Shrink Sleeve And Stretch Sleeve Labels Market Size 2025-2029

The shrink sleeve and stretch sleeve labels market size is forecast to increase by USD 5.12 billion at a CAGR of 5.7% between 2024 and 2029.

-

The market is experiencing significant growth due to the increasing demand for shrink sleeve and stretch sleeve labels across various end-use industries, particularly in food and beverage, where visual appeal and branding are key drivers. This upward trend is the advantages these labels offer over traditional labeling methods, including improved product differentiation, enhanced branding opportunities, and greater consumer engagement. Additionally, the luxury cosmetics packaging segment is emerging as a high-potential area, as brands seek premium, visually striking, and tamper-evident labeling solutions that align with their high-end image. Sleeve labels provide a 360-degree branding canvas that resonates with the aesthetics and exclusivity required in the luxury cosmetics space.

-

Moreover, the development and adoption of sustainable shrink sleeve and stretch sleeve labels, often made from recycled or recyclable materials, is gaining momentum among environmentally conscious consumers and companies, a trend that's expected to further accelerate market growth. However, a notable challenge remains: the high initial investment required for the production infrastructure and implementation of these labeling technologies, which can be a barrier for small and medium-sized enterprises (SMEs) aiming to enter or scale within the market. Nonetheless, as demand for innovative, eco-friendly, and brand-enhancing packaging solutions continues to rise, the market is poised for continued expansion across both mass and premium product categories.

What will be the Size of the Shrink Sleeve And Stretch Sleeve Labels Market during the forecast period?

- The market in the United States continues to experience significant growth, driven by the increasing demand for labeling efficiency, labeling software, and labeling innovations. Labeling trends include digital transformation, label inventory management, and connected packaging, leading to reduced label waste and improved labeling accuracy. Sleeve labels, including both shrink and stretch varieties, have gained popularity due to their ability to provide full or partial wrap coverage, enhancing product aesthetics and branding. Labeling systems have evolved to offer automation, tamper-proof features, and integration with smart packaging technologies, such as RFID and QR codes. Labeling cost optimization, sustainability, and environmental concerns are also key factors shaping the market.

- Innovations in labeling materials include recyclable, biodegradable, compostable, cold shrink, and heat shrink labels, catering to various industries and consumer preferences. The market is expected to continue growing, driven by these trends and the increasing importance of labeling in ensuring product safety, traceability, and consumer engagement. The labeling industry is witnessing significant market growth and trends, driven by advancements in labeling automation, labeling speed, and label waste reduction. Innovations in labeling lines and shrink tunnels have enhanced the application of full wrap labels, partial wrap labels, tamper-proof labels, and cold shrink labels across diverse sectors such as food & beverage.

- Sustainable labeling practices are gaining traction, with rising demand for recyclable labels, compostable labels, and biodegradable labels, supported by developments in shrink sleeve films and stretch sleeve films. The market also reflects increasing adoption of shrink sleeve applicators and stretch sleeve applicators to boost efficiency and improve label resistance. In parallel, label management and label cost optimization are key focus areas in recent market analysis and reports, helping businesses balance performance with environmental impact through innovations like offset printing and smart labeling solutions.

How is this Shrink Sleeve And Stretch Sleeve Labels Industry segmented?

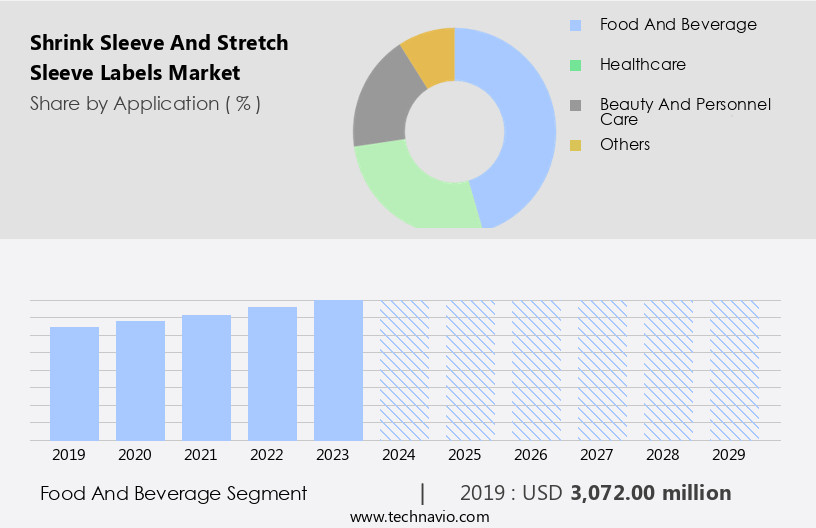

The shrink sleeve and stretch sleeve labels industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food and beverage

- Healthcare

- Beauty and personnel care

- Others

- Product Type

- Stretch sleeves label

- Shrink sleeves label

- Material

- PVC

- PETG

- OPS

- PE

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

The food and beverage segment is estimated to witness significant growth during the forecast period. The global market for shrink sleeve and stretch sleeve labels is driven by the necessity for effective product labeling in various industries, particularly in food and beverage. Regulatory bodies such as the Food and Drug Administration (FDA) and the Food Safety and Standards Authority of India (FSSAI) mandate labeling to ensure consumer safety and product information. These labels offer increased label real estate compared to pressure-sensitive labels, enabling product differentiation and branding. Advancements in labeling technology, such as RFID technology, QR codes, and label customization, contribute to the market growth. Labeling solutions now offer value-added services like label tamper evidence, temperature resistance, moisture resistance, and label integrity.

Label engineering ensures label durability and chemical resistance, using materials like PVC films, polyolefin films, PET films, and UV resistance. Label application methods like rotogravure printing, flexographic printing, digital printing, and high-speed labeling cater to various industry requirements. Labeling machines and labeling consulting services offer automated labeling solutions, ensuring label compliance with labeling standards. Brand protection is crucial in today's competitive market, and labeling plays a significant role. Effective label design and label printing are essential for product traceability and consumer trust. The market is expected to grow steadily due to these factors, providing opportunities for labeling solution providers.

Get a glance at the market report of share of various segments Request Free Sample

The Food and beverage segment was valued at USD 3.07 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is witnessing significant growth due to the increasing demand for product traceability and brand protection in various industries, particularly in food and beverage. Label application technologies, such as RFID and QR codes, are gaining popularity for enhancing product differentiation and ensuring label integrity. Labeling solutions are being customized to meet specific label compliance requirements, including temperature resistance, moisture resistance, and chemical resistance. Label engineering and design play a crucial role in product branding and consumer appeal. High-speed labeling and automated labeling systems are being adopted for increased efficiency and productivity. Eco-friendly packaging solutions, including PVC-free films like polyolefin and PET, are becoming increasingly preferred due to environmental concerns.

In developing countries, such as India and China, the market is experiencing the fastest growth due to the rising demand for packaged food and beverages driven by lifestyle and demographic changes. The increase in exports from Association of Southeast Asian Nations (ASEAN) countries has further escalated the demand for shrink sleeve and stretch sleeve labels. In the last ten years, US imports of goods from APAC have increased by over 120%. Value-added services, including label tamper evidence and label security, are becoming essential for ensuring product authenticity and consumer safety. Label printing technologies, such as rotogravure, flexographic, and digital printing, cater to various label durability and label adhesion requirements. Labeling consulting and labeling machines are being utilized for optimizing labeling processes and ensuring labeling standards compliance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Shrink Sleeve And Stretch Sleeve Labels Industry?

- Increase in demand for sleeve labels is the key driver of the market. The sleeve label market is experiencing notable growth due to its ability to provide comprehensive container coverage. Compared to traditional shrink sleeve labels, sleeve labels offer up to 150% more coverage, making them an attractive option for packaging companies. Although the cost of sleeve labels is approximately 25% higher than shrink sleeve labels, the increased coverage justifies the investment. Sleeve labels eliminate the need for colored containers and present new opportunities for innovative advertising.

- In contrast, shrink labels, which are polymer plastic films, conform to the shape of containers through heat application. Despite the added cost, sleeve labels' full coverage and advertising advantages make them a valuable investment in the competitive packaging industry.

What are the market trends shaping the Shrink Sleeve And Stretch Sleeve Labels Industry?

- Emergence of sustainable shrink sleeve and stretch sleeve labels is the upcoming market trend. Shrink sleeve and stretch sleeve labels have gained significance in the packaging industry due to the growing consumer awareness towards sustainability. Companies are responding to this trend by utilizing eco-friendly materials in the manufacturing of these labels. The use of recyclable materials and resins derived from renewable resources is becoming increasingly common. For instance, polyethylene terephthalate (PET) bottles are being labeled with a minimum amount of material to reduce waste. Moreover, environmentally friendly label raw materials, such as face stock liners, inks, coatings, and adhesives, are being adopted.

- Technological advancements have also led to innovative designs in shrink sleeve and stretch sleeve labels, further enhancing their appeal. These factors are driving the market growth in this sector. Companies are focusing on providing sustainable solutions while maintaining the functionality and aesthetics of the labels. This approach not only addresses environmental concerns but also caters to the evolving preferences of consumers.

What challenges does the Shrink Sleeve And Stretch Sleeve Labels Industry face during its growth?

- High initial investments is a key challenge affecting the industry growth. Shrink sleeve and stretch sleeve labels are intricately designed packaging solutions that cater to various industries and product requirements. The production process involves the use of numerous machines and materials, resulting in a significant investment for manufacturers. The demand for innovative materials and designs from end-users drives up the production costs. For instance, creating labels of varying sizes and degrees of flexibility necessitates expensive machinery, such as those from Zebra Technologies Corp. These labels are essential for companies seeking to enhance their brand image and product appeal.

- Despite the high production costs, the market for shrink sleeve and stretch sleeve labels continues to expand due to their versatility and ability to accommodate complex designs. The industry is driven by factors such as increasing consumer preference for premium packaging and the growing demand for sustainable labeling solutions.

Exclusive Customer Landscape

The shrink sleeve and stretch sleeve labels market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the shrink sleeve and stretch sleeve labels market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, shrink sleeve and stretch sleeve labels market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

adapa Holding GesmbH - The company offers shrink sleeve and stretch sleeve labels such as VACUshrink F FL flowpack films which is available in transparent, dyed and printed format.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- adapa Holding GesmbH

- Amcor Plc

- Atlantic Corp.

- Berry Global Inc.

- CCL Industries Inc.

- Clondalkin Group Holdings BV

- D and L Packaging

- Edwards Label Inc.

- Fuji Seal International Inc.

- Huhtamaki Oyj

- KP Holding GmbH and Co. KG

- Kris Flexipacks Pvt. Ltd.

- Multi Color Corp.

- Orianaa Decorpack Pvt. Ltd.

- Polysack Flexible Packaging Ltd.

- Taghleef Industries SpA

- The Dow Chemical Co.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The shrink sleeve and stretch sleeve label market continues to experience significant growth due to the increasing demand for innovative labeling solutions that offer product differentiation and enhanced branding capabilities. These labels provide various benefits, including product traceability, improved label application, and the ability to conform to complex and irregularly shaped containers. Labeling solutions in this market go beyond the traditional paper or pressure-sensitive labels. They incorporate advanced technologies such as RFID and QR codes for enhanced traceability and product information. Label artwork and customization have become essential aspects of this market, allowing brands to create unique and eye-catching designs that differentiate their products from competitors.

The shrink sleeve and stretch sleeve label market is experiencing strong growth, driven by rising demand for versatile, durable, and regulation-compliant labeling solutions across diverse industries such as food and beverage, household products, and industrial applications. One of the key growth drivers is label compliance, as regulatory standards across global markets continue to tighten. These labels offer superior features such as temperature, moisture, and chemical resistance, ensuring product integrity and consumer safety. Additionally, label engineering and advanced printing techniquesâincluding rotogravure, offset, and digital printingâenable the creation of high-quality, durable labels with strong security and tamper-evident features, enhancing brand protection. The integration of eco-friendly packaging, with a shift away from traditional PVC and PET films toward more sustainable alternatives, reflects evolving consumer preferences and environmental priorities. The adoption of automated, high-speed labeling systems, supported by labeling machines and consulting services, is further propelling the market forward.

From a strategic perspective, current market trends and analysis in the cosmetics industry highlight a significant shift toward customized, value-added labeling solutions that enhance product differentiation, support premium brand positioning, and align with growing sustainability goals. In particular, shrink sleeve and stretch sleeve labels are gaining popularity for their ability to deliver high-impact visuals, 360-degree design coverage, and functional features such as tamper evidence, critical for both luxury and mass-market cosmetic products. According to recent market analysis and reports, the cosmetics packaging sector is poised for continued expansion, with market growth and forecasting projecting steady increases in demand driven by advancements in labeling technologies, eco-conscious consumer behavior, and the rising need for regulatory compliance and ingredient transparency. These trends underscore the strategic importance of innovation, operational efficiency, and compliance in capturing market share and addressing the evolving expectations of both beauty brands and consumers in a highly competitive global marketplace.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 5.12 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, Japan, Canada, UK, Germany, India, Mexico, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Shrink Sleeve And Stretch Sleeve Labels Market Research and Growth Report?

- CAGR of the Shrink Sleeve And Stretch Sleeve Labels industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the shrink sleeve and stretch sleeve labels market analysis and report

We can help! Our analysts can customize this shrink sleeve and stretch sleeve labels market research report to meet your requirements.