Spinning Machinery Market Size Report 2024-2028

The spinning machinery market size is forecast to increase by USD 2.24 billion, at a CAGR of 6.56% between 2023 and 2028. The market's growth is driven by several key factors. One major driver is the increasing adoption of sustainable manufacturing practices within the textile industry. As environmental concerns become more prominent, manufacturers are incorporating eco-friendly processes and materials, leading to a higher demand for advanced spinning machinery, including industrial sewing machines designed with sustainability in mind. Government policies that support the textile industry also play a crucial role in market expansion. Incentives, subsidies, and favorable regulations encourage investments in modern spinning technologies, further boosting market growth. Additionally, the rising demand for non-woven fabrics, driven by their wide range of applications in industries such as healthcare, automotive, and consumer goods, is creating a greater need for efficient and innovative spinning machinery. These factors highlight the dynamic nature of the market and its crucial role in advancing both the capabilities and sustainability of the textile industry.

What will the size of the Spinning Machinery Market be during the Forecast Period?

To learn more about this market report, Request Free Sample

Spinning Machinery Market Segmentation

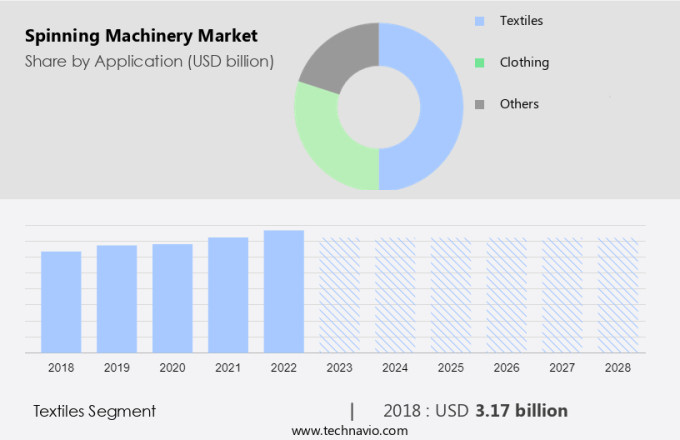

The report offers extensive research analysis on the market, with a categorization based on Application, including textiles, clothing, and others. It further segments the market by Product, encompassing short-staple spindles, long-staple spindles, and open-end rotors.

- Application Outlook

- Textiles

- Clothing

- Others

- Product Outlook

- Short-staple spindles

- Long-staple spindles

- Open-end rotors

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Application Analysis

The textiles segment is estimated to witness significant growth during the forecast period. The growth in the textile segment is fuelled by factors such as technological advancements in the textile industry, such as the adoption of automation, smart textiles, and sustainable manufacturing practices. In addition, spinning machinery plays a major role in the textile segment, from fiber preparation to determining the yarn characteristics.

The textiles segment was the largest segment and was valued at USD 3.17 billion in 2018. Moreover, the primary function of spinning machinery is to convert raw fibers into yarn, which serves as the basic building block for subsequent processes in textile manufacturing. In addition, China and India are two of the largest producers and exporters of textiles in this region. Furthermore, rapid innovation in the production of textile machinery is adding momentum to the Chinese textile industry. In addition, innovations in textile manufacturing, such as computerized data monitoring, automatic fabric spreaders, automatic fabric cutters, and high-speed sewing machines, join forces with garment workers to increase productivity in the textile segment. Hence, such factors are fuelling the growth of this segment which in turn drives market growth during the forecast period.

Additionally, the report provides region segmentation, covering APAC, Europe, North America, Middle East and Africa, and South America. The market analysis and report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028. This research and growth report includes market size, historical data (2018-2022), and future projections are presented in terms of value (in USD billion) for all the mentioned segments.

Product Analysis

Based on the product, the market has been segmented into short-staple spindles, long-staple spindles, and open-end rotors. The short-staple spindles segment will account for the largest share of this segment. This segment is mainly used for spinning yarns from cotton, polyester, viscose, and other blends. In addition, with the increase in the production of fibers such as cotton and polyester, the demand for short-staple spindles also grows. Moreover, the leading countries in APAC that have the highest installed capacities in short-staple spindles are China, India, Vietnam, Bangladesh, Indonesia, and Pakistan. Furthermore, the escalating integration of technology in short-spindles enhances the product quality and efficiency of the short-staple spindle. Hence, such factors are fuelling the growth of this segment which in turn drives the market growth during the forecast period.

Regional Analysis

For more insights on the Spinning Machinery market share of various regions, Download Sample PDF

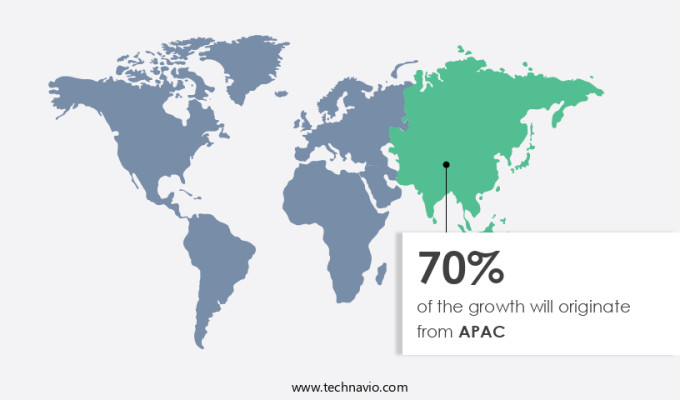

APAC is estimated to contribute 70% to the growth by 2028. Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the forecast period. The market growth in APAC is fuelled by the demand for spinning machinery from countries such as China, India, and Bangladesh. In addition, the blooming garment and textile industry in China is one of the key drivers for the growth of the market in the region. Moreover, China is considered one of the largest producers and exporters of textiles and apparel in the world. Furthermore, India is also emerging as a leading textile manufacturer owing to the robust demand for clothing and fabrics and its competitive advantage. Hence, such factors are driving the market growth in APAC during the forecast period.

Spinning Machinery Market Dynamics

Our researchers studied the market research and growth data for years, with 2023 as the base year and 2024 as the estimated year, and presented the key drivers, trends, and challenges for the market. Although there has been a disruption in the market growth during the COVID-19 pandemic, a holistic analysis of drivers, trends, and challenges of market growth and forecasting will help companies refine marketing strategies to gain a competitive advantage.

Key Spinning Machinery Market Driver

The growing awareness of environmental issues and sustainable practices has resulted in an increased demand for spinning machinery that incorporates eco-friendly features. In addition, the increasing adoption of sustainable spinning practices in the use of textile machinery that render minimal environmental impact, maximum savings in electric power consumption, and optimal utilization of resources are fuelling the growth of the market.

For instance, Rieter Holding AG is developing sustainable spinning machines and systems, and services to save energy, optimize resource utilization and produce efficiently and economically, and increase competitiveness in the market. In addition, innovative solutions, including ensuring optimum raw material utilization and minimizing fiber consumption and processing of sustainable and recycled fibers or eco fiber, help in the sustainable use of raw materials and increase the customer demand for sustainable fibers. Hence, such factors are driving the market growth during the forecast period.

Significant Spinning Machinery Market Trends

The growth potential of the market is encouraging companies to enter into strategic partnerships to expand their customer base and footprint. Therefore, companies in the market are carrying out mergers and acquisitions to remain competitive.

For example, in April 2022, Rieter Holding AG acquired three businesses from Saurer AG, including the automatic winding machine business. In addition, the acquisition completes Rieters ring and compact-spinning system and improves the company's strong position in the staple fiber sector. Hence, such factors are driving the market growth during the forecast period.

Major Spinning Machinery Market Challenge

Even though machinery in the textile industry, such as spinning machinery, is beneficial in minimizing the cost of production, the investment cost is high because of the expensive components required for textile manufacturing. In addition, for the coordination and smooth functioning of the machinery, end-users have to use expensive machinery.

Moreover, in most developing countries, the wages paid are comparatively lower than in developed industrialized countries, which limits many small-scale textile industries in countries including India and China from implementing spinning machinery. In addition, another reason is the difficulty in finding skilled labor to operate the machinery, as well as the maintenance is expensive. Hence, such factors are hindering the market growth during the forecast period.

Major Spinning Machinery Market Companies

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ATE Pvt. Ltd: The company offers spinning machinery for textile industries. They also offer top notch fiber and yarn testing equipment.

We also have detailed analyses of the market's competitive landscape and offer information on 20 market companies, including:

Amarnaathh Engineering, Bonfiglioli Riduttori Spa, Camozzi Group SPA, DS Machinery Makers, Jutex Industries Pvt. Ltd., JWELL Intelligent Machinery Co. Ltd., Lakshmi Machine Works Ltd., Murata Machinery Ltd., Naugra Machines India, Perfect Equipments Pvt. Ltd., Prism Machinery Ltd., Rieter Holding AG, SAURER AG, Shandong Rifa Textile Machinery Co. Ltd., SSB Tex Engineering, Toyota Industries Corp., Trutzschler Group SE, VANDEWIELE NV, and Zhejiang Taitan Co. Ltd.

Technavio market forecast provides an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Market Analyst Overview

The global spinning machinery market is witnessing significant growth due to the increasing demand for high-quality textile products, particularly in the apparel and technical textiles industries. With a focus on sustainability and eco-friendliness, spinning machinery manufacturers are incorporating green technologies to reduce the carbon footprint of textile production. One such trend is the use of biodegradable materials in spinning machinery. This not only reduces the amount of greenhouse gases emitted during production but also aligns with the growing consumer preference for sustainable and eco-friendly products. Moreover, real-time monitoring of spinning machinery using sensors and software is becoming increasingly popular, allowing for improved efficiency and reduced waste. Advancements in spinning machinery technology include the integration of robotics and artificial intelligence.

Ring spinning and rotor spinning techniques are being replaced with more advanced methods, enabling the production of superior textile fibers from both natural and synthetic materials, as well as blended fibers. The technical textiles industry, including automotive textiles, geotextiles, and industrial yarns, is a significant consumer of spinning machinery. The nonwoven fabric market, which includes sanitary care products such as feminine products and baby diapers, is another major consumer of spinning machinery. Diaper manufacturers are investing in advanced spinning machinery to produce high-quality, cost-effective materials for their products. The fast fashion market, driven by fashion trends and online retailers, is also a significant consumer of spinning machinery. Virtual and augmented reality technologies are being used to create virtual reality mirrors, allowing consumers to try on apparel products virtually before making a purchase. Yarn production businesses are also leveraging cloud-based software solutions for connectivity options and improved efficiency.

The Indian textile industry, with its cheap labor and large workforce, is a major player in the global spinning machinery market. The Textile Ministry and textile parks are investing in modern spinning machinery to improve the quality and competitiveness of Indian textile products in the global market. In conclusion, the global spinning machinery market is witnessing significant growth due to the increasing demand for high-quality textile products, particularly in the apparel and technical textiles industries. Advancements in technology, including the use of eco-friendly materials, real-time monitoring, robotics, artificial intelligence, and cloud-based software solutions, are driving innovation and efficiency in spinning machinery production. The market is expected to continue growing, particularly in emerging markets such as India, as the demand for sustainable and cost-effective textile production increases.

|

Spinning Machinery Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.56% |

|

Market Growth 2024-2028 |

USD 2.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.38 |

|

Regional analysis |

APAC, North America, Europe, South America, and the Middle East and Africa |

|

Performing market contribution |

APAC at 70% |

|

Key countries |

US, China, India, Japan, and Vietnam |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks, Spinning Machinery Market Industry |

|

Key companies profiled |

ATE Pvt. Ltd., Amarnaathh Engineering, Bonfiglioli Riduttori Spa, Camozzi Group SPA, DS Machinery Makers, Jutex Industries Pvt. Ltd., JWELL Intelligent Machinery Co. Ltd., Lakshmi Machine Works Ltd., Murata Machinery Ltd., Naugra Machines India, Perfect Equipments Pvt. Ltd., Prism Machinery Ltd., Rieter Holding AG, SAURER AG, Shandong Rifa Textile Machinery Co. Ltd., SSB Tex Engineering, Toyota Industries Corp., Trutzschler Group SE, VANDEWIELE NV, and Zhejiang Taitan Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period, Spinning Machinery Market Growth Analysis |

|

Customization purview |

If our spinning machinery market worth report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Spinning Machinery Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2028

- Precise estimation of the market growth and trends and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Market growth and forecasting across APAC, North America, Europe, South America, and the Middle East and Africa

- A thorough market report analysis and report of the market's competitive landscape and detailed information about companies

- Comprehensive market growth analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch