Strontium Market Size 2024-2028

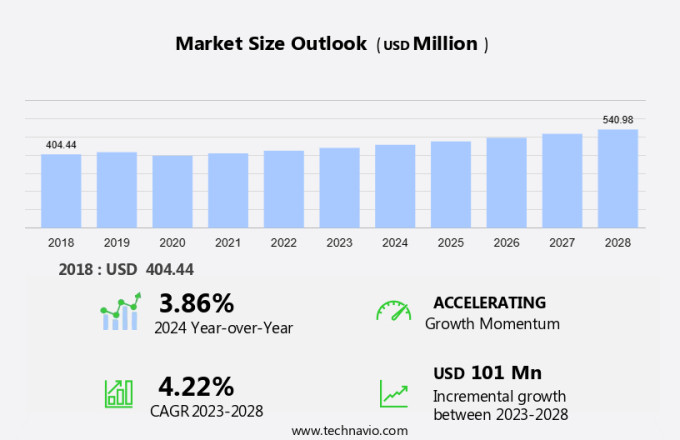

The strontium market size is forecast to increase by USD 101 million at a CAGR of 4.22% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for ferrite magnets in various applications, particularly In the automotive and electronics industries. Market growth is driven by increasing demand from industries that rely on ferrite magnets, particularly glass and ceramics. Additionally, the glass and ceramic industries are major consumers of strontium, contributing to its market expansion. However, concerns regarding the potential health hazards associated with strontium exposure pose a challenge to market growth. The ill-effects of strontium on human health, such as skeletal deformities and kidney damage, necessitate stringent regulations and safety measures. Despite these challenges, the market is expected to continue its upward trajectory, driven by the expanding applications of strontium in diverse industries. The growing awareness of the benefits of strontium in various sectors, coupled with advancements in production technologies, will further fuel market growth.

What will be the Size of the Strontium Market During the Forecast Period?

- The market encompasses various applications, primarily In the production of pyrotechnics and certain industrial sectors. Notable end-use industries include the pyrotechnics industry for fireworks, flashes, streamers, and colorants, as well as in the automotive sector for the manufacturing of strontium nitrate as an oxidizer. Additionally, strontium carbonate, chlorides, and sulfate find applications in paints and coatings, cathode ray tubes, and personal care products. Market dynamics are influenced by several factors, including corporate profits, public finances, and household income in both developed and developing countries.

- Further, the demand for strontium In the pyrotechnics industry is driven by various events such as sports events, media events, festivals, award shows, and recreational shows. The market revenue is expected to grow, driven by the increasing demand for strontium-based pyrotechnic chemicals. However, the market may face challenges from the availability and price volatility of raw materials and the intensifying competition among market players.

How is this Strontium Industry segmented and which is the largest segment?

The strontium industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Ferrite ceramic magnets

- Pyrotechnics

- Medicines and others

- Type

- Strontium carbonate

- Strontium nitrate

- Strontium sulphate

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

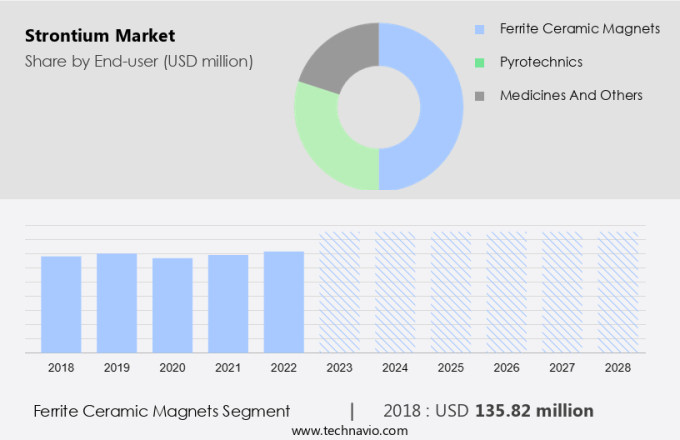

- The ferrite ceramic magnets segment is estimated to witness significant growth during the forecast period.

Strontium ferrites, a type of ferrite magnets, are produced using a combination of iron oxide and strontium carbonate. These magnets exhibit desirable properties such as high magnetic permeability, strong residual magnetic field, high-temperature stability, and good electric insulation. Due to their corrosion resistance and affordability, strontium ferrites are extensively used in various industries. Applications include AC commutator motors, permanent magnet DC motors, magnetic catches, loudspeakers, hard drives, sensors, anti-lock braking systems (ABS), magnetic shock absorbers, alternators, microphones, acoustic detectors, plate magnets, lifting magnets, and magnetic clamps.

In the electronics sector, strontium ferrites are utilized in small electronic motors, recording media, magneto-optic media, and telecommunication equipment. The global market for strontium ferrites is driven by the increasing demand from end-user industries such as automobiles, commercial vehicles, and the electrical and electronics sector. Government regulations, economic growth, and advancements in technology further influence the market's growth.

Get a glance at the Strontium Industry report of share of various segments Request Free Sample

The ferrite ceramic magnets segment was valued at USD 135.82 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

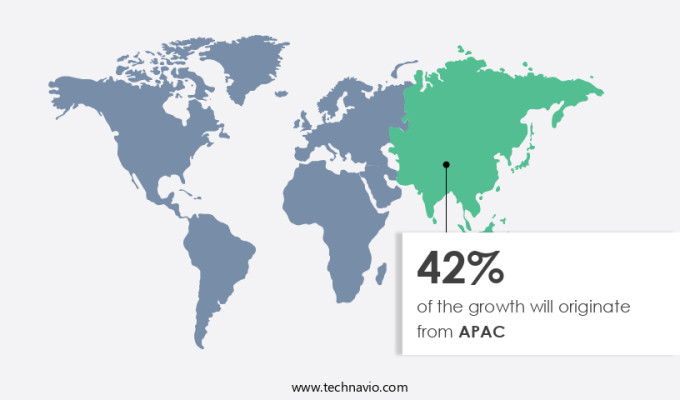

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region leads The market due to its significant role In the production and consumption of strontium sulfate for the fireworks industry. China, as the world's largest producer and exporter of fireworks, is the primary contributor to the region's market growth. India, another significant player, consumes a substantial amount of strontium for its vibrant firecrackers industry, with an annual turnover of over USD 924 million. Sivakasi, a city in Tamil Nadu, India, hosts around 800 fireworks factories. Other APAC countries also contribute to the region's high demand for strontium.

Additionally, strontium nitrate, another variant, finds applications In the pyrotechnics industry, including end-user industries such as automobiles, paints, and coatings, and the entertainment sector for pyrotechnic chemicals used in explosions, confetti, flashes, and streamers. The market revenue is influenced by various factors, including economic growth, regulations, and end-use industries' demand patterns. Strontium carbonates and salts are essential components in various industries, including electrical and electronics, medical and dental, aerospace, and construction. Global stricter regulations on air quality and environmental concerns may impact the market's growth.

Market Dynamics

Our strontium market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Strontium Industry?

Growing demand for ferrite magnets is the key driver of the market.

- Strontium is a crucial element in various industries, with significant applications In the production of ferrite magnets. These magnets are extensively used in automotive applications, including electric motors, sensors, and other components, due to the growing trend toward electric vehicles and the increasing use of magnets in modern automotive technologies. Strontium is preferred over barium and lead due to environmental and safety concerns. The demand for ferrite magnets extends to consumer electronics, household appliances, telecommunication, and other sectors. In the automotive industry, ferrite magnets are utilized in loudspeakers, refrigerator magnets, electric motors, security magnets, anti-lock braking systems (ABS), various types of sensors, and other applications. The escalating demand for ferrite magnets In these industries propels the need for strontium. Strontium also finds extensive use In the pyrotechnic industry for producing pyrotechnic chemicals such as strontium nitrate and strontium carbonate. These chemicals are used as oxidizers, colorants, and pyrotechnic products, including flashes, streamers, theoretical glitter, explosions confetti, and more.

