Social Business Intelligence Market Size 2025-2029

The social business intelligence market size is valued to increase USD 6.66 billion, at a CAGR of 6% from 2024 to 2029. Brand loyalty improvement using social media analytics will drive the social business intelligence market.

Major Market Trends & Insights

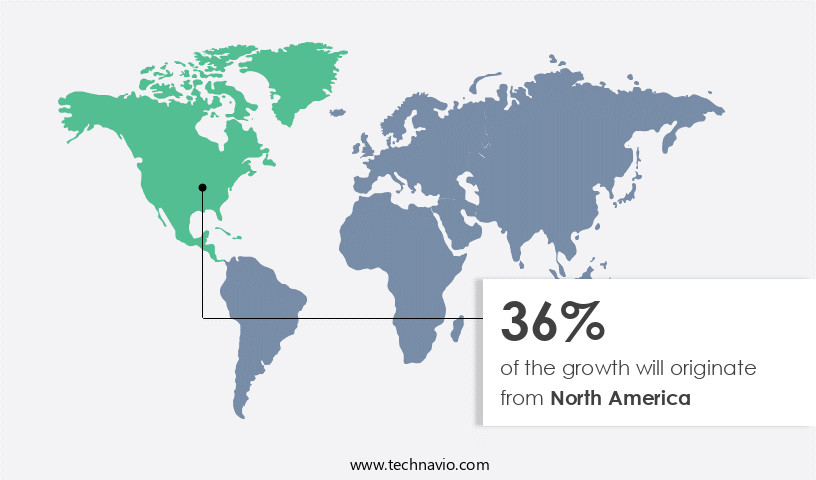

- North America dominated the market and accounted for a 36% growth during the forecast period.

- By Deployment - On-premises segment was valued at USD 9.32 billion in 2023

- By End-user - Enterprises segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 72.83 billion

- Market Future Opportunities: USD 6661.20 billion

- CAGR from 2024 to 2029 : 6%

Market Summary

- The Social Business Intelligence (SBIs) market has experienced significant growth. This expansion is driven by businesses recognizing the value of deriving actionable insights from social media data to enhance customer engagement and improve brand loyalty. SBIs enable organizations to analyze vast amounts of social media data in real-time, providing valuable insights into consumer behavior, preferences, and trends. Advanced targeting options, such as sentiment analysis and demographic segmentation, have become essential components of SBIs. These features allow businesses to tailor their marketing strategies to specific audience segments, increasing the effectiveness of their social media campaigns.

- However, challenges persist, including the increasing connection and bandwidth difficulties that hinder the real-time processing of large volumes of social media data. Despite these challenges, the future of SBIs remains promising. As businesses continue to prioritize digital transformation and data-driven decision-making, the demand for SBIs is expected to grow. The integration of artificial intelligence and machine learning technologies into SBIs will further enhance their capabilities, enabling more accurate and timely insights. In conclusion, the market represents a significant opportunity for businesses seeking to leverage social media data for competitive advantage.

What will be the Size of the Social Business Intelligence Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Social Business Intelligence Market Segmented ?

The social business intelligence industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- End-user

- Enterprises

- Government

- Application

- Sales and marketing management

- Customer engagement and analysis

- Competitive intelligence

- Risk and compliance management

- Asset and inventory management

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with organizations increasingly relying on advanced tools to extract valuable insights from vast amounts of social data. Text mining methods, such as sentiment analysis and opinion mining techniques, are used to gauge customer experience metrics and identify influence scores. Influence mapping tools help visualize message resonance and social media engagement, while big data processing and machine learning algorithms enable real-time data streams to be analyzed for reach and impressions. Crisis communication management is enhanced through risk assessment tools and social intelligence software, which utilize natural language processing and data visualization dashboards for network analysis techniques.

The On-premises segment was valued at USD 9.32 billion in 2019 and showed a gradual increase during the forecast period.

Brands employ consumer insights platforms and social listening tools to monitor engagement rate metrics and sentiment scoring, providing predictive analytics models and social network graphs to inform brand advocacy programs and competitor intelligence platforms. The importance of data security is underscored by the fact that 91% of Fortune 500 companies use on-premises deployment for their social media analytics software. This approach offers superior security through dedicated servers and physical access restrictions, making it a preferred choice for handling sensitive data.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Social Business Intelligence Market Demand is Rising in North America Request Free Sample

The market in the US is experiencing significant growth, fueled by the increasing digitalization of businesses and the widespread adoption of cloud services. Small and medium-sized enterprises (SMEs), which account for nearly two-thirds of net new jobs in the private sector, are increasingly utilizing social business intelligence tools and analytics. These platforms and software solutions are poised for growth as more companies expand their use of cloud systems.

