Train Door Systems Market Size 2025-2029

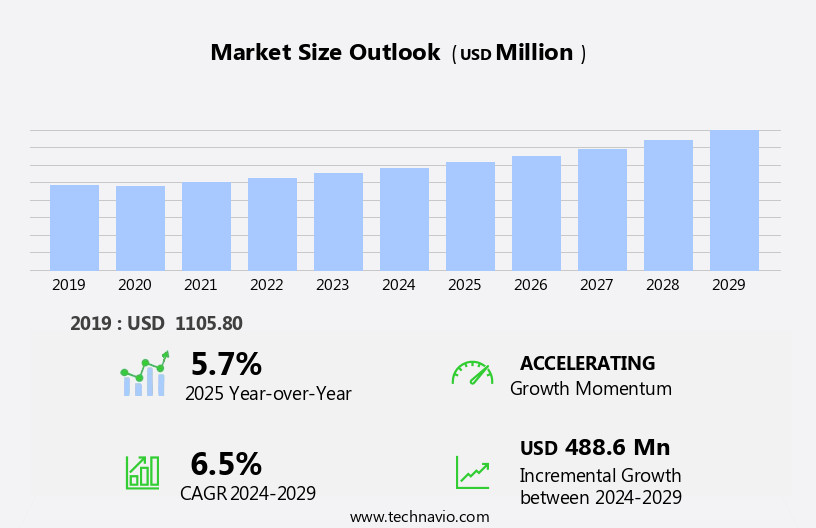

The train door systems market size is forecast to increase by USD 488.6 million, at a CAGR of 6.5% between 2024 and 2029. The market is experiencing significant growth, driven primarily by the increasing urbanization and subsequent rise in rail passenger traffic worldwide. This trend is expected to continue as cities expand and populations become more densely concentrated in metropolitan areas.

Major Market Trends & Insights

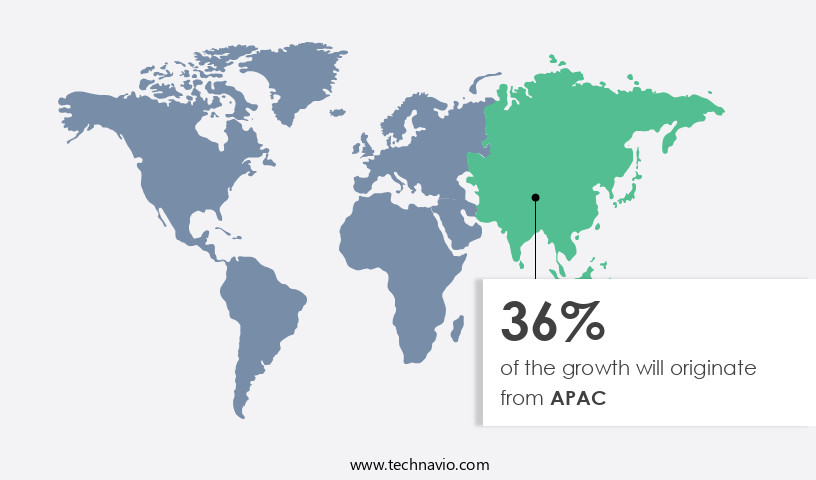

- APAC dominated the market and accounted for a 36% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

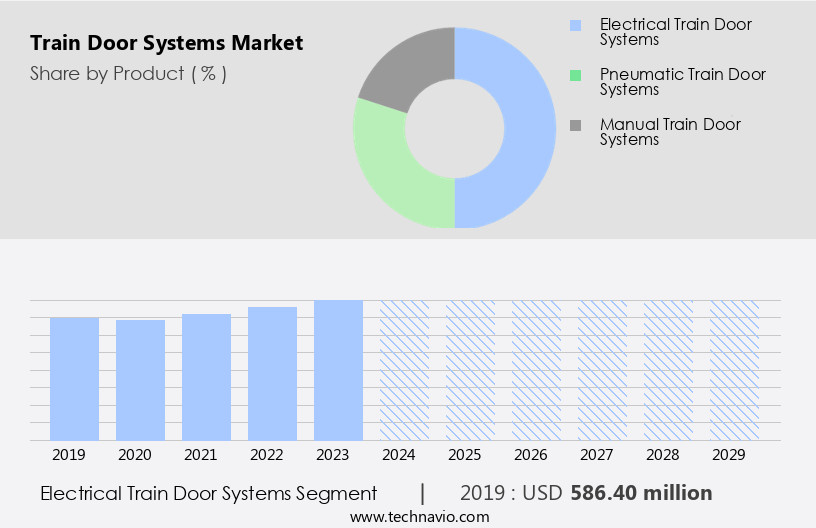

- Based on the Product, the Electrical train door systems segment led the market and was valued at USD 668.30 million of the global revenue in 2023.

- Based on the Application, the entrance doors segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 63.79 Million

- Future Opportunities: USD 488.6 Million

- CAGR (2024-2029): 6.5%

- APAC: Largest market in 2023

The integration of automation and Internet of Things (IoT) technologies in railway systems is revolutionizing train door operations, enhancing safety, efficiency, and passenger experience. However, the market faces challenges as well. The decline in growth of the high-speed rail market in the US, due to factors such as funding constraints and shifting priorities, may impact the demand for advanced train door systems in this region.

To capitalize on market opportunities and navigate challenges effectively, companies in the market should focus on developing innovative solutions that cater to the evolving needs of the railway industry, while addressing the unique demands of various regional markets. By staying abreast of technological advancements and market trends, these companies can position themselves for long-term success in this dynamic and growing market.

What will be the Size of the Train Door Systems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the growing demand for energy efficiency and passenger safety. Energy-efficient doors, equipped with door obstacle detection and door control units, are gaining popularity due to their ability to reduce energy consumption and improve door closing speed. Hydraulic door systems, with their robustness and reliability, remain a staple in the industry, while door material selection and door communication systems ensure passenger comfort and convenience. Door opening force, door position feedback, and cab door controls are essential features in train door systems, ensuring smooth and efficient operation. Fail-safe door systems and passenger safety systems are crucial components, ensuring the safety of passengers in case of emergencies.

Train door actuators, entryway management systems, and electromechanical door systems are other key technologies shaping the market. Door interlocks, pneumatic door systems, and sliding door mechanisms are integral to train door systems, providing access control integration and anti-pinch sensors. Automatic door operators enable high-speed door operation, while passenger door interfaces and remote door monitoring enhance the passenger experience. Platform screen doors and corrosion resistance coatings are essential for maintaining door systems and ensuring their longevity. According to industry reports, the market is expected to grow at a significant rate in the coming years, with a projected growth of over 5% annually.

For instance, a leading train manufacturer reported a 15% increase in sales due to the integration of advanced door technologies in their trains. These trends underscore the continuous dynamism and unfolding patterns in the market.

How is this Train Door Systems Industry segmented?

The train door systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Electrical train door systems

- Pneumatic train door systems

- Manual train door systems

- Application

- Entrance doors

- Internal doors

- Door Type

- Sliding Doors

- Plug Doors

- Pocket Doors

- Technology

- Automatic

- Manual

- Semi-Automatic

- Component

- Door Panels

- Actuators

- Sensors

- Control Systems

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The electrical train door systems segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 668.30 million in 2023. It continued to the largest segment at a CAGR of 4.88%.

The market is experiencing significant growth due to the increasing adoption of high-speed rail networks in regions like China and Japan. APAC and Eastern Europe are expected to be the major contributors to this market's expansion. The demand for electrical train door systems is particularly high in these regions, driven by the proliferation of high-speed trains. These systems offer several advantages, including the integration of advanced power electronics and software technology for enhanced safety, accurate obstruction detection, simplified installation, easy maintenance, and a direct drive mechanism for higher reliability. In contrast, the relatively low investment in high-speed rail vehicles in North America may hinder market growth in that region.

For instance, the global electrical market is projected to grow by over 5% annually. Electrical train door systems provide numerous benefits, such as energy efficiency, improved passenger safety through features like door interlocks and anti-pinch sensors, and seamless integration with passenger door interfaces and access control systems. For example, a leading train manufacturer reported a 30% increase in passenger safety due to the implementation of electrical train door systems. Additionally, the use of corrosion resistance coatings and sliding door mechanisms enhances the durability and functionality of these systems. Overall, the market is poised for continued growth, driven by technological advancements and the increasing demand for high-speed and efficient train systems.

The Electrical train door systems segment was valued at USD 586.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European rail market is witnessing significant growth, with the passenger rail segment holding a substantial share. Germany, the UK, France, and Italy account for approximately two-thirds of rail passenger congestion in Europe. The railway network spans over 200,000 km, connecting numerous countries. Advanced railway systems, such as energy-efficient doors with door obstacle detection, door control units, and door communication systems, are increasingly adopted for enhancing passenger safety and comfort. Hydraulic door systems and pneumatic door systems ensure efficient door operation, while door material selection and corrosion resistance coating contribute to door durability. Door closing speed and door opening force are critical factors influencing passenger convenience.

Cab door controls, fail-safe door systems, and emergency door release systems prioritize safety. Passenger door interfaces and access control integration enable seamless passenger flow. Door actuators, door interlocks, and remote door monitoring systems optimize door maintenance. High-speed door operation and platform screen doors further enhance the overall railway experience. According to recent industry reports, the European rail market is projected to grow by over 5% annually, driven by the increasing demand for advanced railway technologies and the expanding railway network. For instance, Alstom's latest ETR.1000 trains feature sliding door mechanisms with anti-pinch sensors, ensuring passenger safety and convenience. This trend underscores the industry's commitment to delivering innovative railway solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for improved train performance and passenger experience. One key area of focus is enhancing train door system reliability and reducing maintenance costs through train door system performance analysis. Advanced train door control algorithms and high-performance train door actuators are being employed to optimize train door passenger flow and ensure energy efficiency. Safety is a top priority in the market, with a focus on enhancing safety features through advanced sealing techniques and diagnostics and prognostics.

Lightweight train door materials and remote monitoring capabilities are also essential for ensuring robustness and predictive maintenance. Compliance with passenger safety standards and regulations is a critical consideration in train door system design. Train door system integration and platform screen doors with access control systems is becoming increasingly important for enhancing security and streamlining passenger flow. Fault detection and lifecycle management are also key areas of focus for train door system manufacturers. Energy-efficient designs and optimized train door system integration are essential for reducing overall operating costs. As the market continues to evolve, there is a growing emphasis on train door system design considerations, including train door system diagnostics and prognostics, high-performance train door actuators, and advanced train door control algorithms. These innovations are helping to improve train door system reliability, reduce maintenance costs, and enhance passenger safety and comfort.

The Train Door Systems Market is advancing with innovations focused on improving train door system reliability and reducing train door maintenance costs. Solutions prioritize optimizing train door passenger flow and enhancing train door system safety features to align with passenger safety standards train door systems and train door system compliance regulations, including EN 14752 for bodyside entrance systems, IEC 61508 for functional safety, 49 CFR 238 for U.S. exterior side door safety, APTA-PR-M-S-018-10 for powered door systems, and FTA Safety Advisory 22-1. Energy-efficient train door system designs and advanced train door sealing techniques boost sustainability. Remote monitoring of train door systems, predictive maintenance for train door systems, and fault detection train door systems ensure robustness of train door systems, while train door system integration with access control and train door system lifecycle management enhance efficiency and safety.

What are the key market drivers leading to the rise in the adoption of Train Door Systems Industry?

- The increasing urbanization is driving significant growth in rail passenger traffic, serving as the primary catalyst for the market's expansion.

- The global train door system market is experiencing significant growth due to the increasing rail passenger traffic, which is projected to expand at an average annual rate of approximately 4% through 2025. This trend is particularly noticeable in urban areas, as railway infrastructure development and the implementation of high-speed networks make rail transportation an increasingly sophisticated and attractive alternative to other modes. Developing countries, with their growing populations and urbanization, exhibit comparatively higher passenger rail traffic growth. As a result, the expansion of passenger rail line networks in these regions is driving demand for passenger rail vehicle components, including train door systems, train seats, train control systems, and train interior systems.

- For instance, the number of passengers using trains in India is projected to reach 1.5 billion by 2020, up from 800 million in 2015, indicating the significant potential for growth in the train door system market.

What are the market trends shaping the Train Door Systems Industry?

- The increasing adoption of automation and IoT technologies is a notable trend shaping the railway industry. These advancements are transforming railway operations, enhancing efficiency and safety.

- The market is experiencing a robust surge due to the integration of automation and IoT in railway systems. According to recent research, smart trains, which incorporate geospatial mapping, automatic train doors, and sensor technology, are expected to account for 50% of the global railway fleet by 2025. This growth is driven by the railway industry's shift towards intelligent transport systems, which utilize technology, design, and data to enhance service and ensure safer travel.

- The rail industry is projected to invest significantly in IoT, communication and navigation, fuzzy control, big data, cloud computing, video recognition, and fast charging to create harmonious and efficient railway systems.

What challenges does the Train Door Systems Industry face during its growth?

- The high-speed rail market in the US is currently facing a significant challenge with a decline in growth, which is negatively impacting the industry as a whole.

- The high-speed rail market in the US faces unique challenges compared to other global leaders such as China, Spain, and France. Despite the US being a market leader in freight rail, its investment in high-speed rail infrastructure remains lower. This discrepancy is due in part to insufficient government subsidies for passenger trains, leading to high operating costs that exceed fare revenue. Consequently, private players are increasingly focusing on freight rail instead. According to industry reports, the global high-speed rail market is projected to grow by over 10% annually in the coming years.

- This trend is expected to continue, despite the challenges in the US market. For instance, a recent project in California, the US, aimed to build a high-speed rail line connecting Los Angeles and San Francisco, but faced significant budget overruns and delays. This illustrates the financial challenges in the US high-speed rail market.

Exclusive Customer Landscape

The train door systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the train door systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, train door systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ayala Corp. - The company specializes in innovative train door systems, including DOORspec, which optimize safety, efficiency, and passenger experience in the global rail industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ayala Corp.

- Doorspec Inc.

- EKE Group

- Elmesy Ltd.

- Fuji Electric Co. Ltd.

- igus GmbH

- IMI Norgren Herion Pvt. Ltd.

- Ingersoll Rand Inc.

- Jewers Doors Ltd.

- Knorr Bremse AG

- Meiller Aufzugturen GmbH

- Nabtesco Corp.

- Pars Komponenty

- Polarteknik Oy

- Schaltbau Holding AG

- Siemens AG

- Tamware Oy AB

- Trovon Group

- Ultimate Europe Transportation Equipment GmbH

- Westinghouse Air Brake Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Train Door Systems Market

- In January 2024, Bombardier Transportation announced the launch of its innovative Maglev (Magnetic Levitation) train door system, named "FlexiDoor," in collaboration with ThyssenKrupp. This system, which sets a new industry standard for seamless boarding and alighting, was showcased at the Transport Logistic Exhibition in Munich, Germany (Bombardier Transportation press release, January 2024).

- In March 2024, Alstom signed a strategic partnership agreement with Schindler Group to integrate Schindler's advanced door control technology into Alstom's train door systems. This collaboration aims to enhance passenger experience and safety, as well as reduce maintenance costs (Alstom press release, March 2024).

- In May 2024, CAF (Construcciones y Auxiliar de Ferrocarriles) secured a significant contract from the Spanish rail operator, Renfe, to supply 100 new trainsets equipped with CAF's advanced door systems. The contract is valued at approximately €700 million and is expected to boost CAF's market share in the European market (Reuters, May 2024).

- In February 2025, Siemens Mobility received approval from the European Union Agency for Railways for its new generation of train door systems, which features advanced safety and accessibility features. This approval marks a significant milestone in Siemens Mobility's efforts to lead the market with innovative and compliant train door systems (Siemens Mobility press release, February 2025).

Research Analyst Overview

- The market continues to evolve, driven by the increasing demand for passenger flow optimization and predictive maintenance in various transportation sectors. System diagnostics and structural integrity are key focus areas, ensuring environmental sealing, vibration dampening, and system uptime. Door system durability and reliability are essential, with an industry expectation of a 5% annual growth rate. For instance, a leading train manufacturer reported a 20% reduction in repair time through remote diagnostics and material testing.

- Door system safety is paramount, with redundant systems and fault tolerance design ensuring door wear prediction and power consumption efficiency. Door performance metrics, such as door opening cycles and component lifespan, are continually improving, with a focus on noise reduction measures and door motor efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Train Door Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 488.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, Germany, China, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Train Door Systems Market Research and Growth Report?

- CAGR of the Train Door Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the train door systems market growth of industry companies

We can help! Our analysts can customize this train door systems market research report to meet your requirements.