Strapping Machine Market Size 2024-2028

The strapping machine market size is forecast to increase by USD 1.33 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. One of the primary drivers is the increasing demand for strapping machines from the e-commerce sector as online shopping continues to rise in popularity. Additionally, emerging economies present a high growth potential for strapping machine manufacturers. Another trend transforming the market is the emergence of robots In the strapping process, which enhances productivity and efficiency. Consumer goods, household appliances, and various industries also utilize them for packaging applications. These factors contribute to the market's expansion and make it an attractive investment opportunity for businesses. The market analysis report offers an in-depth examination of these trends and other growth factors, providing valuable insights for stakeholders.

What will be the Size of the Strapping Machine Market During the Forecast Period?

- The market encompasses automated solutions for securing various types of loads, including pallets, boxes, cases, and soft or hard packages, in industries such as food and beverages and consumer goods. These machines utilize diverse strapping materials, including polypropylene (PP) and polyester (PET), as well as steel straps.

- The market is segmented into manual, mechanical, semi-automatic, and fully automatic segments, with the latter two gaining traction due to their increased efficiency and productivity. Key trends include the integration of sensors for improved safety and quality control, as well as the use of elastic memory and adjustable tension systems for more effective strapping. Additionally, these are employed In the production of household appliances and other industries, further expanding the market's reach.

How is this Strapping Machine Industry segmented and which is the largest segment?

The strapping machine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Automatic

- Semi-automatic

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Insights

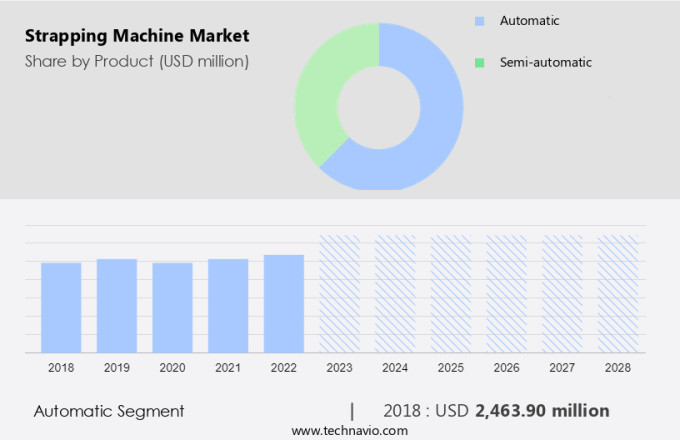

- The automatic segment is estimated to witness significant growth during the forecast period.

The automatic segment of the market is projected to experience significant growth due to its application in industries producing irregularly shaped output. Automatic ones utilize a roller for strapping without manual assistance, are commonly employed in industrial production lines. Key contributors to the global food and beverage industry's revenue include the US, China, and Germany. The increasing demand for food and beverage products is expected to boost strapping machine adoption, as it ensures product safety and shock resistance throughout the supply chain.

The adoption of strapping technology enhances safety and stability, particularly In the transportation of perishable, delicate, and fragile products. Strapping materials, such as polypropylene (PP) and polyester (PET), are used for various applications, including pallet loads, boxes, cases, soft packages, and hard packages. The implementation in the packaging process leads to increased operational efficiency, labor savings, and improved package safety. Additionally, strapping machines contribute to reducing contamination, spillage, and package collapse risks.

Get a glance at the Strapping Machine Industry report of share of various segments Request Free Sample

The automatic segment was valued at USD 2.46 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

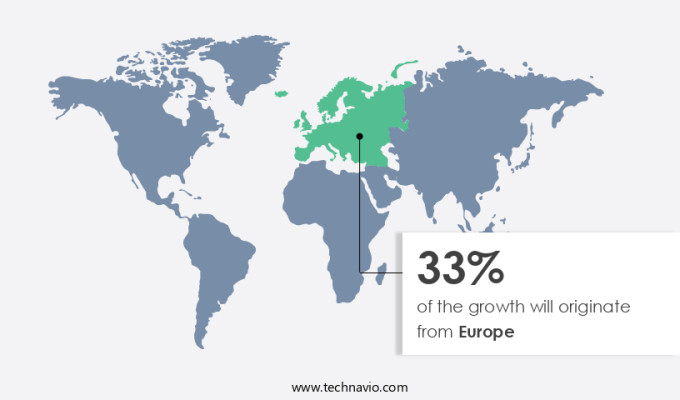

- Europe is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Another region offering significant growth opportunities to vendors is North America. The North American market is experiencing growth due to increasing demand from industries such as paper and printing, steel, and tiles. The transportation and logistics sector is expanding in this region as a result of the rising number of goods being transported. Strapping machines are essential for securely transporting various products, making them a popular solution In the logistics industry. In the competitive North American transportation sector, manufacturers utilize strapping machines to ensure the safe shipment of their products. The market growth can be attributed to the need for efficient and reliable packaging solutions, particularly for industries dealing with fragile or bulky products, perishable items, and consumer electronics.

Strapping machines offer benefits such as safety and stability and come in various forms including power, semi-automatic, and manual models. Strapping materials include polypropylene (PP), polyester (PET), steel, and plastic straps. These machines contribute to operational efficiency, reducing labor-intensive tasks, and improving package safety. Additionally, strapping machines are integral to the packaging process in industries that prioritize automation and hygiene. Compliance with safety and health regulations is also crucial, making strapping machines an essential investment for warehouses and workplaces.

Market Dynamics

Our strapping machine market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Strapping Machine Industry?

Rising demand for strapping machines from the e-commerce sector is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for efficient and automated packaging solutions in various industries. In particular, the food and beverages, consumer goods, and household appliances sectors are major contributors to this trend. Strapping machines, which use materials like polypropylene (PP) and polyester (PET) straps, are increasingly being adopted to ensure safety and stability during the transportation and storage of perishable and delicate products. Moreover, the automotive industries are also investing in strapping machines to secure cable straps and steel straps on shipping pallets, reducing the risk of contamination, spillage, and collapse. The semi-automatic and automatic segments of the market are witnessing particular growth, as these machines offer adjustable tension and can be integrated with conveyor systems, making the packaging process more efficient.

- Furthermore, strapping machines are essential for ensuring package safety and reducing labor-intensive tasks In the packaging process. The use of sensors and automation in strapping machines also enhances operational efficiency in production units. The growing demand for miniaturized devices, consumer electronics, and wearable devices is also driving the market, as these products require secure and protective packaging. Despite the numerous benefits, environmental concerns, such as carbon emissions, are a potential challenge for the market. However, the industry is addressing this issue by developing eco-friendly strapping materials and improving the energy efficiency of strapping machines. Overall, the market is poised for continued growth, driven by the need for safe, efficient, and cost-effective packaging solutions.

What are the market trends shaping the Strapping Machine Industry?

High growth potential in emerging economies is the upcoming market trend.

- The market is experiencing significant growth, particularly in emerging economies such as those in APAC, the Middle East, Africa, and South America. This shift is driven by several factors, including the availability of a cost-effective workforce, less stringent government regulations, and lower transportation costs In these regions. APAC is currently one of the fastest-growing markets for strapping machines. The region's industrialization and economic development, led by countries like China, India, and Japan, are the primary drivers of demand. APAC's economic transformation includes policies aimed at inclusive growth, job creation, economic stability, and revenue growth in commodity-exporting countries. Strapping machines are essential for various industries, including food and beverages, consumer goods, household appliances, and automotive industries.

- In the food and beverage sector, strapping machines ensure safety and stability during the wrapping and packaging process. For consumer goods, they help secure pallet loads, reducing the risk of contamination, spillage, and collapse. In the automotive industry, strapping machines are used to secure cable straps, steel straps, and plastic straps to shipping pallets, ensuring the safety and stability of vehicles during transportation. Strapping machines come in various types, including manual, mechanical, semi-automatic, and automatic. Manual strapping machines are ideal for small businesses or low-volume applications, while mechanical strapping machines offer increased efficiency for medium-volume applications. Semi-automatic and automatic strapping machines are suitable for high-volume applications, providing even greater efficiency and consistency.

