Treatment Resistant Depression Therapeutics Market Size 2025-2029

The treatment resistant depression therapeutics market size is forecast to increase by USD 2.06 billion at a CAGR of 6.1% between 2024 and 2029.

- The market is experiencing significant growth due to the high prevalence of mental health disorders, such as depression, in the US population. The emergence of advanced technologies, like artificial intelligence, in drug development is also driving pipeline development in this market. However, the high cost of treatment remains a major challenge, leading to a need for innovative solutions. Combination therapy and somatic therapies are gaining popularity as effective treatment options for those with treatment-resistant depression. Clinical guidelines recommend these approaches for patients who have not responded to traditional antidepressant medications. Furthermore, the market is witnessing an increase in the number of patent filings for new treatment modalities, providing opportunities for pharmaceutical companies to expand their offerings. The market is particularly relevant to individuals suffering from chronic conditions, such as fibromyalgia and chronic pain, who often experience depression as a co-occurring condition. Overall, the market is poised for growth, with a focus on developing effective and affordable treatment options for those in need.

What will be the Size of the Market During the Forecast Period?

- The market represents a significant challenge in mental health care due to the limited efficacy of current antidepressant medications for individuals experiencing major depressive episodes. TRD, also known as treatment-resistant major depression, is a subtype of major depressive disorder (MDD) that does not respond to two or more trials of adequate doses of antidepressant medications of appropriate classes. TRD is a complex condition that often results in poor treatment adherence, increased healthcare utilization, and higher risk for hospitalization, suicidal ideation, and psychotic symptoms. According to the Anxiety and Depression Association of America, approximately one-third of individuals diagnosed with MDD experience TRD, making it a critical area of focus for drug development. Pharmacological treatment remains the primary approach for managing TRD. Antidepressants, which are typically administered through oral, intravenous, or nasal routes, have shown limited success in treating TRD. However, recent advancements in TRD therapeutics include the use of esketamine, an N-methyl-D-aspartate (NMDA) receptor antagonist, which is administered nasally. Esketamine has shown promising results in clinical trials, providing rapid and sustained antidepressant effects in TRD patients. Despite these advancements, there is a need for alternative treatment approaches to address the complexities of TRD. Nonpharmacological treatments, such as electroconvulsive therapy (ECT), psychotherapy, and transcranial magnetic stimulation, have shown potential in managing TRD.

- Combination therapies, which involve the use of multiple treatment modalities, are also being explored to improve treatment outcomes. The market is witnessing a steady product pipeline, with several drugs in various stages of development. These drugs target various mechanisms involved in TRD, including neuroplasticity, neuroinflammation, and neurotransmission. Drug approval processes are ongoing, and successful approvals could significantly impact the market. Mental health disorders, including TRD, have a substantial impact on healthcare access and suicide statistics. According to the National Institute of Mental Health, suicide is the 10th leading cause of death in the US, with depression being a significant risk factor.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Antidepressants

- NMDA

- Antipsychotics

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Spain

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

Treatment-resistant depression (TRD) is a significant challenge in healthcare access, affecting a substantial number of individuals with major depressive disorders and other depression subtypes, including generalized anxiety disorder. According to statistics, suicide is a tragic consequence for some patients with TRD who do not respond to traditional antidepressant therapies. To address this unmet medical need, the product pipeline is brimming with innovative drugs and combination therapies. Denovo Biopharma, among other pharmaceutical companies, is leading the charge in developing novel treatments for TRD. These advanced therapeutics aim to target specific biological mechanisms underlying TRD, offering hope to millions of patients.

Further, hospital pharmacies play a pivotal role in the distribution and management of TRD therapeutics. These specialized healthcare facilities collaborate closely with psychiatrists and other mental health professionals to provide personalized medication management for patients with TRD. Their services include medication therapy management, pharmacogenetic testing, and psychopharmacology consultations, ensuring that patients receive the most effective and tailored treatments. Medication Therapy Management: Hospital pharmacies conduct comprehensive reviews of all medications a patient is taking to optimize treatment regimens, ensuring the safest and most effective therapies for patients with TRD. Pharmacogenetic Testing: By analyzing a patient's genetic profile, hospital pharmacies can help determine the most suitable medications, minimizing the trial-and-error process and reducing the risk of adverse reactions.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 2.89 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Treatment Resistant Depression (TRD) therapeutics market in North America is experiencing notable growth due to increased investments in mental health infrastructure and services. The United States and Canada, making up this region, are witnessing a substantial expansion in this sector, driven by government initiatives and heightened awareness of mental health disorders. In the U.S., the Health Resources and Services Administration (HRSA) under the Department of Health and Human Services (HHS) has allocated USD240 million to bolster mental health and substance use disorder services across approximately 400 community health centers. These centers, serving over 10 million people, play a vital role in delivering accessible mental health care, including TRD therapeutics, to underrepresented populations. Antidepressants, such as Esketamine, are administered through various methods, including nasal, intravenous, and oral administration, to address TRD. Drug development in this field continues to progress, with ongoing research and innovation in TRD therapeutics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Treatment Resistant Depression Therapeutics Market?

The high prevalence of depression is the key driver of the market.

- Depression is a debilitating mental health condition that affects millions of people worldwide, impacting their personal and professional lives. The condition, which goes beyond normal mood fluctuations, can stem from various causes such as traumatic experiences, severe losses, and chronic stress. Women are disproportionately affected, with approximately 6% of women and 4% of men suffering from depression. Older adults are also at a higher risk, with 5.7% of individuals over 60 years old experiencing depression. These statistics equate to approximately 280 million people globally living with this condition. Despite the prevalence of depression, patient management remains challenging due to diagnostic difficulties and the stigma surrounding mental health conditions.

- Treatment-resistant depression (TRD), a subtype of depression that does not respond to standard antidepressant medications, further complicates matters. Innovative therapeutic measures, such as psychotherapy, ketamine infusions, and deep brain stimulation, are being explored to address TRD. Ensuring treatment adherence is crucial for the effective management of depression, as non-compliance can hinder the therapeutic process. In the US, addressing depression and its treatment-resistant forms is a priority, with various organizations focusing on research, education, and advocacy efforts. Depression not only affects individuals but also has broader societal implications, including increased disability and decreased productivity. By fostering a better understanding of depression and its treatment options, we can help reduce the stigma and improve patient outcomes.

What are the market trends shaping the Treatment Resistant Depression Therapeutics Market?

The emergence of AI in drug development is the upcoming trend in the market.

- Artificial Intelligence (AI) integration in pharmaceutical research signifies a groundbreaking advancement, revolutionizing drug development through advanced computational techniques. AI technology analyzes vast datasets to forecast drug efficacy, toxicity, and interactions, expediting the process across stages such as target identification, lead optimization, and clinical trial design. In the realm of Treatment Resistant Depression (TRD) therapeutics, AI's predictive capabilities are invaluable. By merging clinical and biological data, AI can determine personalized therapeutic outcomes. For example, a novel AI algorithm developed by Amsterdam UMC and Radboudumc identified patients who would benefit from the selective serotonin reuptake inhibitor (SSRI) sertraline. Combination therapy and somatic therapies are also gaining traction in TRD treatment.

- Clinical guidelines recommend these approaches when initial treatments fail. Pipeline development in this area is strong, with several companies and research institutions focusing on patent details to bring innovative therapies to market. The mental health landscape, including chronic pain and fibromyalgia, stands to benefit significantly from these advancements. AI's precision and efficiency are essential in addressing the complexities of TRD, ensuring better patient outcomes.

What challenges does Treatment Resistant Depression Therapeutics Market face during the growth?

The high cost of treatment is a key challenge affecting the market growth.

- The treatment of Treatment Resistant Depression (TRD) involves both pharmacological and nonpharmacological approaches, which can incur significant costs for patients. Hospitalization may be necessary for those at high risk for suicidal ideation or psychotic symptoms, adding to the financial burden. Pharmacological treatment, such as antidepressants and antipsychotics, can range from USD50 to USD300 per month, depending on the medication and location. Psychotherapy, an essential component of TRD treatment, can also be costly, with sessions ranging from USD 100 to USD R250 per session. These ongoing expenses can add up quickly, making it challenging for many patients to access the necessary care. The high cost of TRD therapies highlights the unmet medical needs in this area and the importance of diagnostic evaluation and effective treatment strategies to improve patient outcomes.

- The epidemiology of TRD and current treatment practices continue to evolve, requiring ongoing research and innovation to address the challenges associated with this complex condition.

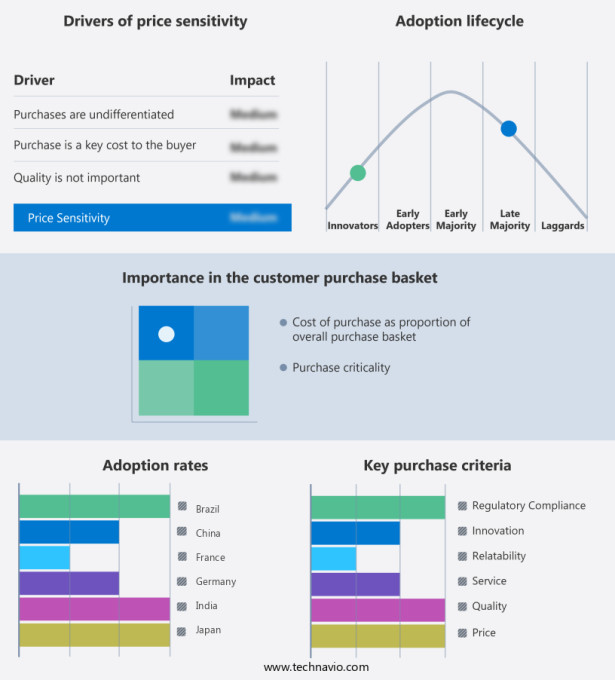

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Acadia Pharmaceuticals Inc.

- Alkermes Public Ltd. Co.

- AstraZeneca Plc

- Axsome Therapeutics Inc.

- Eli Lilly and Co.

- Evotec SE

- H Lundbeck AS

- Intra-Cellular Therapies Inc

- Johnson and Johnson Inc.

- Numinus Wellness Inc

- Otsuka Pharmaceutical Co. Ltd.

- Pfizer Inc.

- Sage Therapeutics Inc

- Stella MSO LLC dba Field Trip Health

- Sumitomo Pharma Co. Ltd.

- Teva Pharmaceutical Industries Ltd.

- Vistagen Therapeutics Inc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Treatment-resistant depression (TRD) is a complex mental health disorder characterized by the non-responsiveness to traditional antidepressant medications. Major depressive episodes can significantly impact an individual's daily life, leading to disability, suicidal risk, and psychotic symptoms. The unmet medical needs in TRD have driven the development of innovative therapeutics. Pharmacological treatment involves antidepressant medications administered through various routes such as oral, intravenous, and nasal administration. Esketamine, a nasal spray, has shown promising results in TRD treatment. However, diagnostic challenges and stigma surrounding mental health disorders hinder effective patient management. Nonpharmacological treatment includes somatic therapies like electroconvulsive therapy and neurostimulation devices. Clinical guidelines recommend combination therapies, switching treatments, and alternative treatments for TRD.

Further, the pipeline development for TRD therapeutics includes newer treatment modalities like SNRIs and denovo biopharma's innovative drugs. The epidemiology of depression disorders, including TRD, is a significant concern for healthcare access. Chronic conditions like fibromyalgia and chronic pain can co-occur with depression. Mental health awareness and digital healthcare technologies are essential for improving diagnostic evaluation and treatment strategies. Despite advancements, adverse drug reactions and the need for drug approval pose challenges in TRD treatment. The product pipeline includes acute care, outpatient care, and specialty clinics. Mental health disorders, including TRD, require continued research to address the diagnostic challenges and improve treatment practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 2.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, India, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch