Throat Cancer Therapeutics Market Size 2024-2028

The throat cancer therapeutics market size is forecast to increase by USD 2.33 billion at a CAGR of 7.51% between 2023 and 2028.

- Throat cancer, also known as head and neck cancer, is a significant health concern with increasing incidence rates. This trend is driving the growth of the market. Furthermore, strategic alliances among market companies are enhancing the competitive landscape and contributing to market expansion.

- A preference for alternative treatment options, such as immunotherapy and targeted therapy, is also influencing market development. These trends are shaping the future of the market, offering opportunities for stakeholders to capitalize on the growing demand for effective medical technologies. The market's growth is expected to remain robust, providing a favorable business environment for market participants.

What will be the Size of the Throat Cancer Therapeutics Market During the Forecast Period?

- The market encompasses the development and provision of treatments for various types of throat cancers, including those affecting the voice box, vocal cords, tonsils, oropharynx, and larynx. These malignant growths, often originating from squamous cells, can manifest with symptoms such as chronic sore throat, difficulty swallowing, and hoarseness. Risk factors include use of alcohol and tobacco.

- Throat cancer treatment modalities include radiation therapy, surgery, chemotherapy, targeted drug therapy, and emerging approaches like immunotherapy and precision medicine. Hospitals remain key providers of these services, catering to the needs of patients with conditions like pharyngeal cancer and laryngeal cancer, which can impact the glottis area and cause symptoms such as sore throat and hoarseness.

How is this Throat Cancer Therapeutics Industry segmented and which is the largest segment?

The throat cancer therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Pharyngeal cancer

- Laryngeal cancer

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Asia

- India

- Rest of World (ROW)

- North America

By Type Insights

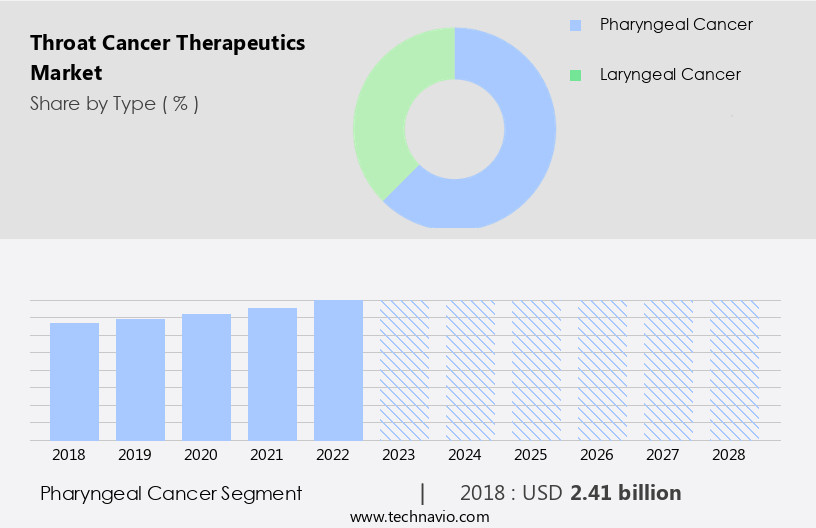

- The pharyngeal cancer segment is estimated to witness significant growth during the forecast period.

Throat cancer, specifically pharyngeal cancer, is a serious condition characterized by malignant cells developing In the pharynx, a tube extending from the back of the nose to the esophagus. Classified as nasopharynx, oropharynx, and hypopharynx cancer based on the pharynx region, this disease poses a significant health concern due to its potential for rapid spread. Risk factors, such as tobacco usage, alcohol intake, HPV infection, betel juice consumption, and advanced age, contribute to its prevalence. Diagnostic tools like CT scans, PET scans, needle biopsy, MRI scans, thoracoscopy, and mediastinoscopy aid in illness detection. Treatment modalities include surgery, radiation therapy, targeted therapy, chemotherapy using antimetabolites, platinum derivatives, plant derivatives, nitrogen mustards, and antibiotics.

Hospitals, cancer research institutes, multispecialty clinics, and ambulatory surgical centers provide essential services for managing this condition. Key symptoms include persistent sore throat, hoarseness, cough, bad breath, significant weight loss, and constant ear pain. Precision medicine, utilizing genetic information, and oral drugs in capsule or tablet form are emerging trends in pharyngeal cancer therapeutics.

Get a glance at the Throat Cancer Therapeutics Industry report of share of various segments Request Free Sample

The Pharyngeal cancer segment was valued at USD 2.41 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

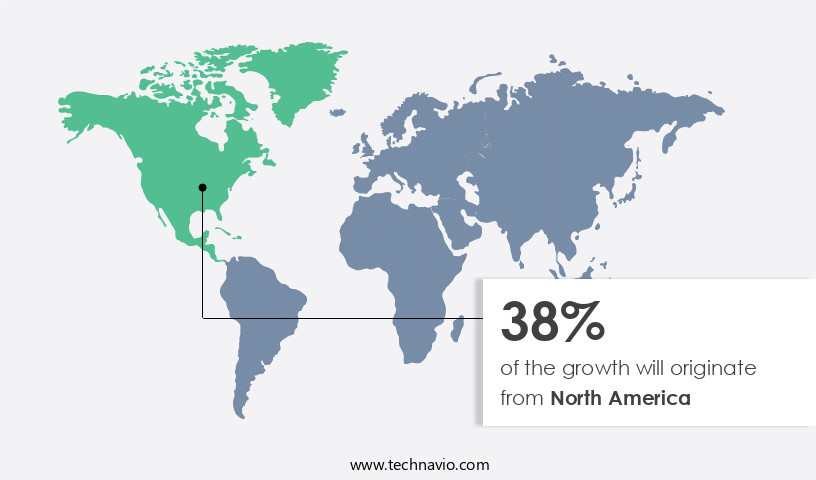

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Throat cancer, including tumors In the voice box, vocal cords, tonsils, oropharynx, larynx, and squamous cells, affects various areas of the throat. In the US, significant numbers of new cases are reported annually, with around 66,000 cases of pharyngeal and laryngeal cancer combined in 2021. Risk factors include chronic sore throat, difficulty swallowing, unhealed mouth sores, raspy voice, enlargement, swollen lymph nodes, and symptoms like persistent cough, hoarseness, persistent bad breath, and significant weight loss. The elderly population is particularly susceptible, with alcohol consumption, HPV infections, and smoking being leading causes. Diagnostic imaging technologies, such as CT scans, PET scans, needle biopsy, MRI scans, thoracoscopy, and mediastinoscopy, aid in illness detection.

Novel technologies and medications, including chemotherapy drugs, antimetabolites, platinum derivatives, plant derivatives, nitrogen mustards, antibiotics, and oral drugs in capsule or tablet form, are used for treatment. Hospitals, cancer research institutes, multispecialty clinics, and ambulatory surgical centers offer various therapies, including surgery, radiation therapy, targeted therapy, chemotherapy, and immunotherapy. The US market for throat cancer therapeutics is substantial due to the advanced healthcare infrastructure and high prevalence of the disease.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Throat Cancer Therapeutics Industry?

Increasing incidence of throat cancer is the key driver of the market.

- Throat cancer, characterized by tumors In the voice box, vocal cords, tonsils, oropharynx, and larynx, affects thousands of individuals each year. Squamous cells, the primary cells affected, can lead to chronic sore throat, difficulty swallowing, unhealed mouth sores, and a raspy voice. Enlargement, swollen lymph nodes, persistent cough, hoarseness, and significant weight loss are other common symptoms. Pharyngeal and laryngeal cancers are the most prevalent types, with risk factors including tobacco usage, alcohol intake, HPV infection, and betel juice consumption. The elderly population and smoking population are disproportionately affected. Diagnostic imaging, such as CT scans, PET scans, needle biopsy, MRI scans, thoracoscopy, and mediastinoscopy, aid in illness detection.

- Novel technologies, including digital technology-based systems, are increasingly used for precision medicine, utilizing genetic information for oral drugs in capsule or tablet form. Chemotherapy drugs, including antimetabolites, platinum derivatives, plant derivatives, nitrogen mustards, and antibiotics, are common treatments. Surgery and radiation therapy are also used, along with targeted therapy and immunotherapy. Hospitals, cancer research institutes, multispecialty clinics, and ambulatory surgical centers offer these treatments. Symptoms such as persistent cough, hoarseness, sore throat, and difficulty swallowing can lead to appointment systems, routine health services, and telemedicine for early intervention. Alcohol and tobacco usage increase the risk of throat cancer, and health awareness campaigns can help reduce their consumption.

- Immunotherapy and targeted drug therapy are emerging treatments for throat cancer, offering new hope for patients.

What are the market trends shaping the Throat Cancer Therapeutics Industry?

Growing strategic alliances of the vendors is the upcoming market trend.

- The market In the US has experienced growth due to an increase in strategic collaborations among companies for the development and commercialization of treatments for various head and neck cancer indications, such as pharyngeal and laryngeal cancer. These partnerships help companies overcome challenges related to research, manufacturing, and commercialization of drugs. For instance, Eli Lilly entered into a licensing agreement with Merck KGaA for the distribution of ERBITUX. Tumors In the voice box, vocal cords, tonsils, oropharynx, and larynx can lead to throat cancer. Symptoms include chronic sore throat, difficulty swallowing, unhealed mouth sores, a raspy voice, enlargement, swollen lymph nodes, and pharyngeal or laryngeal cancer.

- Risk factors include tobacco usage, alcohol intake, HPV infection, and betel juice consumption. The elderly population and smoking population are particularly susceptible. Diagnostic imaging technologies like CT scans, PET scans, needle biopsy, MRI scans, thoracoscopy, and mediastinoscopy are crucial for illness detection. Novel technologies and medications, including chemotherapy drugs like antimetabolites, platinum derivatives, plant derivatives, nitrogen mustards, and antibiotics, play a significant role in treatment. Precision medicine and genetic information are driving the development of oral drugs in capsule or tablet form. Health awareness, immunotherapy, and routine health services, including appointment systems and telemedicine, are also essential components of the market.

