Thailand Dies And Molds Market Size 2025-2029

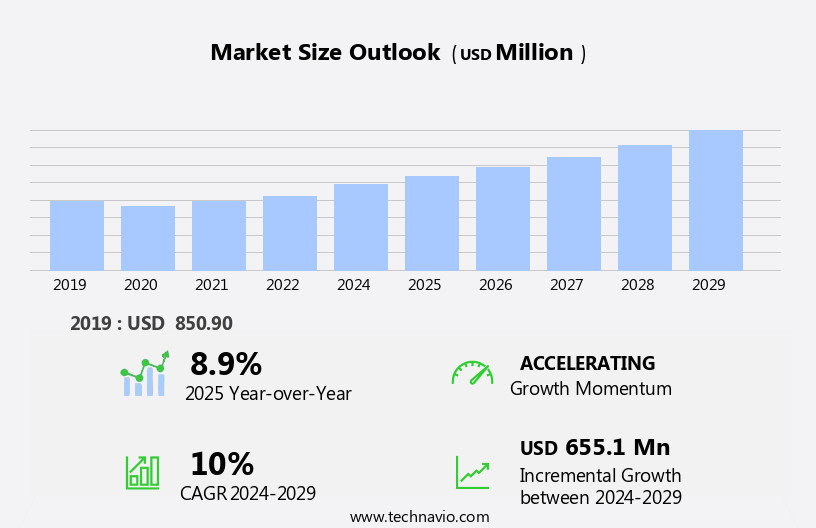

The Thailand dies and molds market size is forecast to increase by USD 655.1 million at a CAGR of 10% between 2024 and 2029.

- The Dies and Molds market is experiencing significant growth, driven by the expanding manufacturing sector in countries like Thailand, where the automotive and electronics industries are witnessing in production growth. This trend is further fueled by the adoption of advanced technologies, such as simulation technology in the casting process, which enhances productivity and reduces production costs. However, the market is not without challenges. The significant energy consumption associated with dies and mold technology poses a major environmental concern and increases operational costs.

- The integration of smart manufacturing, digital transformation, and advanced technologies like additive manufacturing and mold flow analysis have significantly impacted the dies and molds market. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on energy efficiency and explore alternative energy sources. Additionally, investments in research and development of innovative materials and manufacturing processes can help reduce production costs and improve product quality, providing a competitive edge in the market.

What will be the size of the Thailand Dies And Molds Market during the forecast period?

- The dies and molds market encompasses the production and sale of dies and molds used in various manufacturing processes, including composite materials, wire EDM, EDM machining, shot blasting, punching dies, ejector pins, mold bases, multi-cavity molds, cooling channels, and more. Composite materials, such as aluminum alloys and stainless steel, are increasingly utilized due to their lightweight and high-strength properties. Advanced technologies, like computer-aided engineering (CAE) and laser cutting, streamline production and enhance precision.

- Market growth is driven by the increasing demand for mass production and customization in industries like automotive, aerospace, and consumer goods. Trends include the use of high-speed steel, tool steel, and titanium alloys for improved durability and efficiency. Additionally, innovations in mold temperature control, gate systems, and hot runners contribute to faster production cycles and reduced waste. Overall, the dies and molds market is a dynamic and evolving sector that continues to play a crucial role in manufacturing processes.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Casting

- Forging

- Injection molding

- End-user

- Automotive

- Construction

- Electronics

- Machine tool

- Others

- Material

- Steel

- Aluminum

- Others

- Geography

- Thailand

By Application Insights

The casting segment is estimated to witness significant growth during the forecast period. Casting dies and molds play a crucial role in the metal casting process, producing intricate metal parts and components for various industries, including automotive, aerospace, and manufacturing. In the metal forming sector, processes such as die casting, powder metallurgy, compression molding, and CNC machining are commonly used. These techniques enable the production of high-precision components with excellent surface finishing and dimensional accuracy. The electronics industry relies heavily on casting dies and molds for Design for Assembly (DFA) applications, particularly in the production of smart manufacturing systems, consumer goods, and medical devices. Advanced technologies like additive manufacturing, mold flow analysis, and digital transformation are increasingly being adopted to optimize cost, improve quality control, and enhance product development.

The aerospace industry benefits from the use of high-performance alloys and advanced mold designs to create lightweight and durable components. Precision engineering, value engineering, and reverse engineering techniques are employed to ensure the highest level of accuracy and efficiency in mold design and manufacturing. Mold life cycle management, heat treatment, and material science are essential aspects of the casting dies and molds market. Quality control measures, such as mold repair and maintenance, ensure the longevity and reliability of the molds. Injection molding, blow molding, and transfer molding are common techniques used for high-volume production in industries like consumer goods and automotive.

Data analytics and lean manufacturing principles are being integrated into the casting dies and molds market to enhance efficiency and reduce waste. The integration of 3D printing technology in mold manufacturing is revolutionizing the industry by enabling rapid prototyping and custom mold design. The casting dies and molds market is a dynamic and evolving sector that plays a vital role in the manufacturing industry. Its applications span various industries, including automotive, aerospace, electronics, and consumer goods, and its continued growth is driven by advancements in technology, material science, and manufacturing processes.

