Sugar-Free Food And Beverage Market Size 2025-2029

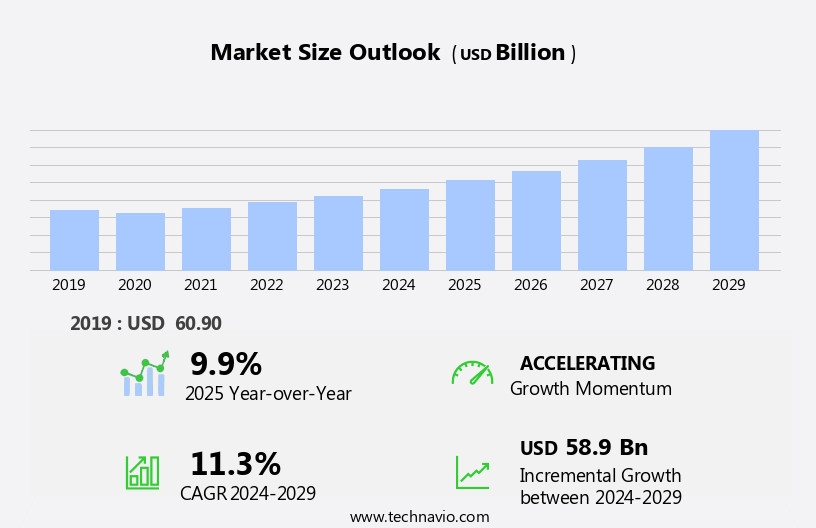

The sugar-free food and beverage market size is forecast to increase by USD 58.9 billion at a CAGR of 11.3% between 2024 and 2029.

- The market is witnessing significant growth due to several key trends. One of the major factors driving market growth is the increasing influence of online retailing. Consumers are increasingly preferring to purchase sugar-free products online due to the convenience and wide product selection. Another trend is the increasing prominence of private-label brands, which offer consumers affordable and high-quality sugar-free options. Sugar-free concepts extend to biscuits, cookies, muffins, and various types of beverages like whey protein drinks in flavors such as vanilla, chocolate, mint chip, and strawberry. However, the market faces challenges such as the lower acceptance of sugar-free products due to ambiguity surrounding the safety profile of artificial sweeteners. Producers must address consumer concerns by providing clear labeling and transparent information about the ingredients used in their products. Overall, the market is expected to continue its growth trajectory, driven by these trends and challenges.

What will be the Size of the Sugar-Free Food And Beverage Market During the Forecast Period?

- The market encompasses a wide range of products designed to cater to consumers seeking to reduce their intake of added sugars. Fueled by rising health consciousness and the prevalence of disorders such as diabetes and obesity, this market has experienced significant growth. Glycation, a process that damages proteins and fats In the body due to sugar intake, has heightened awareness of the negative effects of refined sugar. As a result, demand for low-calorie beverages, sugar substitutes, and sugar-free alternatives has increased. Veganism, gluten-free, raw, refined sugar-free, organic, and other dietary trends have also influenced the market's direction. Consumers increasingly prefer sugar-free and zero-sugar options, prioritizing taste and calorie reduction over traditional sugar-laden products.

- The market's size is substantial, with low-calorie foods and beverages accounting for a notable share. Sugar taxes and regulations aimed at limiting added sugars have further boosted market growth. The industry continues to innovate, offering a diverse range of sugar-free products that cater to various dietary preferences and needs. The market is poised for continued expansion as consumers increasingly seek healthier alternatives to traditional sugary options.

How is this Sugar-Free Food And Beverage Industry segmented and which is the largest segment?

The sugar-free food and beverage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Supermarkets or hypermarkets

- Convenience stores

- Online stores

- Specialty stores

- Product

- Sugar-free beverages

- Sugar-free dairy products

- Sugar-free confectionery

- Sugar-free bakery

- Sugar-free ice-creams

- Product Type

- Artificial sweeteners

- Natural sweeteners

- Sugar alcohols

- Packaging

- Bottles and cans

- Pouches and sachets

- Boxes and cartons

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

- The supermarkets or hypermarkets segment is estimated to witness significant growth during the forecast period.