North America, as an early adopter of complex technologies, is a key market for social business intelligence. This trend underscores the importance of social media and data analytics in driving business insights and decision-making in the digital age.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape that enables organizations to derive valuable insights from real-time social listening tools for brand monitoring and customer feedback analysis using natural language processing. With the increasing importance of social media in business strategy, predictive analytics for social media campaign optimization and social network analysis for influence mapping and brand advocacy have become essential components. Sentiment analysis techniques for crisis communication management and data visualization dashboards for social media performance tracking provide actionable insights, while competitive benchmarking using social listening platforms and topic modeling for social media insights and trends offer a competitive edge.

Machine learning algorithms for social intelligence and prediction, big data processing for social listening and analysis, opinion mining techniques for customer feedback analysis, text mining methods for social media data extraction, network analysis techniques for community detection, influence score calculation for key opinion leader identification, message resonance measurement for effective communication, share of voice analysis for brand performance tracking, and social media engagement measurement for campaign effectiveness are all integral parts of this market. According to recent studies, more than 90% of companies are now using social media for marketing, and over 75% of Fortune 500 companies use social media for customer service.

This demonstrates a significant shift in business strategy, with social media becoming a crucial channel for customer engagement and brand management. In comparison, traditional market research methods are increasingly being overshadowed by the real-time, data-driven insights offered by social business intelligence tools. In conclusion, the market is a vital and growing sector, offering businesses the ability to gain valuable insights from social media data, enabling them to make informed decisions, engage effectively with their customers, and stay ahead of the competition.

What are the key market drivers leading to the rise in the adoption of Social Business Intelligence Industry?

- Brand loyalty enhancement through social media analytics is a crucial market trend. By leveraging social media data, businesses can gain valuable insights into customer behavior and preferences, enabling them to strengthen customer relationships and foster brand loyalty.

- Social media analytics tools, including HubSpot, BuzzSumo, and Google Analytics, serve as a bridge between brands and their customers. These platforms enhance customer engagement and provide valuable insights into consumer behavior. A substantial number of consumers make purchasing decisions based on product information, reviews, and recommendations on social media channels. In developed nations, social media has emerged as a preferred platform for shopping, with a considerable percentage of the population relying on it for purchases. Brands that maintain an open social media presence can expand their customer base and foster customer loyalty.

- The emphasis on retaining existing customers and acquiring new ones fuels the demand for social business intelligence. This trend is expected to propel the expansion of the market during the forecast period.

What are the market trends shaping the Social Business Intelligence Industry?

- Advanced targeting options are becoming increasingly popular in marketing trends. This approach allows for more precise audience segmentation and effective campaign execution.

- Social media analytics plays a pivotal role in expanding businesses' reach beyond traditional demographic and geographic boundaries. By harnessing user data from social networks, analytic tools offer various targeting options for brands to engage potential customers effectively. One such method is interest targeting, which identifies consumers based on their stated interests, activities, and skills on social media platforms. This approach facilitates keyword research and market exploration, enabling brands to tailor their product promotions and personalized services to specific segments. Facebook, LinkedIn, Pinterest, and Twitter are some of the social media giants providing interest targeting services.

- This data-driven strategy allows businesses to connect with their audience in a more meaningful way, ultimately enhancing customer engagement and driving growth in the ever-evolving digital landscape.

What challenges does the Social Business Intelligence Industry face during its growth?

- The expansion of business requirements for greater connection speeds and data capacity poses a significant challenge to the industry's growth due to increasing complexities in establishing and maintaining adequate infrastructure for bandwidth and connectivity.

- Cloud computing services have become indispensable for enterprises, enabling them to access vast amounts of data from anywhere, anytime. The importance of high-performance IT infrastructure is underscored by the need for quick data access and service level agreements. Terabytes of data are stored in cloud-based systems, requiring effective networking to ensure seamless access. However, connectivity faults and network latency can hinder business operations and lead to potential switches to on-premises solutions. Network and data separation are common challenges in cloud computing. To mitigate these issues, enterprises invest in robust IT infrastructure, ensuring minimal packet loss and latency.

- The ongoing evolution of cloud computing is marked by the increasing adoption of advanced technologies such as edge computing and artificial intelligence. Edge computing brings data processing closer to the source, reducing latency and improving overall performance. AI integration enhances data analysis capabilities, enabling businesses to gain valuable insights and make informed decisions. In conclusion, cloud computing plays a crucial role in modern business operations, offering flexibility, scalability, and quick data access. However, maintaining a high-performance IT infrastructure is essential to ensure seamless access and address challenges such as network latency, packet loss, and data separation.

- The continuous advancements in cloud computing technologies, like edge computing and AI, further enhance the value proposition for enterprises.

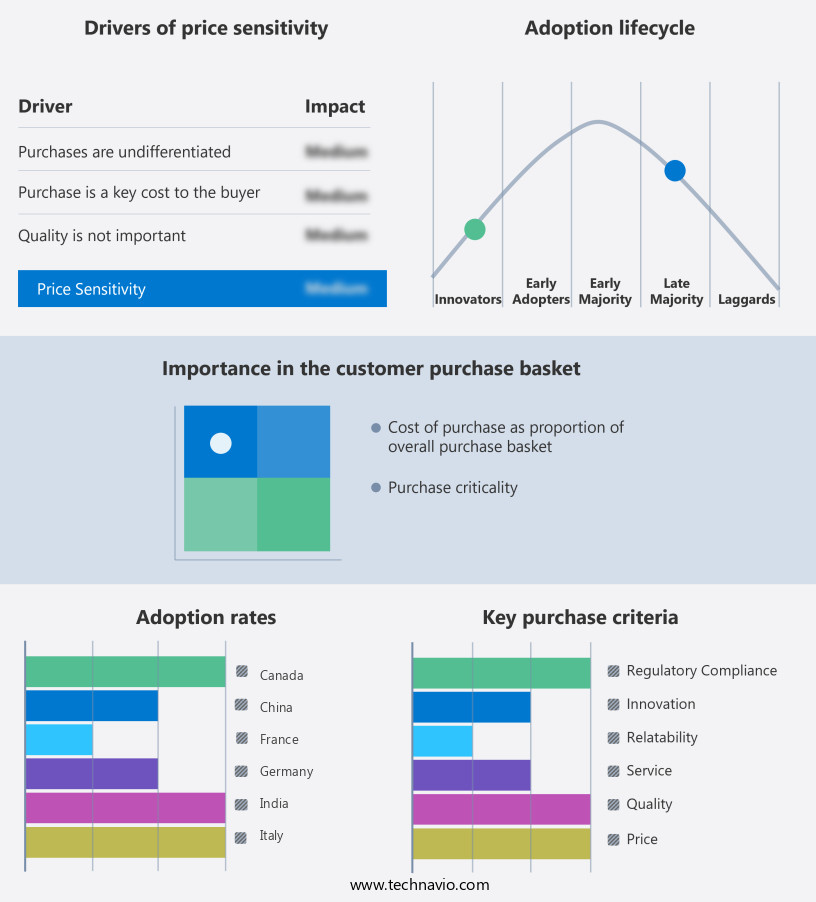

Exclusive Technavio Analysis on Customer Landscape

The social business intelligence market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the social business intelligence market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Social Business Intelligence Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, social business intelligence market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acquia Inc. - Social business intelligence reporting and analytics present complex challenges for marketers, requiring in-depth analysis to effectively utilize collected data for informed campaigns.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acquia Inc.

- Adobe Inc.

- Cision US Inc.

- Emplifi Inc

- GoodData Corp.

- Google LLC

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Ipsos Group S A

- Maritz Holdings Inc.

- Microsoft Corp.

- NetBase Solutions Inc.

- Oracle Corp.

- Piano Software Inc.

- Qualtrics LLC

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Sprout Social Inc.

- Vista Equity Partners Management LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Social Business Intelligence Market

- In January 2024, IBM announced the launch of Watson Explorer for Social Media, an expansion of its Watson AI platform. This new offering enables businesses to analyze unstructured data from social media channels for enhanced customer insights and trend identification (IBM Press Release).

- In March 2024, Microsoft and Adobe formed a strategic partnership to integrate Microsoft's Power BI data analytics service with Adobe Experience Cloud. This collaboration aimed to provide businesses with a comprehensive solution for analyzing customer data from various sources, including social media (Microsoft News Center).

- In May 2024, SAP SE acquired Qualtrics International for USD 8 billion, strengthening its position in the customer experience management market. The acquisition included Qualtrics' Social Listening solution, which uses AI to analyze social media data for customer sentiment and trend identification (SAP Press Release).

- In February 2025, Twitter announced a major expansion of its Twitter Data Partnership Program, allowing more companies to access real-time, anonymized Twitter data for social media analysis. This move increased the availability of valuable social media data for businesses and researchers (Twitter Business Blog).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Social Business Intelligence Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 6.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, Canada, China, Germany, Japan, UK, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the ever-evolving landscape of business intelligence, social business intelligence (SBI) stands out as a crucial component for organizations seeking to gain a competitive edge. SBI harnesses the power of text mining methods to extract valuable insights from customer experience metrics gleaned from social media platforms. This data-driven approach allows businesses to stay attuned to influence mapping tools and message resonance, enabling them to engage effectively with their audience. Social media engagement is a significant driver of SBI, with big data processing playing a pivotal role in managing reach and impressions. Machine learning algorithms and sentiment analysis are essential components of SBI, providing valuable information on customer sentiment and opinion mining techniques.

- These insights can inform crisis communication management, topic modeling, and social intelligence software, enabling organizations to assess risks and respond appropriately. Moreover, SBI offers various benefits, including real-time data streams, information extraction, and competitor intelligence platforms. Brands can monitor their reputation through brand advocacy programs and sentiment scoring, while predictive analytics models help anticipate trends and customer needs. Social network graphs, natural language processing, and consumer insights platforms facilitate network analysis techniques, enabling businesses to understand their audience's community detection and customer journey mapping. The influence score derived from SBI is a critical metric for measuring social media engagement, with sentiment rate metrics and brand monitoring systems offering valuable insights into audience sentiment and brand performance.

- Influence mapping tools and network analysis techniques provide a comprehensive understanding of key opinion leaders and their impact on brand perception. In the realm of SBI, reach and impressions, engagement rate metrics, and sentiment analysis are essential components that work in tandem to provide businesses with a holistic view of their social media presence. By integrating these tools, organizations can make data-driven decisions, optimize their social media campaigns, and ultimately, build stronger relationships with their customers.

What are the Key Data Covered in this Social Business Intelligence Market Research and Growth Report?

-

What is the expected growth of the Social Business Intelligence Market between 2025 and 2029?

-

USD 6.66 billion, at a CAGR of 6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Deployment (On-premises and Cloud), End-user (Enterprises and Government), Application (Sales and marketing management, Customer engagement and analysis, Competitive intelligence, Risk and compliance management, and Asset and inventory management), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Brand loyalty improvement using social media analytics, Increasing connection and bandwidth difficulties

-

-

Who are the major players in the Social Business Intelligence Market?

-

Acquia Inc., Adobe Inc., Cision US Inc., Emplifi Inc, GoodData Corp., Google LLC, Hewlett Packard Enterprise Co., International Business Machines Corp., Ipsos Group S A, Maritz Holdings Inc., Microsoft Corp., NetBase Solutions Inc., Oracle Corp., Piano Software Inc., Qualtrics LLC, Salesforce Inc., SAP SE, SAS Institute Inc., Sprout Social Inc., and Vista Equity Partners Management LLC

-

Market Research Insights

- The market encompasses a range of data-driven solutions that enable organizations to gain valuable insights from customer feedback analysis, strategic communication planning, and brand storytelling. Two key areas of focus within this market are predictive modelling techniques and digital marketing strategies. According to industry estimates, the global market for social intelligence solutions is projected to reach USD 15.4 billion by 2025. This significant expansion can be attributed to the increasing adoption of business intelligence tools for topic detection, audience segmentation, and brand perception measurement. In contrast, traditional market research methods, such as surveys and focus groups, are projected to decline during the same period.

- This shift towards more data-driven approaches reflects the growing importance of social media monitoring, customer service feedback, and online reputation management in today's digital business landscape. Additionally, data mining techniques and social listening platforms enable organizations to gain real-time insights into customer preferences, brand awareness tracking, communication effectiveness, and competitive landscape mapping. Ultimately, these insights inform data-driven decision-making across various business functions, from marketing and communication to risk management and customer relationship management.

We can help! Our analysts can customize this social business intelligence market research report to meet your requirements.