- Additionally, the pyrotechnic segment includes fireworks, entertainment events like award shows, sports events, media events, festivals, and recreational shows. The market revenue is driven by the increasing demand for strontium In the pyrotechnic industry and its applications in various end-user industries. Strontium carbonates and strontium salts are essential in various industries, including electrical and electronics, medical and dental, aerospace, and others. Strontium carbonates are used as pigment extenders and fillers in paints and coatings due to their excellent UV resistance, film coverage, and corrosion resistance. In the construction sector, strontium carbonates are used for their thermodynamic and mechanical properties, including demagnetization resistance, ferrite magnets, household appliances, consumer electronics, telecommunication, and more. The economic growth in developing countries and the increasing demand for decorative and industrial coatings further boost the market revenue.

What are the market trends shaping the Strontium Industry?

Growing demand from the glass and ceramic industries is the upcoming market trend.

- Strontium compounds, notably strontium carbonate, play a significant role in various industries due to their unique properties. In the glass and ceramics sectors, strontium carbonate is utilized for modifying optical properties. It enhances the refractive index and contributes to the optical clarity of glass products. Moreover, strontium carbonate imparts unique colors to glass, ranging from light yellow to deep red, depending on the concentration and other factors. This makes strontium compounds indispensable In the production of colored glass for end-user industries such as automobiles, paints and coatings, and the pyrotechnics industry. Strontium nitrate, another strontium compound, is crucial In the pyrotechnics industry for producing flashes, streamers, theoretical glitter, explosions confetti, and other pyrotechnic products. It functions as an oxidizer and colorant. The pyrotechnic segment, which includes fireworks, entertainment, sports events, media events, and festivals, is a major consumer of strontium nitrate. The market revenue is driven by the demand for strontium compounds in various industries. Strontium carbonates and strontium salts find extensive applications In the electrical and electronics, medical and dental, pyrotechnic, aerospace, and construction sectors. Strontium carbonates are used as cathode ray tubes, pigment extenders, fillers, UV resistance agents, film coverage improvers, and In the production of ferrite magnets for household appliances, consumer electronics, telecommunication, and other applications.

- Additionally, the market is influenced by several factors, including economic growth, technological advancements, and governments' stringent regulations on air quality. The painting industry, for instance, uses strontium compounds as pigment extenders and fillers to enhance the performance and durability of decorative and industrial coatings. In the dental industry, strontium carbonates are used in tooth sensitive paste due to their ability to neutralize acidity and provide a soothing effect. In summary, strontium compounds, including strontium carbonate and strontium nitrate, are essential in various industries due to their unique properties. Their applications span across the glass and ceramics, pyrotechnics, electrical and electronics, medical and dental, aerospace, and construction sectors. The market is driven by the increasing demand for strontium compounds In these industries, fueled by economic growth, technological advancements, and regulatory requirements.

What challenges does the Strontium Industry face during its growth?

The ill-effects of strontium on health are key challenges affecting the industry's growth.

- Strontium is a vital alkaline earth metal with various isotopes, including stable and radioactive forms. While the stable form is essential for numerous industries, radioactive strontium poses health risks, acting as a human carcinogen. Exposure to strontium can occur through air (dust), food, water, and contact with contaminated soil. Consequences of over-exposure include osteoporosis, skin cancer, leukemia, and even fatalities due to radioactive strontium (90Sr). To mitigate these risks, regulatory bodies impose strict guidelines. The US Environmental Protection Agency (EPA) sets the limit for strontium in drinking water at 4 mg per liter. In developing countries, however, enforcement of such regulations may be lax, potentially leading to public health concerns. Strontium's applications span multiple industries, including paints and coatings, automobiles, pyrotechnics, and electronics. In the paints and coatings sector, strontium sulfate serves as a pigment extender and filler, enhancing UV resistance and film coverage. Strontium carbonates and chlorates are crucial In the electrical and electronics industry for cathode ray tubes and pyrotechnic chemicals as oxidizers and colorants. The pyrotechnics industry utilizes strontium nitrate for creating flashes, streamers, theoretical glitter, explosions confetti, and other pyrotechnic products.

- In the automotive sector, strontium is used in ferrite magnets, household appliances, and consumer electronics. The aerospace industry also relies on strontium carbonates and salts for their thermodynamic and mechanical properties, including corrosion resistance and demagnetization resistance. Despite the benefits, governments worldwide enforce stringent regulations due to environmental and health concerns. Air quality is a significant factor, as strontium emissions contribute to particulate matter pollution. The construction sector, too, faces challenges in using strontium due to economic growth and the demand for decorative and industrial coatings. In summary, strontium's market dynamics are complex, with various industries relying on its unique properties while facing regulatory challenges and potential health risks. The market revenue continues to grow, driven by the expanding demand for strontium-based products in end-user industries such as paints and coatings, automobiles, and pyrotechnics. However, governments' stringent regulations and public health concerns necessitate continuous research and innovation to ensure safe and sustainable production and usage of strontium.

Exclusive Customer Landscape

The strontium market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the strontium market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, strontium market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Elements

- Central Drug House Pvt. Ltd.

- Divjyot Chemicals Pvt. Ltd.

- Foshan Nanhai Shuangfu Chemical Co. Ltd.

- Global Calcium Pvt. Ltd.

- Hunan CHMM Metallurgy Engineering Co. Ltd

- Joshi Agrochem Pharma Pvt. Ltd.

- LONGCHANG CHEMICAL

- Marine Chemicals

- Otto Chemie Pvt. Ltd.

- Prakash Brothers

- Reade International Corp.

- Sakai Chemical Industry Co. Ltd.

- Shandong RIYUSHENG International Trade Co. Ltd

- Solvay SA

- Suvchem

- SUVIDHINATH LABORATORIES

- Vizag Chemical International

- Yingfengyuan Industrial Group Ltd.

- Yogesh Agrawal and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Strontium is a chemical element with the symbol Sr and atomic number 38. It is a silvery-white alkaline earth metal that is commonly found In the earth's crust. Strontium is an essential element for human health, and it is used in various industries due to its unique properties. The market is driven by the increasing demand from end-user industries such as paints and coatings, electrical and electronics, medical and dental, pyrotechnic, aerospace, and others. The versatility of strontium compounds, including strontium carbonates, strontium salts, and strontium sulfate, makes them valuable in various applications. In the paints and coatings industry, strontium compounds are used as pigment extenders and fillers. They enhance the properties of paints and coatings, such as UV resistance, film coverage, and corrosion resistance. Strontium carbonates and strontium chlorides are commonly used in decorative coatings and industrial coatings. The electrical and electronics industry uses strontium compounds In the production of cathode ray tubes and ferrite magnets. Strontium carbonates and strontium nitrates are used In the production of high-performance magnets, which are essential in various applications, including household appliances, consumer electronics, telecommunication, and automobiles. The medical and dental industry uses strontium compounds In the production of toothpaste and other dental products.

Additionally, strontium carbonates and strontium chlorides are used as active ingredients in toothpaste for sensitive teeth. Strontium salts are also used In the treatment of vertebral fractures due to their unique thermodynamic and mechanical properties. The pyrotechnic industry is another significant consumer of strontium compounds. Strontium nitrates, strontium carbonates, and strontium chlorates are used as oxidizers, colorants, and pyrotechnic products. Strontium compounds are used In the production of fireworks, flashes, streamers, theoretical glitter, explosions confetti, and other pyrotechnic products. The aerospace industry uses strontium compounds In the production of pyrotechnic chemicals for various applications, including engine ignition, rocket propulsion, and pyrotechnic displays. Strontium compounds are also used In the production of ferrite magnets for aerospace applications due to their high demagnetization resistance.

Thus, the market is expected to grow due to the increasing demand from end-user industries and the unique properties of strontium compounds. However, governments' stringent regulations on air quality and environmental concerns may impact the growth of the market. The market is also subject to economic growth and fluctuations in raw material prices. In summary, strontium is a versatile element that is used in various industries due to its unique properties. The market is driven by the increasing demand from end-user industries, including paints and coatings, electrical and electronics, medical and dental, pyrotechnic, aerospace, and others. The market is expected to grow due to the increasing demand from end-user industries, but it is subject to various factors, including regulations, economic growth, and raw material prices.

|

Strontium Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.22% |

|

Market growth 2024-2028 |

USD 101 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.86 |

|

Key countries |

US, China, India, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Strontium Market Research and Growth Report?

- CAGR of the Strontium industry during the forecast period

- Detailed information on factors that will drive the Strontium growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the strontium market growth of industry companies

We can help! Our analysts can customize this strontium market research report to meet your requirements.