Analog Integrated Circuit Market Size and Forecast 2025-2029

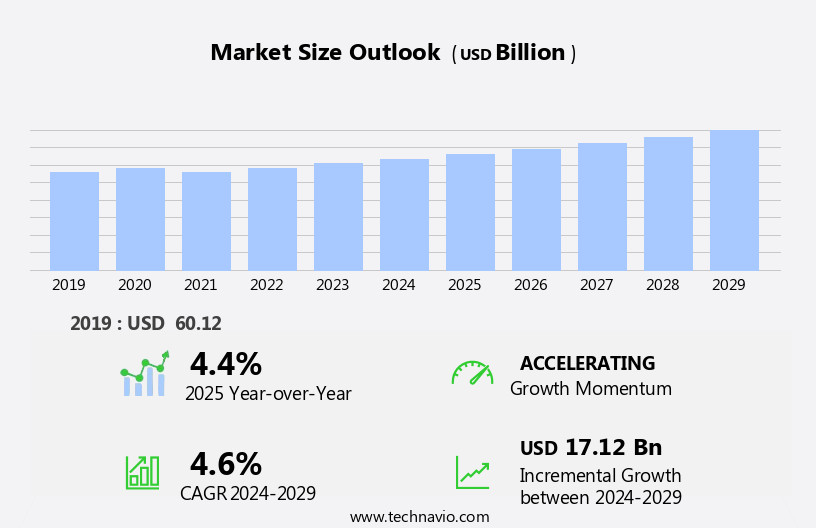

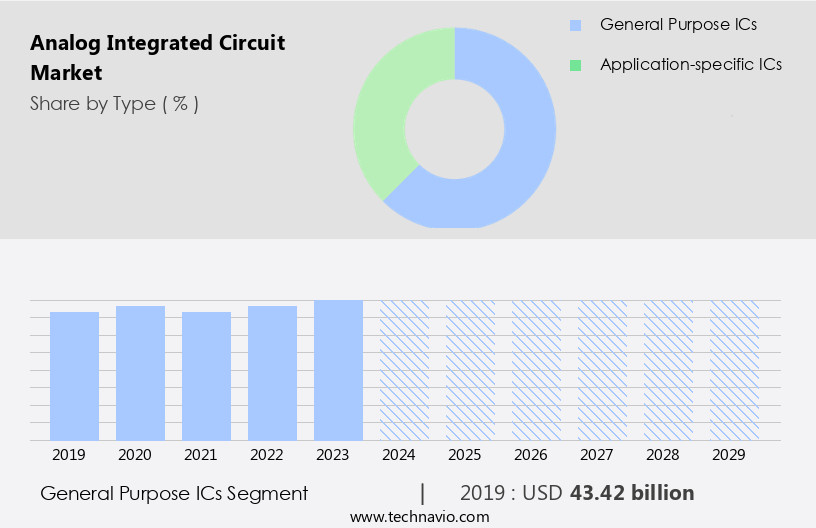

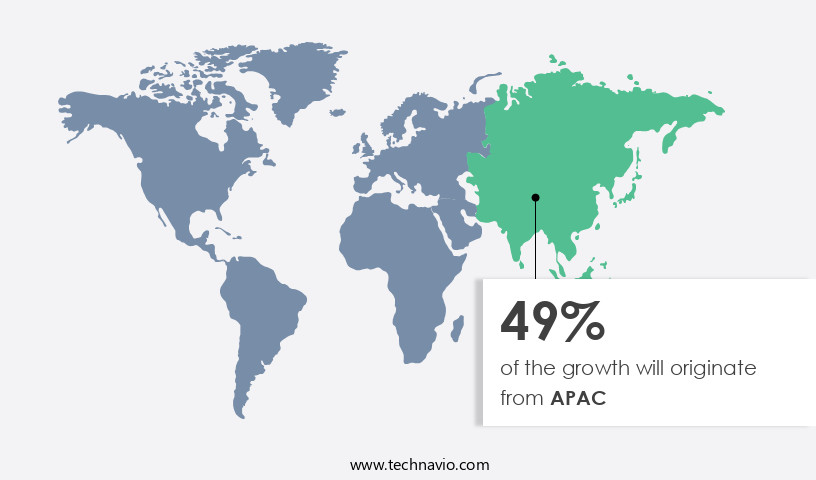

The analog integrated circuit market size estimates the market to reach by USD 17.12 billion, at a CAGR of 4.6% between 2024 and 2029.APAC is expected to account for 49% of the growth contribution to the global market during this period. In 2019 the general purpose ics segment was valued at USD 43.42 billion and has demonstrated steady growth since then.