Supermarkets and hypermarkets serve as the primary distribution channels for sugar-free food and beverages due to their extensive product offerings and competitive pricing. Consumers are drawn to these retail outlets for their convenient one-stop shopping experience, enhanced by discounts and attractive shelf displays. Supermarkets' high product volumes grant them significant buying power, enabling them to price sugar-free items competitively, often at discounted rates. Sugar-free alternatives cater to various health concerns, including diabetes, obesity, irritable bowel disease, and Crohn's disease. These products encompass low-calorie beverages, sugar substitutes, vegan, gluten-free, raw, refined sugar-free, organic, non-GMO, oil-free, and low-carb options.

Get a glance at the Sugar-Free Food And Beverage Industry report of share of various segments Request Free Sample

The supermarkets or hypermarkets segment was valued at USD 39.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

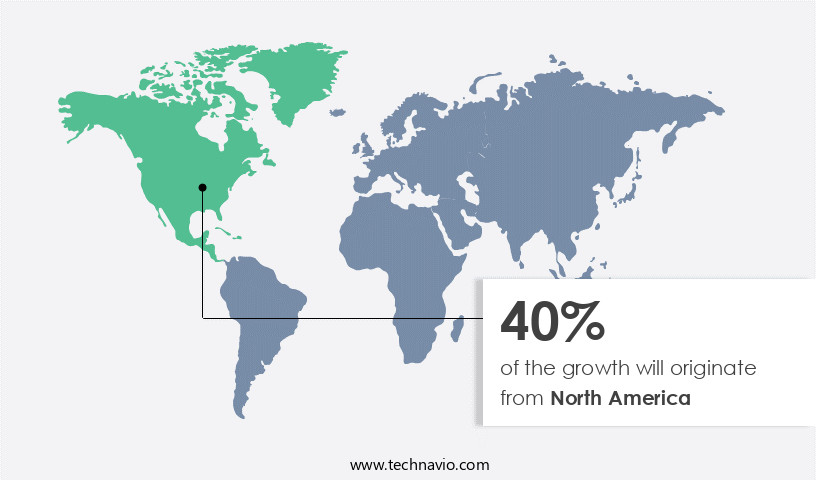

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for sugar-free food and beverages is experiencing significant growth due to the rising prevalence of obesity and diabetes. According to recent studies, over 34 million Americans have diabetes, and an estimated 84.1 million have pre-diabetes. This health concern has led consumers to seek low-calorie, sugar-free alternatives to processed foods and beverages. Major food and beverage companies, such as Coca Cola and Hershey, headquartered In the region, are responding to this trend by introducing sugar-free versions of their popular products. Additionally, the increasing popularity of veganism, gluten-free, raw, refined sugar-free, organic, non-GMO, oil-free, and low-carb diets is fueling the demand for sugar-free products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Sugar-Free Food And Beverage Industry?

Growing influence of online retailing is the key driver of the market.

- The market has witnessed notable growth due to the rising health consciousness among consumers. Factors such as diabetes, obesity, and various disorders, including irritable bowel disease and Crohn's disease, have driven the demand for sugar-free alternatives. Low-calorie beverages, sugar substitutes, and vegan, gluten-free, raw, refined sugar-free, organic, non-GMO, oil-free, and other sugar-free products have gained popularity. Type 2 diabetes and pre-diabetes patients, as well as health-conscious consumers, seek low-carb beverages and metabolic state-friendly food options. Maltitol, sucrose, and glucose are common sugar substitutes used in sugar-free products. Companies like Mondelez International offer sugar-free versions of popular items such as biscuits, cookies, and muffins in various flavors like vanilla, chocolate, mint chip, and strawberry.

- In addition, overweight and obese individuals are increasingly opting for sugar-free alternatives to reduce their sugar intake and manage their caloric consumption. The market dynamics are influenced by factors such as low-sugar solutions, increasing product formulations, and the availability of a wide range of sugar-free foods and beverages in specialty stores, online retail, and convenience stores. Zero sugar and calorie-conscious consumers are driving the demand for low-calorie foods, while sugar taxes and the availability of hygienic, nutritious foods further fuel market growth. Dietary supplements and tabletop sweeteners are other sugar-free product categories that cater to specific dietary needs. The sweetening type and taste preferences of consumers continue to influence product development.

What are the market trends shaping the Sugar-Free Food And Beverage Industry?

Increasing prominence of private-label brands is the upcoming market trend.

- The market is witnessing significant growth due to increasing health consciousness among consumers. This trend is driven by the rising prevalence of conditions such as diabetes, obesity, irritable bowel disease, and Crohn's disease, which require individuals to adopt low-sugar diets. As a result, retailers are expanding their private-label offerings to include sugar-free alternatives. These include low-calorie beverages, sugar substitutes like maltitol and stevia, and vegan, gluten-free, raw, refined sugar-free, organic, non-GMO, oil-free, and dairy-free options. Product formulators are developing low-carb beverages and low-sugar solutions to cater to this market. The demand for sugar-free foods and beverages is not limited to specific diets but is also being adopted by health-conscious customers.

- The market includes a wide range of products, from sugar-free biscuits, cookies, and muffins, to sugar-free type 2 diabetes-friendly foods, and sugar-free beverages like whey protein drinks in flavors such as vanilla, chocolate, mint chip, and strawberry. The market also offers tabletop sweeteners and other sugar-free products. The taste and calorie count of these products are important considerations for consumers. The market for sugar-free and low-calorie foods and beverages is expected to continue growing as more people seek healthier alternatives to processed food and fast food sales. Sugar taxes and a focus on hygiene and nutritious foods are further fueling the demand for these products.

What challenges does the Sugar-Free Food And Beverage Industry face during its growth?

Lower acceptance due to ambiguity on safety profile of artificial sweeteners is a key challenge affecting the industry growth.

- The market caters to health-conscious consumers with various dietary requirements, including those with diabetes, obesity, irritable bowel disease, and other disorders. The demand for sugar-free alternatives to conventional sweeteners, such as refined sugar, sucrose, and glucose, is increasing due to concerns over health risks associated with added sugar intake. Low-calorie beverages, sugar substitutes like maltitol, and low-carb beverages are popular choices. Moreover, consumers are increasingly opting for vegan, gluten-free, raw, organic, non-GMO, oil-free, and dairy-free options. The Caribbean market offers a range of sugar-free products, including biscuits, cookies, muffins, and tabletop sweeteners. Type 2 diabetes, pre-diabetes, and metabolic disorders have driven the demand for sugar-free solutions.

- Product formulators are focusing on creating low-calorie foods and zero sugar beverages that do not compromise on taste. The market for sugar-free beverages, including whey protein drinks in flavors like vanilla, chocolate, mint chip, and strawberry, is growing. Health consciousness and specific diets, such as low-sugar and sugar-free concepts, have led to the popularity of sugar-free products. The market for sugar-free and low-calorie products is expected to grow as consumers seek nutritious foods to manage their health conditions and maintain a healthy lifestyle. The demand for sugar-free alternatives to processed food and fast food sales is also increasing due to sugar taxes and the availability of sugar-free options in specialty stores, online retail, and convenience stores.

