Small Unmanned Aerial Vehicle Market Size 2025-2029

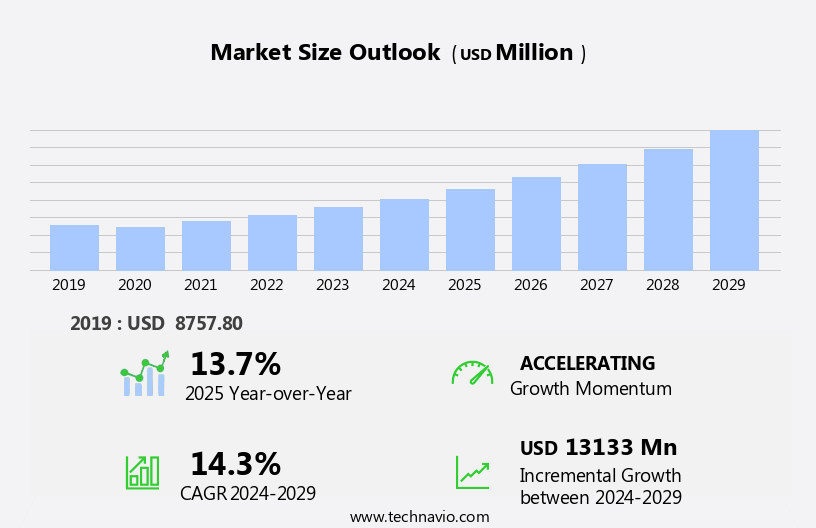

The small unmanned aerial vehicle (SUAV) market size is forecast to increase by USD 13.13 billion, at a CAGR of 14.3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for enhanced surveillance solutions across various industries, including defense, agriculture, and infrastructure. This demand is driven by the need for real-time data collection and analysis, which SUAVs provide efficiently and cost-effectively. However, the market faces challenges as well. Vulnerability to cyber hacking poses a significant threat, as SUAVs carry sensitive data and can be used for malicious purposes if compromised. Companies must invest in robust security measures to mitigate these risks.

- The civilian drone industry continues to grow, driven by the demand for real-time information and the increasing adoption by law enforcement agencies and regional governments. The market encompasses a diverse range of applications, including monitoring, surveying and mapping, precision agriculture, aerial remote sensing, product delivery, and more. Additionally, strategic partnerships and collaborations between SUAV manufacturers and technology providers are crucial for market growth, as they enable the development of advanced features and capabilities. These collaborations can help companies stay competitive and capitalize on emerging opportunities in this dynamic market.

What will be the Size of the Small Unmanned Aerial Vehicle (SUAV) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Rotary wing SUAVs, with their agility and maneuverability, dominate the market, while fixed wing and hybrid wing SUAVs offer longer flight endurance and greater payload capacity. Data analysis is a key component of the SUAV market, with object detection and sensor integration enabling environmental monitoring, commercial sales, and law enforcement. Air data systems ensure stable and accurate flight, while GPS navigation and flight planning software facilitate remote control and autonomous operations. Electric motors power the majority of SUAVs, enabling quiet and efficient flight.

High-resolution cameras and video streaming capabilities enhance aerial photography and real-time data acquisition. Lipo batteries provide the necessary power, and the supply chain continues to adapt to meet the growing demand for these versatile machines. Applications span from environmental monitoring and search and rescue to military and government sales, with hyperspectral and multispectral sensors providing valuable data for various industries. The ongoing integration of advanced technologies, such as image processing and thermal cameras, further expands the potential uses of SUAVs. The SUAV market remains dynamic, with continuous innovation and evolving patterns shaping its future. From object detection to data analysis, electric motors to flight planning software, the interconnected components of this market continue to unfold, driving growth and expansion.

How is this Small Unmanned Aerial Vehicle (SUAV) Industry segmented?