- Alcohol and tobacco consumption are major contributors to the disease, making health awareness and illness prevention crucial. The market dynamics include the increasing prevalence of throat cancer, advancements in diagnostic technologies, and the development of novel therapies like targeted drug therapy and immunotherapy. The market for throat cancer therapeutics is expected to grow significantly In the coming years.

What challenges does the Throat Cancer Therapeutics Industry face during its growth?

Preference for alternative treatment options is a key challenge affecting the industry growth.

- Throat cancer, also known as pharyngeal or laryngeal cancer, affects various areas of the throat, including the voice box, vocal cords, tonsils, and oropharynx (the part of the throat at the back of the mouth). Tumors In these regions can cause symptoms such as chronic sore throat, difficulty swallowing, unhealed mouth sores, a raspy voice, enlargement or swollen lymph nodes, and persistent cough or bad breath. Squamous cells, the most common type of cell found In the throat, are the primary cells affected by this cancer. Risk factors for throat cancer include tobacco usage, alcohol intake, and HPV infection.

- Betel juice is also a known risk factor in certain populations. The elderly population and smoking population are disproportionately affected. Early detection is crucial for effective treatment, and diagnostic imaging technologies such as CT scans, PET scans, needle biopsy, MRI scans, thoracoscopy, and mediastinoscopy are used to identify malignant cells In the glottis area. The market is witnessing significant advancements with the development of novel technologies and medications. Chemotherapy drugs like antimetabolites, platinum derivatives, plant derivatives, nitrogen mustards, and antibiotics are used in combination with targeted drug therapy and immunotherapy to combat the disease. Precision medicine, which uses genetic information to develop oral drugs in capsule or tablet form, is a promising area of research.

- Patients with throat cancer may experience significant weight loss, constant ear pain, and persistent symptoms. Routine health services, appointment systems, telemedicine, and health awareness campaigns are essential for early detection and effective treatment. The market for throat cancer therapeutics is expected to grow due to the increasing prevalence of throat cancer, the aging population, and the availability of advanced treatment options.

Exclusive Customer Landscape

The throat cancer therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the throat cancer therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, throat cancer therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adlai Nortye Ltd.

- Amgen Inc.

- AstraZeneca Plc

- Bayer AG

- Bristol Myers Squibb Co.

- Celldex Therapeutics Inc.

- Clinigen Group Plc

- Eli Lilly and Co.

- F. Hoffmann La Roche Ltd.

- Merck KGaA

- Moderna Inc

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Sanofi SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Throat cancer, also known as head and neck cancer, refers to a group of malignancies that develop In the throat, voice box, tonsils, oropharynx, larynx, and other related structures. These cancers can originate from various types of cells, including squamous cells, which are the most common type. The therapeutic market for throat cancer is driven by several factors. The increasing prevalence of risk factors such as tobacco usage, alcohol intake, HPV infections, and betel juice consumption is a significant contributor. The elderly population is particularly vulnerable due to age-related weakening of the immune system and the higher prevalence of risk factors in this demographic.

The diagnosis and treatment of throat cancer involve various modalities. Diagnostic imaging technologies such as CT scans, PET scans, MRI scans, thoracoscopy, and mediastinoscopy are commonly used for detection. Needle biopsy is another diagnostic technique that involves removing a small sample of tissue for laboratory analysis. Once a diagnosis is confirmed, treatment options include surgery, radiation therapy, targeted therapy, chemotherapy, and immunotherapy. Chemotherapy drugs such as antimetabolites, platinum derivatives, plant derivatives, nitrogen mustards, and antibiotics are used to kill malignant cells. Precision medicine, which utilizes genetic information to tailor treatment to individual patients, is an emerging trend in throat cancer therapeutics.

Oral drugs, available in capsule and tablet form, are also used for the treatment of throat cancer. These medications can be administered at home, providing greater convenience and reducing the need for frequent hospital visits. The therapeutic market for throat cancer is highly competitive, with various hospitals, cancer research institutes, multispecialty clinics, and ambulatory surgical centers offering treatment services. The use of digital technology-based systems for appointment scheduling, telemedicine, and routine health services is becoming increasingly common, streamlining the patient experience and improving access to care. The market for throat cancer therapeutics is expected to grow significantly due to the increasing incidence of throat cancer and the development of novel technologies and medications.

The use of targeted drug therapy, which specifically targets malignant cells while minimizing damage to healthy cells, is a promising area of research. In conclusion, the therapeutic market for throat cancer is driven by several factors, including the increasing prevalence of risk factors, an aging population, and the development of new technologies and medications. The market is highly competitive, with various providers offering a range of treatment options. The use of digital technology to improve access to care and streamline the patient experience is a significant trend in this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.51% |

|

Market growth 2024-2028 |

USD 2.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.31 |

|

Key countries |

US, Canada, Hungary, Poland, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Throat Cancer Therapeutics Market Research and Growth Report?

- CAGR of the Throat Cancer Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the throat cancer therapeutics market growth of industry companies

We can help! Our analysts can customize this throat cancer therapeutics market research report to meet your requirements.