What is the Size of Systemic Psoriasis Therapeutics Market?

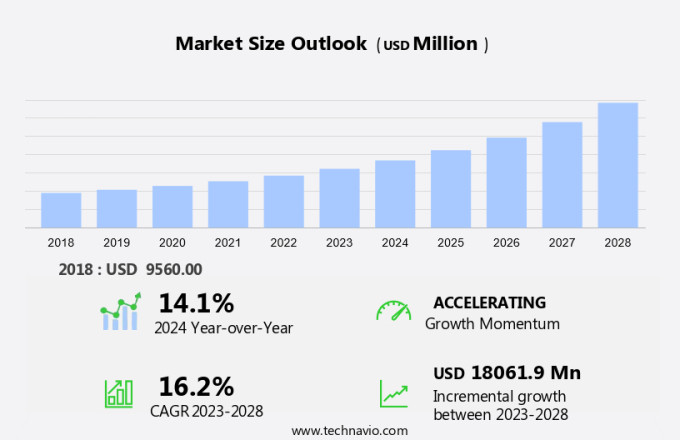

The systemic psoriasis therapeutics market size is forecast to increase by USD 18.06 billion, at a CAGR of 16.2% between 2023 and 2028. The market is experiencing significant growth due to the increasing incidence of psoriasis and the adoption of injectable biologics as an effective treatment option. Early diagnosis and patient awareness are key drivers in the market, leading to an increase in demand for advanced drug delivery systems. The healthcare system is embracing these technologies to improve patient outcomes and reduce hospital pharmacy costs. However, regulatory hurdles in the approval process for new systemic psoriasis therapeutics pose a challenge to market growth. Dermatological products continue to be a significant segment in the market, as they offer effective topical treatments for patients with mild to moderate psoriasis. To stay competitive, market players must focus on developing innovative solutions that address the unique needs of patients and regulatory agencies. Key trends include the use of phototherapy in combination with systemic therapies and the development of patient-centric delivery systems. By addressing these trends and challenges, the systemic psoriasis therapeutics market is poised for continued growth.

Request Free Systemic Psoriasis Therapeutics Market Sample

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- Hospitals

- Retail pharmacies

- Product

- Biologics

- Small molecules

- Route Of Administration

- Oral

- Parenteral

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Spain

- Norway

- Asia

- India

- Rest of World (ROW)

- North America

Which is the Largest Segment Driving Market Growth?

The hospitals segment is estimated to witness significant growth during the forecast period. Systemic psoriasis therapeutics cater to individuals suffering from psoriasis, a chronic skin disorder characterized by inflamed, scaly patches. This market encompasses treatments for both plaque psoriasis and psoriatic arthritis (PsA). The demand for effective therapeutics continues to rise due to the debilitating nature of these conditions. Non-biologic drugs, such as methotrexate and cyclosporine, remain popular options for mild to moderate cases. However, biologic therapies, which inhibit overactive immune cells to alleviate inflammation, are increasingly being utilized for severe cases that have not responded to other treatments. Biologics administered via injection are gaining traction in the market.

Get a glance at the market share of various regions Download the PDF Sample

The hospitals segment was valued at USD 5.97 billion in 2018. Notable examples include guselkumab, brodalumab, secukinumab, ixekizumab, bimekizumab, and risankizumab. These treatments offer targeted interventions, leading to improved patient outcomes. For instance, guselkumab and risankizumab inhibit specific interleukins, thereby reducing psoriasis symptoms. Secukinumab and ixekizumab focus on interleukin-17A, providing relief for those with moderate to severe plaque psoriasis. Telemedicine is also revolutionizing the systemic psoriasis therapeutics landscape, enabling remote consultations and treatment monitoring. This innovative approach enhances accessibility and convenience for patients. The market is marked by the introduction of new drug classes, such as interleukin inhibitors and TNF inhibitors. These targeted treatments provide hope for those living with this chronic condition.

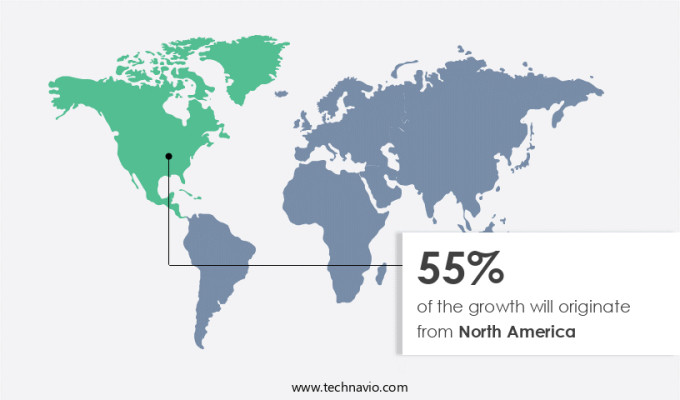

Which Region is Leading the Market?

