Shower Curtain Retail Market Size 2025-2029

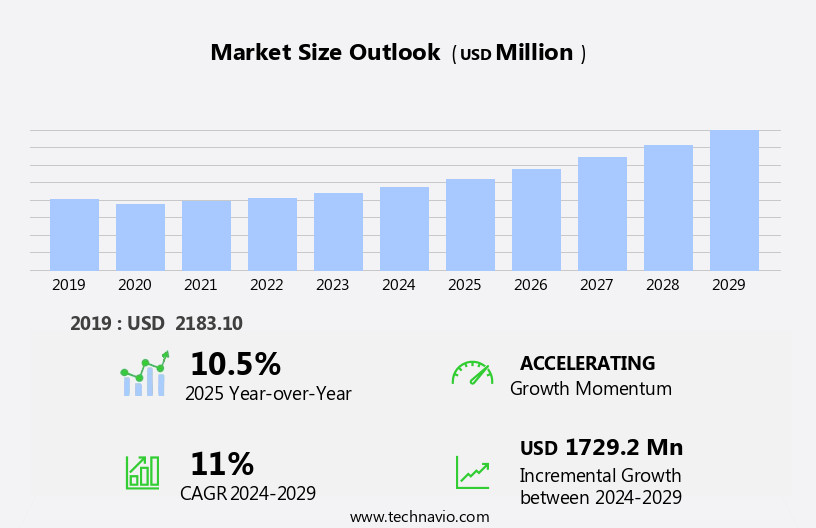

The shower curtain retail market size is forecast to increase by USD 1.73 billion, at a CAGR of 11% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing awareness of hygiene and sanitation. Consumers are increasingly prioritizing shower curtains as essential bathroom accessories, recognizing their role in maintaining cleanliness and preventing the spread of bacteria. Moreover, there is a growing emphasis on sustainability and eco-friendliness, leading to increased demand for shower curtains made from recycled or biodegradable materials. However, market expansion is not without challenges. Regulatory hurdles impact adoption, as various regulatory bodies impose stringent standards on the production and disposal of shower curtains. Furthermore, supply chain disruptions and material volatility pose significant risks, as raw material availability and pricing can significantly impact the market's growth potential. The market is witnessing significant growth due to the increasing number of high-rise buildings and the rising demand for modern, energy-efficient facades in the real estate sector.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay informed of regulatory requirements and invest in robust supply chain management strategies. The adoption of aluminum frames and unitized systems for construction logistics is also on the rise. By addressing these challenges and leveraging consumer trends, businesses can position themselves for long-term success in the market.

What will be the Size of the Shower Curtain Retail Market during the forecast period?

- In the dynamic bathroom decor market, shower curtains remain a popular choice for homeowners seeking to enhance their bathroom design. The shower curtain installation process is a key consideration for consumers, with an increasing focus on DIY solutions and easier hardware designs. Search engine optimization and retail marketing strategies play significant roles in driving sales in the online retail market. Shower curtain pricing and maintenance are crucial factors influencing customer preferences, with brands offering various solutions for storage and replacement. Brand loyalty is a significant trend in the home decor market, with consumers seeking high-quality and innovative shower curtain designs from trusted brands.

- Shower curtain bundles and bathroom renovation market opportunities provide retailers with potential growth avenues. Technology trends, such as social media marketing and content marketing, are essential for reaching and engaging customers. Customer experience, distribution channels, and supply chain management are critical aspects of retail success. Shower curtain promotions, discounts, and cleaning instructions cater to various customer segments. Sustainable practices and shower curtain reviews are essential for addressing evolving consumer demands and staying competitive in the home improvement market. Product innovation and shower curtain hardware continue to shape the industry, with e-commerce marketplaces and digital marketing channels enabling seamless customer interactions and transactions. Infrastructure development in emerging economies and urbanization fuel market growth.

- Customer service and technology integration are essential for enhancing the overall shopping experience and fostering long-term brand loyalty. Bathroom accessories market growth is interconnected with shower curtain trends, providing retailers with opportunities to expand their product offerings and cater to diverse customer preferences.

How is this Shower Curtain Retail Industry segmented?

The shower curtain retail industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Residential

- Commercial

- Type

- Fabric Shower Curtains

- Synthetic Shower Curtains

- Hemp Shower Curtains

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses both online and offline distribution channels. Offline retail, which includes brick-and-mortar stores, remains a significant segment due to the importance of texture, color accuracy, and material quality for discerning buyers. Specialty home decor stores, such as Bed Bath and Beyond, HomeGoods, and The Container Store, are a key subtype within this channel. Their curated selections and knowledgeable staff offer consumers a personalized shopping experience, often featuring trend-forward or premium shower curtain options. Bathroom textiles, including shower curtains, continue to evolve with consumer preferences. Water resistance is a key feature, with both vinyl and fabric shower curtains available.

Easy care and machine washability are also essential considerations. Oversized and extra-long shower curtains cater to larger bathrooms, while solid colors and stain resistance appeal to those seeking a minimalist aesthetic. Home improvement stores, such as Home Depot and Lowe's, also offer a wide range of shower curtains. Modern and contemporary designs, as well as traditional and patterned options, cater to various bathroom decor trends. Mold resistance and mildew resistance are crucial features for bathroom textiles, ensuring longevity and hygiene. Online retail platforms, including Amazon and Wayfair, provide convenience and a vast selection of shower curtains. Custom and waterproof shower curtains, shower curtain sets, and luxury options are readily available.

Shower curtain hooks, rings, and liners are also offered as accessories. Recycled materials and eco-friendly production methods are gaining popularity in the shower curtain market. Sustainability and environmental concerns are increasingly influencing consumer choices. Shower curtain trends include fade resistance, rustic styles, and oversized prints. Bathroom renovation projects often include the selection of new shower curtains to complement the updated design. The market showcases a diverse range of products, from budget-friendly options to luxury designs, catering to various consumer preferences and bathroom decor trends. Water resistance, stain resistance, mold resistance, and easy care are essential features for consumers.

Both offline and online retail channels offer unique advantages, with specialty home decor stores providing a personalized shopping experience and online retail platforms offering convenience and a vast selection. Sustainability and eco-friendly production methods are becoming increasingly important in the market.

The Offline segment was valued at USD 1.46 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 29% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing steady growth, fueled by urbanization, economic resilience, sustainability initiatives, and evolving consumer preferences. With approximately 72% of the European Union (EU) population residing in urban areas as of 2023, the demand for home accessories that are both functional and aesthetically pleasing is on the rise. Urban dwellers often live in compact spaces where bathroom design plays a significant role. As a result, shower curtains that offer water resistance, easy care, and various sizes, including oversized and extra-long, are popular choices. Moreover, home improvement projects continue to be a priority for many European households, leading to increased sales of bathroom textiles, such as shower curtains.

Consumers are also increasingly seeking eco-friendly options, with a growing interest in recycled materials and waterproof fabrics. Bathroom trends lean towards modern and contemporary designs, with mildew resistance and mold resistance being essential features. Shower curtain liners, hooks, rings, and sets are also popular purchases. Luxury shower curtains, custom designs, and waterproof fabrics cater to the higher end of the market. Home decor trends favor rustic and minimalist styles, while traditional and patterned shower curtains remain popular for those seeking a more classic look. Machine washable and fade-resistant materials are desirable for easy maintenance. Overall, the European the market is poised for continued growth, driven by these evolving consumer preferences and trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Shower Curtain Retail market drivers leading to the rise in the adoption of Industry?

- The market's growth is primarily attributed to the heightened consciousness regarding hygiene and sanitation. The market for shower curtains continues to gain traction, driven by the increasing importance of maintaining clean and hygienic bathroom environments. With a focus on water resistance and easy care, shower curtains are becoming essential bathroom textiles for both new constructions and home improvement projects. Consumers are seeking out options that provide superior water containment, such as oversized and extra-long shower curtains, to minimize water spillage and reduce the risk of mold and mildew growth. Both solid and stain-resistant materials, including vinyl and fabric, are popular choices due to their durability and ease of maintenance.

- Brick and mortar home improvement stores and online retailers offer a wide range of shower curtain rods and designs to accommodate various bathroom sizes and styles. Overall, the demand for shower curtains is expected to remain strong as consumers prioritize hygiene and convenience in their homes.

What are the Shower Curtain Retail market trends shaping the Industry?

- The emphasis on sustainability and the use of eco-friendly materials is a growing trend in the market. As a professional, it is essential to acknowledge this trend and incorporate it into business practices whenever possible. For instance, sourcing materials that have a minimal carbon footprint, reducing waste through efficient production processes, and implementing recycling programs are all steps towards creating a more sustainable business model. By prioritizing sustainability, businesses can not only contribute to the betterment of the environment but also appeal to consumers who value eco-conscious practices.

- The global shower curtain market is experiencing a notable evolution as consumers and manufacturers prioritize sustainability. With growing environmental consciousness, there's a clear trend moving away from conventional PVC shower curtains due to their association with harmful chemical emissions and poor biodegradability. In response, consumers are gravitating towards eco-friendly alternatives. Manufacturers are meeting this demand by introducing shower curtains made from sustainable materials such as organic cotton, recycled polyester, hemp, bamboo, and biodegradable plastics like polyethylene vinyl acetate. These options not only lessen ecological impact but also cater to consumers' expectations for safer, non-toxic household products. Home decor trends favor mold resistance and fade resistance properties, making these eco-friendly materials increasingly popular.

How does Shower Curtain Retail market faces challenges face during its growth?

