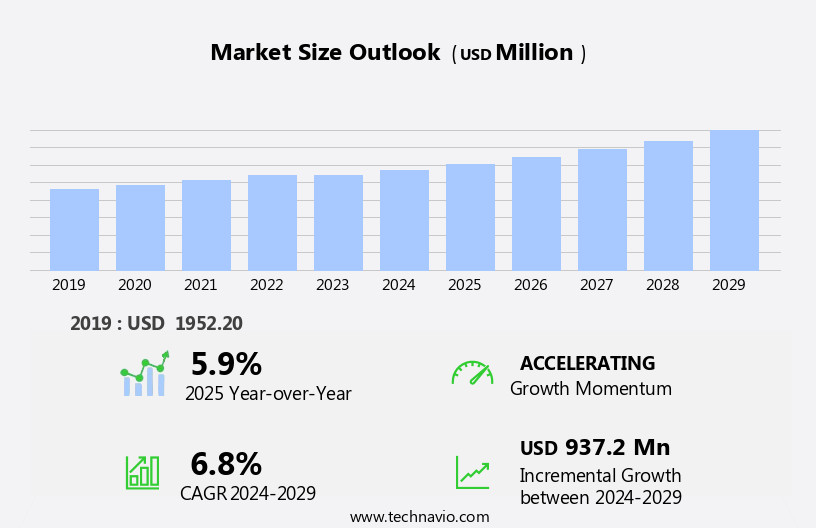

The self defense products market size is forecast to increase by USD 937.2 million, at a CAGR of 6.8% between 2024 and 2029.

- The market is witnessing significant growth, driven by escalating personal safety concerns and increasing government initiatives aimed at ensuring the safety of citizens. This trend is fueled by a heightened awareness of potential threats and the need for effective self-protection solutions. Additionally, innovation and technological advancements in self defense solutions, such as smart personal safety devices and non-lethal weapons, offer lucrative opportunities for companies to differentiate themselves and cater to evolving consumer needs. Plastic components are increasingly being used for various self-defense tools, such as lightweight, durable handles and holsters, contributing to product accessibility and affordability. However, the market faces challenges as well, with the rise of fraudulent and counterfeit self defense products posing a significant threat. These illicit offerings not only undermine the credibility of legitimate players but also put consumers at risk. As such, companies must prioritize product authenticity and invest in robust quality control measures to maintain market trust and differentiate themselves from unscrupulous competitors.

- To capitalize on the market's potential, businesses should focus on innovation, addressing the evolving needs of consumers, and collaborating with regulatory bodies to ensure compliance and consumer safety. By navigating these challenges effectively, companies can seize opportunities in the dynamic market and establish a strong market presence.

What will be the Size of the Self Defense Products Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market trends shaping its application across various sectors. Defensive equipment, such as tactical pens and concealed carry holsters, remain essential for personal safety. Situational awareness is heightened through the use of security cameras and personal alarms, while self defense keychains and motion sensors provide added protection. Non-lethal weapons, including stun guns and pepper spray, offer effective deterrents in potentially threatening situations. Self defense kits and defensive tactics training equip individuals with the necessary skills and tools for self protection. Security guards and access control systems ensure a secure environment for businesses and residential complexes.

Firearms training and emergency response plans are crucial components of comprehensive security strategies. Threat assessment and home security systems provide peace of mind for individuals and families. Self defense techniques, self defense accessories, and self defense supplies are constantly evolving to meet the changing needs of consumers. Anti-aggression devices, knife defense, and self defense weapons offer various levels of protection, while self defense training and security lighting ensure individuals are prepared for potential threats. CCTV systems and surveillance equipment provide valuable insights for threat assessment and response. The ongoing integration of technology into self defense products enhances their effectiveness and accessibility.

Self defense continues to be a priority for individuals and organizations, driving the continuous growth and innovation of this market.

How is this Self Defense Products Industry segmented?

The self defense products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Folding knives