For more insights on the market share of various regions Request Free Sample

North America is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. This approval expands treatment accessibility and affordability for a larger patient base, as it serves as a cost-effective alternative to Stelara. These approvals underscore the commitment to advancing treatment options for psoriasis patients in North America.

How do Technavio's company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AbbVie Inc. -The company offers psoriasis treatments such as risankizumab, which is used to treat adults with specific kinds of plaque psoriasis, psoriatic arthritis, ulcerative colitis, and crohns disease.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- Amgen Inc.

- AstraZeneca Plc

- Bausch Health Companies Inc.

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- Bristol Myers Squibb Co.

- Eli Lilly and Co.

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- LEO Pharma AS

- Merck and Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- UCB SA

- Viatris Inc.

Explore our company rankings and market positioning Request Free Sample

How can Technavio Assist you in Making Critical Decisions?

What is the Market Structure and Year-over-Year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2023-2024 |

14.1 |

Market Dynamic

Psoriasis is a chronic skin disorder characterized by the rapid growth and accumulation of skin cells. This autoimmune condition is marked by inflammatory responses that trigger the production of red, scaly patches on the skin. The two most common forms of psoriasis are plaque psoriasis and psoriatic arthritis (PSA). The treatment landscape for psoriasis is diverse, encompassing various drug classes and administration routes. Two major classes of biologically targeted therapies are TNF-alpha inhibitors and interleukin inhibitors. These drugs have shown significant efficacy in managing the symptoms of psoriasis and PSA. TNF-alpha inhibitors target the tumor necrosis factor-alpha, a protein that plays a crucial role in the inflammatory response. Interleukin inhibitors, on the other hand, target specific interleukins, which are proteins involved in cell signaling and immune responses. Both classes of drugs are available in various forms, including oral, topical, and parenteral administration. The demand for systemic psoriasis therapeutics is driven by the increasing prevalence of psoriasis and PSA. According to the National Psoriasis Foundation, more than 7.5 million Americans are living with psoriasis, and about 30% of them have PSA. The high prevalence of this chronic condition necessitates the development of effective treatment options. Non-biologic drugs, such as retinoids, methotrexate, and cyclosporine, are also used to manage psoriasis. These drugs work by suppressing the immune system and reducing inflammation. However, they come with a higher risk of side effects and are less effective than biologic therapies. The advent of telemedicine has revolutionized the way psoriasis is diagnosed and treated.

Telemedicine enables patients to consult with healthcare professionals remotely, reducing the need for in-person visits and making treatment more accessible. This trend is expected to boost the demand for systemic psoriasis therapeutics. The biotechnology sector plays a significant role in the development of systemic psoriasis therapeutics. Biotech companies are investing heavily in drug development to create more effective and safer treatments for psoriasis and PSA. The use of advanced technologies, such as gene therapy and RNA interference, is expected to yield innovative treatments in the future. The treatment outcomes of systemic psoriasis therapeutics are closely monitored to assess their safety and efficacy. Immunological and genetic factors, as well as systemic inflammatory conditions, metabolic syndrome, psychological issues, cardiovascular disease, and inflammatory bowel disease, are some of the factors that influence treatment outcomes. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Primary Factors Driving the Market Growth?

The rising incidence of psoriasis is notably driving market growth. The market is experiencing significant growth due to the increasing number of individuals diagnosed with psoriasis. According to recent data, over 8 million Americans live with psoriasis, marking a notable rise from the previous year. This equates to approximately 3% of the US population or around 7.5 million people. On a global scale, psoriasis affects an estimated 125 million people, representing 2-3% of the world's population. With such a large and growing population of individuals affected by this chronic skin condition, the demand for effective therapeutic options is increasing.

Notable treatments include systemic drugs such as retinoids and cyclosporine, as well as advanced phototherapy and personalized treatments. Clinical startups and research institutions are also working on new treatment insights to address the unique needs of psoriasis patients. Thus, such factors are driving the growth of the market during the forecast period.

What are the Significant Trends being Witnessed in the Market?

The use of phototherapy to treat systemic psoriasis is the key trend in the market. The market is experiencing a notable transition towards phototherapy as an effective treatment solution for this skin disorder, which is an autoimmune condition. Narrowband ultraviolet B (UVB) therapy is a widely used phototherapy method that helps alleviate symptoms such as sores, scales, and inflammation. Approximately 60% of patients report clear or mostly clear skin after following a bi-weekly treatment regimen for 12 weeks. A significant trend in this market is the growing availability and utilization of home phototherapy devices. These devices enable self-administration, allowing patients to manage their condition outside of clinical settings with ease. Shift towards phototherapy as a treatment option for psoriasis, an autoimmune skin disorder.

Narrowband ultraviolet B (UVB) therapy, a type of phototherapy, is extensively used in clinical settings due to its effectiveness in alleviating symptoms such as sores, scales, and inflammation. This method has proven successful, with approximately 60% of patients reporting clear or mostly clear skin after a 12-week bi-weekly treatment regimen. A trend worth noting in the market is the growing availability and utilization of home phototherapy devices. These devices facilitate self-administration, making it easier for patients to manage their condition outside of clinical environments.

What are the Major Market Challenges?

Regulatory hurdles in approval of systemic psoriasis therapeutics is the major challenge that affects the growth of the market. The market is shaped by stringent regulatory requirements set by the Food and Drug Administration (FDA). These guidelines focus on critical aspects of biologic agents used for the treatment of moderate to severe psoriasis in adults. The evaluation process includes assessing the efficacy, safety, and effectiveness of these agents, whether used alone or in combination with other therapies. Comorbid conditions, such as arthritis, heart disease, metabolic syndrome, smoking, excessive alcohol intake, inflammatory bowel disease, and psychiatric disorders, are significant considerations in the management and treatment of psoriasis.

Hospital pharmacies and the healthcare system play a crucial role in ensuring the appropriate use of these biologic agents. Early diagnosis and increased patient awareness are essential to effective treatment and improved patient outcomes. Injectable biologics and advanced drug delivery systems are key components of the systemic psoriasis therapeutics market, offering targeted and efficient treatments for patients. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The market caters to the treatment of an autoimmune disorder characterized by inflammation and the rapid growth of skin cells, leading to red, scaly patches on the skin. Plaque psoriasis and psoriatic arthritis are common forms of this chronic skin disorder. The therapeutics market offers various treatment options, including topical, oral, and parenteral interventions. Biologically targeted therapies, such as TNF-alpha inhibitors and interleukin inhibitors, have gained significant traction due to their efficacy in managing systemic inflammatory conditions associated with psoriasis. Non-biologic drugs, like corticosteroids, salicylic acid, calcineurin inhibitors, and coal tar, are also used for mild to moderate cases. The pipeline drugs in the systemic psoriasis therapeutics market include advanced phototherapy and personalized treatments. These new interventions aim to improve treatment outcomes and reduce severe side effects. Telemedicine and online pharmacies are increasingly becoming popular for enhancing healthcare accessibility and reducing medication costs.

The healthcare system is focusing on early diagnosis and patient awareness to improve treatment demand for systemic psoriasis. The market for systemic psoriasis therapeutics is expected to grow significantly due to the increasing prevalence of immunological and genetic factors contributing to this disorder. Additionally, the association of systemic psoriasis with other conditions like metabolic syndrome, cardiovascular disease, inflammatory bowel disease, and psychological issues further boosts the market growth. The biotechnology industry plays a crucial role in drug development for systemic psoriasis, focusing on creating innovative drug delivery systems and hospital pharmacies to cater to the diverse treatment needs of patients. The market for systemic psoriasis therapeutics is expected to witness significant advancements in the coming years, offering new hope for those suffering from this chronic skin disorder.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.2% |

|

Market Growth 2024-2028 |

USD 18.06 billion |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 55% |

|

Key countries |

US, Norway, Kazakhstan, UK, Germany, Philippines, India, Canada, Brazil, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AbbVie Inc., Amgen Inc., AstraZeneca Plc, Bausch Health Companies Inc., Biogen Inc., Boehringer Ingelheim International GmbH, Bristol Myers Squibb Co., Eli Lilly and Co., GlaxoSmithKline Plc, Johnson and Johnson Services Inc., LEO Pharma AS, Merck and Co. Inc., Novartis AG, Pfizer Inc., Sun Pharmaceutical Industries Ltd., UCB SA, and Viatris Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, AI impact on market trends, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies