Spa And Salon Software Market Size 2025-2029

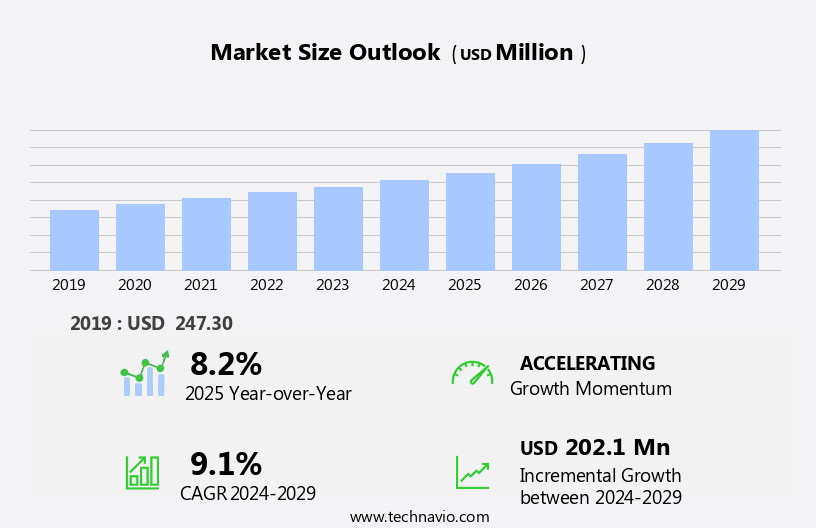

The spa and salon software market size is forecast to increase by USD 202.1 million at a CAGR of 9.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the reduction in overall operational costs and the increasing adoption by small-scale spa and salon providers. Traditional manual methods of managing appointments, inventory, and financial transactions are being replaced with automated software solutions, leading to increased efficiency and cost savings. Furthermore, the growing trend towards digitalization in the beauty industry is fueling market expansion. However, the market is not without challenges. Trends include the integration of add-ons for payment processing, mobile apps, and data security features such as HIPAA compliance. Complications in changeover from traditional systems and the need for extensive training and IT infrastructure can hinder adoption, particularly for smaller businesses with limited resources.

- To capitalize on market opportunities and navigate these challenges effectively, companies must focus on providing user-friendly software, affordable pricing, and strong customer support. By doing so, they can help small-scale spa and salon providers streamline their operations, enhance the customer experience, and ultimately, drive business growth.

What will be the Size of the Spa And Salon Software Market during the forecast period?

- The market caters to the unique needs of businesses in the beauty industry, including salons, spas, luxury hotels, resorts, medical spas, and wellness centers. This market is driven by the increasing adoption of digital technologies to streamline operations and enhance customer experience. Key features of spa and salon software include online storefronts for selling wellness products, appointment scheduling and booking, inventory management, reporting dashboards, and staff management. Cloud-based solutions offer flexibility, accessibility, and cost savings for small and large enterprises alike.

- Developing economies and wellness tourism are emerging markets for spa and salon software. Business continuity and operational costs are key considerations for spa owners, making cloud solutions an attractive option. Digital tools enable beauty professionals to manage their businesses more efficiently, improve client retention, and offer online booking options. The market is expected to grow as the wellness industry continues to prioritize healthy lifestyles and digital transformation.

How is this Spa And Salon Software Industry segmented?

The spa and salon software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Cloud

- On premises

- Customer Type

- SMEs

- Large enterprises

- Function

- Booking and Scheduling

- Inventory Management

- Employee Management

- Analytics and Reporting

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

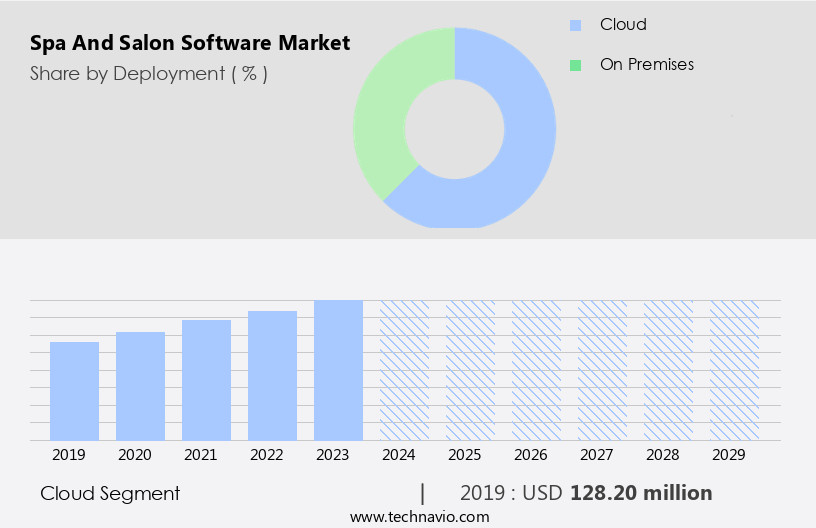

By Deployment Insights

The cloud segment is estimated to witness significant growth during the forecast period. Cloud-based spa and salon software is experiencing significant growth due to its flexibility and cost-saving benefits for businesses worldwide. This software allows spas and salons to focus on their core competencies while cloud service providers manage the IT infrastructure. Clients can save on infrastructure costs by utilizing cloud-based solutions, enabling easy updates and access to information from anywhere. Cloud deployment ensures business continuity and accommodates unique spa and salon requirements. Key features include booking and scheduling, inventory management, employee management, reporting dashboards, and add-ons for large businesses and medical spas. Digitalization and the healthy lifestyle trend are driving demand for these solutions in luxury hotels, spa resorts, and wellness tourism.

However, data security concerns must be addressed by SaaS providers. The market caters to beauty industry professionals, wellness products, and large enterprises, offering automation, resource management, marketing activities, and client management tools. Developing economies and HIPPA regulations are also influencing market growth.

Get a glance at the market report of share of various segments Request Free Sample

The Cloud segment was valued at USD 128.20 million in 2019 and showed a gradual increase during the forecast period.

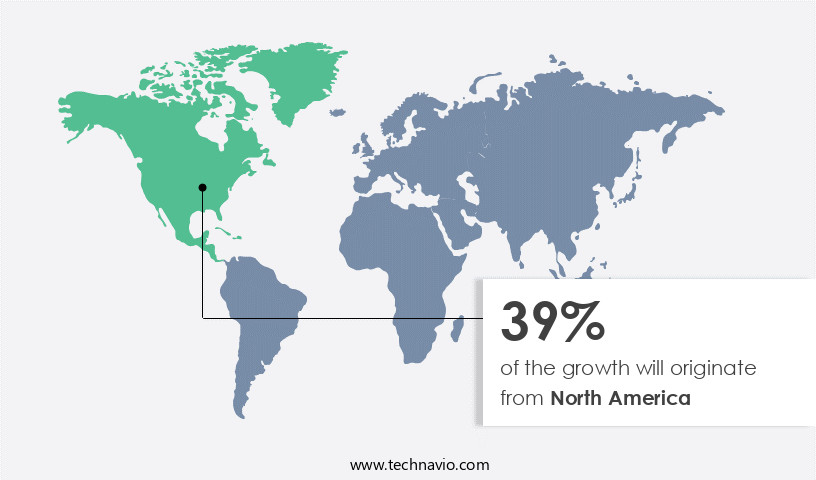

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is experiencing growth due to the increasing adoption of cloud-based solutions in the beauty industry. Spas and salons are leveraging these systems to manage client communication, streamline appointments, and gain data-driven insights for business improvement. The trend toward healthy lifestyles and instant services in North America, particularly in the US, is fueling this demand. Additionally, digitalization in the form of mobile salon apps and online storefronts is enabling businesses to expand their reach and enhance customer satisfaction levels. Regulations, employment issues, and data security concerns are key challenges for market players, necessitating the need for compliance with standards such as HIPAA and interoperability solutions.

Large businesses, luxury hotels, spa resorts, and medical spas are significant market participants, utilizing add-on features, inventory management, employee management, and marketing activities to drive growth. Cloud-based SaaS providers offer business continuity and automation solutions, making it easier for beauty professionals to manage their resources and plan effectively. The market is expected to continue growing as the industry embraces digital technologies and the healthy lifestyle trend.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Spa And Salon Software Industry?

- Reduction in overall operational costs is the key driver of the market. Spas and salons are integrating technology into their operations to manage client and employee needs more efficiently and effectively. Mid-to-small size businesses in this sector aim to increase revenue by controlling expenses and streamlining processes. Approximately 10% of their budgets are allocated to strategies and solutions that help maintain and retain customers. Spa and salon software is a valuable investment in this regard, reducing the reliance on manual record keeping and increasing overall efficiency.

- This software enables managers to optimize staff scheduling, catering to peak demand while controlling labor costs. By automating various functions, spas and salons can eliminate inadequacies, accelerate process efficiencies, and focus on delivering exceptional customer experiences.

What are the market trends shaping the Spa And Salon Software Industry?

- Growing adoption by small-scale spa and salon providers is the upcoming market trend. The spa and salon industry is witnessing significant changes due to evolving consumer preferences and the adoption of technology. Small-scale providers are increasingly turning to cloud-based services to meet fluctuating demands and offer uninterrupted services. The reliability and convenience offered by cloud solutions, coupled with the rise in adoption of technology for marketing and social media, are driving the deployment of spa and salon management software.

- This trend is particularly prominent in developing economies in the Asia Pacific region, where there is a growing demand for Software-as-a-Service (SaaS) applications. Small spa and salon management players are shifting from on-premises servers to cloud-based applications to streamline their operations and remain competitive.

What challenges does the Spa And Salon Software Industry face during its growth?

- Complications in the changeover from traditional systems are a key challenge affecting the industry growth. In the dynamic spa and salon industry, businesses must stay attuned to customer needs and market trends to remain competitive. Advanced technology adoption, while beneficial, introduces challenges such as system integration and interoperability issues.

- Three primary hurdles in implementing a new management system include forming a dedicated team to support various stakeholders, which adds to the cost structure; ensuring seamless communication and collaboration among team members; and providing comprehensive training to end-users for effective utilization of the new system. By addressing these challenges, businesses can optimize their operations, enhance customer experience, and ultimately, boost revenue growth.

Exclusive Customer Landscape

The spa and salon software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the spa and salon software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, spa and salon software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

DaySmart Software Inc. - The company offers spa and salon software, such as Beauty spa software.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AestheticsPro

- Booksy International sp. z o.o.

- Boulevard Labs Inc.

- Hive

- Millennium Systems International LLC

- MINDBODY Inc.

- OpenSpend Inc.

- Phorest Inc.

- ProSolutions Software

- Salonist

- SalonRunner Software LLC

- SalonTarget

- Shortcuts Software Australia Pty Ltd.

- SimpleSpa

- Springer Miller Systems

- Syntec Business Systems Inc.

- Vagaro Inc.

- Waffor Inc.

- Zenoti

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for salon and spa software is experiencing significant growth as businesses in this sector seek to digitalize their operations and enhance the customer experience. This trend is particularly prominent in the luxury hotel spas and spa resorts, where disposable incomes are higher and the expectation for personalized and convenient services is high. The increasing adoption of online storefronts and mobile salon apps enables spa owners to offer clients the ability to book appointments online, view a reporting dashboard of their treatment history, and even purchase wellness products. These digital solutions also offer benefits such as real-time inventory management, employee management, and business continuity planning.

However, the implementation of digital technologies in the salon and spa industry also presents challenges. Regulation and employment issues are key concerns for spa owners, particularly about data security and compliance with regulations such as HIPAA. Additionally, the cost of training staff to use new software and the interoperability issue with existing systems can be barriers to adoption. The beauty industry, which includes medical spas and wellness tourism, is also driving the demand for advanced software solutions. Large businesses and enterprises are increasingly turning to cloud-based software and SaaS providers to streamline their operations and improve customer satisfaction levels.

The addition of features such as automation, resource management, marketing activities, and client management further enhances the value proposition of these solutions. Digitalization is also transforming the way beauty professionals operate, with many opting for virtual offices and remote work arrangements. This trend is particularly prevalent in developing economies, where the cost savings and flexibility offered by digital solutions are particularly attractive. The wellness lifestyle trend is also driving growth in the salon and spa software market. Consumers are increasingly seeking personalized and convenient services, and software solutions enable businesses to offer tailored treatments and recommendations based on client data.

Additionally, the ability to offer online booking and scheduling, inventory management, and employee management enables businesses to operate more efficiently and effectively. Despite the benefits of digitalization, there are also challenges. Data security concerns are a major issue, particularly for businesses handling sensitive client information. Additionally, the cost of implementing and maintaining software solutions can be a barrier for smaller businesses. The salon and spa software market is experiencing significant growth as businesses seek to digitalize their operations and enhance the customer experience. The trend is particularly prominent in the luxury hotel spas and spa resorts, and is being driven by the wellness lifestyle trend and the increasing adoption of digital technologies in the beauty industry.

However, there are also challenges, including regulation and employment issues, data security concerns, and the cost of implementation and maintenance. Despite these challenges, the benefits of digitalization are clear, and businesses that invest in the right software solutions will be well-positioned to grow and thrive in a rapidly changing market. A spa owner looking to enhance their business efficiency can benefit greatly from an online storefront that enables online appointments and booking, and scheduling. Platforms like Fresha provide a comprehensive SaaS provider solution, offering features such as add-ons, customer management, and inventory tracking. These tools help med-spas streamline operations while ensuring service personalization through CRM integration. With automation tools and real-time data, spa owners can achieve better planning and control over their services. The scalability features of such platforms allow businesses to grow while keeping training costs low, making them an ideal choice for both virtual office and mobile salon app users.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 202.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.2 |

|

Key countries |

US, UK, China, Germany, Canada, Japan, France, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Spa And Salon Software Market Research and Growth Report?

- CAGR of the Spa And Salon Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the spa and salon software market growth and forecasting

We can help! Our analysts can customize this spa and salon software market research report to meet your requirements.