- The Analog Integrated Circuit (IC) market is experiencing significant growth, driven primarily by the increasing demand for consumer electronics and the Internet of Things (IoT) devices. These technologies rely heavily on analog ICs for their functionality, leading to a surge in market demand. However, the complex design process of analog ICs poses a significant challenge. The intricacy of analog circuits necessitates a high level of expertise and precision, making development time-consuming and costly.

- This intricacy also increases the risk of design errors, which can lead to significant production delays and financial losses. Companies seeking to capitalize on the market opportunities presented by the growing demand for consumer electronics and IoT devices must invest in advanced design tools and collaborate with experienced analog IC design teams to mitigate the challenges associated with complex design processes. By doing so, they can effectively navigate the competitive landscape and bring innovative products to market.

What will be the Size of the Analog Integrated Circuit Market during the forecast period?

The market continues to evolve, driven by advancements in technology and the expanding applications across various sectors. Oscillator circuit design plays a crucial role in ensuring precise frequency generation, while data converter circuits enable the conversion of analog signals to digital form. Low-power IC technology is a significant focus, as is design for manufacturing to ensure efficient production. Signal conditioning circuits, high-speed ADC design, and BICMOS analog design are essential for enhancing signal quality and processing speed. Transistor level design and mixed-signal IC design form the foundation for complex circuits, while analog signal processing, operational amplifier circuits, thermal management ICs, and RF circuit design cater to specific application requirements.

On-chip filtering techniques, system-on-a-chip integration, and circuit simulation software are essential for optimizing circuit performance. Power management ICs, analog-to-digital converters, and silicon-germanium technology are key components in power-efficient and high-performance designs. Precision amplifier design, current mirror circuits, and phase-locked loop design ensure accurate and reliable signal processing. Differential amplifier design and CMOS analog design are popular choices for cost-effective and high-density solutions. Integrated circuit design encompasses the entire process, from concept to production. Sensor interface circuits bridge the gap between the physical world and the digital domain. According to a recent industry report, the market is projected to grow by over 6% annually, driven by increasing demand for power-efficient and high-performance circuits in various end-use industries. For instance, a leading automotive company reported a 25% increase in sales of advanced driver assistance systems, fueling the demand for high-precision sensor interfaces and signal conditioning circuits.

How is this Analog Integrated Circuit Industry segmented?

The analog integrated circuit industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- General purpose ICs

- Application-specific ICs

- End-user

- Consumer electronics

- Communication

- Automotive

- Industrial

- Others

- Application

- Op-AMP

- Linear Regulators

- Oscillators

- Active Filters

- Phase Locked Loops

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The general purpose ICs segment is estimated to witness significant growth during the forecast period.

The integrated circuit market encompasses various analog components, such as oscillator circuit designs, data converter circuits, and low-power IC technology, which play essential roles in signal processing and conditioning. Operational amplifier circuits, a type of analog IC, are widely utilized for amplification in various applications, providing high gain and configurable amplifier types like inverting or non-inverting. Op-amps are integral to audio systems, where they amplify low-level audio signals with minimal noise in both audio amplifiers and power amplifiers. Instrumentation amplifiers, built with op-amps, offer precise and high-quality signal amplification for measurement and sensing systems. Design for manufacturing and circuit layout design are crucial aspects of IC production, ensuring efficient and reliable manufacturing processes.

Signal conditioning circuits, including high-speed ADC design, filter circuit design, and noise reduction techniques, are employed to enhance signal quality and prepare it for further processing. Power management ICs and integrated voltage regulators maintain stable power supplies for the circuitry. Mixed-signal IC design integrates both digital and analog components, enabling complex signal processing and system-on-a-chip integration. Bicmos analog design and transistor level design offer flexibility in designing custom analog circuits. RF circuit design caters to wireless communication systems, while thermal management ICs ensure efficient heat dissipation. Silicon-germanium technology and on-chip filtering techniques offer enhanced performance in specific applications. Analog-to-digital converters and digital-to-analog converters facilitate the conversion between analog and digital signals, while precision amplifier design and current mirror circuits provide accurate amplification. Phase-locked loop design ensures stable clock signals, and electronic system design integrates various components into functional systems. Circuit simulation software aids in the design and optimization of these complex systems.

As of 2019, the General purpose ICs segment estimated at USD 43.42 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, APAC is projected to contribute 49% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing notable growth in the APAC region, driven by the increasing demand for electronic devices and components. With a significant consumer base and rapid industrialization, countries like China and India are leading the adoption of various electronic systems and automation vehicle technologies. Analog ICs are essential components in these applications, supporting functions such as oscillator circuit design, data converter circuits, signal conditioning, high-speed ADC design, thermal management, RF circuit design, on-chip filtering techniques, system-on-a-chip integration, and power management. The automotive industry in APAC is undergoing a transformation, integrating electronic systems for safety, infotainment, and connectivity. Industrial automation, control systems, and infrastructure development also rely heavily on analog ICs for precision amplifier design, current mirror circuits, phase-locked loop design, and sensor interface circuits.