- Tactical gloves

- Pepper sprays

- Stun guns

- Others

- Material

- Metal

- Polymer and plastic

- Chemical-based

- End-user

- Law enforcement

- Civilians

- Security personnel

- Military and defense

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

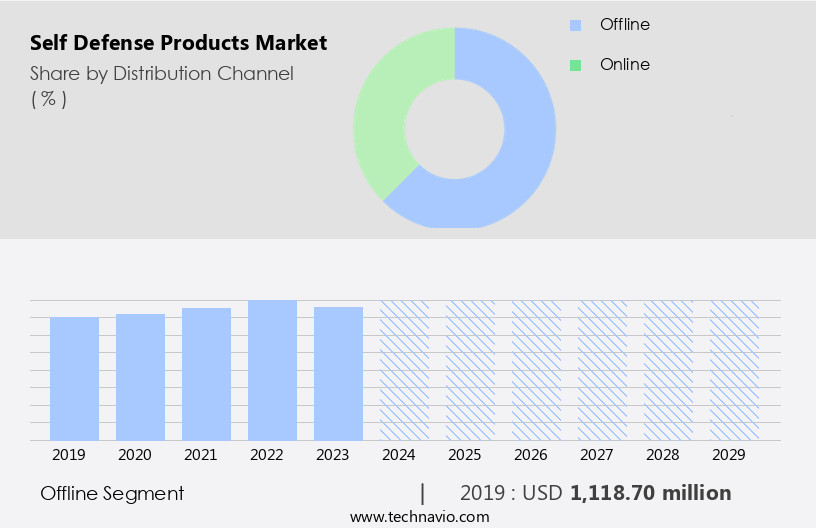

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, the offline distribution channel continues to hold significant influence. Consumers prioritize personal safety and seek tangible, instantly accessible solutions. Brick-and-mortar retailers, such as self defense stores and sporting goods outlets, cater to this demand. These establishments provide expert advice and product demonstrations, instilling confidence in customers. Moreover, local regulations and age restrictions ensure responsible sales of self defense equipment. Self defense products encompass a range of offerings, including pepper spray, stun guns, and personal alarms. Additionally, companies invest in defensive tactics training, security consulting, and emergency response planning. Access control systems, CCTV systems, and situational awareness tools are integral components of comprehensive security solutions.

Self defense techniques, firearms training, and surveillance equipment are essential for both individuals and organizations. Self defense accessories, such as tactical pens, concealed carry holsters, and anti-aggression devices, augment the effectiveness of these measures. Home security systems, defensive equipment, and motion sensors further fortify personal and property protection. Overall, the market remains a vital sector, evolving to meet the ever-changing needs of consumers and businesses alike.

The Offline segment was valued at USD 1118.70 million in 2019 and showed a gradual increase during the forecast period.

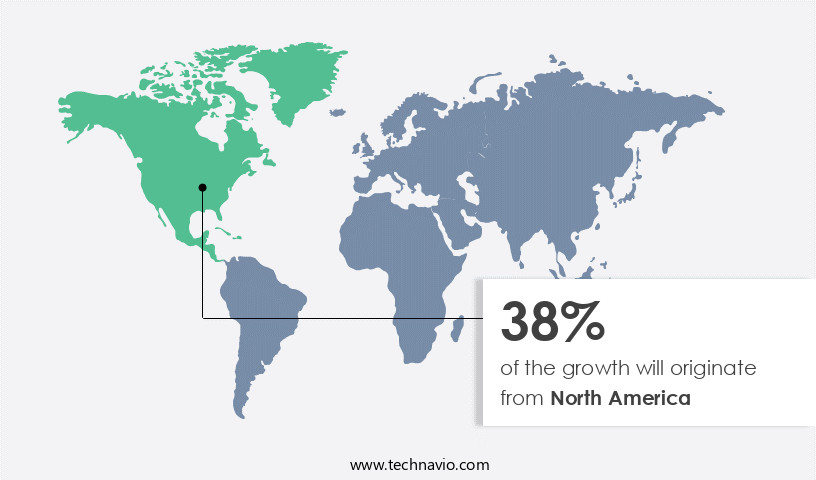

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America has experienced notable growth due to escalating concerns for personal safety and the demand for protective measures. This market comprises a wide array of offerings, such as pepper spray, stun guns, personal alarms, and non-lethal weapons. High-profile incidents and heightened awareness of self defense techniques have significantly contributed to market expansion. In 2024, several market players in North America introduced innovative self defense solutions. For instance, SABRE, a leading global brand in personal safety and self defense products, launched the SABRE 3-in-1 Stun Gun with Personal Alarm and Flashlight in March 2024. Other companies have focused on advanced technologies, including access control systems, CCTV systems, and motion sensors, to enhance security and deter potential threats.

Self defense training, firearms training, and situational awareness courses have also gained popularity, as individuals seek to improve their defensive skills. Self defense kits, concealed carry holsters, and tactical pens have become essential items for personal protection. Overall, the market in North America continues to evolve, offering a diverse range of solutions to meet the growing demand for safety and security.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Self Defense Products Industry?

- The escalating concern for personal safety serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to escalating personal safety concerns and increasing crime rates worldwide. In 2023, the FBI reported a 7% rise in murders in the US, following a similar trend observed in previous years. This upward trend is not limited to large cities but also affects small towns and suburban areas. According to recent statistics, Tijuana, Mexico, had one of the highest murder rates in 2024, with 140 murders per 100,000 people. To mitigate these threats, individuals are investing in various self defense measures. Self defense techniques, firearms training, and self defense accessories are gaining popularity.

- Surveillance equipment, such as CCTV systems and home security systems, are also in high demand. Emergency response plans and threat assessment are crucial components of comprehensive self defense strategies. The market for self defense supplies, including pepper spray, stun guns, and personal alarms, is also witnessing steady growth. The integration of technology in self defense products, such as immersive self defense apps and harmonious self defense systems, further enhances their effectiveness. In conclusion, the increasing crime rates and personal safety concerns are propelling the market forward.

What are the market trends shaping the Self Defense Products Industry?

- The growing concern for citizen safety is driving an upward trend in government initiatives. This trend represents a significant market development in the realm of public security.

- The global market for defensive equipment is witnessing growth due to increasing government initiatives to promote personal safety. In various countries, governments are supporting the use of self defense products to enhance consumer safety, particularly for women and children. For instance, in India, the Ministry of Women and Child Development launched the Women Safety Initiative of Emergency Response Support System (ERSS) in 16 States and union territories (UT), allowing citizens to call a single pan-India number, 112, for emergencies. This initiative recommends the inclusion of a panic button in smartphones, which can be triggered by pressing the power button three times quickly or by dialing 112 from any phone.

- For feature phones, a long press of the touch key 5 or 9 can also activate the emergency response system. Additionally, the 112 India Mobile App, available for free downloading, provides a special SOS feature that alerts registered volunteers in the vicinity for immediate assistance. With the rising awareness about personal safety and the increasing number of government initiatives, the demand for self defense products is expected to increase, driving the growth of the market during the forecast period. Self defense training and the use of self defense weapons, such as pepper spray and stun guns, are also becoming increasingly popular as people seek to protect themselves.

- Motion sensors and other advanced technologies are also being integrated into self defense products to enhance their effectiveness. Overall, the market for defensive equipment is expected to grow significantly due to the increasing concern for personal safety and the support of governments around the world.

What challenges does the Self Defense Products Industry face during its growth?

- The proliferation of fraudulent and counterfeit self-defense products poses a significant challenge to the industry's growth, requiring heightened vigilance and regulatory measures to ensure consumer safety and trust.

- Self defense products have gained significant importance in today's world due to rising crime rates and the increasing need for personal safety. The market for self defense products is diverse, encompassing a range of offerings from non-lethal weapons like tactical pens and concealed carry holsters to security cameras and defensive tactics training. However, the market faces challenges such as the proliferation of counterfeit products. These counterfeits, often sold under private labels at lower prices, can pose a significant risk to consumers.

- Unscrupulous sellers may use false crime statistics or other unethical tactics to promote these products, leading consumers to purchase defective or counterfeit items. Established brands face the challenge of maintaining consumer trust in the face of these practices. Despite these challenges, the market for self defense products continues to grow, driven by the increasing awareness of personal safety and the need for effective security solutions.

Exclusive Customer Landscape

The self defense products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the self defense products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, self defense products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Axon Enterprise Inc. - This company specializes in the provision of advanced self defense solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axon Enterprise Inc.

- Buck Knives Inc.

- Defense Aerosol

- Gerber Gear

- Hesham Industrial Solutions

- Kiehberg

- Mace Security International Inc.

- Oberon Alpha

- SABRE

- Salt Supply LLC

- SHENZHEN MEINOE ELECTRONIC TECHNOLOGY CO. LTD.

- Shyn Sing Enterprise Co. Ltd.

- Unisafe Services

- Victorinox AG

- Zaira Enterprises

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Self Defense Products Market

- In January 2024, Smith & Wesson Brands, Inc., a leading firearms manufacturer, announced the launch of their new line of home security and personal safety products, including pepper spray, stun guns, and home security systems (Smith & Wesson Press Release). This expansion marked their entry into the market beyond their traditional firearms business.

- In March 2024, TASER International, a leading provider of conductive energy weapons and advanced body cameras, entered into a strategic partnership with Amazon to sell its self defense products directly on Amazon's platform (TASER International Press Release). This collaboration aimed to increase TASER's market reach and customer base.

- In May 2024, Guardian Protection Services, a leading provider of security services and self defense products, completed the acquisition of SafeHome Security, a major home security company (Guardian Protection Services Press Release). This acquisition allowed Guardian Protection Services to expand its product offerings and customer base in the residential security market.

- In February 2025, the U.S. Consumer Product Safety Commission approved new safety standards for self defense spray products, requiring manufacturers to include a safety locking mechanism on their pepper spray products to prevent accidental discharge (USCPSC Press Release). This regulatory approval aimed to reduce potential safety hazards associated with self defense sprays.

Research Analyst Overview

- In the dynamic market, businesses prioritize risk assessment and threat mitigation to cater to the growing demand for advanced security solutions. Smart locks and security system maintenance are integral components of smart home security systems, which also include home security monitoring, video doorbells, panic buttons, and GPS tracking devices. RFID technology and biometric security enhance access control and data security. Self defense apps and martial arts training offer additional layers of protection for individuals.

- Home automation integrates various security elements, creating a comprehensive solution for businesses and homeowners. Regular security audits ensure the effectiveness of these systems, while continuous innovation drives the integration of new technologies like threat detection and artificial intelligence.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Self Defense Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 937.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, China, Canada, UK, Germany, Japan, India, France, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Self Defense Products Market Research and Growth Report?

- CAGR of the Self Defense Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the self defense products market growth of industry companies

We can help! Our analysts can customize this self defense products market research report to meet your requirements.