What challenges does the Strapping Machine Industry face during its growth?

The emergence of robots in the strapping process is a key challenge affecting the industry growth.

- The market encompasses various types of machinery used for wrapping and securing different types of packages in industries and transit. These machines are widely adopted in sectors such as food and beverages, consumer goods, and household appliances, among others. The strapping materials used include polypropylene (PP) and polyester (PET), as well as steel straps. In the food and beverage industry, strapping machines ensure safety and stability during the transportation and storage of packaged products. In consumer goods, they help In the efficient handling of bulky and fragile items. In the automotive industry, they are used for securing pallet loads and shipping pallets, reducing the risk of contamination, spillage, collapse, and damage.

- The market offers both manual and automated solutions. Manual strapping machines are suitable for small-scale operations, while power strapping machines, semi-automatic and automatic segments, cater to larger production units. Adjustable tension features enable the machines to accommodate various package sizes and shapes. Strapping machines are also used In the packaging process of consumer electronics, including multi-functional devices, wearable devices, and miniaturized devices. The adoption of strapping machines is driven by the need for safety, efficiency, and labor savings. However, the high initial investment and carbon emissions are challenges that need to be addressed.

Exclusive Customer Landscape

The strapping machine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the strapping machine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, strapping machine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASN Packaging Pvt Ltd.

- Crown Holdings Inc.

- Crown Packaging Corp.

- Cyklop International

- Dongguan Xutian Packing Machine Co. Ltd.

- Dynaric Inc.

- Fromm Holding AG

- Hefei Seelong Import and Export Group Co. Ltd.

- Hunan ADTO Industrial Group Co. Ltd.

- Messersi Packaging Srl

- Mosca GmbH

- North Shore Strapping Inc.

- Packmaster Machinery Pvt Ltd.

- Polychem Corp.

- Samuel Son and Co. Ltd.

- StraPack Corp.

- Tiger Pack Inc.

- TITAN Umreifungstechnik GmbH and Co. KG

- Transpak Equipment Corp.

- VENUS HARTUNG PTY LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of machinery used for securing various types of loads for transportation and storage. This market caters to numerous industries, including food and beverages, consumer goods, and household appliances, among others. The primary materials used In the production of strapping machines are polypropylene (PP) and polyester (PET), as well as steel. Strapping machines come in various forms, including power, semi-automatic, and manual models. Power strapping machines offer increased efficiency and productivity, while manual and mechanical strapping machines cater to smaller-scale applications. The semi-automatic segment represents a significant portion of the market, offering a balance between cost and productivity.

Moreover, adjustable tension is a crucial feature in strapping machines, allowing for optimal strap application and ensuring the safety and stability of the load. Strapping materials, such as cable straps, steel straps, and plastic straps, are essential components of the market. These materials offer different benefits, including strength, flexibility, and cost-effectiveness. The strapping and packaging process plays a vital role in maintaining the safety and integrity of various products during transportation and storage. Strapping machines help prevent contamination, spillage, collapse, and other potential hazards. The market is particularly relevant to industries dealing with fragile and bulky products, such as consumer electronics, automotive industries, and packaged food.

Furthermore, safety and efficiency are paramount considerations In the market. Strapping machines help minimize the risk of accidents in warehouses and other industrial settings, while also streamlining the packaging process. Automation and labor-intensive tasks are essential areas of focus, as operational efficiency and production units seek to reduce costs and improve productivity. Heavy metal parts are commonly used In the production of strapping machines due to their strength and durability. However, the market is also witnessing the emergence of lighter, more compact designs, such as those incorporating elastic memory and sensors. These innovations offer increased versatility and adaptability, making strapping machines an indispensable tool in various industries.

|

Strapping Machine Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 1.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Strapping Machine Market Research and Growth Report?

- CAGR of the Strapping Machine industry during the forecast period

- Detailed information on factors that will drive the Strapping Machine market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution to the industry in focus on the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the strapping machine market growth of industry companies

We can help! Our analysts can customize this strapping machine market research report to meet your requirements.