The small unmanned aerial vehicle (SUAV) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Light fixed-wing SUAV

- Heavy fixed-wing SUAV

- Multi-rotor VTOL SUAV

- Nano SUAV

- Application

- Civil

- Military

- Variant

- Micro

- Mini

- Nano

- Modality

- Lithium-ion

- Solar

- Hydrogen

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

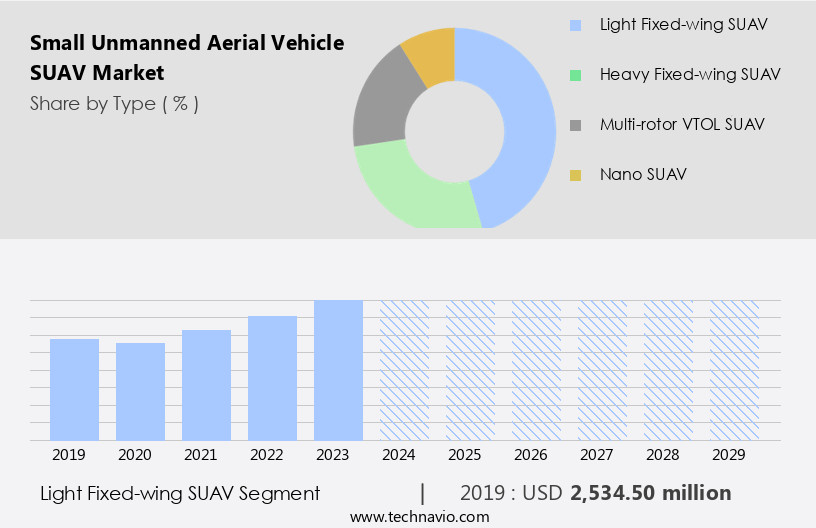

The light fixed-wing suav segment is estimated to witness significant growth during the forecast period.

Light fixed-wing Unmanned Aerial Vehicles (UAVs), also known as drones, are increasingly utilized in commercial applications due to their efficiency and precision. These aircraft, operated remotely or autonomously, offer significant cost savings and accessibility to areas unreachable by manned aircraft. Light fixed-wing UAVs are particularly popular for tasks such as aerial mapping, inspection, agriculture, construction, security, and surveillance. Their data-focused design makes them an ideal solution for commercial applications. Rotary wing UAVs, on the other hand, are known for their vertical takeoff and landing capabilities, making them suitable for various missions, including search and rescue, law enforcement, and environmental monitoring.

Object detection and sensor integration are crucial features for these UAVs, enhancing their effectiveness. Hybrid wing UAVs combine the advantages of both fixed-wing and rotary wing designs, offering the best of both worlds. Their versatility makes them suitable for various applications, including military and government use. Payload capacity, flight controller, data acquisition, and air data systems are essential components for UAVs, enabling them to carry sensors and cameras for data collection. Thermal cameras, hyperspectral sensors, multispectral sensors, and high-resolution cameras are commonly integrated into UAVs for various applications. Electric motors power most UAVs, with lipo batteries providing the energy required for extended flight times.

Flight planning software and remote control systems enable operators to plan and execute missions effectively. GPS navigation and autonomous flight capabilities are essential features for UAVs, ensuring accurate and efficient flight paths. Over-the-counter (OTC) sales and commercial sales channels have made UAVs more accessible to businesses and individuals. The supply chain for UAVs involves various components, including sensors, batteries, motors, and controllers. As the market continues to evolve, we can expect advancements in technology, such as improved sensor capabilities, longer flight endurance, and more sophisticated autonomous flight systems.

The Light fixed-wing SUAV segment was valued at USD 2.53 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

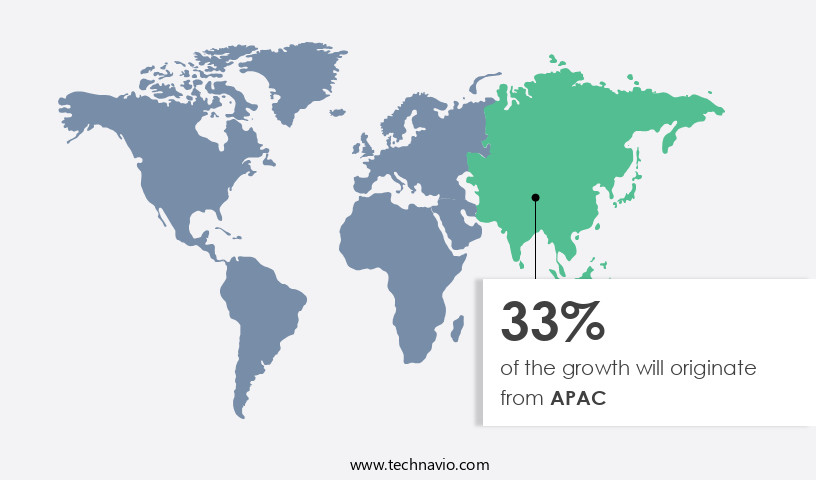

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by various applications and technological advancements. Image processing technology is a key factor in enhancing SUAV capabilities, enabling object detection and data analysis for sectors like environmental monitoring and commercial sales. Rotary wing, fixed wing, and hybrid wing SUAVs cater to diverse mission requirements, with fixed wing and hybrid models offering greater flight endurance and payload capacity. Law enforcement agencies increasingly rely on SUAVs for surveillance and search and rescue operations, while sensor integration, including thermal cameras and hyperspectral sensors, expands their functionalities. Government sales dominate the market due to military applications, while commercial sales are poised for growth as businesses explore new use cases.