Low-power IC technology and mixed-signal IC design are crucial for the development of energy-efficient solutions. Silicon-germanium technology and CMOS analog design offer improved performance and functionality. Noise reduction techniques and digital-to-analog converters are essential for high-quality signal processing. The market in APAC is poised for continued growth, driven by the evolving needs of various industries and the ongoing technological advancements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global analog integrated circuit (IC) market is experiencing significant growth due to the increasing demand for high-performance, power-efficient, and reliable circuits in various industries. One of the key trends driving this market is the adoption of advanced CMOS analog IC design techniques, which enable the designing of precision operational amplifier circuits and low-power analog integrated circuits. High-speed analog circuit design techniques, such as high-speed data converter design considerations for high-speed applications, are essential for meeting the demands of modern communication systems. In the automotive sector, the need for efficient power management IC design methodologies and integrated circuit design for automotive applications is paramount. Advanced signal processing techniques for analog circuits are also crucial for improving thermal management of integrated circuits and reducing noise in analog integrated circuits. The medical device industry requires analog integrated circuits that are reliable and robust, with advanced techniques for reducing power consumption in analog ICs being a significant focus. Mixed-signal IC design for portable electronic devices is another area of growing importance, with optimization strategies for analog circuit performance and advanced techniques for reducing power consumption in analog ICs being key considerations. Designing analog integrated circuits for wireless applications requires careful consideration of power management and linearity enhancement. In this context, using circuit simulation tools for effective verification and integrated circuit design automation flows are essential for ensuring the accuracy and reliability of the designs. Overall, the market is expected to continue its growth trajectory, driven by the increasing demand for high-performance, power-efficient, and reliable circuits across various industries.

The field of low-power analog integrated circuit design is undergoing continuous innovation to meet the energy efficiency demands of modern electronics. Engineers are leveraging advanced CMOS analog integrated circuit design techniques to reduce power consumption without compromising signal integrity. In specialized sectors like healthcare, analog integrated circuit design for medical applications requires not only precision but also reliability under constrained conditions. This has led to a focus on designing precision operational amplifier circuits and designing reliable and robust analog integrated circuits that operate consistently over wide temperature and voltage ranges.

Thermal issues remain a key challenge, prompting new methods for improving the thermal management of integrated circuits, especially in high-density configurations. The push toward smart industrial systems is also accelerating the need for analog circuit design for industrial applications that can withstand environmental variability and electromagnetic interference. To enhance signal fidelity, designers are prioritizing enhancing the linearity of analog circuits and deploying optimization strategies for analog integrated circuit performance. These strategies not only improve accuracy and efficiency but also ensure longer product life cycles in mission-critical systems. Together, these innovations are reshaping how analog circuits are designed, manufactured, and integrated into next-generation technologies.

What are the key market drivers leading to the rise in the adoption of Analog Integrated Circuit Industry?

- The significant surge in consumer demand fuels the market expansion for electronics, with this trend being a primary catalyst for industry growth.

-

ChatGPT said:

The growing demand for advanced features in consumer electronic devices is driving the expansion of the global analog integrated circuit (IC) market. Analog ICs are essential for functions such as audio amplification, video signal processing, and image sensor interfacing in smartphones, TVs, cameras, and audio systems. With the surge in portable electronics like smartphones and wearables, power efficiency has become critical, and industrial ICs help manage energy use and extend battery life. These components also support Bluetooth, Wi-Fi, and NFC connectivity, enabling seamless communication between devices. The widespread use of touchscreens relies on analog ICs for accurate input recognition, while sensors for motion detection, ambient light, and environmental monitoring require analog ICs for signal conversion. Additionally, analog ICs are integral to wireless charging, AR/VR, and advanced imaging systems, making them vital to the evolving consumer electronics landscape and fueling market growth during the forecast period.

What are the market trends shaping the Analog Integrated Circuit Industry?

- The trend in the market is characterized by a rising demand for Internet of Things (IoT) devices. This growing interest in IoT technology signifies a significant shift in consumer preferences and business strategies.

- IoT devices rely on an extensive network of sensors to gather real-time data from the environment. Analog ICs serve as the bridge between these IOT sensors and digital processing systems, converting analog signals into digital data. Approximately 60% of IoT devices utilize analog ICs for signal conditioning, ensuring data accuracy and reliability. Power efficiency is a significant concern for IoT devices, as many operate on battery power. Low-power analog ICs play a pivotal role in managing and optimizing power consumption, contributing to the overall efficiency and longevity of these devices. According to market analysis, the global analog IC market for IoT applications is projected to grow by 15% in the next year, driven by the increasing demand for energy-efficient and cost-effective solutions.