- The industry faces significant challenges from supply chain disruptions and material volatility, which negatively impact growth. These issues can lead to increased costs, production delays, and decreased efficiency, making it crucial for businesses to implement robust strategies to mitigate these risks and ensure a stable and reliable supply chain. The market faces challenges from supply chain disruptions and volatile material costs. Shower curtains are primarily manufactured using materials such as polyvinyl chloride (PVC), polyethylene vinyl acetate (PEVA), polyester, and specialty fabrics. These materials are often derived from petrochemical sources, making their availability and pricing sensitive to oil market fluctuations. In 2024, geopolitical unrest, including the Red Sea crisis and trade tensions, disrupted global freight routes, affecting 76% of European shippers with essential material procurement issues. Modern shower curtain sets, including those with mildew resistance, shower curtain liners, rings, luxury, waterproof, contemporary, and custom designs, are popular in bathroom design.

- Shower curtain trends favor waterproof fabrics, colors, and patterns. Online retail platforms have increased accessibility to these trends, making it essential for retailers to maintain a strong online presence. Mildew resistance and waterproof fabrics are crucial features for consumers, ensuring their shower curtains remain functional and attractive. Shower curtain sets come in various materials and designs, catering to diverse consumer preferences. Mildew resistance and waterproof fabrics are essential features for functionality and longevity. The market for shower curtains continues to evolve, with contemporary and luxury designs gaining popularity. Online retail platforms offer convenience and accessibility, making it crucial for retailers to maintain a strong online presence. Market segments include building materials suppliers, architectural firms, construction companies, and building technology providers.

Exclusive Customer Landscape

The shower curtain retail market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the shower curtain retail market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, shower curtain retail market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - The company specializes in providing a diverse range of high-quality shower curtains, including the AmazonBasics Shower Curtain, LiBa Shower Curtain, and Gorilla Grip Shower Curtain.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Bed Bath and Beyond Inc.

- Best Buy Co. Inc.

- Inter IKEA Holding B.V.

- Kohls Inc

- Lowes Co. Inc.

- Macys Inc.

- Menard Inc.

- Otto GmbH and Co. KG

- Penney IP LLC

- Target Corp.

- The Home Depot Inc.

- Walmart Inc.

- Wayfair Inc.

- Z Gallerie home LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Shower Curtain Retail Market

- In February 2023, IKEA, the renowned Swedish furniture retailer, introduced a new line of eco-friendly shower curtains made from 100% recycled plastic, marking a significant stride in sustainable product offerings within the market (IKEA Press Release, 2023).

- In May 2024, Target Corporation, an American retailing giant, partnered with Amazon to sell Target-branded essentials, including shower curtains, on Amazon's platform. This collaboration aimed to expand Target's reach and boost sales in the competitive e-commerce market (Target Press Release, 2024).

- In October 2024, The Home Depot, the largest home improvement retailer in the US, acquired Apex Home Fashions, a leading manufacturer of home textiles, including shower curtains. This strategic acquisition enabled The Home Depot to strengthen its private label offerings and gain a larger market share in the shower curtain retail sector (The Home Depot Press Release, 2024).

- In January 2025, the European Union passed new regulations mandating the use of biodegradable or recycled materials in shower curtains by 2028. This initiative is expected to drive demand for eco-friendly shower curtain options and foster innovation in the sector (European Parliament Press Release, 2025).

Research Analyst Overview

The market continues to evolve, reflecting the dynamic nature of consumer preferences and market trends. Bathroom textiles, including shower curtains, remain an essential component of home decor and functionality. Water resistance and easy care are key considerations for consumers, leading to the popularity of various materials such as vinyl and fabric. Brick and mortar stores and online retailers alike offer a wide range of options, from oversized and extra-long shower curtains to solid and stain-resistant designs. Rustic and vintage styles, including rustic shower curtains and bathroom decor, have gained traction in recent years. Plastic shower curtains, while budget-friendly, have given way to more eco-friendly alternatives made from recycled materials. The market encompasses the production and installation of large, transparent building facades, primarily utilized in commercial construction projects.

Shower curtain hooks, shower curtain rings, and liners are essential accessories that cater to various consumer needs. Home improvement projects and bathroom renovations often include the selection of new shower curtains and coordinating sets. Modern and contemporary designs, as well as mildew-resistant and machine-washable options, cater to the latest home decor trends. Luxury and custom shower curtains, made from waterproof fabrics, add a touch of elegance to bathroom spaces. The market for shower curtains is diverse and continually unfolding, with new trends and applications emerging. From traditional and patterned designs to minimalist and printed options, the market offers a vast array of choices to suit various consumer preferences and bathroom styles.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Shower Curtain Retail Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11% |

|

Market growth 2025-2029 |

USD 1729.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.5 |

|

Key countries |

US, UK, Germany, France, China, Japan, Canada, Italy, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Shower Curtain Retail Market Research and Growth Report?

- CAGR of the Shower Curtain Retail industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the shower curtain retail market growth of industry companies

We can help! Our analysts can customize this shower curtain retail market research report to meet your requirements.