Get a glance at the market share of various segments Request Free Sample

The Casting segment was valued at USD 364.50 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Thailand Dies And Molds Market?

- The expanding manufacturing sector in Thailand is the key driver of the market. The expanding manufacturing sector in Thailand, driven primarily by the automotive industry, is a significant factor fueling the nation's economic growth and development. This sector has attracted global automakers such as Toyota, Honda, BYD, and Ford, who have established advanced production facilities in the country. The increasing demand for automotive components and parts due to the growth of the automotive sector necessitates the use of precision dies and molds to produce high-quality vehicle components.

- For instance, in July 2024, BYD, a leading automobile and technology company, inaugurated its first EV factory outside China in Rayong, Thailand. This trend underscores the importance of the dies and molds market in supporting the Thai manufacturing sector's growth. Such factors will increase the market growth analysis during the forecast period.

What are the market trends shaping the Thailand Dies And Molds Market?

- Incorporation of simulation technology in casting process is the upcoming trend in the market. The dies and molds industry has experienced significant advancements due to the integration of simulation technology into the casting process. Previously, casting process optimization relied heavily on trial and error, leading to lengthy and costly production. However, the adoption of simulation technology enables manufacturers to assess various casting scenarios before initiating production. Simulation technology can be utilized throughout the casting process, from design to tooling and production. During the design phase, it can help identify potential defects and optimize cast geometry to enhance quality. By visualizing molten metal flow and anticipating potential problems, designers can make necessary modifications to minimize flaws.

- Throughout the casting process, simulation technology offers numerous benefits. It reduces production time, lowers costs, and improves overall product quality. Furthermore, it allows for more accurate forecasting of production outcomes, leading to increased efficiency and productivity. The implementation of simulation technology in the dies and molds industry has revolutionized the casting process, leading to substantial improvements and advancements. It offers numerous benefits, including reduced production time, lower costs, and enhanced product quality. By utilizing simulation technology, manufacturers can optimize their processes and stay competitive in today's market. Such factors will increase the market growth during the market forecasting period

What challenges does Thailand Dies And Molds Market face during the growth?

- Significant energy consumption associated with dies and mold technology is a key challenge affecting the market growth. The dies and molds market faces a substantial challenge due to the significant energy consumption associated with its production processes. In Thailand, this issue is particularly relevant, as the manufacturing of precision dies and molds involves energy-intensive procedures. One of the primary contributors to high energy usage is the operation of heavy machinery, such as those used for milling, grinding, and shaping metal alloys and other materials.

- These machines demand considerable electrical power and generate heat during operation, leading to increased energy consumption levels. Moreover, the necessity for precise temperature control during manufacturing processes, particularly during heat treatment and tempering, further amplifies the energy demand. Addressing this challenge is essential for both economic sustainability and environmental responsibility. Such factors will hinder the market report during the forecast period.

How can Technavio assist you in making critical decisions?

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acme International Thailand Ltd.

- Dynacast

- EXEDY Corp.

- Jet Industries Thailand Co.

- KANSEI Co. Ltd.

- Keiteq Co. Ltd.

- KIKUWA Corp.

- KYOWA CASTING Thailand Co. Ltd.

- Malaplast Co. Ltd.

- Mazak Thailand Co. Ltd.

- Mitsui Chemicals Inc.

- Molder Enterprise Co. Ltd.

- Newton Co. Ltd.

- Panasonic Holdings Corp.

- Ryobi Ltd.

- Thai Auto Tools and Die Public Co. Ltd.

- Thai Mikami Co. Ltd.

- Thai Rung Union Car Public Co. Ltd.

- Thai Summit Group

- TTS Plastic Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The dies and molds market encompasses a vital segment of the manufacturing industry, playing a pivotal role in various sectors such as electronics, aerospace, medical devices, and consumer goods, among others. This market is characterized by constant innovation and advancements in technology, driven by the demand for efficient, cost-effective, and high-quality manufacturing processes. Design for assembly (DFA) and design for manufacturing (DFM) are crucial aspects of the dies and molds market, enabling manufacturers to optimize their production processes and reduce costs. Powder metallurgy and metal forming processes, including die casting and compression molding, are widely used to create intricate and precise components for various industries.

These technologies enable manufacturers to streamline their supply chain management, improve product development, and enhance quality control. Moreover, the market is witnessing a shift towards value engineering, lean manufacturing, and precision engineering, as manufacturers strive to minimize waste and optimize costs. The use of advanced materials, such as metal alloys and polymer science, further enhances the capabilities of dies and molds in high-volume production. Mold design, maintenance, and repair are essential components of the dies and molds market.

Heat treatment and surface finishing are crucial processes that ensure the longevity and durability of molds. The market also caters to custom molding requirements, enabling manufacturers to create unique and specialized components. The dies and molds market is subject to various market dynamics, including technological advancements, cost optimization, and changing industry trends. Mold life cycle, mold maintenance, and quality control are critical factors that influence the market's growth and competitiveness. The dies and molds market is a dynamic and evolving industry, driven by the need for efficient, cost-effective, and high-quality manufacturing processes. The integration of advanced technologies, materials, and manufacturing methodologies continues to shape the market's future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10% |

|

Market growth 2025-2029 |

USD 655.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.9 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Thailand

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch