Super Abrasives Market Size 2025-2029

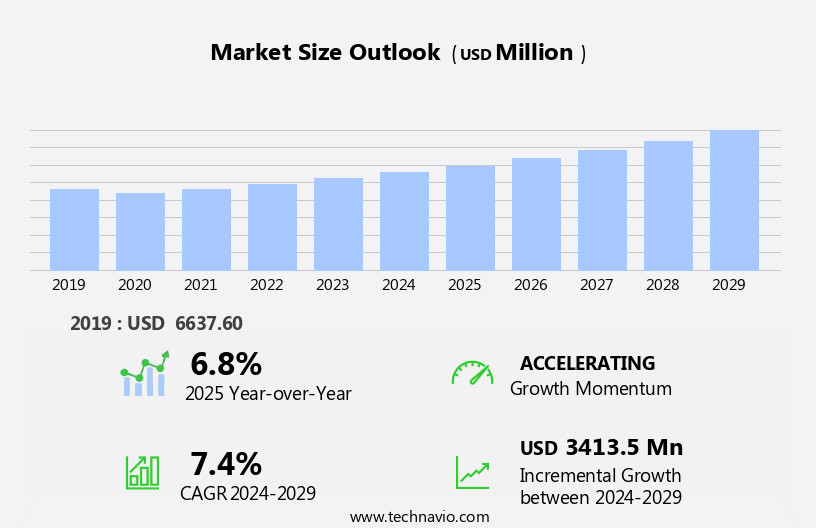

The super abrasives market size is forecast to increase by USD 3.41 billion, at a CAGR of 7.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand from the consumer electronics and transportation industries. These sectors rely heavily on super abrasives for various applications, including precision machining and surface finishing, which are essential for manufacturing high-performance components. Furthermore, the expanding use of super abrasives in cutting tools is fueling market expansion. However, the market's growth trajectory is not without challenges. Stringent government regulations governing the production and use of super abrasives pose a significant obstacle.

- Compliance with these regulations adds to the manufacturing costs, potentially impacting the competitiveness of market participants. Companies must navigate these regulations effectively to maintain profitability and market position. Additionally, the market's competitive landscape is intensifying, with several players vying for market share. To capitalize on opportunities and mitigate challenges, companies must focus on innovation, cost optimization, and regulatory compliance.

What will be the Size of the Super Abrasives Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in materials science and manufacturing technologies. Composite materials, such as cubic boron nitride, metal-bonded abrasives, resin-bonded abrasives, and electroplated abrasives, play a crucial role in various sectors, including machining tools, automotive manufacturing, aerospace, and electronics. The ongoing quest for higher bond strength, improved thermal stability, and smaller superabrasive grains fuels product development in these areas. In machining applications, superabrasives enhance production efficiency by enabling ultrasonic machining, electrolytic grinding, and waterjet cutting. These techniques offer increased precision and material removal rates, particularly in the production of medical devices and high-precision components.

Smart manufacturing, machine learning, and data analytics are transforming the market, with applications in process optimization, design optimization, and quality control. Thermal stability, wear resistance, and safety standards are essential considerations in the development of advanced abrasive tools for industries like automotive manufacturing, aerospace, and industrial automation. The integration of superabrasives in various sectors continues to unfold, with applications in surface finishing, lapping plates, honing stones, and CNC machining. As the market evolves, the role of superabrasives in advanced manufacturing processes, such as precision engineering and high-tech industries, will become increasingly significant.

How is this Super Abrasives Industry segmented?

The super abrasives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Diamond

- Cubic boron nitride

- End-user

- Automotive

- Aerospace

- Electronics and semiconductors

- Machinery and tool manufacturing

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW).

- North America

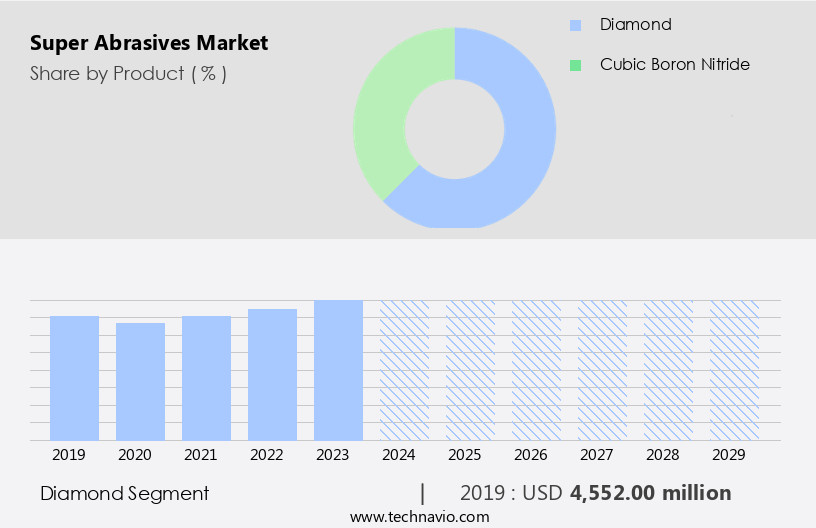

By Product Insights

The diamond segment is estimated to witness significant growth during the forecast period.

In the realm of super abrasives, vitrified diamond emerges as a significant player due to its wide application in various industries. A key component of pitch circle diameter (PCD) and polycrystalline cubic boron nitride (PCBN) tools, vitrified diamond is essential for cutting through hard materials in automotive manufacturing, aerospace, and medical engineering. Comprised of abrasive grains, fillers, and bonding agents, vitrified diamond is also utilized in cemented carbide, ceramic cutting tools, and other milling cutters, bits, reamers, and super hard cutting tools. Grinding wheels with a vitrified bond are indispensable for surface grinding, shafts, holes, profiles, sharpening cutting tools, and metal processing workshop operations.

The burgeoning demand for precision engineering, smart manufacturing, and machine learning in these industries propels the need for high-performance cutting tools, thereby driving the growth of the vitrified diamond segment and The market. Moreover, the integration of artificial intelligence, advanced materials, and process optimization in manufacturing processes further enhances the demand for vitrified diamond. For instance, in laser machining, vitrified diamond tools offer superior thermal stability, enabling efficient material removal and extended tool life. In biomedical engineering, vitrified diamond polishing pads ensure precise surface finishing for medical devices. The environmental impact of manufacturing processes is another critical factor influencing the market dynamics.

Super abrasives, including vitrified diamond, play a crucial role in minimizing waste and increasing production efficiency by reducing the need for multiple machining steps. Additionally, the adoption of industrial automation and the Internet of Things in manufacturing processes further streamlines production and enhances overall productivity. In the realm of composite materials, vitrified diamond tools demonstrate exceptional wear resistance and material removal rate, making them a preferred choice for machining advanced materials such as carbon fiber reinforced polymers and ceramics. Furthermore, in the aerospace industry, vitrified diamond lapping plates are utilized for high-precision machining of complex geometries and intricate surfaces.

The evolving trends and applications of super abrasives, particularly vitrified diamond, underscore their significance in various industries, from automotive manufacturing to biomedical engineering. As manufacturing processes become increasingly sophisticated, the demand for high-performance cutting tools and precision engineering solutions will continue to fuel the growth of The market.

The Diamond segment was valued at USD 4.55 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, APAC held the largest share in both production and consumption in 2024. Key contributors to this region's growth include China, India, and Japan. The increasing demand for electronic devices and the utilization of super abrasives in manufacturing processes are primary factors fueling market expansion. Super abrasives are essential in various industries, including automotive manufacturing and laser machining, where high precision and productivity are crucial. Advanced materials, such as composite materials, cubic boron nitride, and polycrystalline diamond, are integral to superabrasive grains. Artificial intelligence and machine learning are revolutionizing the manufacturing sector, leading to the development of smart manufacturing and precision engineering.

Ultrasonic machining and electrolytic grinding are advanced machining techniques that utilize super abrasives for high-precision cutting and grinding. In the biomedical engineering sector, super abrasives are used in the production of medical devices and in surface finishing for implants. Product development and process optimization are ongoing priorities for companies in the super abrasives industry. Abrasive tools, such as grinding wheels, lapping plates, and honing stones, are essential components in various manufacturing processes. Thermal stability, wear resistance, and material removal rate are critical factors in the selection of super abrasives for different applications. Environmental impact is a significant concern in the manufacturing sector, and super abrasives are no exception.

Companies are focusing on the development of eco-friendly super abrasives and improving production efficiency to minimize waste and reduce environmental impact. The integration of the Internet of Things, data analytics, and quality control systems is helping to optimize processes and improve overall efficiency. The market is diverse, with various types, including metal-bonded, resin-bonded, and electroplated abrasives. Each type has unique properties and applications. For instance, metal-bonded abrasives offer high bond strength and durability, while resin-bonded abrasives provide better flexibility and are suitable for intricate shapes. Electroplated abrasives offer superior edge retention and are commonly used in CNC machining and high-precision machining.

In the aerospace manufacturing industry, super abrasives are used in the production of complex components, such as engine parts and landing gear, due to their high strength and durability. The market for super abrasives in the electronics manufacturing sector is also growing due to the increasing demand for miniaturized components and the need for high-precision machining. Safety standards are a critical consideration in the super abrasives industry, with companies focusing on the development of dressing tools and other safety equipment to minimize workplace hazards. In the automotive manufacturing sector, super abrasives are used in wire drawing dies and polishing pads to ensure the production of high-quality parts with consistent surface finishes.

The market is a dynamic and evolving industry, driven by advancements in technology, increasing demand for high-precision manufacturing, and a focus on sustainability. Companies are investing in research and development to create innovative super abrasive solutions that meet the demands of various industries, from automotive manufacturing to aerospace and electronics. The integration of artificial intelligence, machine learning, and the Internet of Things is transforming the manufacturing sector and providing new opportunities for super abrasive companies to optimize processes and improve efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Super Abrasives Industry?

- The electronics and transportation industries, driven by rising demand, significantly contribute to the market's growth.

- Super abrasives have gained significant traction in various industries due to their cost-effective production of high-quality finishes. In the automotive manufacturing sector, these abrasives are integral to laser machining processes, ensuring precise cuts and smooth edges. Advanced materials, such as composites and alloys, require the use of super abrasives for their fabrication. The adoption of artificial intelligence and design optimization in product development has led to the increased use of super abrasives in machining tools. This includes polishing pads for biomedical engineering applications, where precise finishes are essential. The environmental impact of manufacturing processes is a growing concern, and super abrasives offer a solution with their ability to reduce waste and improve production efficiency.

- Ultrasonic machining, a non-traditional machining process, also relies on super abrasives for its effectiveness. The global market for super abrasives is expanding, driven by the increasing demand for high-performance materials and components in various industries. The consumer goods sector, particularly in developing regions, is witnessing a rise in sales of durable goods, fueling the demand for super abrasives in polishing applications. The transportation industry, including shipping, trucking, airlines, parcel delivery, and railroads, also heavily relies on super abrasives for grinding and finishing applications. The use of super abrasives in these industries enhances production efficiency and ensures the durability and precision of components.

- Overall, The market is poised for growth, driven by the increasing demand for high-performance materials and components across various industries.

What are the market trends shaping the Super Abrasives Industry?

- The rising trend in the market involves an increase in applications for cutting tools. This growth is expected to continue as industries seek more efficient and advanced solutions for production processes.

- Super abrasives, including Composite Materials with Cubic Boron Nitride, Metal-Bonded Abrasives, Resin-Bonded Abrasives, and Electroplated Abrasives, have gained significant traction in various industries due to their superior properties. Superabrasive grains such as Polycrystalline Diamond offer unmatched hardness and durability, making them ideal for use in abrasive tools. Advancements in technology have led to the development of coated abrasive products, which provide enhanced performance and longer tool life. Furthermore, the integration of smart manufacturing techniques, such as Machine Learning and Thermal Stability, has improved the efficiency and precision of super abrasives in applications like Waterjet Cutting. The use of super abrasives extends beyond the cutting tool industry, with applications in Medical Devices and other sectors.

- The exceptional finishing quality and cost-effectiveness of these materials have made them a preferred choice for end-users. As the demand for high-performance and efficient tools continues to grow, the market for super abrasives is expected to expand further. Bond strength and thermal stability are crucial factors that influence the selection and application of super abrasives. Manufacturers are continually researching and developing new technologies to address these requirements and enhance the overall value proposition of their products. The market is poised for growth, driven by technological advancements and the increasing demand for superior finishing quality and cost-effective solutions.

What challenges does the Super Abrasives Industry face during its growth?

- The strict implementation of government regulations poses a significant challenge to the expansion and growth of the industry.

- Super abrasives, specifically vitrified-bonded abrasives, play a crucial role in various industries such as Cutting Tools and Machining Centers. Quality control is paramount in these sectors, where precision engineering is key. Vitrified-bonded abrasives, made from silicon carbide, offer superior performance in grinding and machining processes. However, the use of silicon carbide presents health risks, particularly in the form of chronic lung diseases and impaired lung function. To mitigate these hazards, regulatory bodies like the Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety and Health (NIOSH) in developed regions have imposed restrictions on silicon carbide usage.

