Rugged Thermal Cameras Market Size 2024-2028

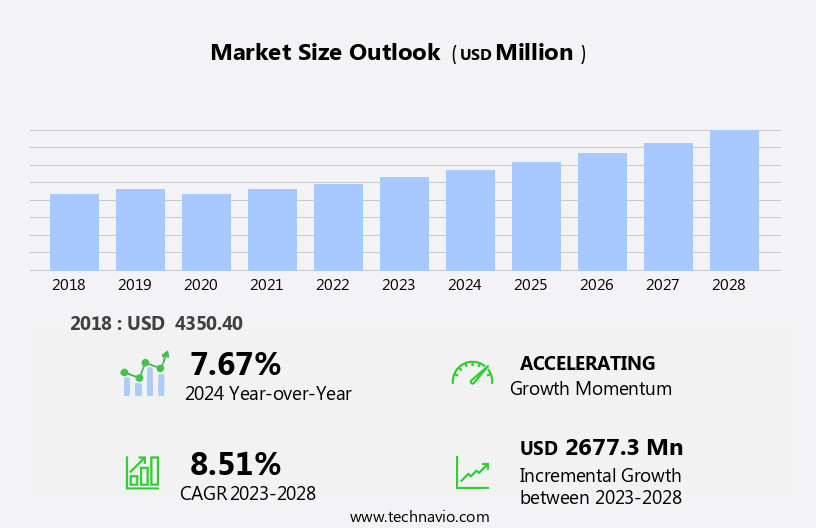

The rugged thermal cameras market size is forecast to increase by USD 2.68 billion at a CAGR of 8.51% between 2023 and 2028.

- The market is poised for significant growth, driven primarily by increasing military expenditure and advancements in photogrammetry and thermal imaging technology. Military applications, particularly in border surveillance and defense, account for a substantial market share due to the heightened security concerns worldwide. This trend is further bolstered by the continuous improvement in thermal imaging technology, enabling higher resolution and accuracy in image data collection. However, the market faces challenges in obtaining precise image data due to environmental factors and technical limitations.

- Inaccuracies in image data collection can lead to false alarms or missed threats, making it crucial for manufacturers to invest in research and development to address this issue. Companies that successfully navigate these challenges and leverage the market drivers will be well-positioned to capitalize on the growing demand for rugged thermal cameras in various industries, including military, security, and industrial applications.

What will be the Size of the Rugged Thermal Cameras Market during the forecast period?

- The market continues to evolve, driven by advancements in imaging technology and its applications across various sectors. Thermal analysis plays a crucial role in scientific research, defense industry, and industrial inspection, enabling temperature measurement, process monitoring, and thermal signature analysis. Thermal imaging software, machine vision, and data analysis tools enhance image processing and recognition capabilities, while frame rate and image resolution improve video recording capabilities. Environmental monitoring and wildlife monitoring benefit from thermal imaging, providing insights into temperature changes and animal behavior. Deep learning and artificial intelligence (AI) integration enable advanced object recognition and fault detection, extending thermal imaging's applications to predictive maintenance, energy audits, and security industry.

- Ruggedized cameras with wireless connectivity, noise reduction, and image stabilization cater to the demands of law enforcement, target identification, and search and rescue. Low-light imaging and heat detection are essential features for night vision applications, while battery life and thermal sensitivity are critical factors for military applications. Autonomous vehicles and remote control systems further expand the market's potential, offering new opportunities for thermal imaging in various industries. The ongoing unfolding of market activities and evolving patterns underscore the continuous dynamism of the market.

How is this Rugged Thermal Cameras Industry segmented?

The rugged thermal cameras industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Security and surveillance

- Monitoring and inspection

- Detection and measurement

- Others

- End-user

- Military and defense

- Commercial

- Industrial

- Residential

- Type

- Handheld

- Fixed

- Technology Specificity

- Cooled

- Uncooled

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

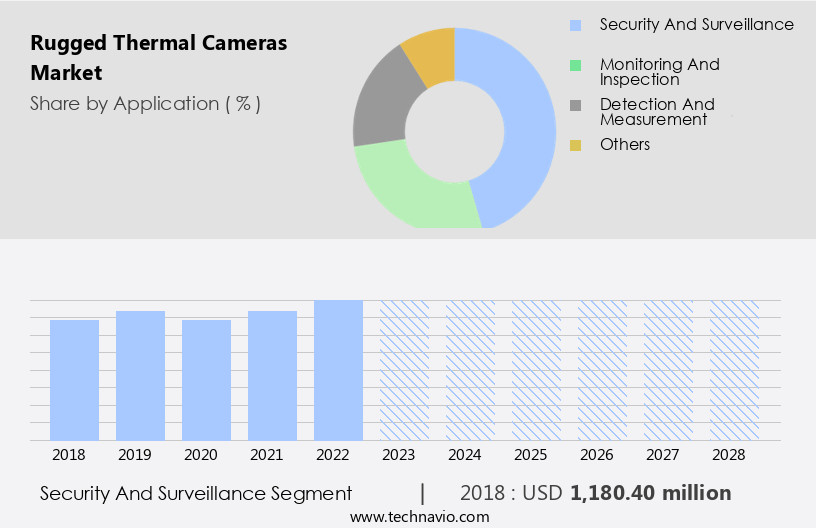

By Application Insights

The security and surveillance segment is estimated to witness significant growth during the forecast period.

Rugged thermal cameras, also referred to as infrared thermal imaging cameras, are essential devices that produce images using infrared light. These cameras are widely adopted by security and defense industries for continuous monitoring and surveillance. Thermography, a key technology in these cameras, offers distinct advantages over traditional visual cameras. It can provide temperature data and identify heat signatures, enabling the detection of individuals or objects in various conditions, including low light and harsh environments. The global market for rugged thermal cameras is experiencing significant growth due to their applications in security and defense sectors. Thermal imaging is particularly useful for identifying intruders on private property or in restricted zones, enhancing security measures.

Thermal analysis, data logging, and image processing are integral components of these cameras, offering advanced capabilities such as thermal signature analysis, process monitoring, and quality control. In addition, rugged thermal cameras find applications in scientific research, industrial inspection, building maintenance, wildlife monitoring, remote sensing, and environmental monitoring. They are also employed in military applications, including target identification, night vision, and search and rescue operations. With advancements in technology, these cameras now offer features like deep learning, image recognition algorithms, noise reduction, wireless connectivity, image stabilization, and autonomous vehicles. Thermal sensitivity, battery life, predictive maintenance, and energy audits are crucial factors influencing the market's growth.

Ruggedized cameras, with their ability to withstand harsh conditions, are gaining popularity in various industries. Furthermore, the integration of artificial intelligence (AI) and machine vision in thermal imaging software is expected to drive market expansion.

The Security and surveillance segment was valued at USD 1.18 billion in 2018 and showed a gradual increase during the forecast period.

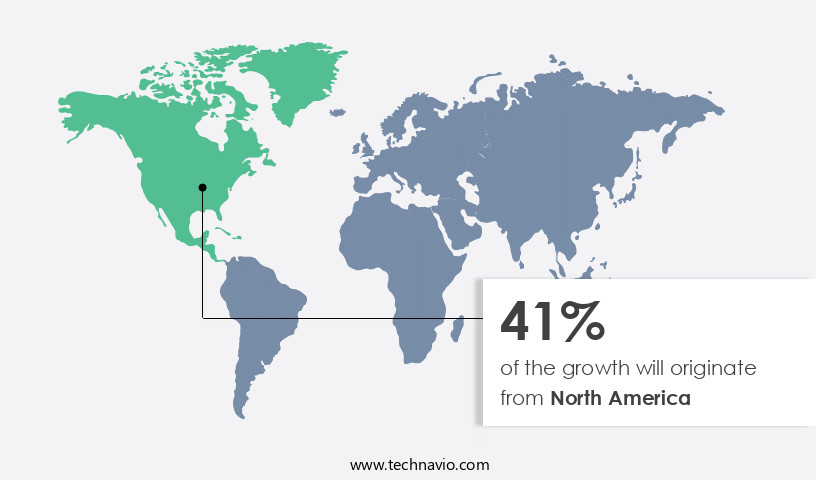

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the presence of prominent defense and military firms, including Lockheed Martin Corporation, BAE Systems plc, and Temporal Defense Systems Inc. These organizations are expanding their investments in various sectors to innovate new defense technologies and weapons. The escalating defense expenditures are anticipated to fuel the demand for rugged thermal cameras in the geospatial industry. Thermal imaging applications, such as thermal signature analysis, process monitoring, and temperature measurement, are crucial components of geospatial research. As research and development activities increase, so does the demand for high-quality thermal imaging solutions.

Rugged thermal cameras offer superior image resolution, frame rate, and noise reduction capabilities, making them indispensable for various thermal imaging applications. Additionally, the integration of artificial intelligence (AI) and machine vision technologies in thermal imaging software further enhances the functionality of rugged thermal cameras. The market is also witnessing the adoption of ruggedized cameras with wireless connectivity, image stabilization, and deep learning algorithms for applications such as predictive maintenance, energy audits, and security industry. The increasing demand for thermal imaging in scientific research, wildlife monitoring, and environmental monitoring further reinforces the market's growth trajectory.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Rugged Thermal Cameras Market thrives with rugged thermal cameras for defense and thermal cameras for industrial inspections. Rugged thermal camera market trends highlight high-resolution thermal imaging and thermal cameras for firefighting. Rugged thermal cameras for surveillance and thermal imaging for search and rescue enhance safety, per rugged thermal camera forecast. IP67-rated thermal cameras leverage thermal cameras with AI analytics, while rugged thermal cameras for oil and gas ensure reliability. Thermal cameras for border security and rugged thermal cameras for construction drive demand. Thermal imaging for predictive maintenance, rugged thermal cameras for utilities, and thermal cameras for environmental monitoring optimize operations. Rugged thermal cameras for automotive, high-sensitivity thermal imaging, thermal cameras for hazardous environments, rugged thermal camera supply chain, advanced thermal camera sensors, and thermal cameras for disaster response fuel growth through 2028.

What are the key market drivers leading to the rise in the adoption of Rugged Thermal Cameras Industry?

- The significant growth in military expenditures serves as the primary catalyst for the market's expansion.

- The global market for rugged thermal cameras is experiencing significant growth due to increasing military spending, which reached USD2.1 trillion in 2021, marking a 6.1% increase from the previous year. This growth can be attributed to substantial investments in research and development (R&D) for next-generation technologies. One such technology is rugged thermal cameras, which are gaining popularity in various industries, including military applications. These cameras are essential for heat detection, enabling predictive maintenance, energy audits, and fault detection. In the security industry, they are used for object recognition and intrusion detection. Furthermore, thermal sensors are increasingly being integrated into autonomous vehicles for improved safety and driver assistance.

- Advancements in technology, such as image stabilization, thermal signature analysis, and artificial intelligence (AI), are enhancing the capabilities of rugged thermal cameras. For instance, AI algorithms can be used for fault detection and predictive maintenance, enabling organizations to address potential issues before they become major problems. In summary, The market is expected to grow exponentially due to the increasing demand for advanced thermal imaging technology in various industries, including military, security, and transportation. The integration of AI and other advanced technologies is further fueling the market's growth.

What are the market trends shaping the Rugged Thermal Cameras Industry?

- The latest market trend involves significant advancements in photogrammetry and thermal imaging technologies. These innovations are expected to bring about substantial improvements in various industries, including surveying, agriculture, and security.

- The market is experiencing significant growth due to the increasing demand for thermal imaging technology in various industries. Thermal analysis, a critical application of thermal imaging, is used for data logging, scientific research, and thermal signature analysis. In the defense industry, thermal imaging plays a crucial role in image processing and thermal image analysis for military applications. Industrial inspection is another major application where thermal cameras are extensively used for process monitoring and building maintenance. The integration of advanced features such as hyperspectral imagery is enhancing the accuracy and quality of thermal images, making it an attractive investment for end-users.

- Companies are responding to this trend by introducing rugged thermal cameras with advanced capabilities to cater to the evolving needs of the market. For instance, some companies are offering these cameras as optional add-ons to their existing product lines, providing greater flexibility to customers. Overall, the market for rugged thermal cameras is expected to continue its growth trajectory during the forecast period, driven by the increasing demand for thermal imaging technology in various industries.

What challenges does the Rugged Thermal Cameras Industry face during its growth?

- Inaccuracies in image data collection pose a significant challenge to the industry's growth, as reliable and precise data are essential for driving advancements and innovation within this field.

- Rugged thermal cameras play a crucial role in various applications, including remote sensing, temperature measurement, wildlife monitoring, and environmental monitoring. These cameras use thermal imaging technology to convert infrared radiation into visible images, enabling users to detect objects and measure temperatures in various environments. The market for rugged thermal cameras is driven by the increasing demand for machine vision applications, such as quality control and deep learning, which require high-performance thermal imaging systems. One challenge in using thermal cameras is positional accuracy, which is essential for geographic information systems (GISs). Inaccuracies in thermal images can lead to incorrect data analysis and impact the overall effectiveness of the system.

- Scene contrast and atmospheric clarity are significant factors affecting image resolution, with low-resolution scans resulting in a loss of critical information and high-resolution scans requiring large storage capacities. Furthermore, thermal imaging software and data analysis tools are essential for effectively utilizing thermal camera data. These tools enable users to process and analyze large volumes of data, making it easier to identify patterns and trends. Video recording capabilities add an extra layer of functionality, allowing for real-time monitoring and analysis. In conclusion, the market for rugged thermal cameras is growing due to their increasing applications in various industries. However, challenges such as positional accuracy and data analysis require advanced thermal imaging software and data analysis tools to effectively utilize the data generated by these cameras.

Exclusive Customer Landscape

The rugged thermal cameras market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rugged thermal cameras market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rugged thermal cameras market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- FLIR Systems

- Teledyne Technologies

- Axis Communications

- Hikvision

- Bosch Security

- Leonardo DRS

- Opgal

- Xenics

- Thermoteknix

- Seek Thermal

- InfiRay

- Guide Infrared

- Testo

- Fluke

- Keysight Technologies

- AMETEK Land

- Jenoptik

- ULIS

- DIAS Infrared

- Sierra-Olympic

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rugged Thermal Cameras Market

- In January 2023, FLIR Systems, a leading provider of thermal imaging and sensing technologies, announced the launch of the Boson 320 and Boson 640 thermal cores, marking a significant technological advancement in rugged thermal cameras (FLIR Systems Press Release). These new cores offer improved resolution, higher frame rates, and enhanced image quality, making them suitable for various applications, including border security, military, and industrial inspection.

- In April 2024, Hikvision, a global leader in security solutions, entered into a strategic partnership with Seebo, an Israeli-based thermal imaging technology company (Hikvision Press Release). This collaboration aims to integrate Seebo's advanced thermal imaging algorithms into Hikvision's cameras, enhancing their performance and expanding their product offerings in the market.

- In July 2024, Teledyne FLIR announced the acquisition of Maritime Research and Technology (MARTEL), a Canadian company specializing in maritime thermal imaging systems (Teledyne FLIR Press Release). This acquisition strengthens Teledyne FLIR's position in the maritime market and provides them with MARTEL's advanced technology and expertise in thermal imaging for maritime applications.

Research Analyst Overview

In the market, operational efficiency and data visualization are key drivers for growth. Cooled thermal cameras with high thermal resolution and user-friendly software enable real-time corrosion detection and pattern recognition, enhancing operational readiness and safety. Hyperspectral imaging and machine learning algorithms offer advanced capabilities for condition assessment, target tracking, and heat loss analysis. Uncooled thermal cameras with multispectral capabilities and temperature mapping provide cost savings through risk reduction and improved situational awareness. Infrastructure inspection, border security, fire prevention, and pipeline inspection are primary applications, while spectral range and wavelength sensitivity cater to diverse industries.

Thermal signature libraries and image fusion facilitate data interpretation, enabling accurate object classification and intrusion detection. Thermal contrast and operator interface enhance the effectiveness of visible light cameras, making thermal imaging training essential for optimal performance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rugged Thermal Cameras Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 2677.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rugged Thermal Cameras Market Research and Growth Report?

- CAGR of the Rugged Thermal Cameras industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rugged thermal cameras market growth of industry companies

We can help! Our analysts can customize this rugged thermal cameras market research report to meet your requirements.