Smart Greenhouse Market Size 2025-2029

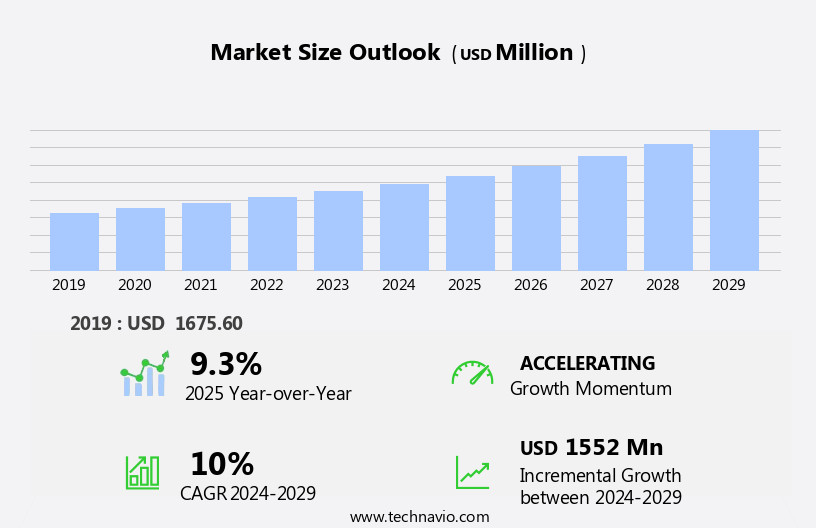

The smart greenhouse market size is forecast to increase by USD 1.55 billion, at a CAGR of 10% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for fresh, locally grown produce and the emerging trend of rooftop farming. This market dynamic is driven by the need to address food security concerns and reduce the environmental impact of long-distance transportation of food. However, the high initial cost of setting up a smart greenhouse remains a significant challenge for market expansion. This includes the investment in advanced technology, such as automation systems and climate control equipment, which can be prohibitive for smaller-scale farmers and new entrants.

- To capitalize on this market opportunity, companies must focus on developing cost-effective solutions while maintaining the necessary technology to ensure optimal crop growth and yield. Effective collaboration between technology providers, greenhouse manufacturers, and farmers will be crucial in addressing the challenge of high setup costs and driving market growth.

What will be the Size of the Smart Greenhouse Market during the forecast period?

The market continues to evolve, driven by the convergence of various technologies and the growing demand for sustainable agriculture. Crop yield optimization is a key focus, with machine learning algorithms and data analytics enabling real-time monitoring and adjustments to plant growth conditions. Water conservation is another critical area, with the integration of irrigation systems and rainwater harvesting solutions helping to minimize water usage. Solar panels and renewable energy systems are increasingly being adopted for greenhouse power needs, contributing to resource optimization and reducing reliance on traditional energy sources. Food security is a major application area, with smart greenhouses enabling year-round production and improved crop quality.

Artificial intelligence and data acquisition play a crucial role in greenhouse management, enabling predictive maintenance, yield forecasting, and precision agriculture. Vertical farms and modular greenhouse systems offer space-efficient solutions for urban agriculture, while climate control systems and lighting systems ensure optimal growing conditions. The integration of plant growth regulators and nutrient management systems further enhances crop yield and quality, while greenhouse design and environmental monitoring ensure optimal growing conditions. The economic viability of smart greenhouses is further boosted by energy efficiency and the integration of wind turbines and LED lighting. Remote monitoring and automation systems enable real-time control and optimization of greenhouse conditions, while data visualization tools provide valuable insights for farmers and researchers.

The ongoing development of these technologies and their integration into the smart greenhouse ecosystem is shaping the future of agriculture and food production.

How is this Smart Greenhouse Industry segmented?

The smart greenhouse industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Hydroponic

- Non-hydroponic

- Component

- HVAC systems

- LED grow lights

- Control systems and sensors

- Others

- Crop Type

- Fruits and vegetables

- Flowers and ornamentals

- Herbs and leafy greens

- Others

- Technology

- IoT-enabled greenhouse

- Automated greenhouse

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

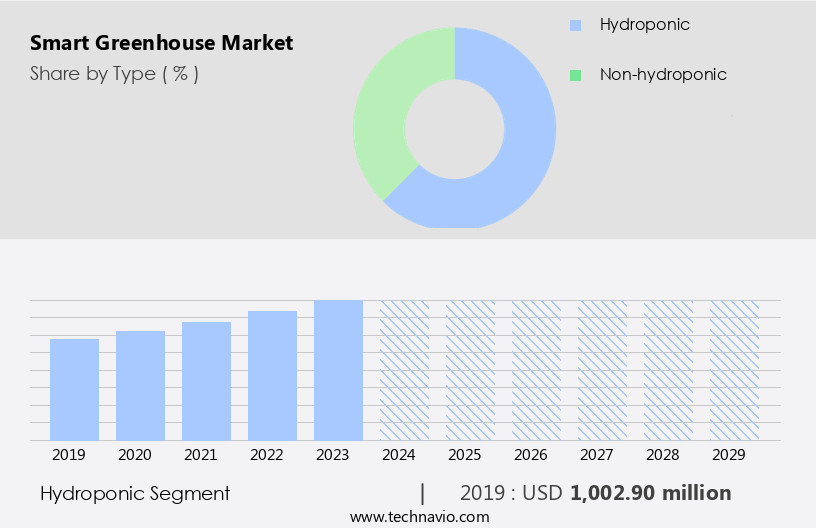

The hydroponic segment is estimated to witness significant growth during the forecast period.

In the realm of agriculture, smart greenhouses have emerged as a pioneering solution for optimizing crop yield and promoting water conservation. These advanced structures leverage technologies such as machine learning, artificial intelligence, and data analytics to create an ideal growing environment. Solar panels and renewable energy sources power climate control systems, lighting systems, and irrigation systems, ensuring resource optimization. Vertical farms and modular greenhouse systems enable urban agriculture, increasing food security in densely populated areas. Controlled environment agriculture, including hydroponics and nutrient management, thrives in smart greenhouses. Hydroponics, a method of growing plants in a water-based nutrient solution, has gained significant traction due to its water efficiency and adaptability to various growing conditions.

Vertical farming and precision agriculture further enhance productivity and resource utilization. Greenhouse management software and data visualization tools facilitate remote monitoring and yield forecasting, allowing farmers to make informed decisions based on real-time data. Automation and environmental monitoring systems ensure consistent growing conditions and minimize human intervention. The integration of LED lighting, wind turbines, and other energy-efficient technologies further boosts the economic viability of these innovative structures. Innovations in greenhouse design continue to shape the market, with a focus on energy efficiency, resource optimization, and sustainable practices. The future of agriculture lies in the integration of technology and science to create efficient, productive, and eco-friendly growing environments.

The Hydroponic segment was valued at USD 1 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the global market for smart greenhouses, APAC holds a significant share due to its large population and the pressing need for sustainable agriculture. Traditional farming faces challenges in the region, including poor land management, natural disasters, and extreme weather conditions. In response, there is a growing trend towards controlled environment agriculture, which includes vertical farms, modular greenhouse systems, and precision agriculture. These innovative farming methods utilize machine learning and artificial intelligence for data acquisition and analysis, resource optimization, and climate control. Solar panels and wind turbines are increasingly being integrated into greenhouse design for renewable energy.

Food security is a major concern, particularly in densely populated areas where urban agriculture is gaining popularity. Smart greenhouse technology enables efficient nutrient management, irrigation systems, and yield forecasting, making it an essential tool for economic viability. Greenhouse management software and automation systems streamline operations and improve energy efficiency. The integration of LED lighting and environmental monitoring ensures optimal plant growth and reduces the need for pesticides. Overall, the market is evolving to meet the demands of a growing population and the need for sustainable, efficient, and technologically advanced agriculture.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Smart Greenhouse Industry?

- The increasing demand for fresh food serves as the primary market driver.

- The market is witnessing significant growth due to the increasing urban population and the resulting demand for fresh produce. According to United Nations data, approximately 55% of the world's population currently resides in urban areas, with this proportion projected to reach 68% by 2050. As urban populations grow and affluence increases, so does the consumption of fresh fruits and vegetables. Traditional farming in rural areas may not be able to meet this demand efficiently due to logistical challenges. To ensure freshness and availability of fruits and vegetables, greenhouses located near cities are becoming increasingly popular.

- These advanced greenhouses incorporate various technologies such as LED lighting, wind turbines, environmental monitoring, precision agriculture, greenhouse automation, data visualization, and energy efficiency. These innovations enable the production of fresh produce year-round, irrespective of external weather conditions. By integrating these technologies, greenhouse operators can optimize crop yields, reduce water usage, and minimize energy consumption, making the overall operation more sustainable and cost-effective. In conclusion, the market is experiencing substantial growth due to the increasing urban population and the resulting demand for fresh produce. These advanced greenhouses employ various technologies to optimize crop yields, reduce water usage, and minimize energy consumption, making them a sustainable and cost-effective solution for meeting the demand for fresh fruits and vegetables.

What are the market trends shaping the Smart Greenhouse Industry?

- Rooftop farming is an emerging market trend that is gaining popularity. This innovative agricultural approach utilizes underutilized urban spaces to grow fresh produce in densely populated areas.

- In response to the changing dietary preferences and the increasing urban population, rooftop smart greenhouses have emerged as a promising solution for sustainable food production in urban areas. These innovative structures, built on the rooftops of buildings, utilize advanced technologies such as hydroponics and aeroponics for crop cultivation without soil. The integration of machine learning and artificial intelligence in these greenhouses enables optimal crop yield and water conservation. Moreover, solar panels are increasingly being used to power these greenhouses, further enhancing their eco-friendliness.

- Rooftop smart greenhouses offer an excellent opportunity to create new agricultural spaces in cities, increasing plant coverage and contributing to food security. By employing data acquisition and analysis techniques, these greenhouses can optimize their operations and ensure consistent crop growth. The use of technology in urban agriculture is a significant step towards sustainable food production and food security in the face of urban population growth.

What challenges does the Smart Greenhouse Industry face during its growth?

- The high initial cost of setting up a smart greenhouse is a significant challenge that can hinder the growth of the industry. This financial hurdle may discourage potential investors and limit the expansion of the market. To mitigate this issue, it is essential to explore cost-effective solutions, such as government incentives, subsidies, or partnerships with technology providers, to help offset the initial investment and encourage broader adoption of smart greenhouse technology.

- Smart greenhouses represent a significant investment due to the integration of advanced systems, including heating, ventilation, and air conditioning (HVAC), light emitting diodes (LED) grow lights, sensors, and greenhouse management software. LED grow lights offer energy efficiency, as they consist of numerous diodes, making them more cost-effective in the long run compared to high-pressure sodium (HPS) lights. However, the initial investment for LED grow lights is higher due to the expense of their diodes. Vertical farming and controlled environment agriculture have gained popularity due to resource optimization, nutrient management, and the ability to grow crops year-round. Renewable energy integration, such as solar panels, is increasingly common in smart greenhouses to reduce energy costs and promote sustainability.

- Data analytics plays a crucial role in greenhouse management, enabling resource optimization and improving plant growth through the use of plant growth regulators. In conclusion, smart greenhouses offer numerous benefits, including energy efficiency, resource optimization, and year-round crop production. The integration of advanced technologies, such as LED grow lights, greenhouse management software, and renewable energy, contributes to the high initial investment but offers long-term cost savings and improved crop yields.

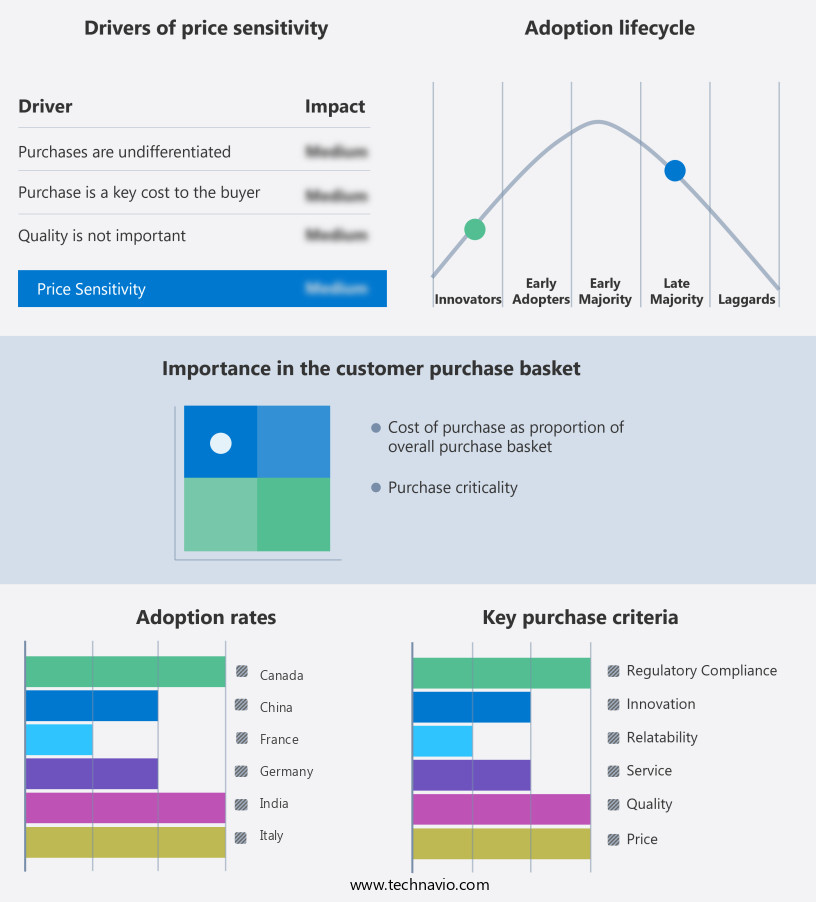

Exclusive Customer Landscape

The smart greenhouse market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the smart greenhouse market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, smart greenhouse market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ag Leader Technology - This company specializes in innovative greenhouse technologies, including InCommand and AgFiniti solutions. Our offerings enhance agricultural productivity through advanced data management and precision farming techniques. InCommand facilitates real-time monitoring and control of greenhouse environments, while AgFiniti provides seamless data integration and analysis. By leveraging these smart solutions, farmers can optimize resource usage, improve crop yields, and minimize operational costs. Our commitment to sustainable agriculture and technological advancement sets us apart in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ag Leader Technology

- AGCO Corp.

- Agra Tech Inc.

- Ceres Greenhouse Solutions

- Certhon Build B.V.

- CLAAS KGaA mBH

- CNH Industrial NV

- Controlled Environments Ltd.

- Cultivar Ltd.

- Deere and Co.

- Gibraltar Industries Inc.

- Green Automation Group Oy Ltd.

- Heliospectra AB

- LOGIQS B.V.

- Orbia Advance Corp. S.A.B. de C.V.

- Phonetics Inc.

- Richel Group SAS

- Signify NV

- Sollum Technologies inc.

- TSI Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Smart Greenhouse Market

- In February 2023, Signify, a global lighting company, announced the launch of its new Philips GreenPower LED toplighting system, designed specifically for smart greenhouses. This innovative solution combines horticulture-specific LED lights with Philips' digital control system, aiming to optimize plant growth and yield (Signify Press Release, 2023).

- In June 2024, Microsoft and Bright Agrotech, a US-based smart greenhouse technology provider, announced a strategic partnership to integrate Microsoft's Azure IoT and AI solutions with Bright Agrotech's greenhouse systems. This collaboration aims to enhance automation, data analysis, and precision farming capabilities for greenhouse operators (Microsoft News Center, 2024).

- In October 2024, Plenty, a leading vertical farming company, secured a USD200 million Series D funding round, bringing its total funding to over USD400 million. The investment will support the expansion of Plenty's smart greenhouse operations and the development of new technologies to increase production capacity and efficiency (Plenty Press Release, 2024).

- In March 2025, the European Union announced the Horizon Europe research and innovation program, allocating â¬1 billion to the development of smart and sustainable agriculture, including greenhouse technology. This significant investment aims to boost European greenhouse production, reduce carbon emissions, and promote sustainable farming practices (European Commission Press Release, 2025).

Research Analyst Overview

- The market encompasses innovative technologies and practices that optimize plant science in organic farming, enabling efficient plant growth analysis and environmental impact assessment. Plant breeding advances, such as genetic engineering and tissue culture, are integrated with big data and cloud computing to enhance crop yields and reduce greenhouse gas emissions. Sustainable agriculture practices, including crop rotation, vertical farming, and urban farming, are gaining traction in the market. Aquaponic and hydroponic systems, along with aeroponic and circular economy principles, contribute to resource-efficient growing media and water usage.

- Indoor farming and plant stress monitoring technologies ensure optimal growing conditions and minimize environmental impact. Leafy greens, a key focus of the market, undergo life cycle analysis to reduce carbon sequestration and further promote sustainable practices. Overall, the market is driven by the integration of technology and science to optimize plant growth and minimize environmental impact.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Smart Greenhouse Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2025-2029 |

USD 1552 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.3 |

|

Key countries |

China, India, US, Japan, Germany, Canada, France, UK, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Smart Greenhouse Market Research and Growth Report?

- CAGR of the Smart Greenhouse industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the smart greenhouse market growth of industry companies

We can help! Our analysts can customize this smart greenhouse market research report to meet your requirements.