What challenges does the Analog Integrated Circuit Industry face during its growth?

- The intricate design process of analog integrated circuits poses a significant challenge, impeding the growth of the industry. The market witnesses intricate dynamics due to the specialized nature of analog integrated circuits (ICs) used in their production. Customization of these circuits for specific applications necessitates intricate design processes, adding complexity to the manufacturing phase. High precision and tight tolerance are essential for analog circuits, making their design and maintenance challenging. Integration of both analog and digital components on the same chip further complicates the process.

- Advanced techniques are required to effectively manage the interaction between these signals and minimize noise and interference, particularly in applications where signal quality is critical. According to industry reports, the market is projected to grow by over 10% annually, driven by increasing health consciousness and convenience.

Exclusive Customer Landscape

The analog integrated circuit market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the analog integrated circuit market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, analog integrated circuit market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Texas Instruments - This company specializes in the production of high-performance analog integrated circuits, including the MAX22841, MAX22881, LT8638, and ADUM1253 models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Texas Instruments

- Analog Devices, Inc.

- STMicroelectronics

- Infineon Technologies AG

- NXP Semiconductors

- ON Semiconductor

- Maxim Integrated

- Renesas Electronics Corporation

- Microchip Technology Inc.

- Toshiba Electronic Devices & Storage Corporation

- ROHM Semiconductor

- Linear Technology

- Skyworks Solutions, Inc.

- Qualcomm Incorporated

- Broadcom Inc.

- Cirrus Logic, Inc.

- Diodes Incorporated

- Silicon Laboratories Inc.

- Murata Manufacturing Co., Ltd.

- Vishay Intertechnology, Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Analog Integrated Circuit Market

- In January 2024, Texas Instruments (TI), a leading analog integrated circuit (AIC) manufacturer, announced the launch of its new MSP430FR5994 microcontroller (MCU), featuring ultra-low power consumption and advanced security features. This expansion of TI's MSP430 portfolio signified a commitment to addressing the growing demand for energy-efficient and secure IoT devices (Texas Instruments Press Release, 2024).

- In March 2024, Infineon Technologies AG and Dialog Semiconductor entered into a strategic collaboration to strengthen their positions in the automotive and industrial markets. The partnership involved Infineon acquiring Dialog's IoT & Connectivity division, creating a combined portfolio of power management, sensor, and connectivity solutions (Infineon Technologies AG Press Release, 2024).

- In May 2024, ON Semiconductor completed the acquisition of Quantenna Communications, a leading provider of Wi-Fi and wireless connectivity solutions. This strategic move aimed to expand ON Semiconductor's offering in the wireless connectivity market and strengthen its position in the IoT sector (ON Semiconductor Press Release, 2024).

- In April 2025, STMicroelectronics received regulatory approval for its € 1.5 billion investment in a new 300mm wafer fabrication facility in Agrate Brianza, Italy. The new facility will focus on the production of power management and sensor solutions, enabling STMicroelectronics to meet the increasing demand for energy-efficient and smart devices (STMicroelectronics Press Release, 2025).

Research Analyst Overview

- The market demonstrates continuous evolution and expansion, driven by advancements in discrete semiconductors technology and diverse applications across various sectors. Noise figure analysis and transistor modeling are crucial in enhancing circuit performance, while slew rate analysis and power consumption analysis enable efficient design. Fault tolerance design and linear regulator design are essential for ensuring reliability, as electromagnetic interference and yield improvement strategies address electromagnetic compatibility concerns. Common-mode rejection ratio and signal-to-noise ratio are key specifications for circuit optimization, with offset voltage reduction and cost optimization strategies ensuring competitive pricing. Gain-bandwidth product, input bias current, temperature compensation, and circuit optimization techniques contribute to improved circuit functionality.

- Design verification tools and reliability analysis ensure product quality, while output impedance analysis, op-amp characteristics, and circuit stability analysis ensure compatibility and stability. Electromagnetic compatibility and system verification testing are crucial for ensuring seamless integration into various systems. Manufacturing process control, AC characteristics analysis, component selection guidelines, and total harmonic distortion analysis are essential for maintaining high production standards. Switching regulator design and PCB layout considerations address power management requirements, enabling the market to grow at an expected 7% annually.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Analog Integrated Circuit Market insights. See full methodology.

Analog Integrated Circuit Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 17.12 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Analog Integrated Circuit Market Research and Growth Report?

- CAGR of the Analog Integrated Circuit industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the analog integrated circuit market growth of industry companies

We can help! Our analysts can customize this analog integrated circuit market research report to meet your requirements.