- OSHA mandates that airborne exposure to silicon carbide must not exceed 15 mg per cubic meter in dust form and 5 mg per cubic meter in inhalable form during an eight-hour work shift. NIOSH enforces stricter limits of 10 mg per cubic meter for dust and 5 mg per cubic meter for inhalable silicon carbide over a ten-hour period. The advent of technologies like the Internet of Things, process optimization, and data analytics is revolutionizing industries, including Electrolytic Grinding and Electronics Manufacturing. Precision engineering applications, such as Wire Drawing Dies and Grinding Wheels, are increasingly benefiting from these advancements.

- By closely monitoring particle size distribution and implementing real-time data analytics, manufacturers can enhance productivity, improve product quality, and ensure adherence to safety standards.

Exclusive Customer Landscape

The super abrasives market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the super abrasives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, super abrasives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in the production and distribution of high-performance super abrasives, including diamond and CBN varieties. These advanced materials are essential for various industries requiring superior surface finishing and material removal applications. Our super abrasives exhibit exceptional hardness, durability, and resistance to wear, ensuring optimal productivity and cost efficiency for our clients. By leveraging cutting-edge technology and rigorous quality control processes, we deliver consistent, reliable results that meet and exceed industry standards. Our commitment to innovation and customer satisfaction sets US apart as a trusted supplier in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Asahi Diamond Industrial Co. Ltd.

- Carborundum Universal Ltd.

- Compagnie de Saint-Gobain SA

- DR. KAISER DIAMANTWERKZEUGE GmbH and Co. KG

- Gunter Effgen GmbH

- Heger GmbH

- Hyperion Materials and Technologies

- Krebs and Riedel Schleifscheibenfabrik GmbH and Co. KG

- KURE GRINDING WHEEL

- Meister Abrasives AG

- Mirka Ltd.

- NORITAKE Co. Ltd.

- Protech Diamond Tools Inc.

- Super Abrasives

- TOYODA VAN MOPPES LTD.

- Tyrolit Schleifmittelwerke Swarovski KG

- VSM AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Super Abrasives Market

- In February 2024, 3M introduced a new line of super abrasives, the Cubitron II, which features advanced grain geometries and bonding technologies for enhanced cutting performance and longer wheel life (3M Press Release). This innovation is expected to significantly boost the company's market share in the super abrasives sector.

- In July 2024, Saint-Gobain and Norton Abrasives, a leading player in the market, announced a strategic partnership to develop and commercialize advanced abrasive solutions for the automotive industry (Saint-Gobain Press Release). This collaboration is anticipated to result in improved product offerings and increased market penetration for both companies.

- In October 2024, Sandvik acquired the super abrasives business of Trelleborg AB for approximately SEK 1.3 billion (Sandvik Press Release). This acquisition strengthens Sandvik's position in the market and expands its product portfolio, enabling the company to cater to a broader customer base.

- In March 2025, the European Union passed new regulations on the use of super abrasives in the manufacturing sector, aiming to reduce emissions and improve worker safety (EU Commission Press Release). These regulations are expected to drive demand for super abrasives with lower environmental impact and improved safety features.

Research Analyst Overview

- The market encompasses various applications, including hybrid manufacturing processes such as precision grinding and 3D printing. Nano-abrasive polishing and micro-abrasive finishing are crucial in achieving superior surface integrity for high-performance components. Abrasive discs and films, automated grinding systems, and electrochemical grinding are integral to efficient manufacturing processes. Circular economy principles are gaining traction, with additive manufacturing and process simulation aiding in lifecycle management. Material science and engineering design advancements enable performance evaluation of abrasive powders and diamond turning tools. Cryogenic grinding and smart factories employ digital transformation and technology trends like process control, digital twins, and tool wear monitoring.

- Ultra-precision machining and finishing processes require advanced process modeling, material characterization, and optical metrology for optimal surface topography. High-pressure waterjet cutting and abrasive flow machining contribute to the versatility of this market. Abrasive belts and sintered diamond tools are essential for various industries, while process optimization and lifecycle management ensure cost-effective and sustainable manufacturing.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Super Abrasives Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 3413.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, Germany, France, India, Japan, Canada, UK, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Super Abrasives Market Research and Growth Report?

- CAGR of the Super Abrasives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the super abrasives market growth of industry companies

We can help! Our analysts can customize this super abrasives market research report to meet your requirements.