Air data systems ensure flight stability, and GPS navigation enhances precision. Electric motors power most SUAVs, with lipo batteries providing energy efficiency. Flight planning software and remote control enable efficient operation, while high-resolution cameras capture aerial photography. The supply chain is streamlining to meet increasing demand, with manufacturers focusing on sensor integration and data acquisition systems. In APAC, defense capabilities are expanding in countries like China, India, Japan, and South Korea, driving growth in the regional market. Indigenization efforts are underway to develop advanced SUAV systems, with defense authorities funding R&D for mission-critical capabilities in adverse conditions.

Market Dynamics

The Small Unmanned Aerial Vehicle Market is experiencing rapid expansion, driven by advancements in drone technology. These versatile small drones, including mini UAVs, are transforming numerous industries. Commercial drones are at the forefront, revolutionizing fields such as aerial photography drones and drone surveying and mapping. The rise of industrial drones for inspection drones highlights their utility in infrastructure and energy sectors. Furthermore, the integration of AI for small UAVs is paving the way for autonomous drones, enhancing capabilities and safety. Critical components like advanced drone sensors and improved drone batteries are boosting performance. Electric drones dominate the market, with both fixed-wing drones small and rotary-wing drones small configurations addressing diverse drone applications, including vital public safety drones. This growth defines the dynamic global drone market, as portable drones become increasingly prevalent.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Small Unmanned Aerial Vehicle (SUAV) Industry?

- company partnerships, collaborations, and agreements are essential drivers in shaping and growing the market. These strategic alliances foster innovation, enhance competitiveness, and contribute significantly to business expansion.

- The market is experiencing significant growth as companies seek to expand their business and strengthen their market position. Strategic partnerships, collaborations, and agreements are key business strategies being employed to achieve these goals. For instance, in November 2024, AeroVironment (AV) announced a definitive agreement to acquire BlueHalo in an all-stock transaction valued at approximately USD 4.1 billion. This acquisition aims to create a more diversified global leader in defense technologies, enabling the combined company to offer a comprehensive portfolio of high-growth franchises driven by advanced technology. Moreover, the integration of hyperspectral and multispectral sensors in SUAVs is a significant trend in the market, particularly for military applications.

- These sensors enhance the capabilities of SUAVs for aerial photography, GPS navigation, and other applications. Additionally, the use of lipo batteries and focus on increasing flight endurance are essential factors driving market growth. Government sales continue to be a significant contributor to the SUAV market, with military applications being a primary focus. The demand for SUAVs in defense and security sectors is expected to remain high due to their versatility, cost-effectiveness, and ability to provide real-time data and imagery. Overall, the SUAV market is poised for continued growth, driven by technological advancements and increasing demand from various industries.

What are the market trends shaping the Small Unmanned Aerial Vehicle (SUAV) Industry?

- The demand for advanced surveillance solutions is experiencing significant growth and is a notable market trend. This increasing need reflects the importance of enhancing security and safety measures in various industries and applications.

- The market is experiencing significant growth due to the increasing demand for advanced surveillance solutions. Industries and sectors such as military, law enforcement, agriculture, and infrastructure are adopting SUAVs for surveillance due to their ability to provide real-time, high-resolution data analysis. SUAVs are equipped with high-definition cameras, infrared sensors, and other advanced technologies, enabling remote monitoring and improved situational awareness. For instance, Elbit Systems Ltd. Recently secured a contract worth approximately USD60 million to supply its multi-layered Counter Unmanned Aerial Systems (C-UAS) to a NATO European country.

- SUAVs are propelled by electric motors and can be controlled remotely using flight planning software. They offer immersive and harmonious aerial perspectives for various applications, including video streaming and data collection. The use of SUAVs streamlines supply chain operations and enhances operational efficiency. Overall, the SUAV market is poised for continued growth as more industries recognize the benefits of these innovative technologies.