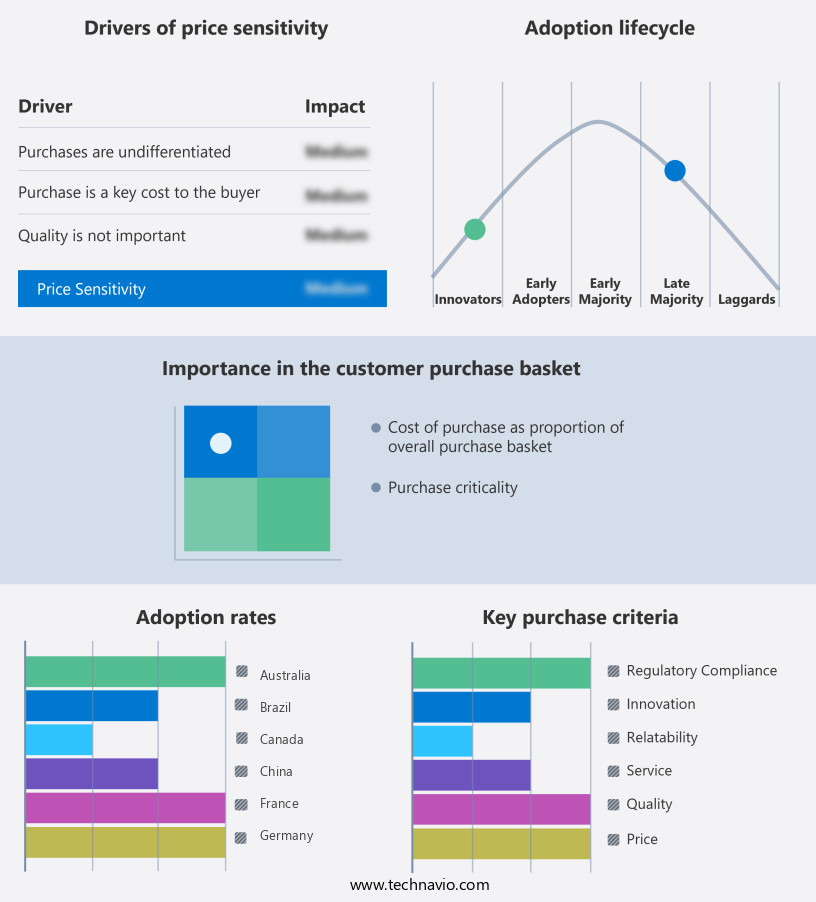

Exclusive Customer Landscape

The sugar-free food and beverage market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sugar-free food and beverage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sugar-free food and beverage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Atkinson Candy Co. - The company offers sugar-free food and beverages that include candies, gums, chocolates, and various other sweeteners.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Britvic plc

- Chocoladefabriken Lindt and Sprungli AG

- Flowers Foods Inc.

- General Mills Inc.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Jones Soda Co.

- Kellogg Co.

- Keurig Dr Pepper Inc.

- Monster Energy Co.

- Nestle SA

- PepsiCo Inc.

- Russell Stover Chocolates

- Suntory Beverage and Food Ltd.

- The Coca Cola Co.

- The Hershey Co.

- The Kraft Heinz Co.

- Turkey Hill Dairy

- Vadilal Industries Ltd.

- Wells Enterprises Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing health consciousness among consumers. This trend is driven by the rising prevalence of disorders such as diabetes, obesity, and gastrointestinal conditions like irritable bowel disease and Crohn's disease. The demand for sugar substitutes in food and beverages is on the rise as consumers seek low-calorie alternatives to refined sugar. The shift towards veganism, gluten-free, raw, and organic diets is also fueling the growth of the sugar-free market. Consumers are increasingly opting for sugar-free and low-calorie beverages, biscuits, cookies, muffins, and other baked goods. The market for sugar-free and low-carb beverages is particularly strong, as these products cater to consumers in a metabolic state seeking to manage their blood sugar levels.

In addition, product formulators are responding to this trend by developing a wide range of sugar-free and low-calorie products. These include sugar-free concept snacks, dairy-free and lactose-free milk alternatives, and sugar-free and zero sugar beverages. The taste and calorie count of these products are crucial factors In their success, as consumers demand products that are not only healthier but also delicious. The sugar-free market is diverse, with a range of sweetening types available, including natural and artificial sugar substitutes. Maltitol, a common sugar substitute, is derived from corn and has a sweet taste similar to sugar. Other sugar alternatives include sucrose, glucose, and various types of sugar alcohols.

Furthermore, the sugar-free and low-calorie food and beverage market is also influenced by health-conscious consumers who are seeking nutritious foods and avoiding processed foods and fast food sales. The market for sugar-free and low-calorie products is expanding, with specialty stores, online retail, and convenience stores offering a wide range of options. The demand for sugar-free and low-calorie products is driven by the increasing number of health disorders related to sugar intake. According to the World Health Organization, non-communicable diseases, including cardiovascular disease and diabetes, accounted for 71% of all global deaths in 2016. The prevalence of these diseases is increasing, and many are linked to high sugar intake.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

255 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.3% |

|

Market growth 2025-2029 |

USD 58.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, China, Germany, Canada, Italy, UK, France, India, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sugar-Free Food And Beverage Market Research and Growth Report?

- CAGR of the Sugar-Free Food And Beverage industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sugar-free food and beverage market growth of industry companies

We can help! Our analysts can customize this sugar-free food and beverage market research report to meet your requirements.