What challenges does the Small Unmanned Aerial Vehicle (SUAV) Industry face during its growth?

- Cybersecurity vulnerabilities pose a significant threat to the expansion of various industries, as hacking incidents can compromise critical data and disrupt business operations.

- The market is experiencing significant growth due to the increasing demand for image processing capabilities in various industries. Rotary wing, fixed wing, and hybrid wing SUAVs are increasingly being used for commercial sales, particularly in sectors such as environmental monitoring and object detection. Advanced technologies, including air data systems and object recognition algorithms, are being integrated into SUAVs to enhance their functionality and efficiency. However, the reliance on wireless connectivity for control and data transmission makes SUAVs susceptible to cyber-attacks.

- companies are focusing on developing infiltration-resilient systems, but the continuous evolution of cyber intrusion techniques poses a persistent challenge. Despite these concerns, the market for SUAVs is expected to continue its growth trajectory due to their versatility, cost-effectiveness, and ability to provide real-time data and insights.

Exclusive Customer Landscape

The small unmanned aerial vehicle (suav) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the small unmanned aerial vehicle (suav) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, small unmanned aerial vehicle (suav) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AeroVironment Inc. - The company specializes in providing small unmanned aerial vehicles, including the Raven B T 20, Jump 20, and Puma LE, for various industries. These drones offer advanced capabilities for aerial data collection and analysis, enhancing operational efficiency and decision-making processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AeroVironment Inc.

- Airbus SE

- Airgility

- AZUR DRONES SAS

- C Astral d.o.o.

- Elbit Systems Ltd.

- Freebird Aerospace India Pvt. Ltd.

- General Atomics

- Israel Aerospace Industries Ltd.

- Leonardo Spa

- Northrop Grumman Corp.

- Parrot Drones SAS

- Red Cat Holdings

- Skydio Inc.

- SwissDrones Operating AG

- SZ DJI Technology Co. Ltd.

- Teledyne Technologies Inc.

- The Boeing Co.

- Throttle Aerospace System Pvt Ltd.

- Vantage Robotics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Small Unmanned Aerial Vehicle (SUAV) Market

- In January 2024, Skylark Technologies, a leading SUAV manufacturer, announced the launch of its new long-range, high-altitude SUAV, the Falcon X1, designed for industrial inspections and surveillance. The Falcon X1 can fly up to 50,000 feet and offers a 20-hour flight time (Skylark Technologies press release).

- In March 2024, Boeing and Intel entered into a strategic partnership to integrate Intel's RealSense LiDAR technology into Boeing's SUAVs, enhancing their capabilities for precision agriculture and infrastructure inspection applications (Intel newsroom).

- In May 2024, AeroVironment, a major SUAV provider, completed a USD100 million Series E funding round, bringing its total funding to USD 350 million. The funds will be used for product development, geographic expansion, and market penetration (AeroVironment press release).

- In April 2025, the European Union Aviation Safety Agency (EASA) approved the use of SUAVs in its airspace for commercial operations, opening a significant market for companies like DJI, Parrot, and 3D Robotics (EASA press release).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of innovative technologies and evolving regulatory frameworks. Battery technology improvements enable longer flight times, while drone regulations facilitate wider commercial applications. Autonomous flight and AI are revolutionizing industries, from agriculture to construction, by enhancing efficiency and accuracy. GIS integration and flight simulation enable better data analysis and training. Edge computing and computer vision facilitate real-time processing and analysis, while deep learning and machine learning algorithms optimize performance. Data security concerns are addressed through encryption and anti-drone technology.

- Collision detection systems ensure safe operations, and remote diagnostics allow for efficient maintenance. Swarm technology, 3D modeling, and digital twin simulations offer new possibilities for complex projects. Software updates and pilot certification ensure safety and compliance. Despite privacy concerns and drone jamming threats, the market continues to grow, driven by the potential of these technologies to transform various sectors.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Small Unmanned Aerial Vehicle (SUAV) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.3% |

|

Market growth 2025-2029 |

USD 13133 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.7 |

|

Key countries |

US, China, India, France, Brazil, Germany, Canada, UK, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Small Unmanned Aerial Vehicle (SUAV) Market Research and Growth Report?

- CAGR of the Small Unmanned Aerial Vehicle (SUAV) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the small unmanned aerial vehicle (suav) market growth of industry companies

We can help! Our analysts can customize this small unmanned aerial vehicle (suav) market research report to meet your requirements.